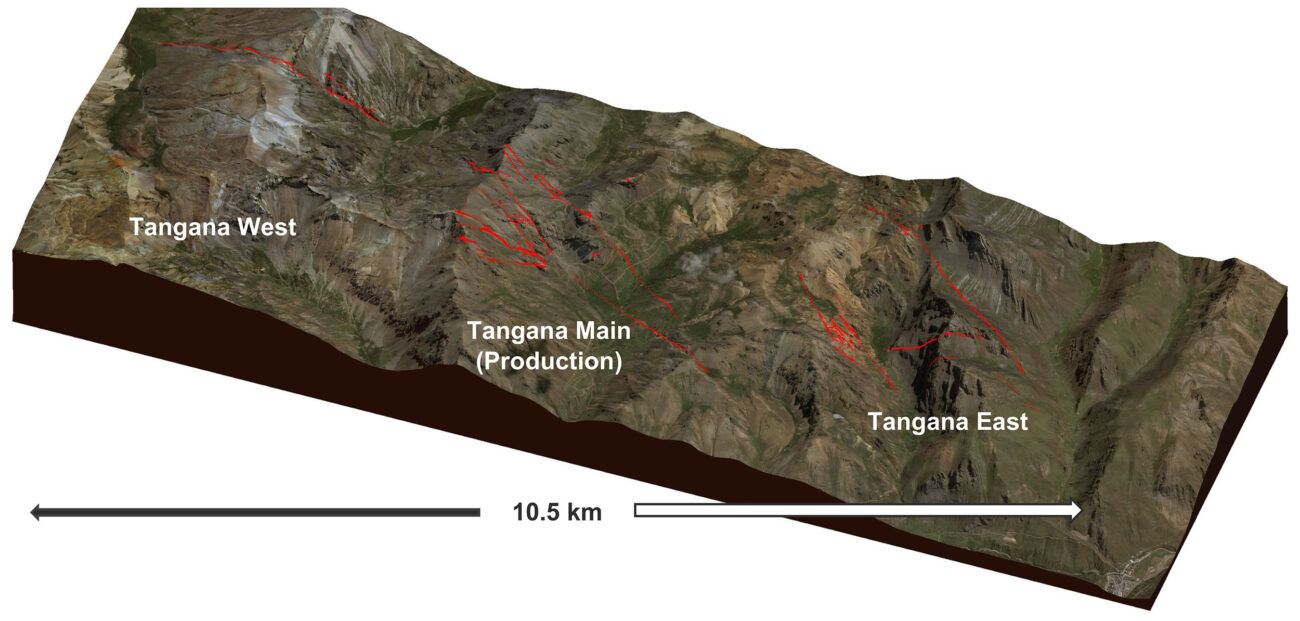

Silver X Mining (AGX.V) released the summary of its PEA last week. The Preliminary Economic Assessment is focusing on the construction of a new 1,500 tonnes per day plant at the Tangana mine site, which will replace the current 720 tpd plant which is about an hour away. As this is the very first economic study that has been published on the project, it now provides Silver X with an official document to point to when it explains its story to its investor base and prospective investors.

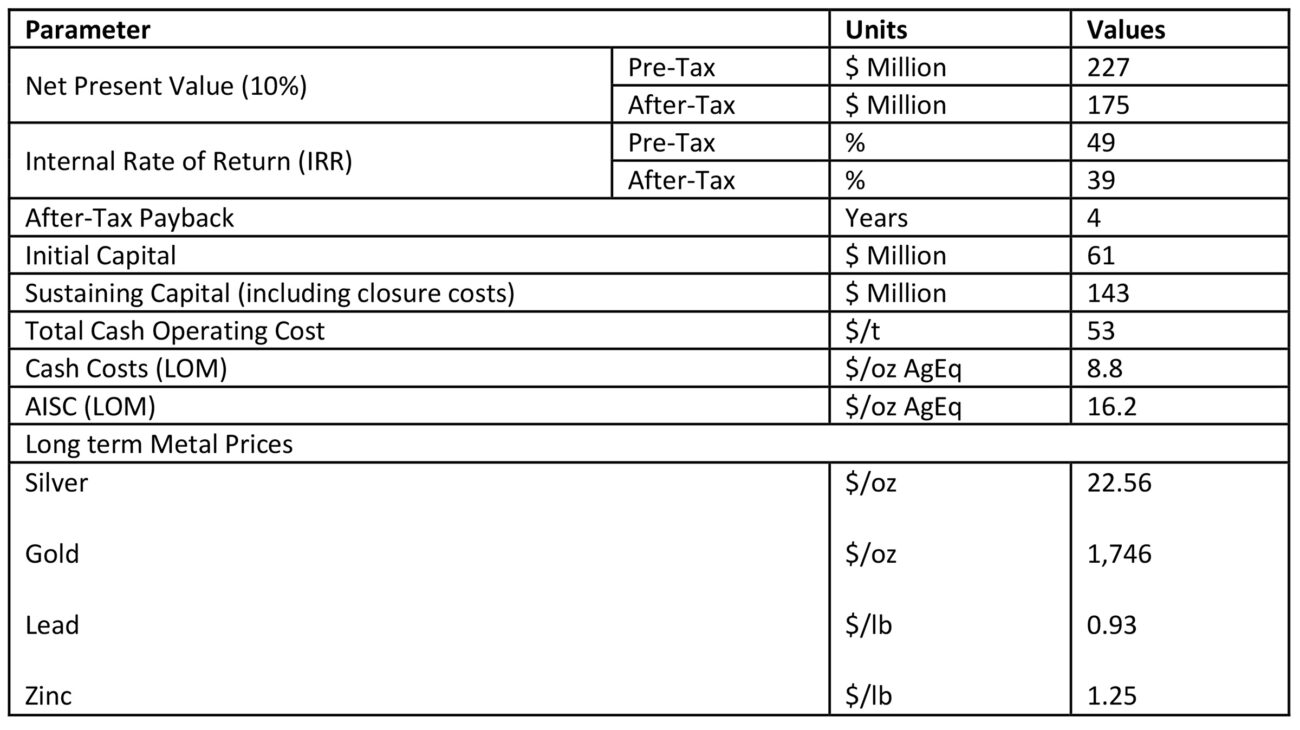

The full technical report still has to be filed (the deadline for that is April 1st) and we obviously expect that report to contain more details beyond what’s available in Silver X’s press release. But the summary provided by the company is already very helpful to establish a first impression. With an after-tax NPV10% of US$175M (and likely closer to US$200M using the more standard 8% discount rate), the NPV per share comes in at US$1.18 or in excess of C$1.50 using a silver price of US$22.56 and a zinc price of US$1.25 per pound.

This PEA should be seen as the starting point as it only incorporates just 5.75 million tonnes of the in excess of 15 million tonnes in the consolidated resource estimate in the greater Nueva Recuperada district (3.6 million tonnes in the measured and indicated category, 11.9 million tonnes are in the inferred resource category) while the company has plans to use the existing 720 tpd mill to start processing rock from other zones in the district.

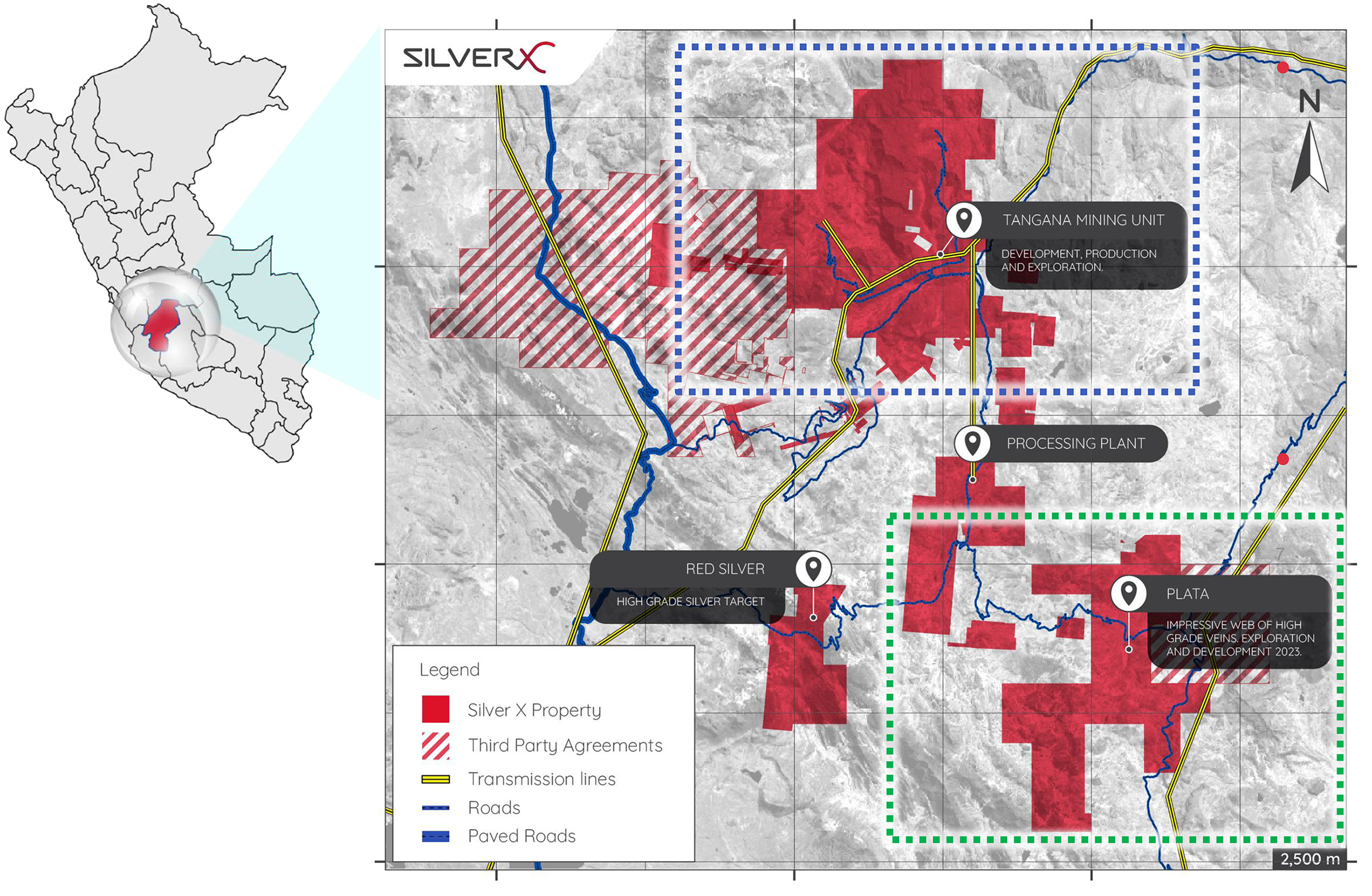

Nueva Recuperada Silver District

The economics of the new 1,500 tpd plant look good

Silver X did a good job in preparing the market for the PEA, and there aren’t really any surprises in the summary of the PEA. The Preliminary Economic Assessment is based on the updated resource estimate which contains 3.6 million tonnes in the measured and indicated resource category and about 11.9 million tonnes of rock in the inferred resource category.

Of that total of in excess of 15 million tonnes (in the entire district but the vast majority will be related to the Tangana mining unit), about 5.75 million tonnes made it into the mine plan. This doesn’t mean the remaining 9 million tonnes are worthless; some zones are just a bit further away or need some more ‘meat on the body’ before a mining decision could be made. We consider the 5.75 million tonnes in the mine plan as a starting point and by no means will this be the final number. It’s just the tonnage Silver X and its consultants are currently comfortable with to build an economic scenario around.

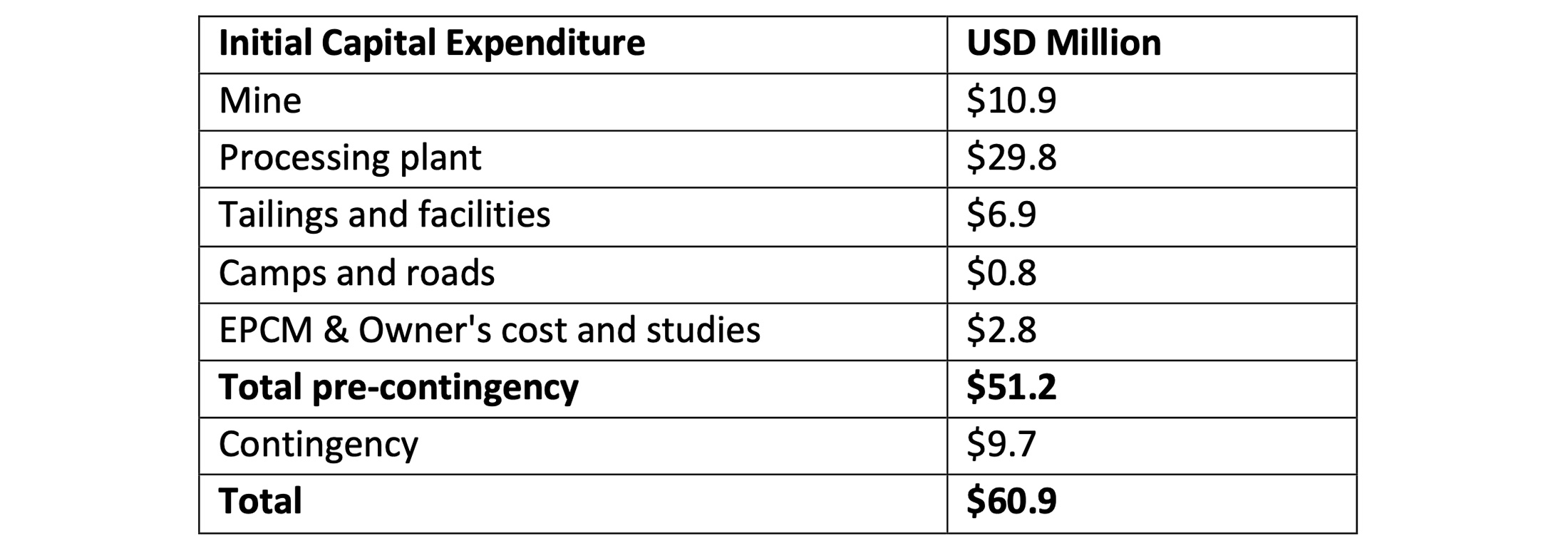

The initial capex is estimated at US$61M. That’s higher than we anticipated but by looking at the breakdown provided in the press release, there seems to be some fat on the bones. First of all, a 20% contingency is pretty generous, especially seeing how the consultants budgeted the construction of the 1,500 tonnes per day processing plant at US$30M. CEO Garcia has proven before he is able to increase capacity at an industry-low capital intensity (the expansion of the current mill to 720 tonnes per day came with a price tag of just a few hundred thousand dollars) and we wouldn’t be surprised if the entire capex would come in substantially lower than the quoted US$61M.

Initial Capital Cost Estimate

A lower capex would have a direct impact on both the NPV and the IRR. The after-tax NPV10% of US$175M is already very respectable but a US$15M capex saving would further boost this to US$190M while the NPV8% would increase to almost US$210M. And the after-tax IRR of 39% would also jump towards 50%.

But as far as base cases go, the preliminary economic assessment paints a positive picture. Based on the currently known resources and the mine plan, the average annual would be approximately 4.2 million ounces at a cash cost of US$8.8 per ounce of silver-equivalent and an all-in cost of US$16.2 per ounce silver-equivalent as the total sustaining capex is budgeted at US$143M (and this mainly consists of underground mine development activities and the expansion of the initial tailings facility).

Interestingly, Silver X’s All-In Sustaining Cost also includes exploration, G&A and taxes which really sets this company apart from others. Most, if not all, of its peers just use operating costs + royalties + sustaining capex to calculate the AISC. Adding the G&A, exploration and taxes is a very honorable thing to do by Silver X, but it does make a comparison difficult. To ensure we are comparing apples to apples: excluding the aforementioned exploration, G&A and taxes, the AISC per payable ounce of silver-equivalent would be just over US$13.

It’s now up to Silver X to maintain its timeline towards the 1,500 tpd production scenario at Tangana. The company expects to submit its Environmental and Social Impact Assessment before the summer and anticipates approval by the end of this year (working on a dry stacked tailings scenario should be seen as a bonus from an environmental perspective). This would put the company on track to start construction in 2024 and ramp commission the new mill in 2025 to indeed achieve the eyed 2,220 tpd district-wide capacity by 2026.

This will allow Silver X to pursue a district-wide processing rate of 2,220 tonnes per day

The plan is to build the new 1,500 tonnes per day plant at the Tangana mine unit as that will reduce the transportation costs from the mine to the mill. Right now, the Tangana ore is being trucked to the plant which is about 15 kilometers away (but it takes about an hour by road). By constructing the plant right at the mine, Silver X’s operations should be more efficient.

This doesn’t mean the current mill with a capacity of 720 tonnes per day will be scrapped. For now, the Tangana rock will still be trucked to the existing plant which will continue to generate cash flow. Once the new 1,500 tpd plant is up and running, the current, old plant will likely start processing rock from other mineralized zones in the district. We know Silver X is quite optimistic about its Plata project, which is located to the south-southwest of the 720 tpd mill and we wouldn’t be surprised to see Silver X ramping up its exploration activities at and around Plata to develop some sort of mine plan using the existing mill.

So while the PEA solely focuses on the economic contribution of a new 1,500 tonnes per day plant to be constructed at the Tangana mine, keep in mind the total milling capacity will be 2,220 tonnes per day consisting of the new 1,500 tpd mill and the current 720 tpd mill. That’s a valid plan as the Plata zone already hosts an inferred resource of just under 450,000 tonnes at an average grade of 201 g/t silver and a ZnPb content of in excess of 7%. Using the same commodity prices as used in the Tangana PEA, this represents a silver-equivalent grade of approximately 450 g/t. And while 450,000 tonnes isn’t a whole lot to start with, let’s not forget Silver X has been solely focused on Tangana and has barely done any work at Plata. A moderate drill budget could likely rapidly increase the tonnage at Plata and it will be up to Silver X’s management to figure out its exploration priorities.

Conclusion

This of course is just a first look at the Preliminary Economic Assessment and we will provide a more in-depth update on Silver X and the Tangana PEA once the full report has been filed on SEDAR. As we will undoubtedly have more questions for the Silver X management team as well, you can expect a more comprehensive update once we have all the details.

Our preliminary impression is positive. While the ‘official’ capex number comes in higher than anticipated (and we wouldn’t be surprised if the final number comes in below what’s quoted in the PEA), the capital intensity is pretty good as the ratio of NPV8% versus capex exceeds 3:1 without having to resort to aggressive commodity prices. Using a silver price of $22.50 per ounce and a zinc price of US$1.25 per pound is quite modest and realistic.

Base metals will continue to play an important role in the economics of Tangana and considering the current zinc price is about 10% higher than the price used in the PEA, there appears to be some upside as well.

The PEA is an excellent ‘first pass’ to figure out the value of the Tangana mining unit, and it will solve one of Silver X’s headaches: as the company is currently producing from an asset that didn’t have any economic assessment, the management had to be careful what it could and could not disclose as per the Canadian regulations.

Disclosure: The author has a long position in Silver X Mining. Silver X Mining is not a sponsor of the website.