Although the shares of Pacific Ridge Exploration (PEX.V) have only traded between 4.5 to 6 cents on lack lustre volume over the last several years, the current valuation makes it an attractive gamble on exploration success at its flagship Kliyul copper-gold project in British Columbia.

Newly appointed CEO Blaine Monaghan appears to recognize the attractive risk/reward ratio and has acquired 564,000 shares through open market purchases (representing 14% of the total trading volume) since becoming CEO in early January, which we are very pleased to see. There are many reasons why an insider might sell shares but only one reason why they buy it; because they think that it is going higher.

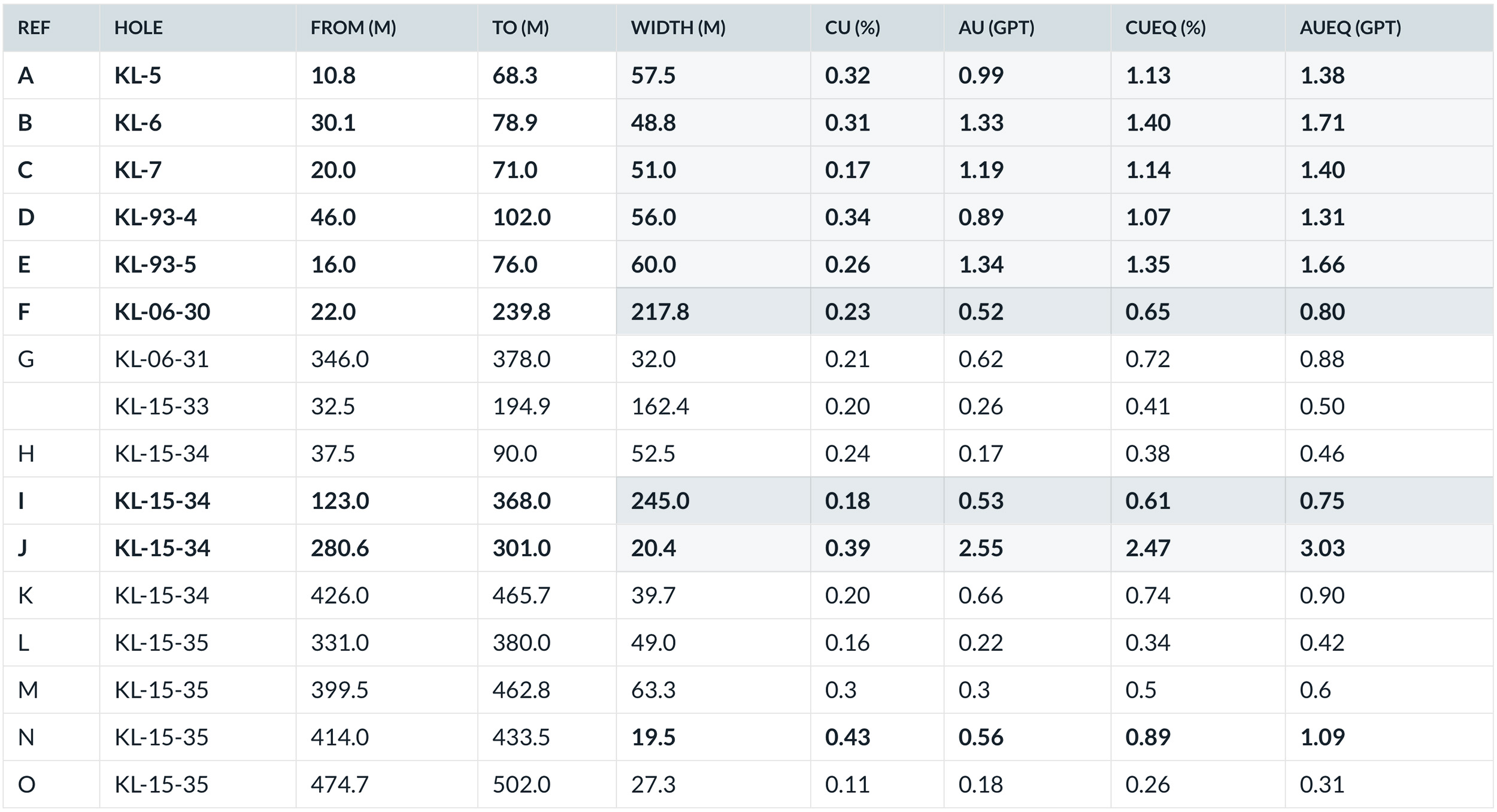

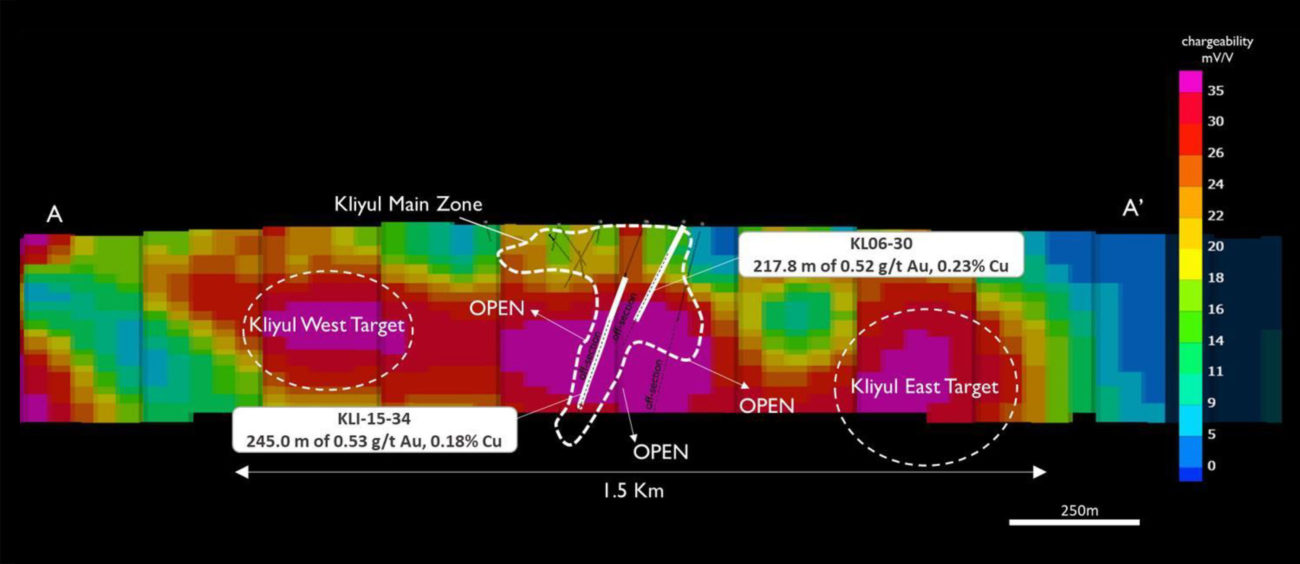

We will provide a more detailed review of the Kliyul copper-gold project in a separate report. However, to get a better understanding of what Pacific Ridge is chasing at Kliyul let’s take a look at some of the better historic drill results: Drill hole KL-06-30 returned 218 meters (starting almost at surface) containing 0.23% copper and 0.52 g/t gold and drill hole KL-15-34 returned 245 meters of 0.18% copper and 0.53 g/t gold. These results help validate Pacific Ridge’s exploration theory that Kliyul could host a significant copper-gold porphyry system.

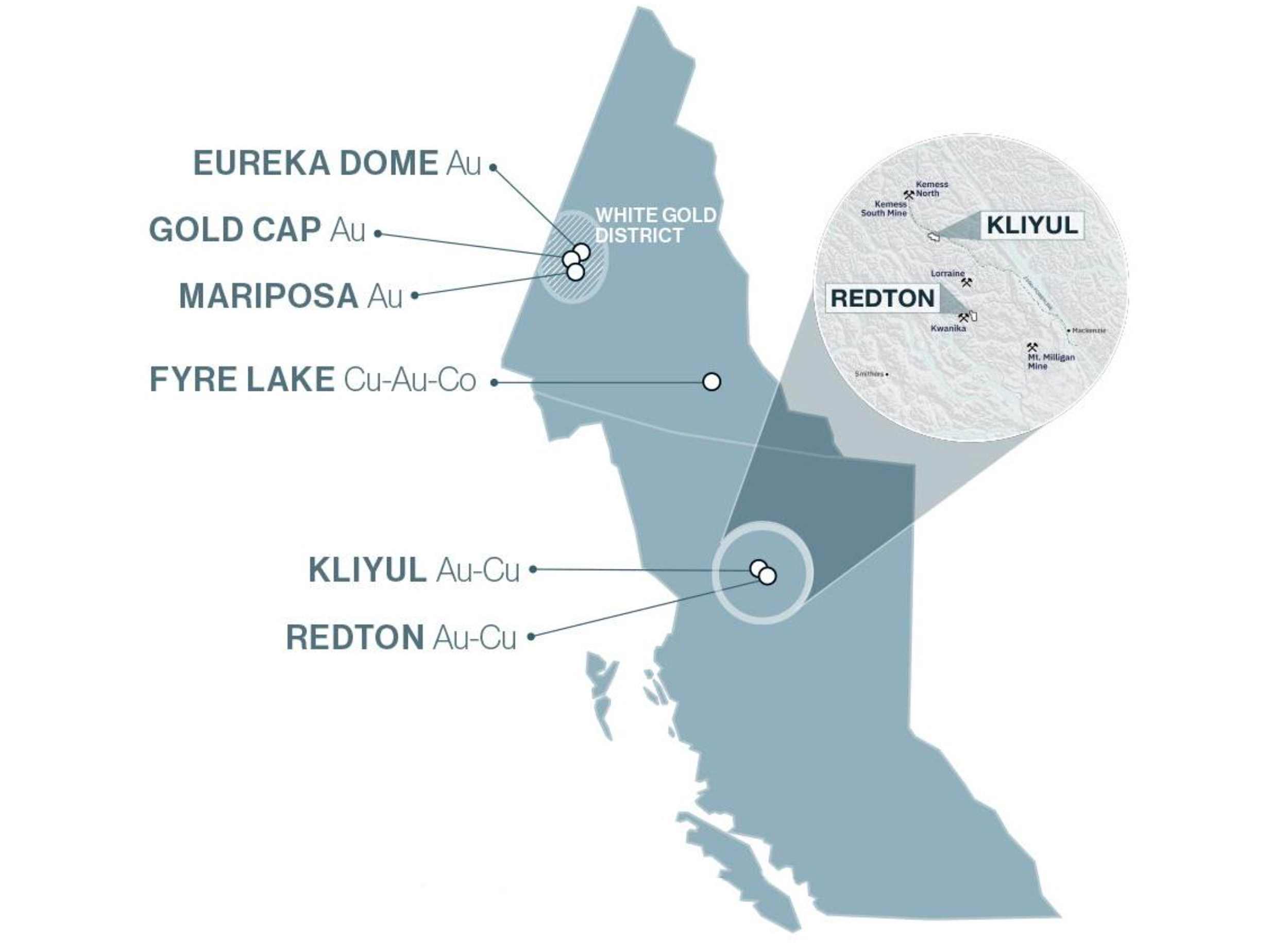

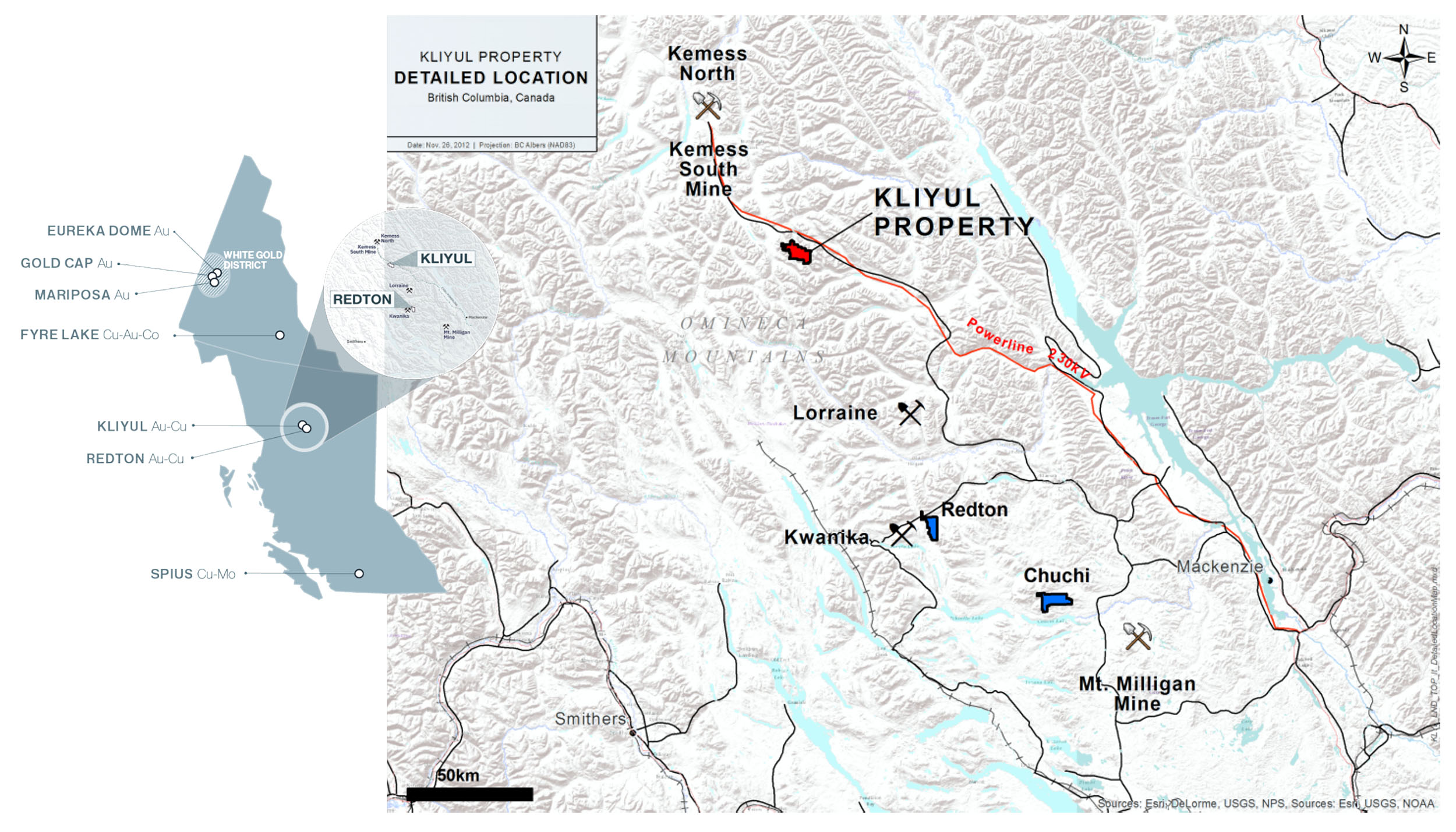

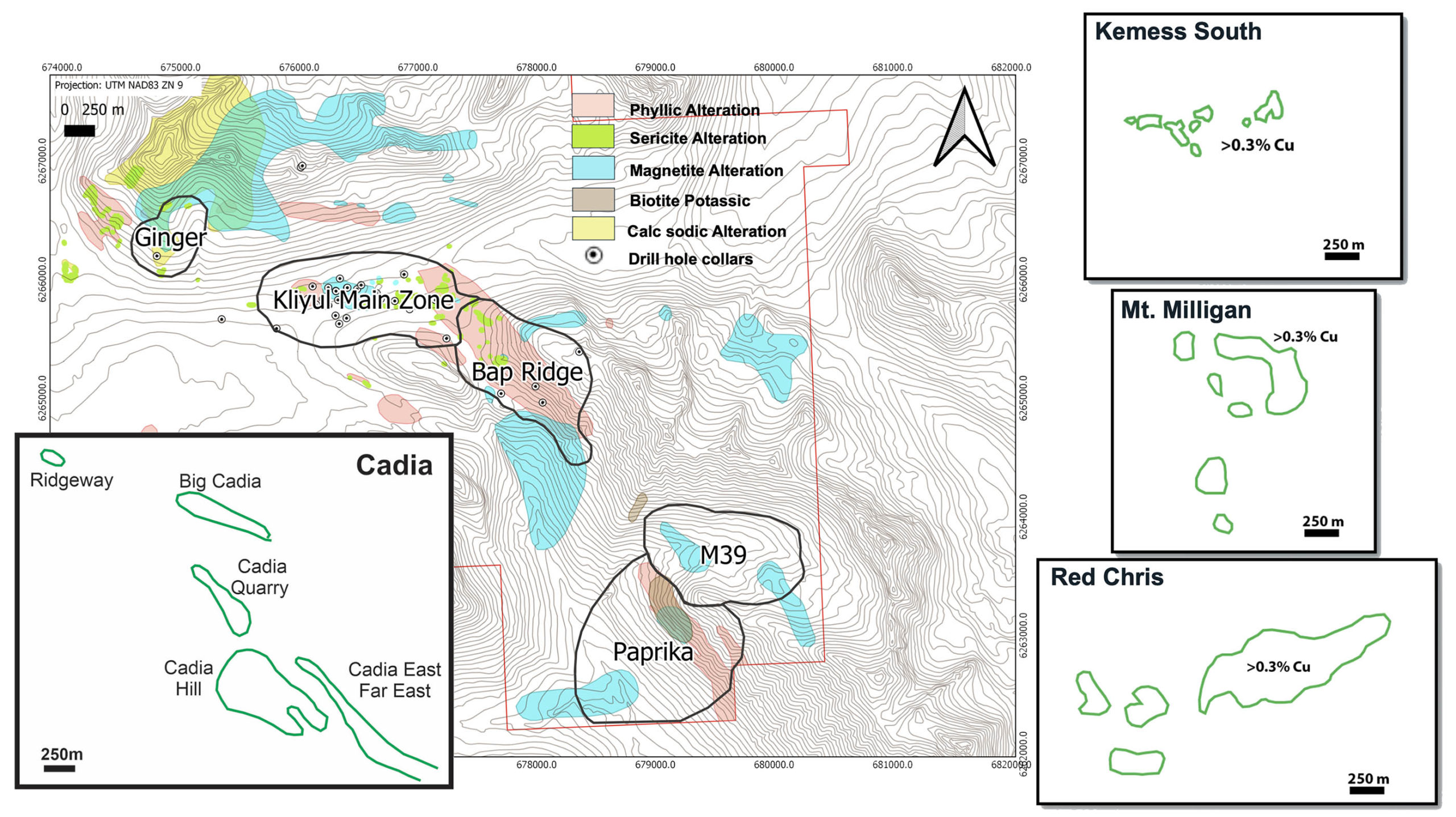

Pacific Ridge Exploration optioned Kliyul from Centerra Gold (CG.TO), operator of the Kemess Mine to the north and Mt. Milligan to the south, so the property is definitely located in the right zip code.

Before diving into the technical side of the project, we wanted to catch up with newly appointed CEO Blaine Monaghan.

Sitting down with CEO Blaine Monaghan

Kliyul

The Kliyul project is your flagship project. You entered into an option agreement with Aurico Metals (a subsidiary of Centerra Gold) in 2020, which requires you to spend C$1.25M on exploration by the end of this year. How much have you spent on Kliyul and how much more do you need to spend by the end of this year?

At the end of Q3, we had spent approximately C$250,000on Kliyul and roughly C$80,000 on Redton. We have to spend a total of $1.25M on both projects by Dec. 31, 2021, which means we still have to spend just over C$900,000 to meet the exploration expenditure requirement.

Kliyul has been drilled before, it has seen over 30 drill holes, and some of the intervals are pretty darn interesting. It looks like Pacific Ridge’s timing was excellent. With copper currently trading at $3.50 per pound, there is no way that you would be able to scoop up the project today with the same terms.

Yes, I absolutely agree with you. The timing was fantastic. Since the agreement was announced there has been a lot more interest in copper-gold projects in B.C. Look at GT Gold, Kodiak Copper, and, more recently, the Serengeti and Sun Metals merger that is being spear headed by Dr. Mark O’Dea. That development validates our shift from a Yukon gold exploration company to a company focused on becoming one of BC’s leading copper-gold exploration companies.

Could you walk us through your plans to drill out Kliyul? What are your plans for this year?

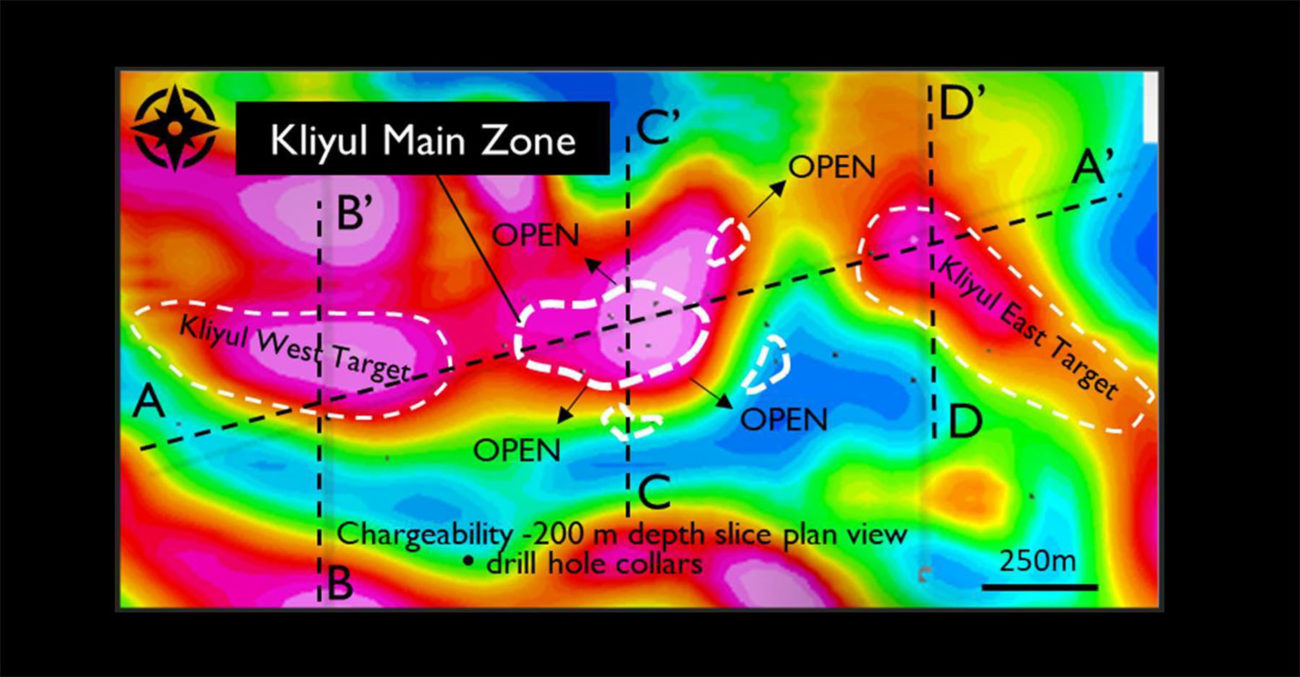

We plan to drill approximately 2,500 metres starting in Q3. The results of the 2020 geophysical survey demonstrated the potential to expand copper-gold porphyry mineralization at the Kliyul Main Zone and outlined two new adjacent targets, Kliyul East and Kliyul West. Neither of the two new targets have previously been drilled. We plan to drill test all three targets during the 2021 field season.

In addition to Kliyul Main Zone, and the new East and West targets, three other porphyry targets exist along an underexplored 4-km mineralized trend. I don’t know what work we will be able to complete at these other targets this year but the scale of the Kliyul mineralized system compares favourably with other well-known mines and deposits.

Considering that Kliyul contains copper-gold mineralization and Centerra Gold is operating the Kemess mine, which is geologically similar, just up the road, we have the impression that Centerra may just be farming out exploration to Pacific Ridge. Centerra would likely be an interested party considering they would own 25% of Pacific Ridge upon PEX completing all earn-in milestones?

If we have success, I believe Kliyul would be of interest to many different companies.

Other projects in the portfolio

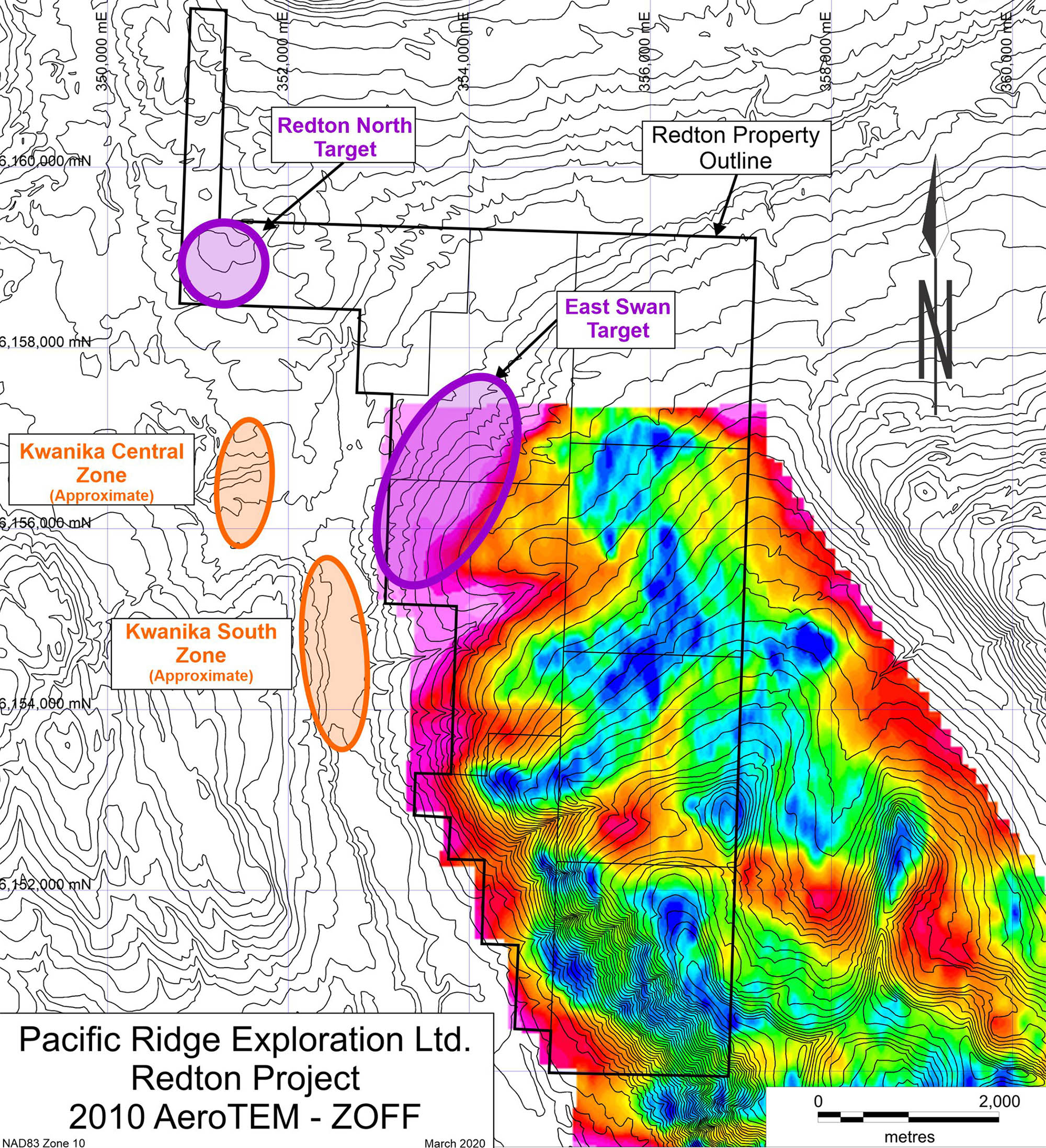

As part of the Kliyul earn-in, you also got the Redton property thrown in the mix. One hole was drilled in September-October but unfortunately the hole came up empty. Of course, we cannot write off the entire project based on one hole, but how do you see the property evolve? Will you go back and do more ground work before committing to another drill program at Redton?

Redton is adjacent to Serengeti’s Kwanika in a highly mineralized belt that will likely see increased activity as a result of Serengeti’s proposed acquisition of Sun Metals Corp.

We did drill one-hole last year at the Redton North target but a number of other targets remain to be tested. Right now, we plan to reprocess the 2010 AeroTEM airborne electromagnetic survey to refine future drill targets.

Redton is clearly located in the right district as Serengeti Resources (SIR.V) is acquiring Sun Metals (SUNM.V) while South32 (S32.AX, S32.L) also has a substantial land package in the district. Do you see the potential to attract either one of them as a joint venture partner so you can focus on Kliyul?

Anything is possible. We shall see how everything unfolds once the merger is complete.

You sold the Spius copper porphyry project to Arctic Fox and when announcing that deal, you mentioned Spius would likely be drilled this year. Do you have any update on the exploration plans of Arctic Fox?

I don’t have an update the present time but I can get back to you.

There is also hidden value on your balance sheet. A few years ago, you sold the Fyre Lake VMS project to BMC Minerals, a private company, which subsequently released very strong economics on the project in 2020. According to the agreement, you are slated to receive C$1M in cash upon Fyre Lake’s water permit being approved but, in any event, no later than December 31, 2021. Additionally, you are entitled to yet another C$1M in cash 12 months after commercial production. C$2.0M in cash would represent approximately 6 cents per share of PEX, correct?

Yes, that is correct. BMC has already made payments totalling more than $2.0M so I do expect them to make the $1.0M payment due by Dec. 31. If they don’t, we get the project back and I’m sure that it is worth a lot more now than when we originally struck the deal. Either way, it is a win-win for Pacific Ridge and its shareholders.

Corporate

Blaine, many people will recognize you as CEO of Fremont Gold, a Nevada-focused gold exploration company. How did you end up at Pacific Ridge and how do you see the combination of both jobs working out?

Good question. The timing made sense as Fremont is in good shape – I recently raised C$2.0M for Fremont and a drill program is underway at North Carlin right now – while Pacific Ridge needs help building interest and awareness to finance a drill program at Kliyul later this year.

I would not have taken the role at PEX if there was a conflict and there isn’t. Fremont is focused on gold in Nevada while Pacific Ridge is focused on copper-gold projects located in BC. Further, splitting my time between both companies will help to keep their respective G&A costs low.Its also important to keep in mind that I had pre-existing relationship with Pacific Ridge, I sat on its board before I became the CEO of Fremont.

What’s the status on the cash front? You ended Q3 2020 with about C$800,000 in working capital, but you likely still had some bills related to the Redton drill program to pay.

The cash situation is quite healthy. However, we will have to raise money before the drill program starts in July.

How difficult will it be to raise money this year, given your sub-C$3M market capitalization? Do you think a flow-through financing at a premium may be one of the ideas you may want to explore?

As mentioned earlier, there is a lot more interest in copper-gold projects than there has been in sometime. I don’t expect there to be any problems accessing the capital required to drill Kliyul. And, yes, one of the advantages of conducting exploration in Canada is the ability to fund exploration with a flow-through financing. These financing are done at a premium to market, because of the tax advantages to the end buyer, which helps to reduce dilution. It certainly is an option and one that we will consider when the time comes.

With the focus of the Pacific Ridge properties on copper, how do you see the copper market evolve from here?

There are lots of reasons to be bullish on the price of copper. Copper prices are currently trading near eight-year highs and long-term demand is backstopped by green energy and the push toward it.

Any parting thoughts?

I’ve purchased more than 500,000 shares of Pacific Ridge since becoming CEO. I believe that it is incredibly attractive at these levels. We have a great technical team, an exiting new project in a good jurisdiction, and its market cap is only C$2.5M.

Conclusion

Pacific Ridge’s risk/reward ratio is very favorable right now. With an enterprise value of less than C$2M (and expecting a C$1M cheque from BMC by the end of the year), Pacific Ridge is cheaper than most shells out there and should be seen as a call option on exploration success at Kliyul. If the thick copper-gold mineralization from historic drill holes can be confirmed, Pacific Ridge’s share price should react positively. But even in the unlikely event that Pacific Ridge can’t find anything interesting, the downside is very limited, considering that a C$1M cash payment should be received by year end. Also, don’t forget that Pacific Ridge recently pivoted to copper-gold projects in BC. It still has three gold projects in the Yukon, which are receiving little to no value. There may be an opportunity for Pacific Ridge to unlock that value in the future as it advances Kliyul and acquires other copper-gold projects in BC.

There are no guarantees in the markets, and definitely not in the junior exploration sector, but Pacific Ridge’s risk/reward ratio is very appealing at the current levels. We will have a closer look at the flagship Kliyul property soon to discuss the merits of the project in more detail.

Disclosure: The author has no long position in Pacific Ridge Exploration. Pacific Ridge Exploration is a sponsor of the website. Please read our disclaimer.