Although nothing has changed at Riverside Resources (RRI.V) from a fundamental perspective, the stock is now trading at its 52 week lows after a sell advice from Exploration Insights. CEO John-Mark Staude has stepped up in buying shares and putting in more bids as he sees the company is oversold in his opinion. It’s a pity to have Exploration Insights sell at a low point, as it exacerbated the decline of the share price throughout what appears to be a very weak summer period for gold exploration companies.

In this brief update report, we’ll have a quick look at Riverside’s operational performance in the past few months, and why the current enterprise value of just C$5M could provide an interesting entry point from a risk/reward perspective.

A sell advice from Exploration Insights tanked the stock

In the final week of a slow August month for the markets, Exploration Insights, the newsletter of Brent Cook and Joe Mazumdar issued a sell alert on Riverside Resources citing ‘a lack of joint ventures and deal flow’. While we obviously respect the decision of Mazumdar and Cook to drop Riverside Resources as part of a portfolio reshuffle, the sell advice had a big impact on the share price as Riverside isn’t the most liquid company on the Venture Exchange particularly in the quiet time of the end of August.

In fact, the Riverside sell appears to be mainly related to the aforementioned portfolio reshuffle (as another company was dumped from the portfolio as well) and the authors note ‘there’s no rush to sell […] as both companies are trading near their nadir (the lowest point), are rather illiquid, and it still is the summer.’

Portfolio reshuffles happen everywhere, all the time, and the 20% drop in Riverside’s share price undoubtedly wasn’t what Exploration Insights wanted to see happen. An unfortunate event and perhaps an opportunity for investors?

The Clemente project was returned to Riverside Resources: an overview of the portfolio

Riverside also published an overview of the activities on its properties. The most important news came from the Clemente project in Sonora, where joint venture partner Silver Viper (VIPR.V) notified Riverside Resources it would not continue to earn a 70% stake in the property as Silver Viper was needing to move to a more advanced asset, and the Clemente project was subsequently returned to Riverside Resources with all property expenses and taxes paid for the next three months and has met the required government exploration spending levels covering the next two years.

That’s a pity but unlike the Glor project (which was dropped as soon as Centerra Gold (CG.TO) opted out of the joint venture agreement), Riverside Resources remains convinced of the merits of the property, and the company will try to attract a new partner to follow up on the results of Silver Viper’s drill program which encountered several mineralized zones (with a highlight of 0.7 meters containing 827 g/t silver, 0.23 g/t gold and 2.09% Zinc-Lead) and intersected old mine workings. Riverside has two vein prospects that need to be drill-tested while a past-producing artisanal mine on the property also provides a juicy exploration target.

At Cecilia, Riverside’s current top priority project, the Company has been conducting a soil sampling program on 25% of the mineral concessions that were acquired through the Mexican mineral tenure lottery earlier this year. This tenure acquisition through the lottery expanded the property to approximately 6,000 hectares containing several rhyolite domes where gold mineralization has been detected by Cambior in the 1980’s. There are drill intervals of 30 meters at 1.41 g/t gold pretty much starting at surface, and now being expanded significantly through Riverside’s exploration work. Riverside said it’s ‘anticipating multiple updates on Cecilia in the coming weeks’, and we expect the company to make a decision to drill some of the priority targets later this year should no suitable partner be found soon.

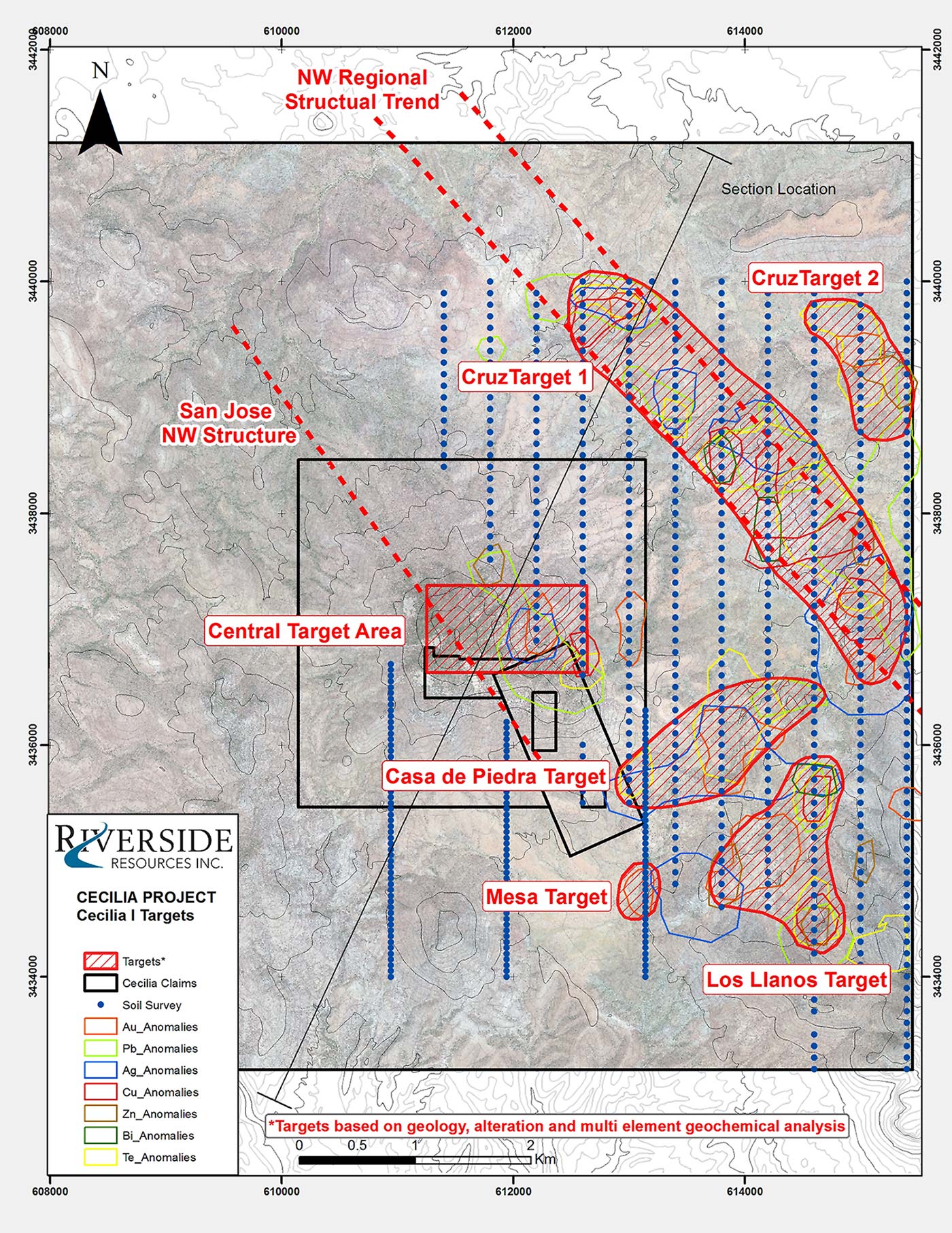

A first update was released yesterday, when Riverside updated the market on its soil sampling program. Approximately 30% of the 50 square kilometer Cecilia 1 concession (which was acquired in the first quarter of the year) has now been subject to an extensive soil sampling program. This resulted in the company being able to define at least 4 new drill targets based on the several anomalies it has detected during the ground work phase.

As you can see on the previous image, some trends are clearly noticeable although the sampling program was based on lines that are lying 400 meters apart from each other, with samples taken every 50 meters. This allowed Riverside to cover a large area and highlighted the new exploration targets. The company says the Cruz targets (on the NE part of the Cecilia claims) appears to be similar to the Mercedes mine (owned and operated by Premier Gold (PG.TO) after acquiring it from Yamana Gold (AUY) two years ago) as the fault and dikes could be potential feeder structures to the mineralized area. At Mercedes, Premier Gold is mining underground epithermal veins along those similar fault structures, so that’s definitely something Riverside will want to follow up on.

Riverside has done an excellent job to describe the four new target areas and rather than just rehashing the company’s update, it could be best to just read up on these targets in Riverside’s press release (see here). The assay results of a rock chip sampling program and the channel assay results should be released in the next few weeks, where after Riverside could make a decision to drill the project themselves.

There was no update on Penoles, Riverside’s 100% owned exploration project in Durango. Perhaps a bit surprising considering the company has spent in excess of C$300,000 on the project in the first nine months of the year. The majority of these expenses were related to geological consulting, which were related to field work, relogging, and studying of the cores. As well updated mapping of the high grades as Riverside took over the project from Morro Bay and has now designed a possible underground high grade mine schematic plus drill targets to test. As we explained in a previous report (see here), we really like this project due to the interesting land situation. Riverside both surrounds and is surrounded by Fresnillo (FRES.L). The existing resource estimate of 331,000 ounces gold and 17 million ounces of silver in the Jesus Maria zone as well as high-grade silver vein structures have now been worked up by Riverside geologists.

The copper assets (mainly Thor and Ariel) also got some attention in the past quarter, as Riverside continued to fine-tune its exploration targets while it continues to aim for a joint venture on these properties. The copper areas are large scale and in the proven copper belt of Sonora as the immediate continuation southward from the highly productive copper mines of Arizona.

Getting the biggest bang for the buck: a look at how Riverside spent its cash in the first semester

Riverside Resources is proud of its prospect and project generator model as its partners with deeper pockets usually do the heavy lifting. That being said, Riverside still chooses to work on its own properties to advance them to a stage where a partner could be sought with more robust business terms.

We know CEO John-Mark Staude to be a frugal spender trying to be as efficient as possible in Mexico, and that’s also clearly visible in the company’s financial statements. About two weeks ago, Riverside filed its financial results for the first nine months of the financial year (which ends in September), so we had a quick look at how the cash has been spent.

You notice a total expense of approximately C$752,000, but not all of these expenses are cash expenses. We are making adjustments for the FX gains, Depreciation charges, share-based payments and the write-down of exploration assets (highlighted in blue). This results in an approximate net cash expense of roughly C$605,000 (and C$720,000 if you would also exclude the reimbursement of joint venture partners on exploration assets).

Not only is this a relatively low overhead for a company with an office in Vancouver and operations and a field office in Mexico, it also means that when you add the C$902,000 that has effectively been spent on the properties (these exploration expenses were capitalized), the total cash outflow of Riverside Resources in the first nine months of the year was C$1,622,000, of which C$125,000 was recovered.

This means that for every dollar Riverside Resources has spent in the first nine months of its financial year, in excess of 57 cents went directly into the ground in ‘pure’ exploration expenses. Additionally, some of the consulting and professional fees were directly related to the exploration programs, so the ratio of cash spent on the properties versus the total amount of cash outflow will be in excess of 65%. And that’s a great percentage.

As of at the end of June, Riverside had almost C$2.7M in cash (which seems to have decreased to just over C$2.3M given the company’s cash update in its late-august press release), but the balance sheet also contains C$810,000 in investments (related to the shares Riverside owns in its joint venture partners) and a total amount of almost C$460,000 in receivables. The majority of these receivables (in excess of 90%) are related to the VAT in Mexico and could be considered ‘as good as cash’ as Riverside has the internal team and skills to recover the VAT.

Most of the investments in other companies are either illiquid or are investments in unlisted companies and the main investment is in Croesus Gold (which represents in excess of 80% of the total value of the investments), still hasn’t been listed on an exchange. This doesn’t mean Riverside is completely unable to monetize this position as it has sold some shares in a private transaction last year, but it is a limiting factor.

CEO Staude continues to buy stock – a vote of confidence

It’s always encouraging to see the CEO of a company stepping up his buying pace. In the past few weeks, CEO John-Mark Staude has started buying more stock, adding 76,000 shares to his position at an average purchase cost of C$0.214.

Conclusion

With a current market capitalization of C$8.3M and approximately C$3M in cash and securities, Riverside Resources remains well-funded for the remainder of 2018 and well into 2019. Although there are no certainties in the ‘exploration game’, the risk/reward ratio at Riverside Resources has improved as a discovery – any discovery – could justify a multiple of the current valuation particularly with the strong program coming through at Cecilia. Riverside continues to work on its properties for copper, gold and silver whilst marketing them to potential joint venture partners.

We are expecting to see another exploration update on the Cecilia project soon, and we hope to see Sinaloa Resources immediately starting its exploration activities on the La Silla project. This should result in an increased news flow now that the calm summer period has ended.

Disclosure: Riverside Resources is a sponsor of the website. The author has a long position in Riverside Resources. Please read the disclaimer