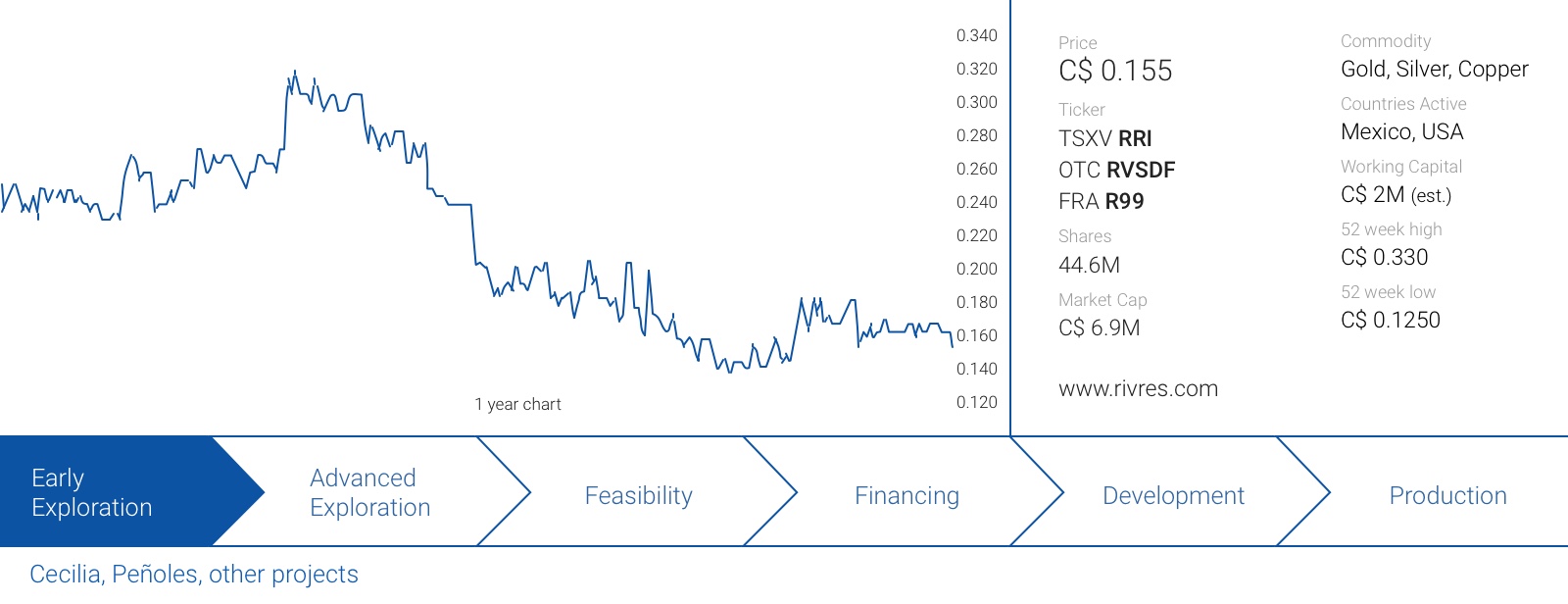

Riverside Resources (RRI.V) will focus on growth in various ways this spring and throughout 2019 with a specific focus on its 100% owned Cecilia gold-silver project in Sonora. The company continues to apply its prospect generator model on this project, but as Riverside has enjoyed exploration success at its first few stages of the exploration curve, it is now looking to add value through a focused drill program as the next stage at Cecilia. Riverside will go ahead and complete a small drill program on a few of the more than eight targets on the project. In 2018 Riverside’s exploration programs found more high-grade gold and the 2019 program will follow up on these areas to find extensions below the surface through shallow drill campaigns. Riverside had been looking for a partner to test the big deeper targets, and these targets will remain independent from the initial program Riverside envisions.

We are expecting an action-packed 2019 for the company with drill results at Cecilia: exploration updates on the other Mexican properties and perhaps more news from the copper front as the interest in exploring for large copper porphyry targets seems to be returning. Riverside envisions 2019 to be similar to 2012 when the Company went beyond Mexico for a strategic exploration alliance working in British Columbia, Canada with Antofagasta (ANTO.L). The company could be planning to broaden its horizon beyond Mexico again.

Additionally, the Mexican elections in 2018 have now been resolved and finding partners in 2019 should be easier with the newly elected president Obredor who seems to have a favorable, pro-mining stance. Riverside should be able to get new partners including ‘major companies’ (as disclosed in a January press release) as well as getting other partnership deals across the finish line. Please note: the share count and working capital position are based on the pre-capital raise situation.

Cecilia will be one of the main focuses in the near term

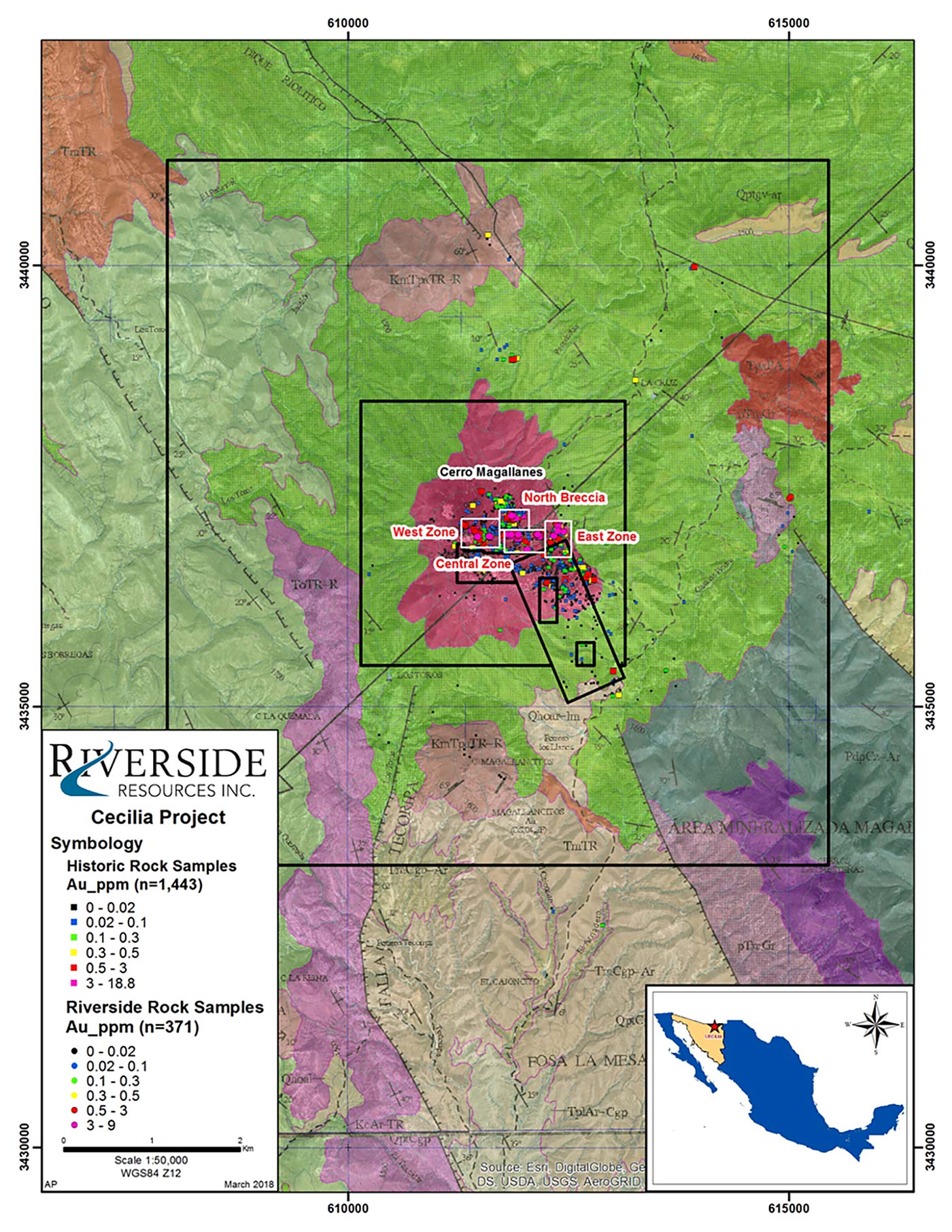

As you probably remember we visited Riverside’s Cecilia project last year (re-read our site visit report here). And since our visit, the property has turned out to be Riverside’s most exciting exploration asset as the 2018 exploration activities confirmed the presence of widespread mineralized zones. Cecilia is deemed to be an epithermal gold-silver exploration target within a felsic flow-dome complex (Cerro Magallanes), and is similar to the San Julian and La Pittarilla deposits in Durango. This doesn’t mean exploration success is guaranteed at Cecilia, but it’s a good place to start looking for a gold-silver system. Additionally, historical exploration programs like the 19-hole drill campaign executed by Cambior Explorations did encounter economic-grade gold mineralization with for instance 30 meters of 1.41 g/t gold starting at just 4 meters down-hole.

After consolidating the initial Cecilia-Margarita internal concessions in 2017, Riverside Resources competed and won the lottery process initiated by the Mexican government and was awarded in excess of 5,000 hectares of land that surround the original Cecilia project during 2018. This increased the total land package of Riverside at Cecilia to almost 6,000 hectares. Preliminary exploration activities on the expanded Cecilia concessions have indicated the presence of numerous exploration targets. Riverside continues to expand its land package and now is a dominant player in the district.

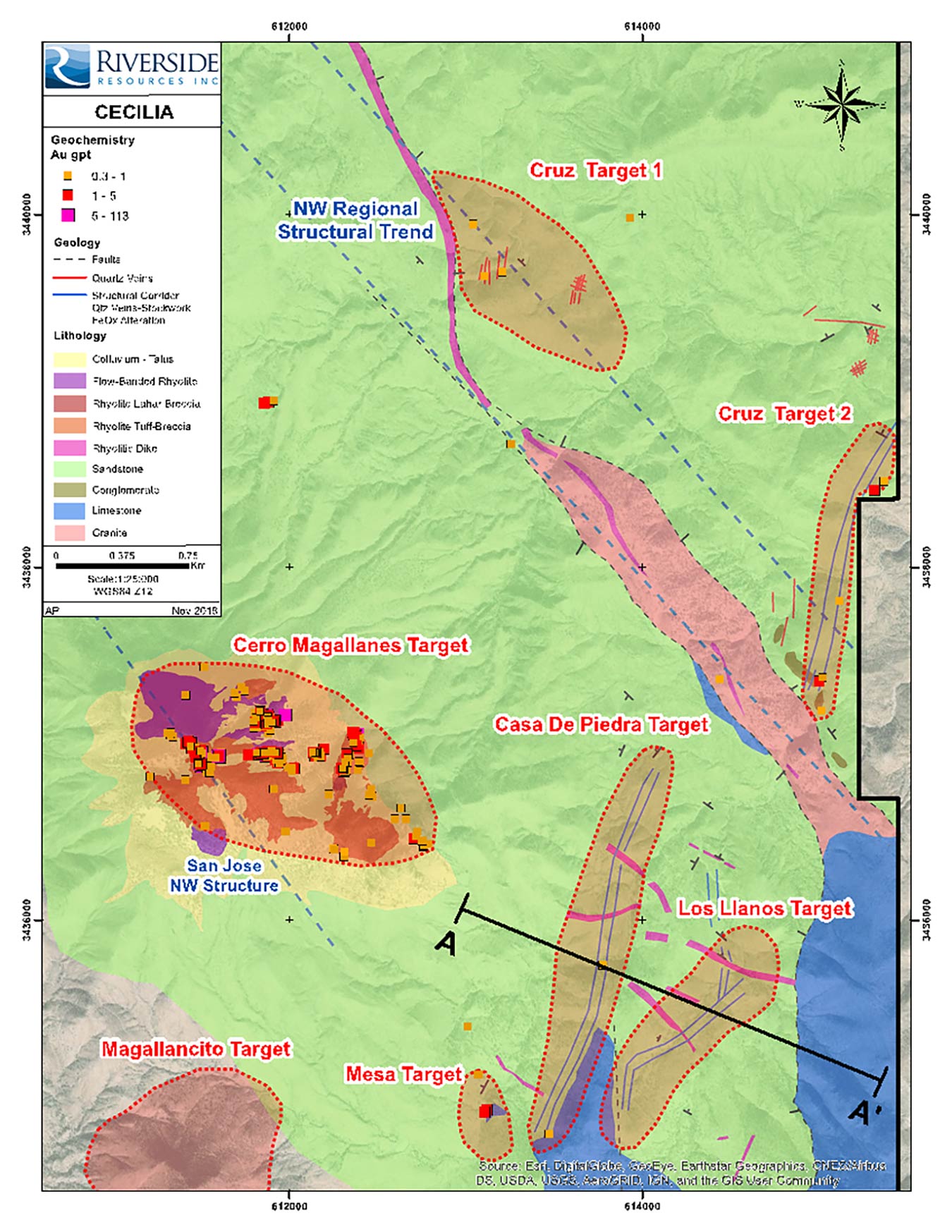

After completing the 2018 rock sampling and mapping program, Riverside has now defined four new large anomalies which brings the total amount of drill targets to 8.

The original Cerro Magallanes target was the first main area of interest until Riverside was able to expand its land package. Cerro Magallanes is the rhyolite dome complex right in the middle of the Cecilia project and channel sampling indicated the presence of a relatively consistent gold zone from the top of the Cerro all the way to San Jose and Agua Prieta. Some of the gold grades are actually pretty good for instance 47 meters of 1.12 g/t from the underground workings at San Jose and 10 meters containing 3.34 g/t gold taken at a surface channel at the Agua Prieta target. These results were already exciting enough for Riverside, but the 2018 exploration program on the newly acquired land continued to pay off.

There are two targets called Cruz (Cruz I and Cruz II) located towards the north and east-northeast of Cerro Magallanes. Both Cruz targets are located on a structural corridor and Cruz I shows relatively high levels of copper, zinc and lead as well. This might indicate it could actually be the lower part of an epithermal system. This seems to be confirmed by the presence of quartz veins with breccia that were found at the outcrop.

At Cruz II, Riverside found evidence of a similar structural corridor of silicification and veining with a width of up to 20 meters and usually consisting of 3 to 5 parallel veinlets that are up to 0.3 meters wide. The gold values encountered in the initial sampling program were low (2 of the 11 samples returned a value of 0.5 g/t), but the system shows the right geological setting to find more gold (-silver) mineralization.

The Casa de Piedra target is located just east of Cerro Magallanes and consists of a 2,000 meter long shear fault vein containing very clear signatures of epithermal mineralization. Despite these features, the Casa de Piedra target has never been drilled, and we would expect Riverside to make this new zone one of its priorities as the 2018 sampling program encountered some gold values as well as other elements Riverside describes as ‘typical of the upper parts of hydrothermal veins’.

The 2-kilometer-long vein at Casa de Piedra isn’t unique. Just east-southeast of Casa de Piedra is the Los Llanos target, which is one half a kilometer away from the Casa de Piedra target zone. Los Llanos is characterized by a structural corridor of altered sandstone with an average width of 20-30 meters and the field geologists have sampled gold in ‘narrow anastomosing veins’ which could have been the source of gold that was mined at historic placer mining sites on the property.

With these five new high-priority drill targets, Riverside Resources knows what will keep them busy throughout this year!

A brief wrap-up of Riverside’s activities in 2018

La Silla

We expect to see some action on the La Silla project in Mexico’s Sinaloa province as Sinaloa Resources, a private company, entered into a definitive agreement in February 2019 with Sinaloa to acquire an initial 70% stake in this gold-silver project. As part of the earn-in agreement, Sinaloa Resources is required to issue C$1M worth of stock to Riverside as well as spending C$2M on exploration within a three year time frame. Sinaloa could subsequently acquire full ownership of the property by issuing an additional C$500,000 in stock and spending an additional C$1M in exploration expenses.

On top of that, Riverside Resources will retain a 3% Net Smelter Royalty which could be provide an additional upside some day and gives shareholders the carried benefit in the project.

Clemente & Glor

The life of a prospect generator isn’t always easy, and sometimes drill programs didn’t yield the results Riverside was hoping for. Drill-testing the high-priority targets on the Glor project in Sonora, funded by partner Centerra Gold (CG.TO), failed to impress the partners. The Glor project was dropped, and Riverside recorded a C$290,000 write-down on the property.

In August 2018, joint venture partner Silver Viper (VIPR.V) notified Riverside Resources it wouldn’t be completing its C$4M earn-in option on the Clemente project, and Riverside regained full ownership. Although the company still owns the project, RRI already recorded a C$225,000 impairment charge as well, which reduces the book value of the property to zero. Riverside Resources is still considering its options for Clemente, so we hope to see a new joint venture partner step in to further figure out the project’s geology.

Riverside’s Management Discussion & Analysis report provides a great overview of the work that has been completed on the company’s assets. At Peñoles, Riverside undertook a full relogging, remapping, studying of the larger area plus the smaller key structural targets including the underground workings and targets of the Gully Fault zone and will look toward 2019 to have these targets now tested.

Riverside funded the larger concession package with taxes and then reduced the size of the land package at the end of the year to a slightly smaller zone of 5000 hectares that is the central key tenure portion of the project.

Riverside also generated a new computer generated 3D model and developed a series of new drill planned projects plus a program with the community to fix the school and church in the village as part of its CSR program. This past year the neighboring concessions were drilled by Fresnillo (FRES.L) without results being released (for a large company, eight drill holes aren’t material information and as such, assay results don’t have to be disclosed to the market). Interestingly, Fresnillo’s 8 holes were drilled immediately adjacent to Riverside’s tenements and one could interpret this as Fresnillo working to evaluate the potential of Riverside’s ground across the claim border. In 2018 Riverside also won the lawsuit against the Mexican government for having to pay excessive extra taxes wrongfully because the Company had not been given the reduced title and then subsequently reduced it. This did cause a higher apparent spending on the 2018 financials due to the settlement which had taken five years to resolve and thus the apparent spending came onto the project as did the over $200,000 in recovery.

Tajitos

Riverside spent just over C$200,000 on the Tajitos project in Mexico, which is located immediately adjacent to Fresnillo’s (FRES.L) gold deposit (also named Tajitos). In 2018, Riverside worked with local surface right owners that cover the mineralized zones on top of the Fresnillo and Riverside zones to make sure it has an access agreement in place, which will facilitate future exploration programs at Tajitos and Tejo.

Riverside now has a Right of First Refusal (‘ROFR’) to buy the ranch which gives the company a key advantage on the Tajitos district. Additionally, Riverside completed extensive relogging, sampling, and provided assistance with a master’s degree thesis for the structural control of gold mineralization and 3-Dimensional data processing and interpretation at Tajitos.

What did the company spend its money on?

Riverside recently published its full-year financial results which provide an overview of how the company managed its finances for the year ending on September 30th. It’s always interesting to see how much money companies are spending to advance the properties through field work, targeting, permitting, surface access agreements.

The company reported a net loss of C$1.46M, but as you can see on the image, there are several elements that had a major impact on this number. First of all, we need to remove the one-time gains from the equation (FX gains, ‘other income’, unrealized gains on short term investments), but we also need to add back the non-recurring expenses such as the C$578,000 impairment charge on exploration assets, which were reduced in size as Riverside focused on key properties and has been acquiring other quality properties progressing with generative work. Riverside also realized losses on the sale of short-term investments as the stock market pricing was lower than a year earlier. We are also adding the share-based expenses back to the result as these are a non-cash expense as well.

All these expenses and gains are non-cash elements, and they make it more difficult to find out how much cash Riverside has effectively spent. If we would make the adjustments mentioned above, Riverside has effectively spent C$931,000 on G&A with just over C$432,000 going to consulting and professional fees. You’ll notice only C$30,312 was allocated to ‘property investigation and evaluation’, but keep in mind that Riverside Resources is a prospect generator and it capitalizes the majority of its exploration expenditures instead of including those costs as expenses. Riverside worked in 2018 on targeting growth ideas and plans in 2019 to go after the highest priority opportunities.

Indeed, if we flip over to the cash flow statement, you’ll see Riverside spent almost C$1.3M on exploration that was capitalized rather than expensed. So of the total amount of C$2.2M in cash expenses, C$1.325M was spent on ‘pure’ exploration (and a substantial part of the consulting fees will very likely be related to the exploration programs as well). This means that for every dollar Riverside has spent in 2018, 60 cents went directly in the ground. And if we would attribute 50% of the professional and consulting fees to project-related work as well, this ratio increases to 70% which is actually really good for an exploration company.

A quick look at Riverside’s current portfolio

As part of its strategy to find joint venture partners to advance the projects in its portfolio, Riverside usually also negotiates share-based payments which allows it to maintain some exposure to potential exploration successes.

As of the end of its financial year, Riverside reported a fair value of C$809,000 for its stock portfolio. That’s substantially lower than the C$2.2M cost basis which could be seen as conservative and also a pricing related to the overall market conditions that have gone down over the past year. It looks like Riverside has reduced the value of its stake in Sierra Madre Developments (with a cost basis of C$1.1M) to zero as the trading in the company’s shares remains suspended. Word on the street is the company could be trading again this year, but Riverside preferred to be cautious and reduced the book value to zero considering the exact status of Sierra Madre remains unknown at this point.

Riverside also monetized its position in Viridium Pacific Group which were the shares from Morro Bay that had come out of Riverside’s original deal with Sierra Madre. This sale of shares for almost a quarter of a million Canadian Dollar which is another reason why the current book value of the short-term investments is lower than last year as Riverside sold and wrote down the positions related to Morro Bay and Sierra Madre it had accumulated over the past 6 years.

Additionally, Riverside received an extra 1.5M shares of Croesus Gold Corp as an agreed ‘penalty payment’ which had been structured into the deal with Croesus Gold in the condition that Croesus did not go public before the end of 2018. Croesus has still not listed its shares on an exchange but states to its shareholders that they are doing a $0.30/share financing currently as a pre-listing step and also adding the Kay Mine, a second gold asset in Arizona. This increases Riverside’s total position in Croesus to 5.3M shares for a pro-forma value of C$975,000 based on the valuation of the Croesus Gold shares.

The current capital raise will help fund the Cecilia drill program

Riverside Resources is currently raising C$2.3M to fund its 2019 exploration programs (the original C$1.5M placement has been upsized due to investor demand). The private placement has been priced at C$0.16 per unit with each unit consisting of one common share and a full warrant allowing the warrant holder to acquire an additional share of Riverside for C$0.22 for a period of two years.

There is an acceleration clause attached to these warrants: should Riverside’s share price be trading at in excess of C$0.45 for a period of 10 consecutive days, the warrants will expire 30 days later. Considering the company currently has 3.2 million warrants outstanding with an average exercise price of C$0.85 expiring before the end of April, the total net impact of the new warrants on the fully diluted share count should be relatively benign.

Conclusion

Life isn’t easy for prospect generators, but in many ways it’s better than a pure explorer and for 2019 Riverside has lined up deals which will help the company have a strong year. Riverside is working hard to advance many of its projects yet focuses on the highest priority; resource assets and key transactionable projects. In 2018 there were drill tests, but these did not hit the Riverside balance sheet, as partners spend the larger amounts related to drill testing. With an efficiency ratio of 60-70% (dollars spent in the ground versus the total amount of money spent in a year), it’s clear the company will focus on its exploration properties in Mexico and we understand for 2019 Riverside will expand northward into USA and Canada as is effective for quality targets.

The company’s main focus will be on the Cecilia project this year, and we are looking forward seeing the company’s plans to move the project forward.

Disclosure: Riverside Resources is a sponsor of the website. The author has a long position in Riverside Resources. Please read the disclaimer