It’s hard to find good projects in Africa, and when you do, there are several other risk factors at play. That’s why exploration companies with a dedicated focus on African assets need to have a qualified management that knows what it’s doing. In the case of Roscan Gold (ROS.V), the board and management team have a combined 100+ years experience of operating in West Africa, which pre-qualifies them for the role.

But the connection is even stronger than that. Roscan Gold is led by Greg Isenor, the former CEO and President of Merrex Gold, which was sold to IAMGOLD in Q1 2017. And not only does this provide Isenor with the relevant African experience, it also gives him (and by extension, Roscan Gold as a company) a serious advantage in western Mali as Roscan’s Kandiolé project is literally bordering the Siribaya project which was Merrex’ main asset. That is what makes Roscan stand out from the crowd of Africa-focused exploration companies.

We noticed the trading volume was quite high yesterday (August 6th) and the share price moved up almost 14% without any news. As always, never chase a stock.

There’s still plenty of gold to be found in Mali

Few people know West Africa is one of the most prolific gold regions in the world, and the economy of countries like Ghana, Burkina Faso and Mali is strongly depending on the mining sector. Not only does the sector create well paid jobs, the positive impact of the tax revenue is huge. Additionally, most countries take a 10% free-carried stake in any mining project.

The same can be said about Mali. Even during the political turmoil earlier this decade, pretty much all mining activities were able to continue uninterrupted as every Malian understands it’s a vital part of the economy due to the job creation, taxes and the positive impact of the 10% stake owned by the Malian state in mining projects.

Even fewer people know Mali is actually one of the largest gold producing countries in the world. In 2018, approximately 1.97M ounces of gold were produced in Mali, which ranked the country in the 16th position of gold producers in the world, well ahead of Burkina Faso, the DRC and Colombia (note: this is the official gold production. As there still are thousands of artisanal gold miners active on Malian soil, the gold production is very likely understated versus the reality). Most of the gold is mined by western companies and for instance Barrick Gold (ABX, ABX.TO), IAMGOLD, B2Gold, and Endeavour Mining (EDV.TO) have operating mines and active projects in the country.

Kouroukaida Workings (left) and Diouraba Workings (right)

Roscan’s flagship project: Kandiolé

A. A look at the bigger picture

To fully understand where Roscan Gold is coming from, we need to go back in time to 2016, when Greg Isenor and his team were advancing the Siribaya gold project in Mali where they defined a total resource of around 1.2 Million ounces of gold (129,000 ounces in the indicated resource category and approximately 1.1 Million ounces in the inferred resource category). This was very much appreciated by Merrex’ main shareholder IAMGOLD (IMG.TO, IAG) which controlled 23% of the share count and subsequently decided to make an offer to gain full ownership of Siribaya.

A successful exit for the Merrex Gold team, and while the gold markets were still tough, IAMGOLD issued 6.9 million new shares for the Merrex acquisition, resulting in a pro forma value of C$35M (and a C$45M valuation for the entire Siribaya gold project). Subsequent to the acquisition, IAMGOLD continued to explore the tenements and was able to increase the total amount of gold by in excess of 50%.

According to IAMGOLD’s recent resource update (as of the end of last year), the Siribaya project currently contains 1.95 million ounces of gold (744koz indicated, 1.2Moz inferred constrained by a Whittle pit shell based on a gold price of $1500 per ounce) at an average grade of 1.28 g/t in the indicated category and 1.58 g/t in the inferred category. IAMGOLD seems to be very enthusiast about the project as it promptly confirmed an additional 10,000 meter drill program to further increase the current gold resource.

Why is IAMGOLD pushing so hard to advance Siribaya as fast as possible? The main reason for the senior producer to acquire Merrex Gold was because of the similarities between Siribaya and its Boto gold project, just 10 kilometers away and right across the border in Senegal. Boto already contains 2.4 Million ounces of gold (with 1.7 million ounces in the reserve category) and IAMGOLD already completed a feasibility study on the project. For an initial investment of US$254M, Boto is expected to produce an average of 140,000 ounces of gold per year at an all-in sustaining cost of US$753/oz. The net margin is quite high but due to the high initial capex, the after-tax NPV remains relatively low at US$261M, so every additional ounce that could be mined would represent an important contribution to the Boto NPV.

We don’t know how IAMGOLD will play its cards and how it could negotiate a deal with both Senegal and Mali (IF such a deal would even be possible), but it’s clear that it makes no sense whatsoever to build two processing plants within 10 kilometers from each other. From IAMGOLD’s perspective, it’s a slam dunk to try to work out a viable win-win-win agreement with both Mali and Senegal to have one central processing plant that could be used for the 2.4Moz Boto project and the 1.95%oz Siribaya project.

And IAMGOLD is planning on building just one processing facility anyway, it’s becoming incredibly important to add as many ounces as possible to the mine plan, and that’s where Roscan’s Kandiolé project comes into play.

On the next map, you can find the Siribaya project (which was owned by Merrex Gold and was the main reason for the acquisition by IAMGOLD) and how the interpretation of the extension of the mineralized trend continues onto Roscan’s tenements.

We realize we may have over-emphasized IAMGOLD due to the strong ties with the Merrex Gold team and the proximity of the Kandiole project to IAMGOLD’s own project, but let’s not forget the Kandiole licenses is also just 10 kilometers away from B2Gold’s Fekola mine, located right across the felsic intrustion to the west. While we have emphasized IAMGOLD due to the history between the company and Roscan’s CEO Isenor, Kandiole could become an interesting satellite deposit for both IAMGOLD and B2Gold. As these two larger companies will have the infrastructure in place, the hurdle for Kandiole will be quite low as even half a million ounces could make a district for both senior producers.

And although IAMGOLD and B2Gold may be the ‘usual suspects’, Barrick Gold and Endeavour Mining will certainly also keep a close eye on the developments at Kandiole, but their required hurdle (resource-wise) will be higher as their respective processing plants are further away resulting in lower synergy benefits compared to B2Gold and IAMGOLD which are the ‘logical contenders’.

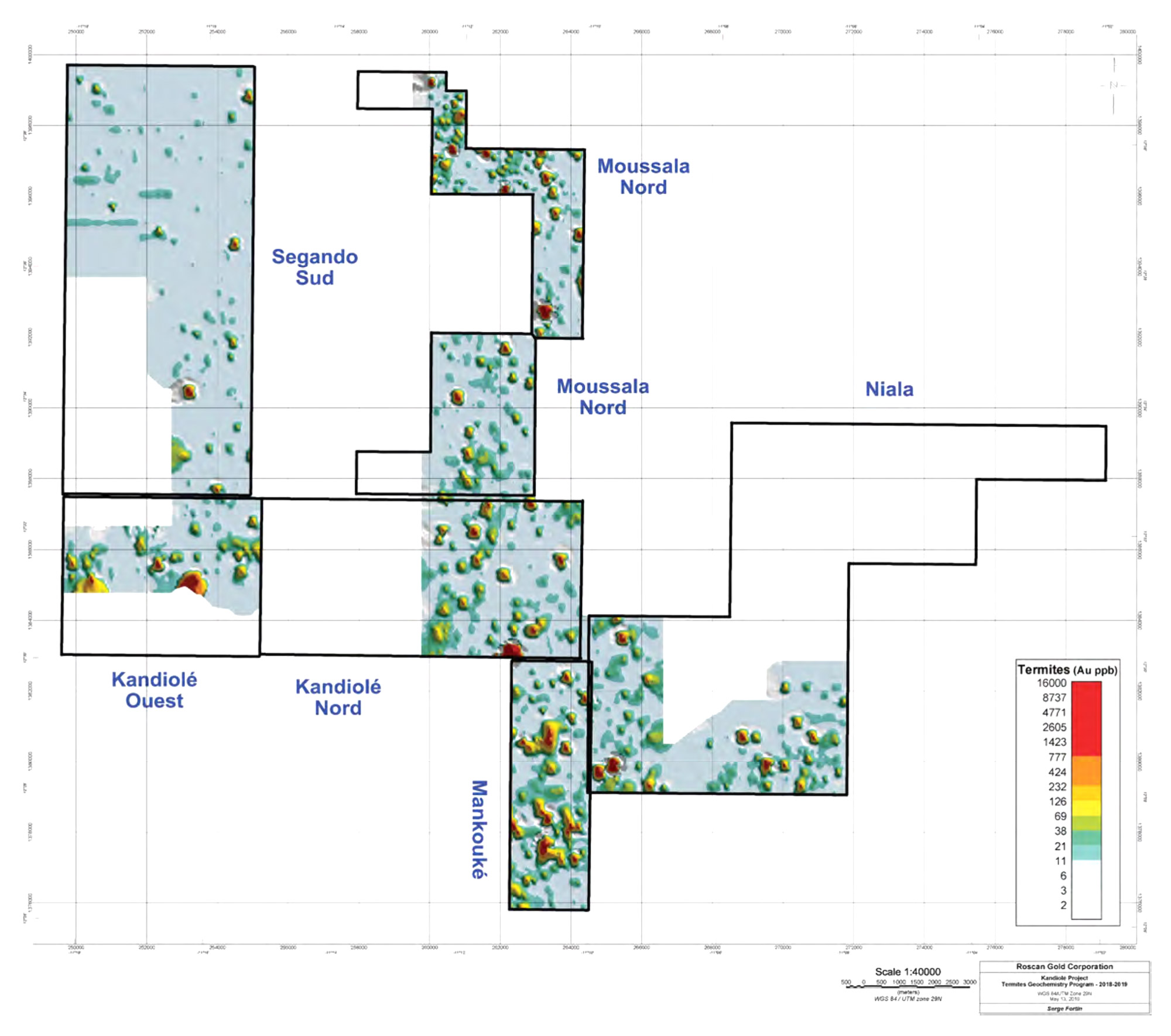

This interpretation was based on the termite mounds that can be found all over the place. In this part of Africa, termites actually provide interesting insight in the potentially gold-bearing zones. When termites build their mounds, they burrow down to the water table and they bring the hardest particles back to the surface from depth. Taking samples from termite mounds is a very efficient and cheap way to detect whether or not there’s gold mineralization in the rocks underneath the surface.

Termite Mound Sampling at Kandiolé

We are surprised IAMGOLD didn’t think about picking up the Siribaya extensions when it decided to purchase Merrex Gold. Didn’t the company agree with the Merrex exploration theory? Were the tenements unavailable or did IAMGOLD not have the right in-country contacts? Or perhaps IAMGOLD only wanted to advance an existing resource rather than chasing gold along the Siribaya structure. In any case, that’s the opportunity Roscan Gold is acting on, and it is the job of the junior exploration companies to make the discoveries that could be of interest to the larger companies.

Whatever the answer is, IAMGOLD’s decision to not pursue that part of the structure created an opportunity for Roscan Gold. Greg Isenor, former CEO of Merrex Gold, initially joined Roscan as a director just weeks after Merrex was sold to IAMGOLD, and just a few months later he was appointed as new CEO of the company. Although Isenor has been at the helm of Roscan for just over 2 years, he already is one of the company’s largest shareholders and in a recent phone call, Isenor confirmed he has invested over C$750,000 in the company in a mix of buying stock and providing working capital to the company in the form of loans. That’s important as it indicates his interests are aligned with the interests of the smaller shareholders. According to the most recent Management Information Circular, Isenor’s salary is just C$150,000 per year which is very reasonable these days. It also means that share price appreciation on his 8.5 million shares will have a much bigger impact than his salary.

B. The acquisition of Kandiolé

The first year after Isenor was handed the keys to Roscan Gold, the company continued to work on its Ghana project, but in the first quarter of 2018, Isenor returned to a very familiar region as he was successful in putting a sizeable land package together which hosts the Siribaya trend towards the north of the Siribaya licenses Isenor had been working on for years.

Roscan Gold had to deal with four underlying property owners to put the deal together on 6-7 contiguous claims (perhaps the complicated land ownership situation was one of the reasons why IAMGOLD or others didn’t pursue this bolt-on acquisition). And Isenor’s local relationships seem to have paid off, as Roscan Gold appears to have gotten a good deal.

You can read the exact earn-in terms in Roscan’s quarterly reports, but in total, the company will be required to pay a total of US$927,500 in cash over several years, issue 1 million shares, pay some permitting fees and incur a minimum of US$575,000 in exploration expenditures on some of the tenements. There are also some Net Profit Interests and Net Smelter Royalties that have been issued to the vendors, but these are quite benign.

It took Roscan a while to put everything together, but it’s good to see the terms are very reasonable and all required payments and expenditures are spread out over several years.

C. Roscan’s recent exploration results

Since acquiring the claims that now make up the Kandiolé project, Roscan hasn’t wasted any time and immediately started an extensive field exploration campaign in 2018 to get as much work done as possible before the rainy season.

The company took almost 5,000 samples from the Moussala North and Mankouke zones, of which in excess of 40% were taken from the previously mentioned termite mounds. Additionally, the ‘normal’ soil samples were collected on 100 and 200 meter lines with 50 meters in between and this sampling campaign indicated the presence of multiple anomalies, some of them with a strike length of up to 600 meters.

We already mentioned before how the original Merrex Gold field team identified an extension to the Siribaya gold structure that appeared to be running north, and the 2018 field work actually encountered some of the strongest gold grades in that zone, which further confirms and validates the exploration theory.

Subsequent to the sampling program, Roscan immediately initiated a drill program to follow up on the highest priority drill targets along three drill fences at the Mankouke zone to test zones of 600 by 750 meters, 400 by 800 meters and 1200 by 425 meters. Additional drill fences were designed to follow up on the Moussala North anomalies where gold-in-soil values of up to 16 g/t gold (16,000 ppb) were discovered in an area where artisanal mining is currently still taking place.

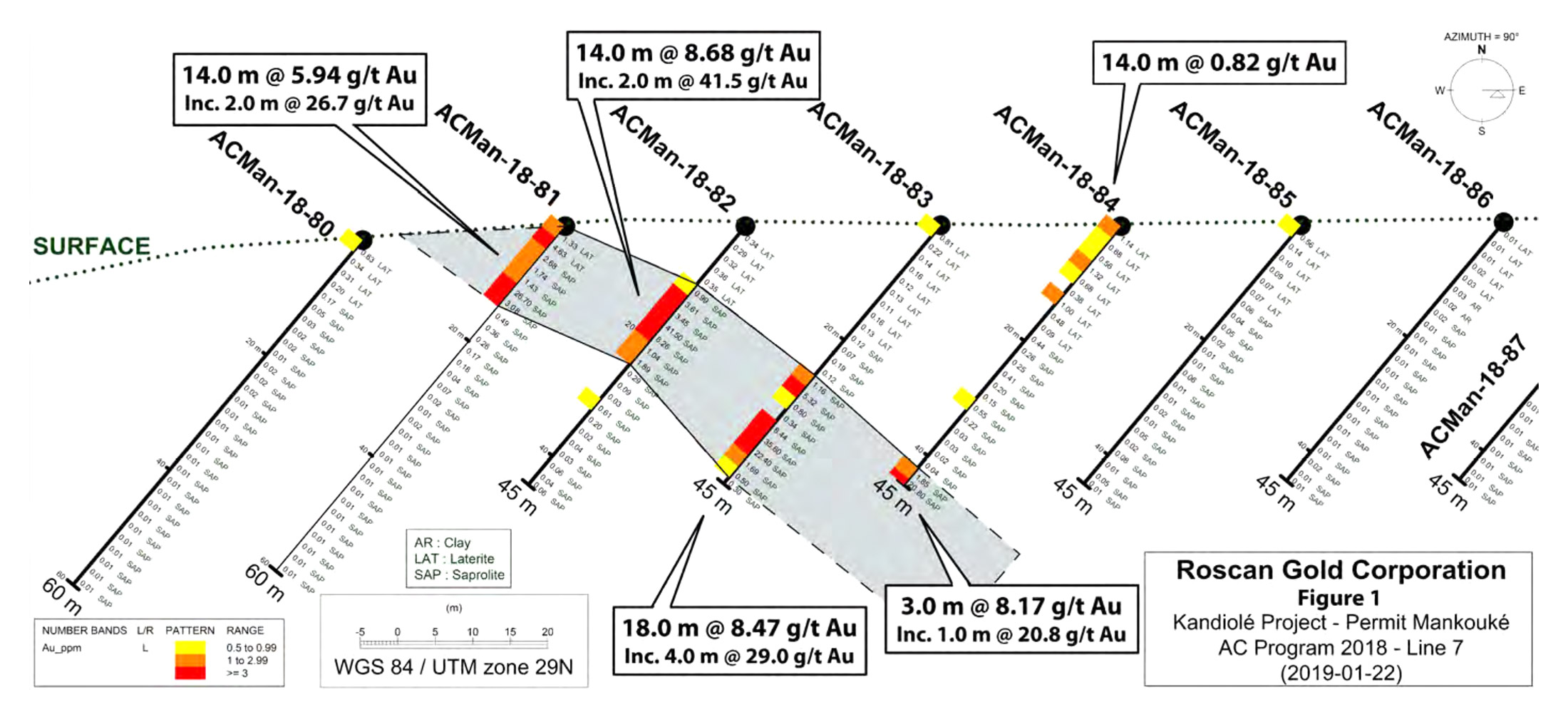

And those initial drill results on the Mankouke zone were really good as the air core drill program encountered high grade gold zones very close to surface. As mentioned before, Air core drilling is useful to define targets that need to be followed up on with either a Reverse Circulation or Diamond drill program (as the NI43-101 rules do not allow the use of aircore drilling to put a resource together), and Roscan also dispatched a diamond drill drig to the Mankouke discovery zone to further define the mineralized envelope and look for potential extensions.

Of the 19 diamond holes, the assay results of 8 more holes are still pending, and we expect to see those shortly. And although Roscan has been relatively quiet in the past few months, rest assured the company has been very busy with the completion of in excess of 2,000 meters of diamond drilling as well as just over 28,000 meters of aircore drilling (and Roscan is still waiting for the assay results of in excess of 10,000 meters of aircore drilling).

Now the rainy season has commenced, drilling activities have ceased and this is an excellent moment for the Roscan team to analyse and interpret the data provided by the 2018-2019 drill campaign. This should help to design the drill targets for the upcoming drill programs once the rainy season ends.

This is just the start of the exploration program, and now that Roscan raised more money in March, the company has the fire power to continue to drill on the properties. The current exploration plan anticipates to drill more Air Core and Reverse Circulation and diamond drillholes towards the north and south of the mineralized zones, while additional sampling programs will be conducted to find new gold zones.

Additionally, Roscan Gold has completed another extensive termite mound sampling program and Air Core drilling, and it should receive the assay results of this campaign relatively soon.

How is the current safety situation in Mali?

No matter how good the project might be, there always is a certain geopolitical risk of doing business in Africa. And although Mali was seen as one of the most stable countries for gold-focused operations on the continent, things have been a bit shaky since the coup in 2012.

However, the coup, whereby the army overthrew the government, was actually relatively peaceful and it is important to realize this wasn’t anything like the bloody and long-lasting civil wars elsewhere in West Africa. In fact, the coup was organized out of love for the country as the military felt the government was dropping the ball on dealing with the Tuareg population in Northern Mali, which subsequently claimed the independence of the northern part of the country.

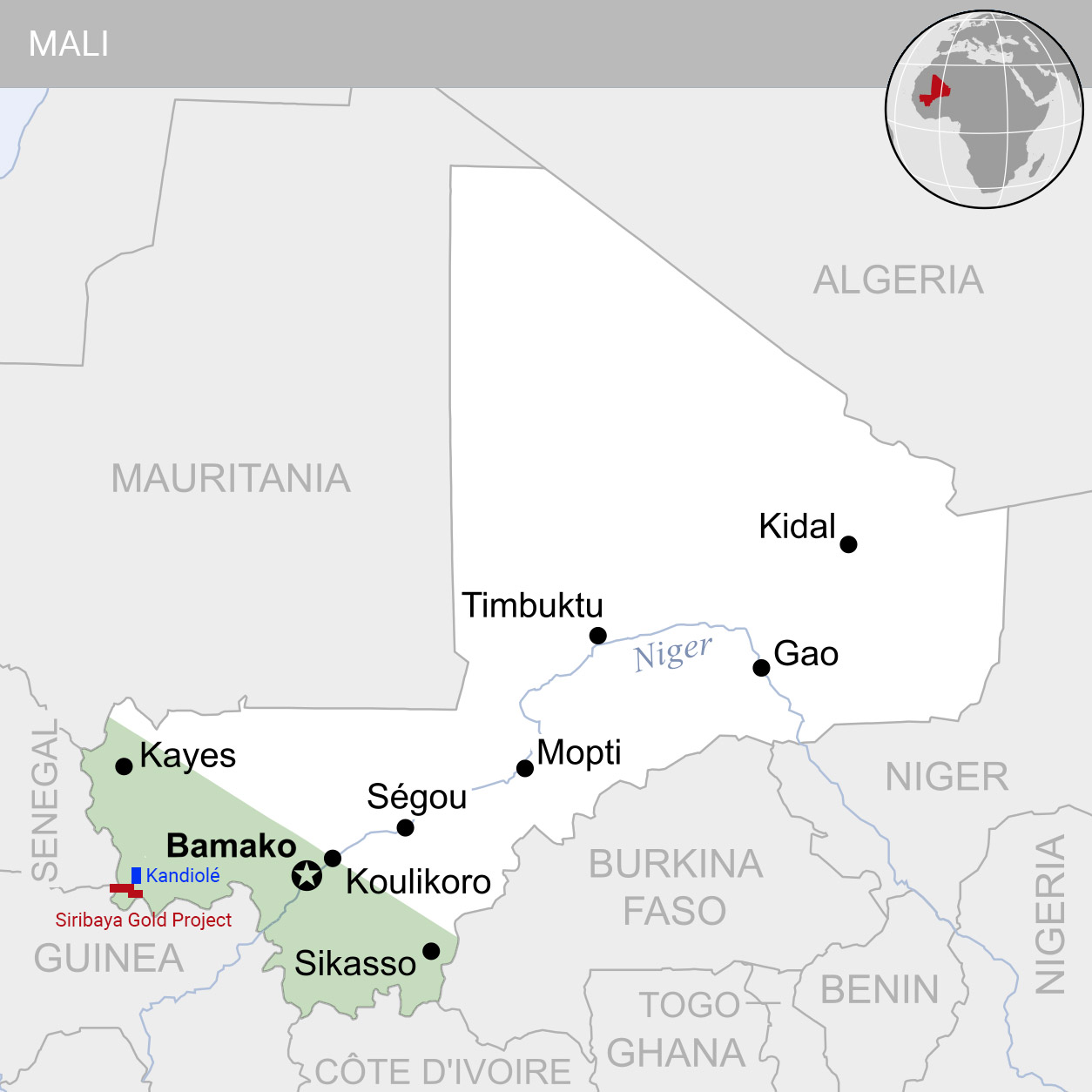

Fortunately, Roscan’s project is located in the southernmost part of Mali, in an area which is deemed to be safe (the rule of thumb these days is that anything south of the axis Kayes-Koulikoro-Sikasso should be relatively safe). This is confirmed by the Belgian Ministry of Foreign Affairs which has a travel advisory for the Northern part of the country but confirms the southern part of the country appears to be fine ‘the security conditions are satisfactory’).

The Kandiolé project is located right at the border with Senegal, and thus comfortably south of the axis, in a territory that’s deemed to be safe.

Considering the current situation in Mali, it also is important to emphasize the decades of experience the current management team has in West Africa. As you’ll see in the management section later on, every key member has extensive experience in doing business in Africa and that’s important to navigate through the sometimes muddy waters the political landscapes in African countries can be.

Roscan is spending its money in the ground

Whenever we check out an exploration stage company, we always find it very interesting to see how these companies are spending their cash. And we have to say, the income statement of first quarter of the year already gives you an idea of how careful Roscan spends its cash.

In the first half of the financial year, approximately C$1.86M was expensed, and approximately C$1.46M of this amount was directly related to the Kandiolé project in Mali, while the G&A expenses totalled just C$380,000. This means that approximately 78% of the H1 expenditures were effectively spent on the properties, and that’s a pretty impressive percentage.

The ratio of cash spent on the properties versus the total amount of expenses will very likely change a bit as Roscan is spending a bit more money on spreading the word (deservedly so, given the recent exploration results and the obvious link with the existing gold district currently controlled by IAMGOLD and B2Gold’s producing Fekola mine) with the recent engagement of Skanderbeg Capital.

As of the end of April, Roscan had a total working capital position of around C$2.8M thanks to completing a C$3.8M capital raise consisting of a C$3.27M brokered and C$0.53M non-brokered part. The capital raise was priced at C$0.14 per unit with each unit consisting of one common share and a full warrant entitling the warrant holder to purchase an additional share at C$0.22 for a period of 2 years ending on March 21, 2021.

Additionally, since the end of the semester, roughly 900,000 million warrants that were ‘in the money’ were exercised for total proceeds of just over C$108,000 to the company.

After issuing those shares, the current share count increased to approximately 118.6M shares for a current market capitalization of C$19.6M, and an enterprise value of approximately C$17M.

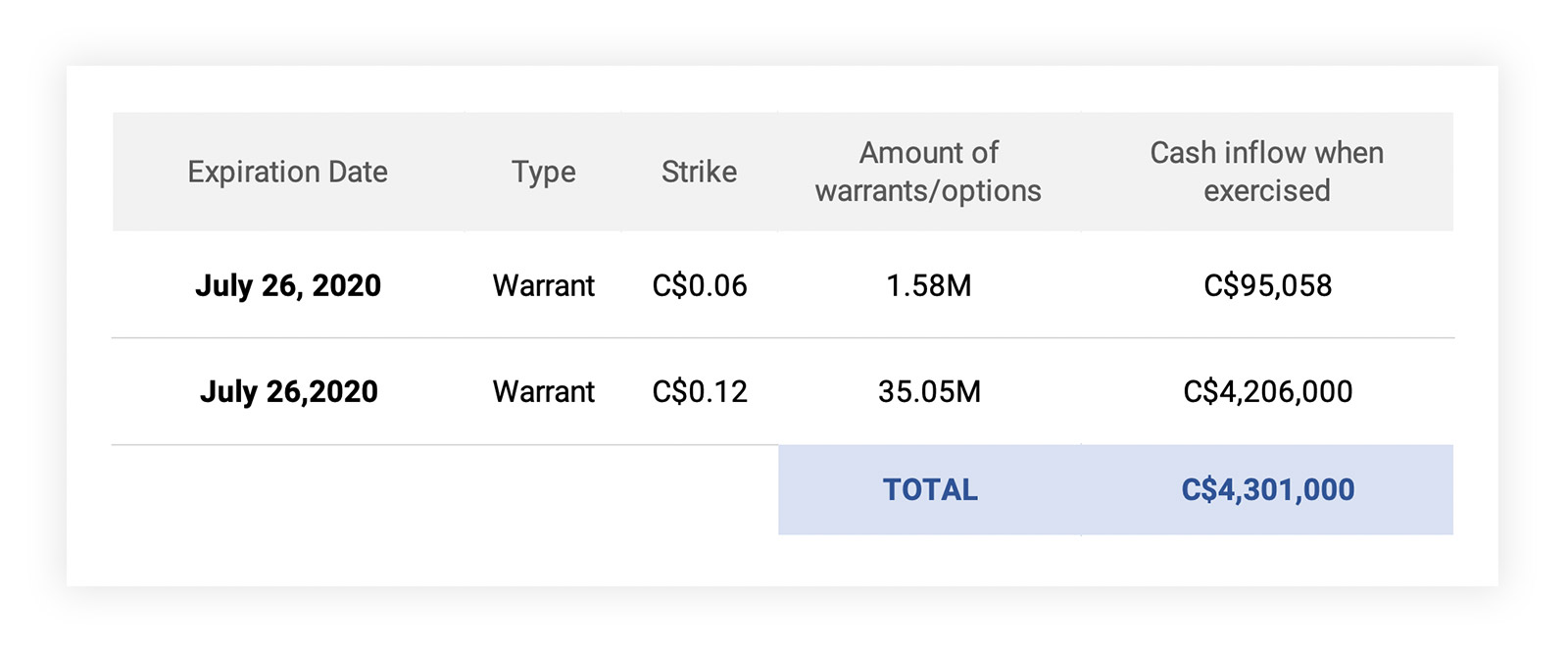

There’s one caveat. Within the next 13 months, approximately 38 million warrants and options (41M outstanding as of January – 3M exercised subsequent to the end of the quarter) are set to expire and this could temporarily cap the share price a bit. But as soccer player Johan Cruijff once said: ‘every disadvantage has an advantage’ and these warrant exercises could act as some sort of secondary financing.

As long as all warrants are in the money, Roscan won’t need to raise more money on the equity markets as the warrant exercises will take care of the company’s cash needs.

Additionally, the C$0.22 warrants that were issued as part of the March placement could also be useful. In an ideal scenario, exploration results should drive the share price up to more than C$0.22/share which could be a trigger for participants in the placement to slowly start exercising the in-the-money warrants. Should all 28.55M warrants be exercised, Roscan will receive an additional C$6.3M in net proceeds, putting it in a very enviable position.

Management & Board

Greg Isenor – President & CEO

Mr. Isenor holds a B.Sc. Geology, (1970) from Acadia University and is a member of the Association of Professional Geologists of Nova Scotia. Since 1970, Mr. Isenor’s career path has been augmented by working for various companies on exploration projects in the energy and mineral resource industries:

- Former President, CEO and Director of Merrex Gold Inc., up until Merrex was taken over by Iamgold Corporation.

- Previously discovered two significant gold deposits in Mali (West Africa): the Siribaya deposit; and, with joint venture partner Iamgold, the Diakha deposit.

- Former President, CEO and Director of Jilbey Gold Exploration Ltd., until Jilbey was

acquired by High River Gold Mines Limited.

David Mosher – Director

- Mining executive with over 35 years of experience in the United States, Canada, Australia, Russia, Africa and Asia. Active in the restructuring, financing and management of a number of mineral projects and mining companies, both private and public.

- Previously served on many boards including Cambior and Equinox Minerals and is currently a director of five public mineral exploration companies, including Pancon Gold and served as President and CEO of TSX-listed High River Gold Mines, where he raised more than US$300 million and developed three mines from exploration through to production in Canada, West Africa and Russia.

Don Dudek – Director

- Has held various roles with junior to senior exploration and mining companies over the past 30 years.

- Recently served as Senior Vice President, Technical Services for Endeavour Mining Corporation while managing a feasibility study for the Houndé gold project in Burkina Faso. Previously, served as Senior Vice President Exploration of Avion Gold Corporation, a successful junior gold producer and explorer in West Africa and as Exploration Manager for Aur Resources Inc.

Jean-Marc Gagnon – Technical Advisor

- Professional geological engineer with over 35 years of experience in mining exploration sector. Previously involved in the generation, management, evaluation and development of exploration projects for gold, main in West Africa, where he held positions as country manager, project manager and consulting geologist. Has managed exploration for various commodities.

- Participated in development of gold project Siribaya in Mali, played role in evaluation of BissaHill gold deposit.

Conclusion

Considering IAMGOLD acquired Merrex Gold in 2017 and is aggressively advancing the Siribaya gold project and given the fact that in those two years since acquiring Merrex, IAMGOLD completed a feasibility study on the nearby Boto gold project in Senegal, you don’t have to be a genius to see they would like to consolidate the entire gold district.

Should Roscan be successful in showing the extensive potential of the Kandiolé project to act as a substantial satellite deposit to Boto-Siribaya, it would only make sense for IAMGOLD to further consolidate the entire district, which would then contain around 5 million ounces, all within an 8-10 kilometer radius. This obviously won’t happen overnight and a first step might be for IAMGOLD to take a strategic stake in Roscan Gold to provide it with the necessary funds to advance the exploration activities at Kandiolé, while it secures a pole position for itself should Kandiolé be interesting enough to be added to the Boto-Siribaya district.

With an anticipated working capital position of around C$3M, we don’t think Roscan will have to tap the equity markets anytime soon as the continuous exercise of in-the-money warrants should keep the treasury at a very acceptable level allowing Roscan to go full speed ahead at Kandiolé.

The author has a long position in Roscan Gold. Roscan Gold is a sponsor of this website. Please read the disclaimer