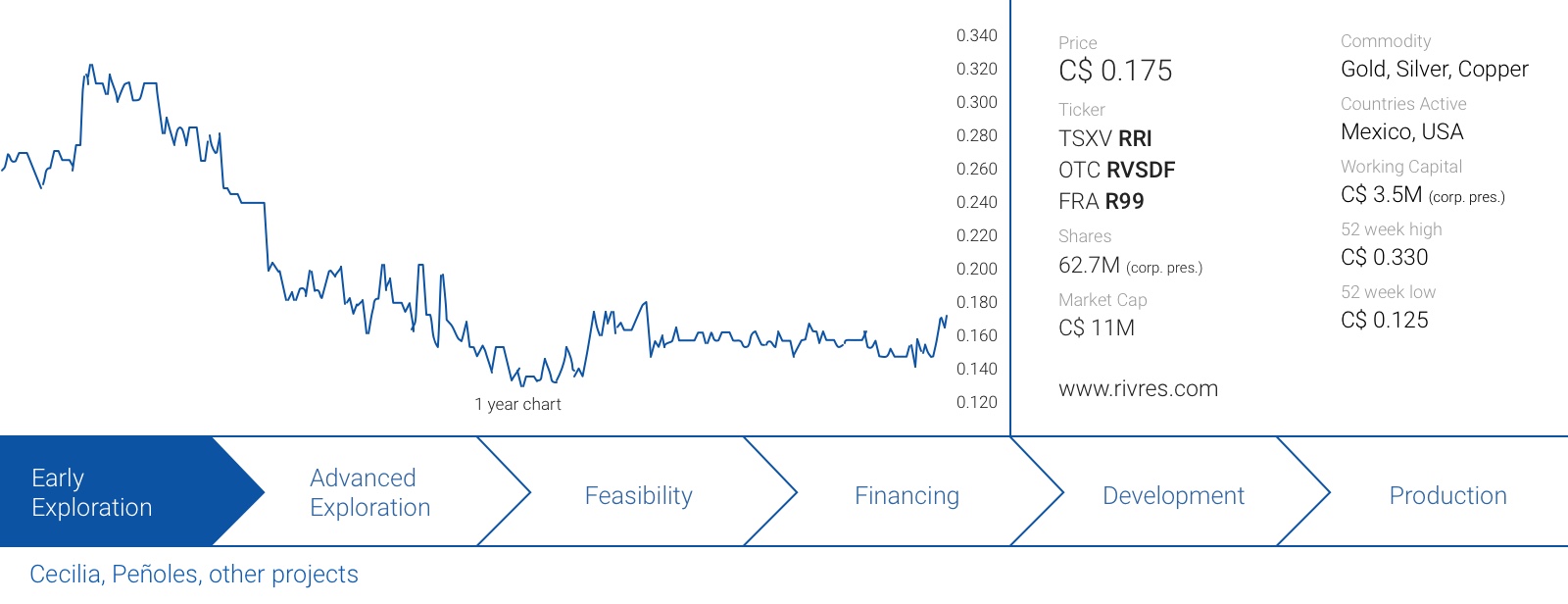

It has been a few years since Riverside Resources (RRI.V) has been tied up in a strategic alliance and since Antofagasta (LON:ANTO) didn’t pursue the joint venture in 2016, Riverside has mainly been working on one-off joint venture deals with a range of companies on one or a few projects.

In a very exciting update today, Riverside announced it was able to attract BHP Group (BHP) (the ‘Billiton’ has been replaced by ‘Group’) as a new relationship to explore for copper deposits in Mexico’s Sonora province.

A nice surprise: BHP Group is an elephant-hunting company

Of all strategic exploration alliances Riverside has been involved in in the past, the agreement with a renowned company like BHP is by far the most prestigious agreement. We can only imagine how many hoops Riverside had to jump through to satisfy the needs and requirements of one of the largest mining companies in the world (BHP’s current market capitalization of approximately US$130B is approximately 1.5 million percent (15,000 times) higher than Riverside’s current market cap), but we see this agreement as a testament to the potential of Sonora which could host additional large copper deposits.

The funding program consists of a three-phase agreement to move the projects forward. Riverside and BHP called these phases the ‘project generation’ ‘project operation’ and ‘joint venture’ phases, but we will keep it a bit simpler.

Phase I: Finding projects

This phase will mainly consist of the usual ‘ground work’ (mapping, sampling, airborne surveys, …) and BHP has committed to spend at least US$1M per year for the next two years, for a total exploration commitment of US$2M (C$2.65M). During this phase, Riverside will be the operator and receive a monthly payment as well as a (standard) 10% operator fee for the expenditures, and a 5% fee on services provided by third parties. Assuming a 60/40 ratio between internal and external services, Riverside Resources will pocket an average operators fee of 8%, or US$160,000 over the next two years. Additionally, Riverside will receive an additional monthly fee for managing the program. So basically, the deal with BHP will take care of a large portion of the Mexican overhead for Riverside for at least the next two years.

Phase II: Advancing projects

Of course, not all prospects that will be identified in the first phase will be interesting enough for BHP to pursue, and only specific projects (‘Defined Projects’, here after ‘DP’) will be advanced towards the second phase.

And this is where it gets interesting for Riverside. Per prospect that gets the status of a defined project, it will receive US$200,000 in bonus payments. And if three prospects get the DP status, an additional US$200,000 would be due as bonus-on-bonus payment. This would add US$800,000 (approximately C$1.05M) to Riverside’s bank account.

These bonus payments could be very welcome at that point as Riverside will be allowed to participate in the Phase II exploration expenditures to retain a stake in the future projects should they go to Joint Venture (Phase III). First of all, BHP will commit to spend up to US$5M per Defined Project to follow up on the original leads. Should BHP walk away from any of these projects in Phase II, full ownership will revert to Riverside Resources (although BHP may retain a Net Smelter Royalty on the projects it returns based upon the total property investment BHP has done).

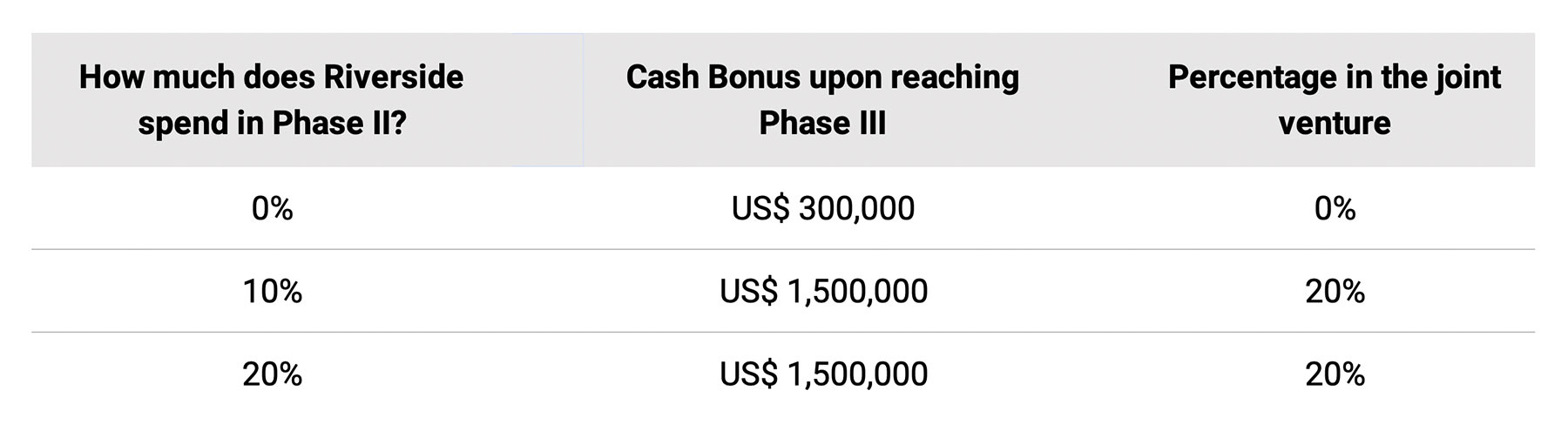

Riverside could opt to fund 10-20% of the respective exploration programs (US$0.5-1M assuming BHP will spend the maximum amount of US$5M before moving to the next stage). After carefully reading the joint venture terms, we think Riverside should just spend the bare minimum (10% of the exploration expenditures) if it wants to play it smart.

Phase III: a joint venture

Why is that? Because if BHP elects to move to the third phase and establish an ‘official’ joint venture on a copper property, Riverside will receive a 20% interest as long as it contributed a minimum of 10% of the Phase II expenditures. So we don’t see why Riverside would spend more than the bare minimum as taking care of 10% of the Phase II exploration expenditures would establish a 20% interest in the joint venture.

Moving forward to this third phase means Riverside Resources will be in for another payday: for every Defined Project that successfully moves from Phase II to Phase III, Riverside will receive a US$1.5M (approximately C$2M) cash bonus if it has contributed at least 10% of the Phase II exploration expenditures (and just US$300,000/C$400,000 in case Riverside didn’t contribute a minimum of 10%).

The strategic alliance agreement seems to be incentivizing Riverside to effectively fund at least 10% of the Phase II expenses. Not only does it represent an additional cash bonus of US$1.2M, it also creates a difference between ending up with 0% in the joint venture or 20%. The next table summarizes how important it is to spend the 10% in Phase II:

It’s pretty clear that not contributing in Phase II would be a bad decision as it would leave Riverside Resources pretty much empty-handed unless BHP would walk away before having spent the entire US$5M. Spending 20% of the exploration expenditures in Phase II would also be a bad move considering Riverside won’t get more out of the joint venture compared to spending just 10%.

Considering there is a cap of US$5M to be spent on each DP in Phase II before making the decision to move ahead to an official joint venture, spending 10% of that amount would cost Riverside Resources just US$0.5M, while it would result in a US$1.2M higher cash payment upon moving to Phase III. So the main risk for Riverside would be to spend half a million dollar and then see BHP pull out before reaching Phase III. However, a project where almost US$5M of work will have been completed on should have a high potential to be re-marketed to other (smaller) copper companies. So in our view, Riverside should contribute 10% (but not more) during Phase II as that’s just the strategy with the highest payoff should the projects move towards Phase III.

Once Phase III is reached, both parties will have beneficial options in place. Riverside Resources has a put option allowing it to sell its joint venture interest in 1% increments for US$100,000 per percent. Selling the entire 20% to BHP would allow it to raise US$2M in cash (but end up empty handed). This could be a strategy Riverside could pursue if for instance two DP’s reach Phase III and Riverside can only contribute funding towards one of both.

Additionally, BHP also has a call option whereby it can purchase the difference between 20% and the total percentage contributed by Riverside in Phase II for US$300,000 per percent. So if Riverside contributed 10% of the Phase II expenditures but ends up with a 20% joint venture stake, BHP has the right to repurchase 10% for US$3M.

Why does BHP care so much about Sonora?

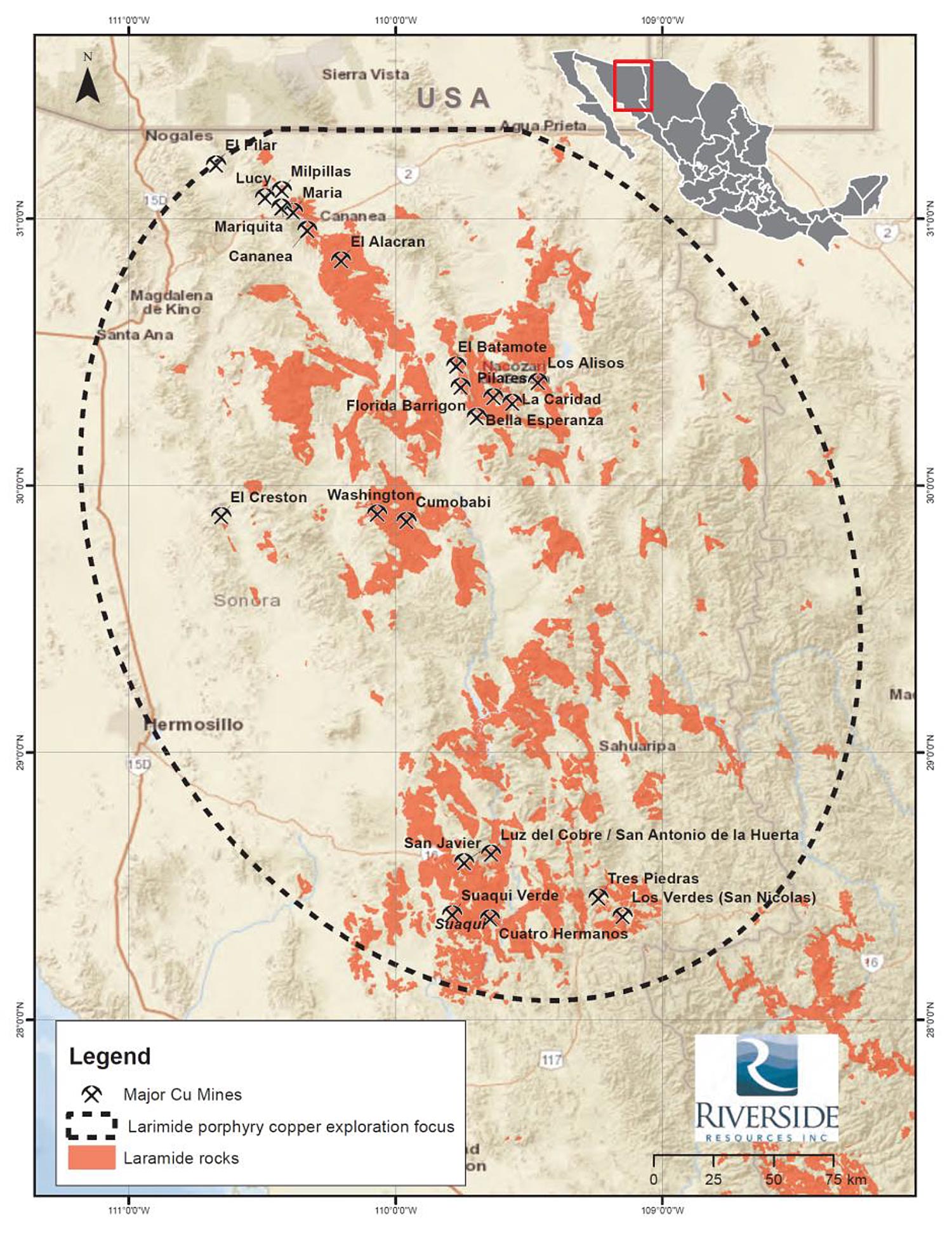

You may perhaps remember our site visit report from February last year. We visited Riverside’s local headquarters in Hermosillo, the capital of the province where after we visited the Glor and Cecilia gold projects.

During the short flight between Phoenix and Hermosillo, the large-scale copper mines in Arizona were very clearly visible, even from 30,000 feet altitude (fortunately the weather was great, so the view wasn’t blocked by clouds). Indeed, very few people realize Arizona is one of the epicenters of the domestic copper production in the United States, and the state hosts numerous producing and past-producing copper mines with billions of pounds of copper in resources and reserves.

There’s obviously no good reason why the copper belt would end at a country border (which usually is per definition an artificial border), and on the Mexican side of the US-Mexico border several large copper deposits were identified and developed. The most famous one is the Cananea mine (now officially renamed Buenavista del Cobre), owned and operated by Grupo Mexico. This actually is the oldest mine on the North American continent as it opened 120 years ago in the 19th century. Despite having a long and rich operating history, the mine still is far from empty. As of the end of 2018, the Buenavista del Cobre mine still had roughly 4.5 billion tonnes of sulphide material proven and probable reserves at an average grade of almost 0.42% copper, for a total of 42 billion pounds of copper. An additional 2.5 billion tonnes at an average grade of 0.149% copper is deemed to be ‘leachable’, adding an additional 8 billion pounds of copper to the in-situ copper resources.

Grupo Mexico (through its 89% owned subsidiary Southern Copper) has just completed a $3.5B investment in the mine to make it the third largest producer in the world with a remaining mine life of approximately 60 years for the sulphide mineralization.

According to the annual report of Southern Copper (SCCO), the 188,000 tonnes per day concentrator capacity and SW-EW plant produced a total of 325,000 tonnes of copper (715 million pounds, rounded). On top of the existing multi-billion-pound reserves, recent exploration results have unveiled increasing grades at depth. From the Southern Copper annual report:

And Cananea/Buenavista del Cobre wasn’t a lucky shot. Further down the Laramide copper belt, approximately 100 kilometers Southern Copper also operates the La Caridad copper mine which contains 3.4 billion tonnes in the sulphide reserves (at a lower grade of 0.22% copper and 0.03% molybdenum).

Elephant deposits aren’t unheard of in Sonora. But none of the ‘Western’ companies has ever gone looking for one.

And deposits like Buenavista and La Caridad are exactly what BHP will be looking for. Huge copper porphyries that are able to move the needle for BHP in terms of annual output and long mine lives.

Conclusion

This strategic alliance is a game-changing deal for Riverside Resources. Not only does attracting BHP lend a lot more credibility to the company’s exploration theory to find more large copper assets in Sonora, BHP also is a partner that has the technical, operational and financial expertise to see a project through from grassroots exploration all the way to production.

Of course, exploration isn’t easy and there’s absolutely no guarantee BHP and Riverside will find meaningful copper deposits. But Sonora has been underexplored for large copper porphyry deposits and the Mexican extension of the Laramide copper belt might be one of the best places in the world to look for a new Cananea/Buenavista/La Caridad.

Disclosure: Riverside Resources is a sponsor of the website. The author has a long position in Riverside Resources. Please read the disclaimer