More often than not, the original business plan of an exploration company does not work out as expected. While ePower Metals had high hopes for its cobalt assets, its Suriname asset warranted some attention, the company shifted gear and acquired the right to earn full ownership of the underexplored Los Reyes gold-silver project in Mexico’s Sinaloa state.

On the back of this acquisition from Minera Alamos (MAI.V), the company completed a share consolidation, a name change to Prime Mining (PRYM.V) and raised almost C$9M in an oversubscribed private placement in the middle of the summer. This allowed Prime to complete the required payments to acquire Los Reyes. Vista Gold (VGZ) (the underlying owner of Los Reyes) is entitled to US$1.5M in October 2021 (18 months from now) as the final cash payment.

The company released an updated resource estimate earlier this month which in essence doubled the size of the resource in only half of a years’ time. Both the sizes of the resources (0.83Moz in the M&I categories and an additional 0.26Moz in the inferred category) as well as the average grade of 1.31 g/t AuEq were a very positive surprise. It is now truly time to pay attention to Los Reyes and Prime Mining.

A brief history of the Los Reyes project

As Prime Mining is the 3rd optionee of the Los Reyes project in just five years, we wanted to make absolutely sure the project has merit which we now believe it truly does.

The first thing that stands out is the lack of background work done by the previous optionees. To be fair, it was a difficult mining market and capital has been hard to raise. However, as the first Prime Mining-led resource estimate on the property demonstrates, the Los Reyes Project truly deserved the attention. Los Reyes has surpassed our expectations (showing 1.1 million gold-equivalent ounces of which 75% in the measured and indicated categories) and our confidence levels have increased.

Finally, thanks to the extensive metallurgical work done by previous operators, if you recalibrate the silver and gold recoveries to the project average and not just the lowest conservative recoveries as Prime has done to calculate its cutoff grade, you are then looking at an even larger resource as it would allow Prime to use a lower its cutoff grade (thus increasing the tonnage at a lower average grade).

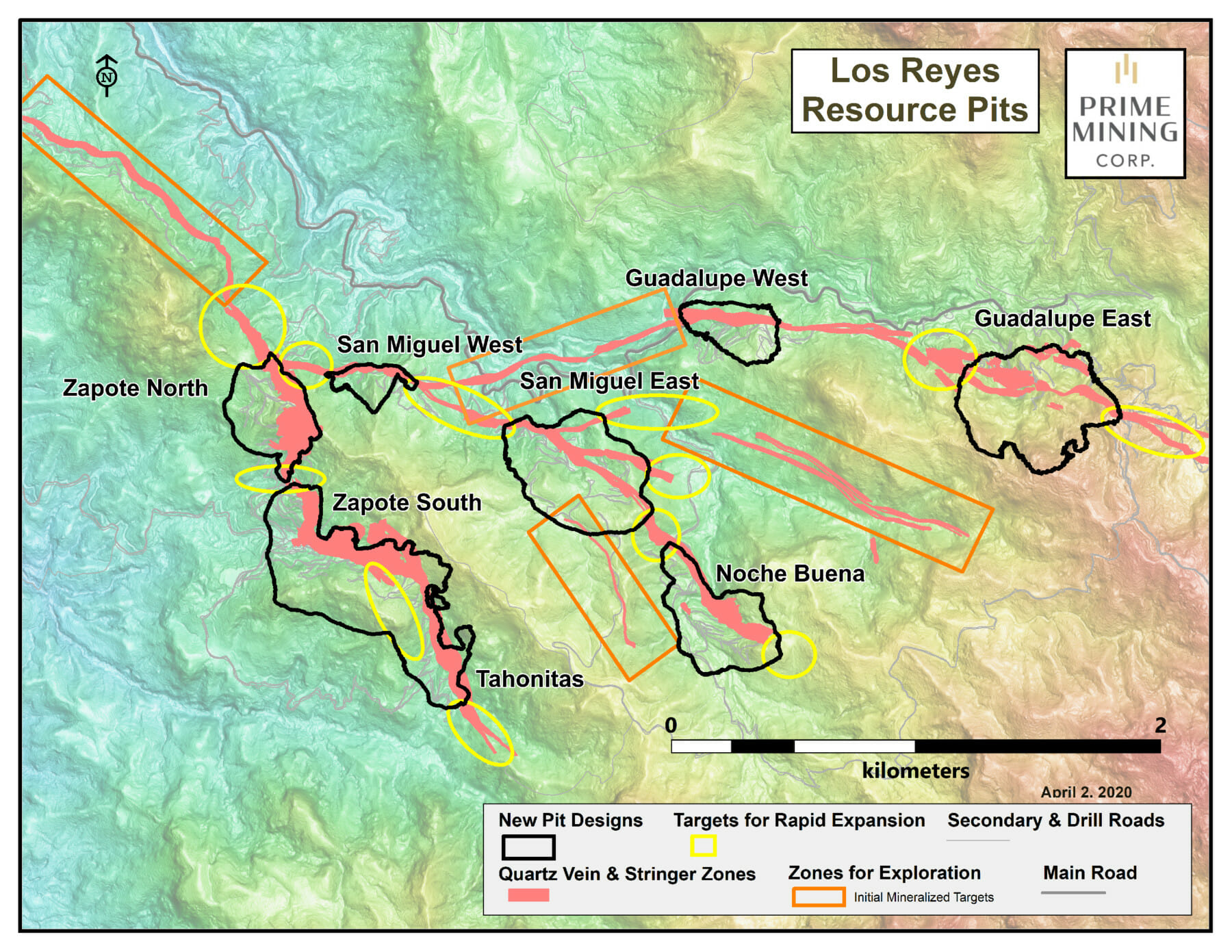

The Los Reyes project is located in Mexico’s Sinaloa province and consists of just over 6,300 hectares (63 square kilometers) of claims which host at least 13 target areas. The property is located in the foothills of the Sierra Madre mountain range with excellent local infrastructure and close proximity to a knowledgeable mining workforce.

The Sierra Madre mountains have historically been a tremendous source of gold and silver. The first traces of gold and silver were discovered in the second half of the 18th century in the town of Guadelupe de los Reyes. This was the start of a mini-gold & silver rush in the Guadelupe de los Reyes mining district as the prospectors rapidly encountered several vein systems in the immediate vicinity of the town.

It is obviously too much to expect anyone to have kept records of the production phase from the late 1700s on. However, in 1936 a first estimate of the historical production came in at 40 million ounces of silver and 600,000 ounces of gold (based on an average grade of 12 g/t gold and 900 g/t (!) silver) of which approximately half was produced in the 50-60 years preceding the 1936 estimate date. Despite the lack of complete records, it is pretty clear the Guadelupe de los Reyes district was quite prolific given the amounts of gold and silver produced, using old school mining techniques and low recovery rates.

The district remained dormant until the late 1980s when the region enjoyed renewed interest by prospectors who recognized the potential of the mining district as the mining and processing options have improved tremendously in the preceding half-century.

As previously mentioned, there has been historical metallurgical test work on Los Reyes with preliminary leaching results in a 1998 test program indicating approximately 76% of the gold and 24% of the silver (with test results ranging between 56%-75.4% for the gold and 20.1-30.6% for the silver) could be recovered through the conventional heap leach techniques. As those test programs were completed over 20 years ago, it would not be a stretch to assume new test work would further increase the recovery results. If 76% and 24% were the 1998 recovery results, it should not be too difficult for Prime Mining to anticipate a higher recovery rate but the company’s consultants remained conservative and determined the cutoff grade of the new resource estimate based on a gold recovery rate of 72% and a silver recovery rate of 25%.

And although Prime Mining is approaching Los Reyes as a heap leach project, it is not a strict requirement. In 2012, the metallurgical test results were focusing on a standard flotation and gravity recovery circuit which resulted in a recovery rate of 93% for the gold and 83% for the silver.

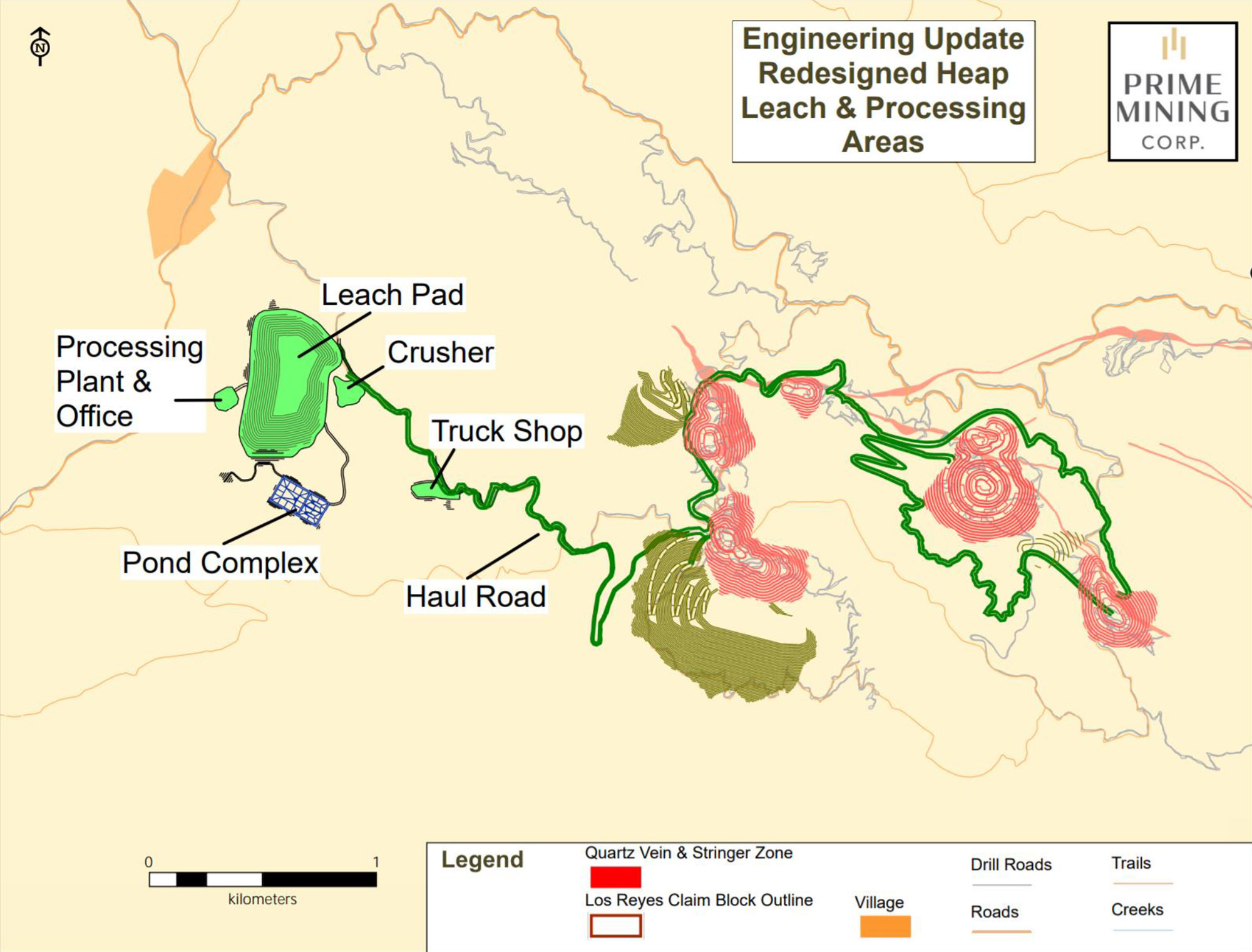

While Prime Mining’s original plan was to focus on a heap leach project, its options are not limited to just that scenario. If Los Reyes hosts more mineralization, and as the resource currently shows, it remains open in all directions, Prime Mining could consider a scenario similar to the one that Integra Resources (ITR.V) is eyeing: start with a low-capex heap leach mine and use those cash flows to build a fully functional processing plant for the transitional and possible sulphide mineralization. To be clear, all of the mineralization to date is currently hosted in oxide ore.

Prime Mining had intended to complete its maiden economic study on Los Reyes in the second half of this year; but with the much larger size and the expansion potential of the resource, we expect a large-scale exploration program to be completed, and possibly, in conjunction with an economic study. From there, we will have much better idea of the direction Prime will take.

The new resource estimate has been published, coming in higher than expected

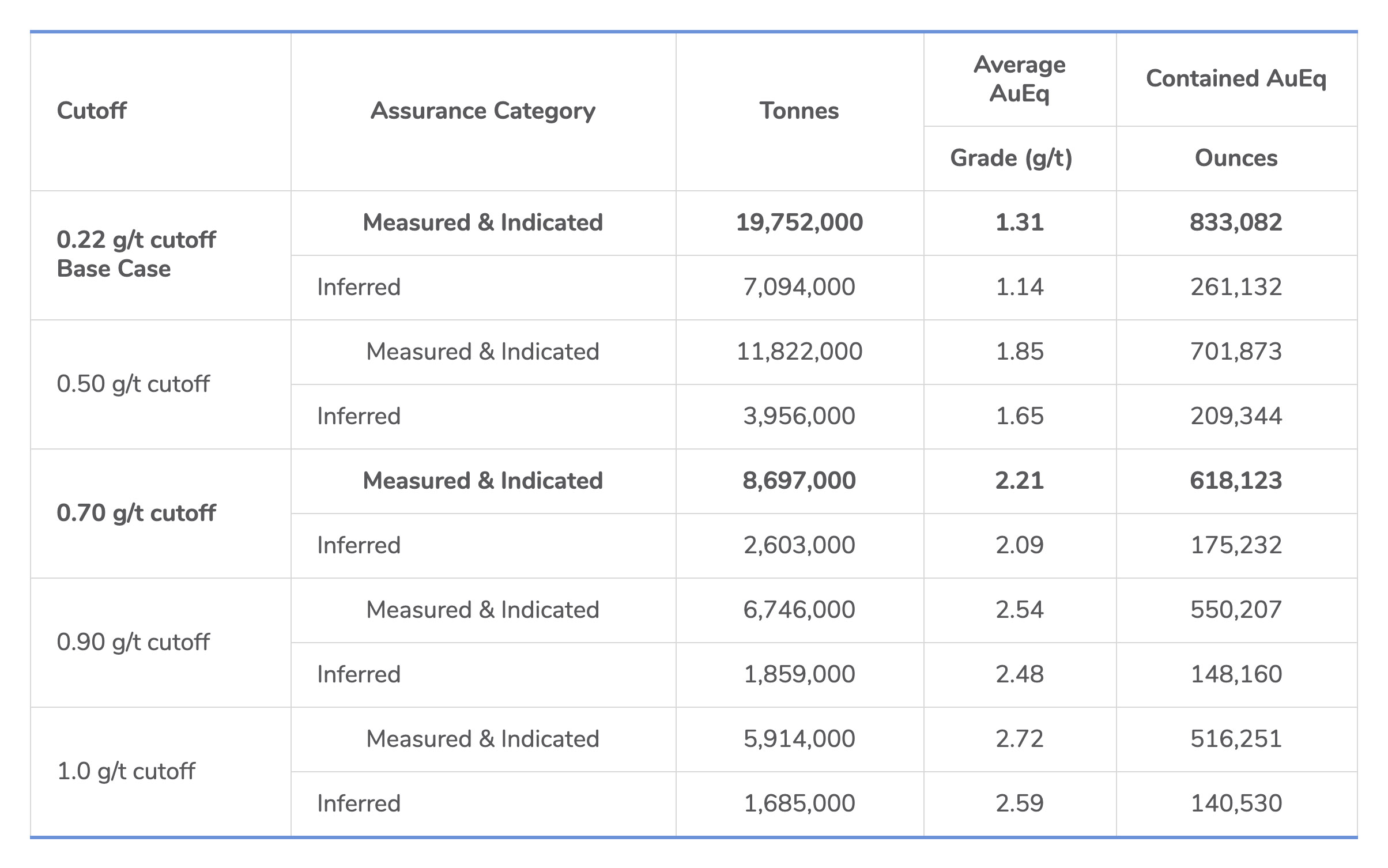

In the first week of April, Prime Mining released the updated pit-constrained resource estimate for Los Reyes. Using a cutoff grade of 0.22 g/t gold (higher than the cutoff grade that would for instance be used in Nevada), the resource contains 19.75M tonnes in the measured and indicated categories at 1.31 g/t AuEq for 833,000 ounces and an additional 7.1 million tonnes of rock at an average grade of 1.14 g/t AuEq for an additional 261,000 gold-equivalent ounces. Across all resource categories, Prime Mining’s first resource comes in at in excess of 1 million gold-equivalent ounces, an important (psychological) bar to jump over.

Interestingly, even if a (much) higher cutoff grade is used, a large part of the gold-equivalent resource remains intact. At a cutoff grade of 0.7 g/t for instance (more than three times higher than the base case cutoff grade), the total amount of gold (-equivalent) in the measured and indicated category is falling back to just 618,000 ounces (down 25.8%), but the average grade increases by almost 69% to 2.21 g/t AuEq. This indicates the current resource estimate is quite resilient and using a higher cutoff grade would reduce the scope of the project but does not kill it, and that’s important to note.

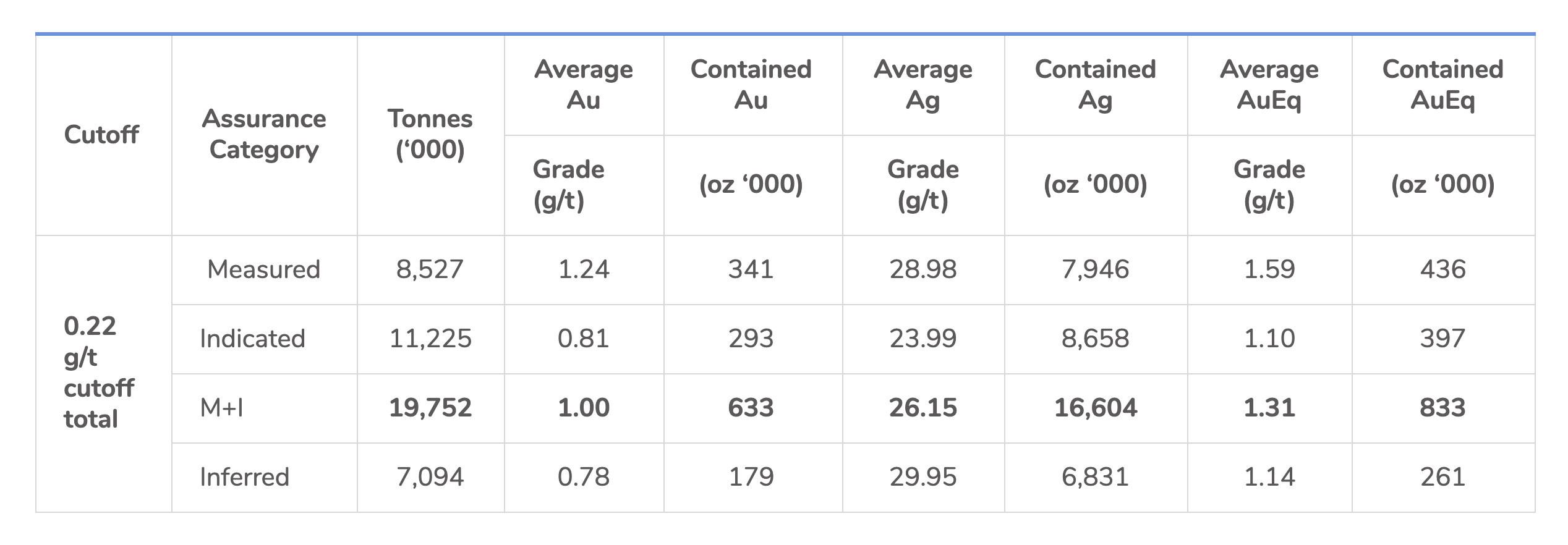

As using 0.22 g/t as a cutoff grade appears to be reasonable, let’s have a look at the breakdown of the gold and silver values that make up the gold-equivalent grade.

So in the measured and indicated categories, approximately 75% of the gold-equivalent resource does consist of actual gold while the balance comes from the 16.6 million ounces of silver (which translate into 200,000 gold-equivalent ounces using the 83:1 ratio).

The breakdown also allows us to calculate the recoverable rock value per tonne of rock in the measured and indicated resources. We see the average gold grade is 1 g/t which will result in a recoverable grade of 0.72 g/t (72% recovery applied) for the gold and 6.54 g/t (25% recovery applied) for the silver. Using a gold price of $1700/oz and a silver price of $15/oz, the recoverable value per tonne of rock in the measured and indicated categories ends up being $39.35 + $3.15 = $42.50. At $1300 gold and $13 silver, the recoverable rock value would decrease to just below $33/t.

Considering the cost inputs used to determine the cutoff grade indicate a mining cost of $13.44 per tonne of mineralized rock and a cost of $4.30/t for leaching and overhead. Therefore, it looks like the production cost per tonne will be less than half the recoverable value per tonne at the current spot prices.

We will use this data to calculate our own NPV based on a few different (gold price) scenarios, but it’s clear the updated resource does not just pass the ‘size’ test but also the viability-test. Using a cutoff grade of 0.22 g/t AuEq does result in a viable in-pit resource (based on the company-provided mining cost inputs which appear to be very reasonable when compared to other mines).

Prime was able to raise a lot of money on the back of the acquisition

During the five months it took to complete the transaction, Prime was working on recapitalizing the company to make sure its treasury would be able to cover the next payment to Vista Gold, while also raising the requisite funds for exploration work on the Los Reyes property.

This is why Prime Mining’s private placement appeared to have been ‘priced to sell’, and the company raised C$8.7M by issuing 29.05 million units at C$0.30. Each unit consisted of one common share as well as half a warrant allowing the warrant holder to purchase an additional share at C$0.50 per full warrant within a two year period after closing the deal. Most of the cash was used to complete the purchase from Minera Alamos and making a payment to Vista Gold, and as of the end of January, the company had a working capital of approximately C$450,000.

This sounds alarmingly low but keep in mind Prime had C$1.5M in cash, and the majority of the current liabilities (C$1.12M of the C$1.66M) is a loan owed to CEO Andy Bowering. Bowering fronted Prime the cash to make sure the transaction went through, and given his enormous interest in Prime’s equity, the likelihood of Bowering playing hardball on the loan and demanding payment is close to zero.

As mining has now been deemed non-essential work by the Mexican government in an attempt to fight the COVID-19 outbreak, the cash outflow should be relatively minimal at this point. Additionally, we should not forget about the 19 million warrants that remain outstanding as part of the C$0.30 capital raise.

These warrants have an exercise price of C$0.50 (and are now in the money) and expire on August 21st, 2021. If Prime Mining’s share price continues to trade above C$0.50 for a little while, we will see some of the warrant money come in which will further help to bankroll the company’s operations. Should all warrants be exercised, a total of C$9.5M will be added to Prime’s bank account but Prime first needs to get its share price trading above that level.

Management team

Andrew Bowering – CEO & Director

- Venture capitalist, 30-years experience as owner operator of drilling companies and leadership in worldwide mineral exploration and development.

- Founded/funded Millennial Lithium Corp and built teams to pursue precious, base and industrial metals from exploration to production.

- Founder/operator of companies on the TSX Venture, TSX main and American Stock Exchange including Caldera Environmental, Pinnacle Mines, ATW Gold, Cap-Ex Iron Ore, Millennial Lithium, and American Lithium Corp.

Gregory K. Liller – COO and Director

- Over 40 years experience in mineral exploration and mine development.

- Played key role with 7 projects which became active mines and for managing exploration and development of over 11 million ounces of gold & 600 million ounces of silver reserves and resources.

- Senior roles in public companies on TSX Venture, TSX main, and American Stock Exchange including Genco Resources (TSX), Gammon Gold (TSX, AMEX), Mexgold Resources (TSV) and Oracle Mining (TSX).

Daniel J. Kunz. – Executive Chairman and Director

- Professional engineer with over 30 years of experience in mining, construction and financing of global resource projects.

- Former CEO of Ivanhoe Mines Ltd., founder and CEO of US Geothermal Inc.

- Served as senior management and/or president level; Morrison Knudson Corporation & MK Gold Company.

- MBA, B.Sc. Engineering Science & Associate of Accounting degree.

Conclusion

Sometimes all a project needs is a fresh set of eyes looking closely at all of the existing and available data in order to come up with a dedicated exploration plan. The Los Reyes project has always been a Plan B or even Plan C when it was owned by the previous companies, and Prime Mining is the first company that will actually dedicate most its resources (human capital as well as monetary resources) to unveil the true potential of the Los Reyes project.

The first resource estimate under Prime’s auspices greatly exceeded the historic resources at Los Reyes and even exceeded our expectations. Not only does Los Reyes contain in excess of 1 million ounces gold-equivalent, but the average grade also exceeds our expectations. And even after applying a 72% recovery rate for gold and 25% recovery rate for the silver, everything points to Los Reyes having the potential to being a very profitable low-capex low-cost open-pit heap leach mine. Or as we previously suggested, Los Reyes, has the potential to be a much larger, multi-million once operation.

Keep in mind this is just the beginning as Prime only started its exploration activities in Mexico in Q3 2019. This report mainly focuses on the first (Prime-led) resource estimate and confirms the current average grade appears to be economical. In a future report, we will focus on the resource expansion potential (including the potential to add sulphide-hosted mineralization to a global resource estimate) while also putting a DCF model together to determine NPVs and IRRs using a range of commodity prices to see how well the Los Reyes project holds up.

Disclosure: The author has a long position in Prime Mining. Prime Mining is a sponsor of the website.