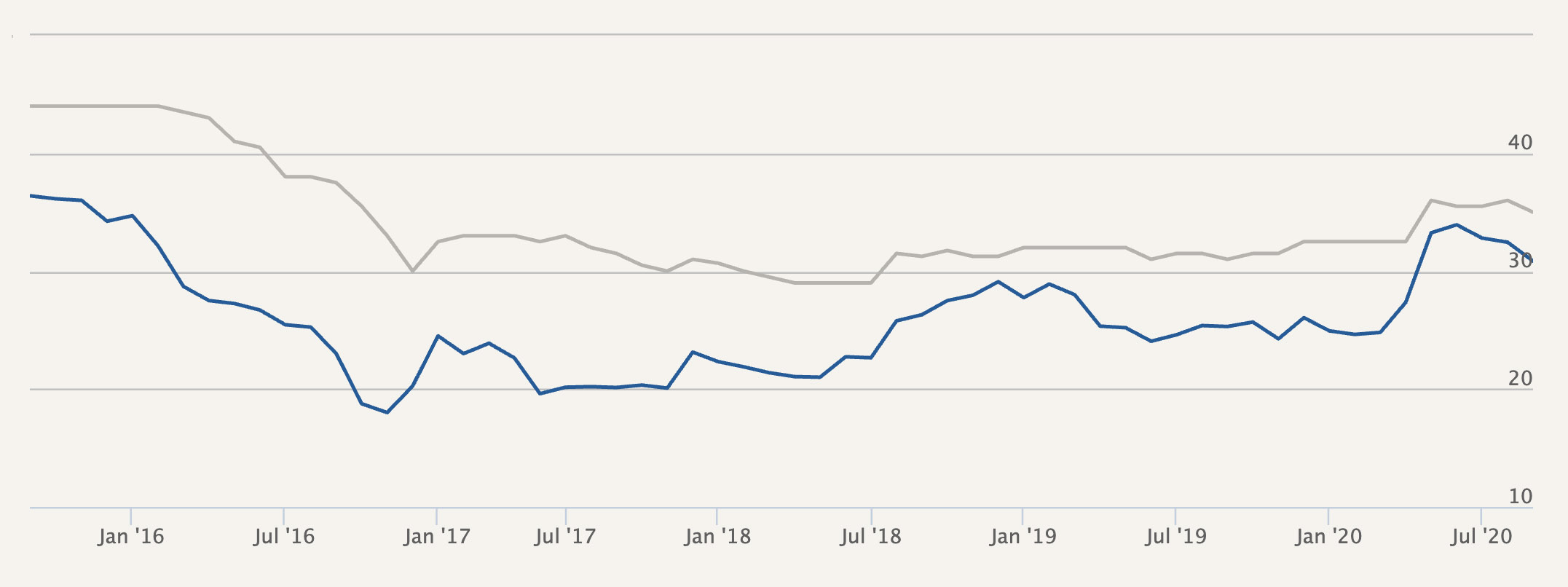

Things appear to be (finally) moving on the uranium front and both the uranium spot price and longer-term contract price are making careful moves up. Although they still have a long way to go (no new mines will be built at the current prices below $40 per pound), it is starting to look like consumption has finally burnt away a large portion of the existing inventory levels. This doesn’t mean the uranium sector will fire on all cylinders: Kazatomprom (and certain ISR producers) remain swing producers and could switch production on and off based on the demand. But that’s just a bandaid-solution: the longer-term future will need new sources of uranium and given the long permitting and construction process, the world better start building its mines years ahead of a potential severe supply crunch.

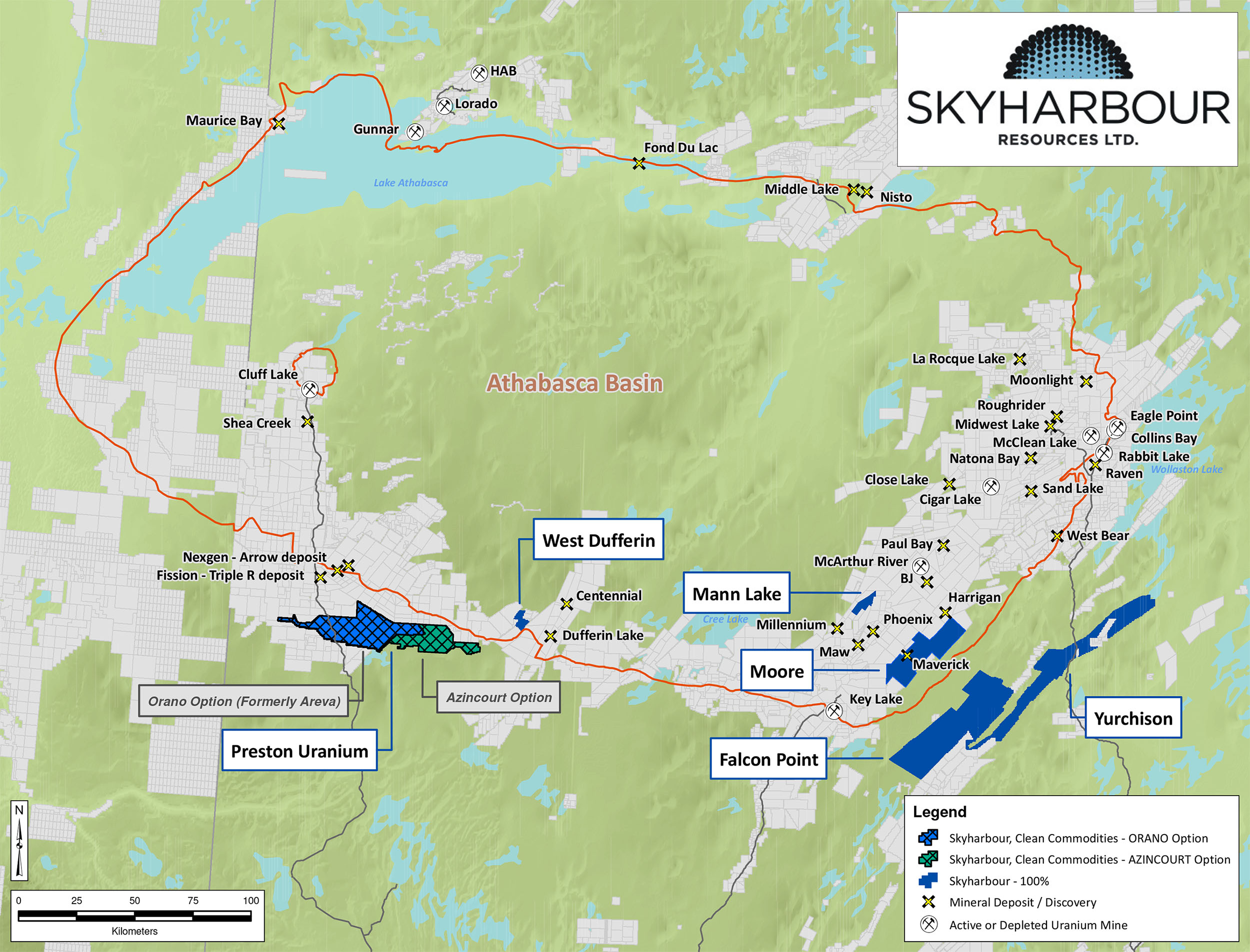

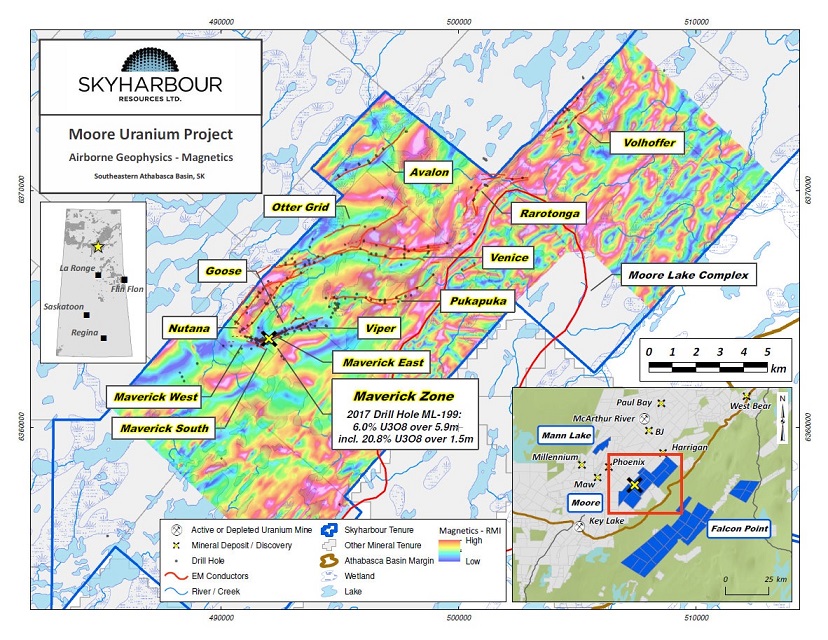

Skyharbour Resources (SYH.V) is still in the exploration phase as it continues to drill at its Moore uranium project in Saskatchewan’s Athabasca Basin. The summer drill program is now in full swing and we thought this was a good time to catch up with Jordan Trimble, the company’s CEO.

A sit-down with Jordan Trimble, CEO of Skyharbour Resources

The Drill Program

You are currently drilling 2,500 meters at the Moore project where you will be following up on the exploration results you encountered last winter. Can you elaborate on what this drill program will try to achieve?

Given the success of Skyharbour’s drilling at the Moore Project over the last several years, the Company will be commencing a 2,500 metre Summer/Fall diamond drilling program consisting of 7-9 drill holes. Drill targets will include both unconformity and basement-hosted mineralization targets along the Maverick Structural Corridor and of particular interest are potential underlying basement feeder zones to the unconformity-hosted high-grade uranium present along the Maverick corridor (previous drill results include grades as high as 21% U3O8 over 1.5m).

The Company specifically plans to expand the high-grade mineralization recently discovered at the Maverick East Zone and to test the Viper target area along strike as well as new targets in the West Maverick area.

Only 2.5 km of the total 4.7 km long Maverick Structural Corridor has been systematically drill tested, leaving robust discovery potential along strike, both at the unconformity, as well as at depth in the underlying basement rocks which have seen limited drill testing to date.

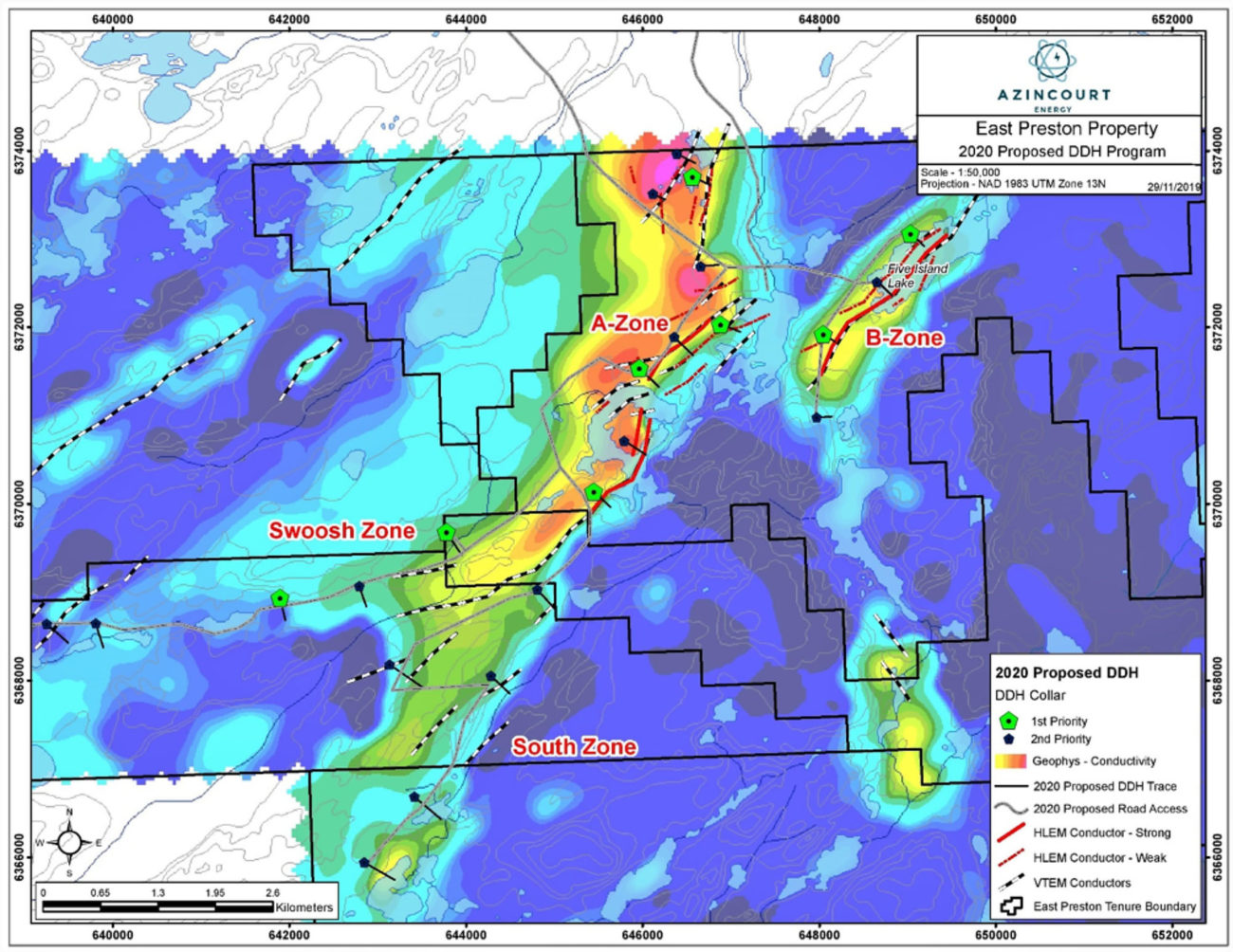

Moving over to the Western side of the Athabasca Basin, Orano and Azincourt both have been keeping their earn-in programs in good standing. May we assume Azincourt will be gearing up for a winter drill program as well?

Azincourt has planned a 2020 late summer / fall geophysical program that covers prospective conductor trends that have yet to be drill tested. This work will add to the target inventory for future winter drill testing at East Preston. They have nearly completed the earn-in for 70% of East Preston and need to complete this upcoming program as well as make a $200,000 cash payment to Skyharbour.

Orano (formerly AREVA) may earn up to a 70% interest in central portion of Preston totaling 49,635 hectares of the total 74,965 hectare project through $8,000,000 of total project consideration over six years, including up to $7,300,000 of exploration and $700,000 of cash payments (all in Canadian dollars) which they are approximately halfway through. They recently complete a large field program and are planning additional programs for later in the year.

The methodological approach

We do receive questions about your exploration approach, so perhaps it makes sense to just discuss how uranium exploration works. Can you perhaps walk us through the exploration steps that come before you actually start drilling?

There is an intricate science behind the mineral discovery process and we have seen that science become more refined over the last few decades.

Traditional Athabasca Basin exploration used to involve rudimentary geophysical targeting and widely spaced vertical drill holes which resulted in a high cost of discovery and lower probability of success. Recently, new techniques, strategies and geological models have led to discoveries through improved targeting methodologies leading to a lower cost of discovery and a higher probability of success (ie. Nexgen at Arrow, Fission at PLS and Denison at the Gryphon Deposit).

For example, a paradigm shift in looking for uranium deposits in the underlying basement rocks has been a major factor in these recent discoveries which is where are focusing on in this drill program. Furthermore, new exploration tools and improved technologies have helped vector in on these basement rock targets. Skyharbour has recently used unmanned aerial vehicles – drones – as a cost-effective way to carry out geophysical surveys and get a better idea of what’s happening geologically at depth. This coupled with new field techniques and a better understanding of geochemistry has allowed us to plan drill programs with optimal targets selected.

The last but most important ingredient is an experienced geological team who have focused expertise in making uranium discoveries in the Basin. Our head geologist Rick Kusmirski is a 40+ year veteran who use to be the Exploration Manager at Cameco and has several notable discoveries under his belt.

The Moore project is located close to the existing infrastructure including roads, power and mills. Does this offer strategic advantages to you?

Absolutely, we are in the right neighbourhood – and being situated near established infrastructure is instrumental in maintaining low capital expenditures for exploration and development.

We are in the premier uranium mining district in the world, the eastern flank of the Athabasca Basin. The world’s highest grade deposits are found here which, when combined with great infrastructure and consistently ranked in the top 5 best mining jurisdictions as ranked by the Fraser Institute, provides key ingredients for success.

Nearby mills are a major bonus as well given the permitting hurdles and high cost associated with constructing new uranium mills. It is worth noting that one of our largest strategic shareholders and partners, Denison Mines, is a minority owner of the McClean Lake Mill on the eastern side of the Athabasca Basin.

The Uranium market

So Cameco recently announced they will restart Cigar Lake, which will remove buying pressure from the uranium spot market and most people see this as a negative catalyst. However, we wouldn’t be surprised if the move to restart was based on Cameco expecting speed bumps on the spot market as it’s a dangerous idea to fully rely on an opaque spot market to deliver into long-term contracts. What’s your view on the restart of Cigar Lake?

I think you’re spot on there and it is clear indication that Cameco doesn’t foresee there being an abundance of supply to buy on the spot market – clear evidence the market has tightened up significantly. Furthermore, their decision to restart Cigar was likely also due to their role in the supply chain as well as the necessary move to combat rising care and maintenance costs on a non-producing mine.

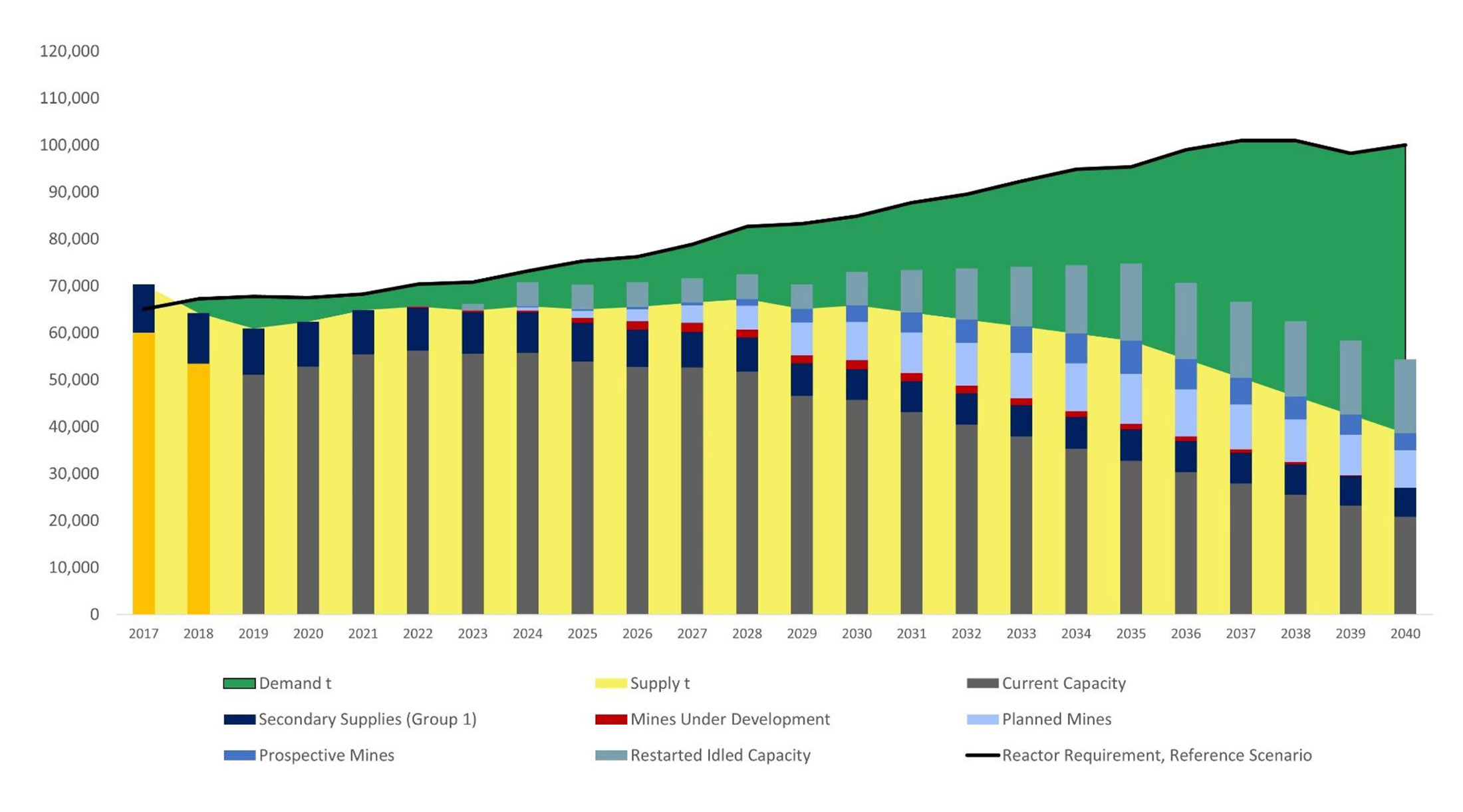

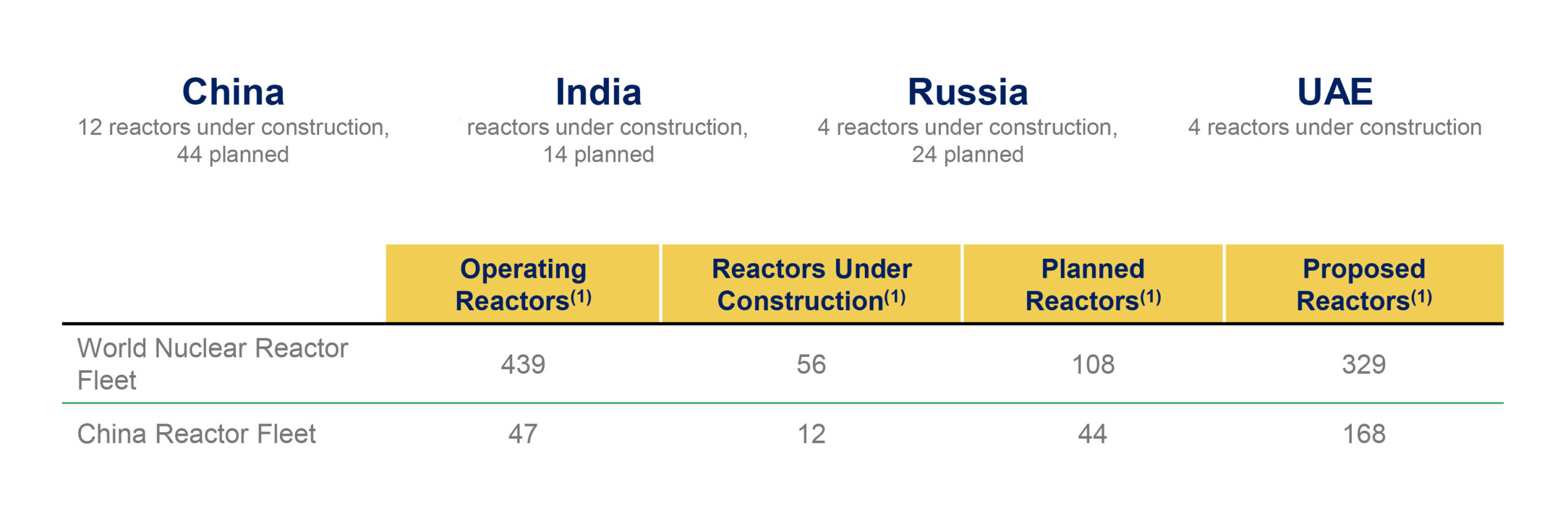

Even with a fully operational Cigar Lake, I still see global major primary mine supply shortfalls in the uranium sector with less than 120mm lbs of mine supply in the backdrop over approx. 180mm lbs of demand. There are over 50 reactors being built and soon to be completed as well as many hundreds more planned, ordered and proposed. With the current pandemic and recent supply disruptions, it is an understatement that the risks to the supply side far outweigh the risks to the demand side for uranium.

You obviously keep a close eye on the uranium markets as well, what’s your take on the current demand and supply side of the market?

The uranium price is moving in the right direction, the spot price has increased from the mid $20’s to the low $30’s/lb. U3O8. Summer is seasonally quiet, but I believe we are in the early days of a new bull market. We have seen a major supply side response play out due to historically low prices and this has been exacerbated by the pandemic which caused further supply curtailments.

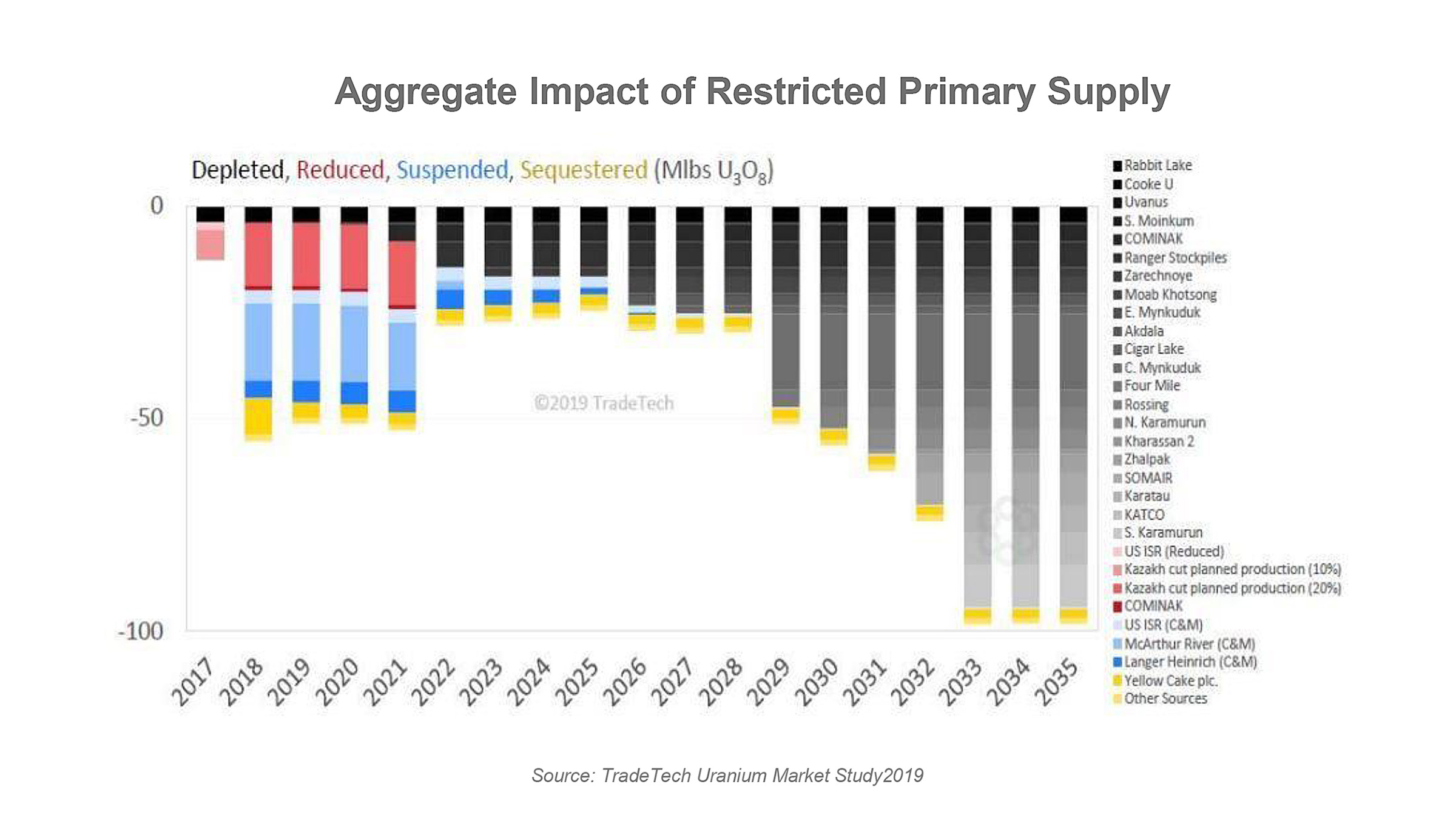

With the onset of the pandemic, several producers shut down or cut back production including Cameco with Cigar Lake shut for 5 months (note that McArthur River is still on care and maintenance). Several producers in Africa have curtailed production as well.

The largest producer Kazatomprom in Kazakhstan, which accounts for up to 40% of global production, has also curtailed production. They recently announced their intention to keep production down 20% through 2022 which would remove over 14mm lbs of U3O8 from supply in 2022 alone. In order to meet contractual delivery requirements with utilities, producers need to acquire millions of pounds of uranium in the spot market this year and we have continued to see that from Cameco but more recently we have also seen Kazatomprom have to step in to the market as well.

A major primary mine supply deficit is looming to the tune of 50-70M pounds of U3O8 per year with secondary supplies / inventories having to make up for this shortfall. This could be amplified in coming years if Kazakhstan is unable to ramp ISR production up as quickly as they would like.

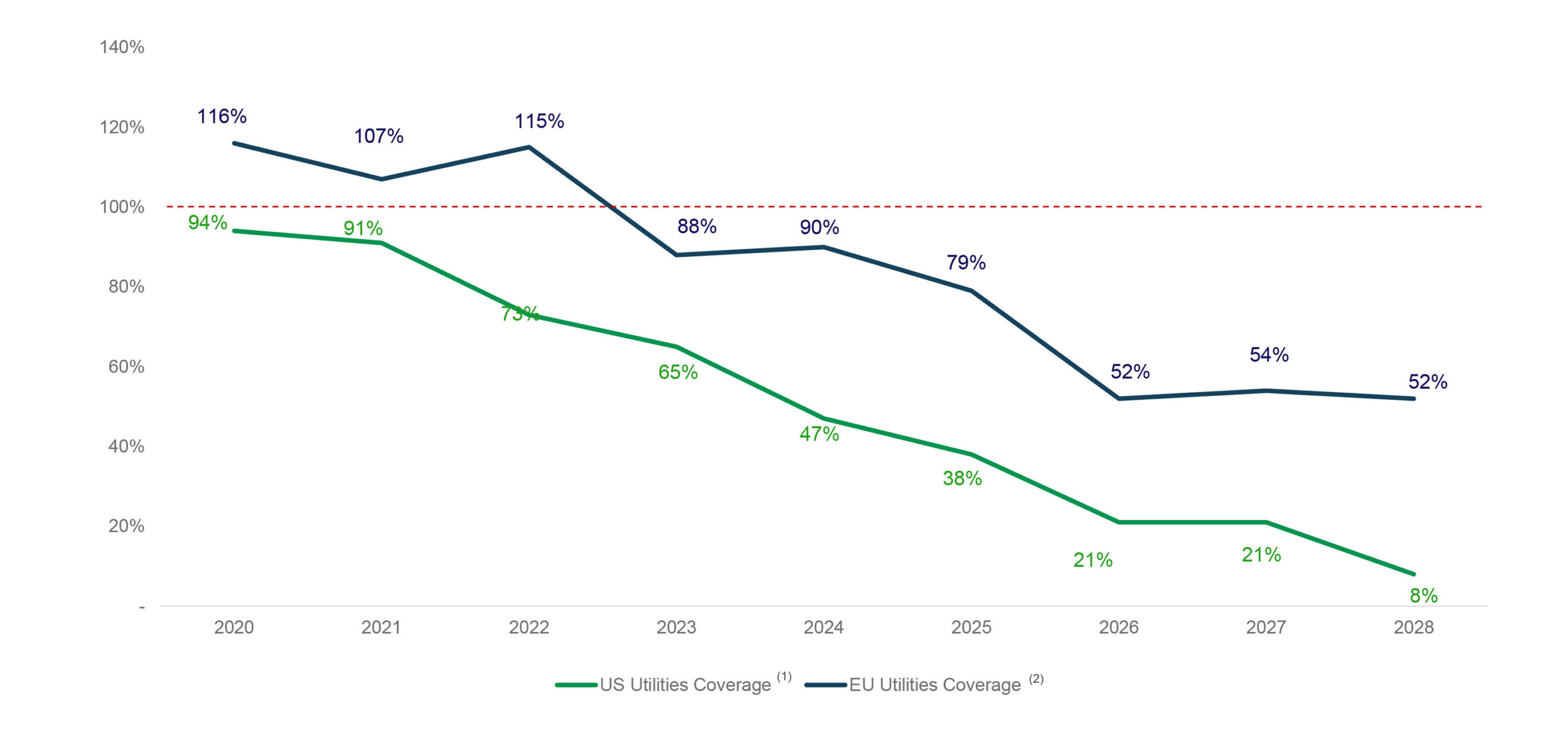

Shifting to demand, the story has been improving, and demand exceeds pre-Fukushima levels and has outstripped primary supply over the past few years. Finite inventories and other secondary supplies are being depleted to make up the difference. Furthermore, well over 50% of all utility contracts require renewal by 2027. Utilities typically renew contracts 18-24 months before they expire. Several utilities have recently come to market with RFPs, but producers are unwilling to lock in long-term contracts at current prices.

Nuclear reactor demand for uranium is sticky and has been largely insulated from the pandemic versus other sources of power generation. It’s still the only source of reliable, baseload, emissions-free electricity. Lastly, demand is expected to increase on the back of new reactor construction. There are 54 reactors under construction, and that doesn’t even consider the advent of SMR’s (Small Modular Reactors).

Since 2003 we have experienced eight periods in which the spot price spiked over a short period of time. The average price increase was +58% over an average of 6.6 months. Worth noting is that spot & term prices are still below the average all-in cost of production and well below the incentive price needed to bring meaningful new production online.

Corporate

You have been successful in raising money this year as you raised almost C$3M in two placements which weren’t widely announced; you announced and closed the raises right away. Do you see a shift in where the demand for shares in uranium companies is coming from? Are you seeing more institutional interest? More North American interest?

We are seeing increasing interest across the board and from all over the world. There has been growing demand from institutional and retail investors alike. We recently announced and closed a $1 million financing with one strategic, generalist fund who has been building positions in uranium companies. We are well funded with approx. $2.5 million in the treasury to complete our upcoming exploration plans and still have option payments due from partner companies.

Meanwhile, your fully diluted share count barely increased as 5.2M options and warrants expired unexercised in July and August. How important is it to you to keep a tight share structure at this stage? We can imagine it’s a fine line between raising enough money to get some meters in the ground while keeping an eye on your share count.

You’ve hit the nail on the head. As an exploration company it is indeed a balance between raising enough money to advance our projects to create value, while maintaining an attractive capital structure. So far, we have been able to advance our portfolio with relatively low dilution, while navigating what has been a tough, albeit improving, uranium pricing environment. This is one of the main reasons we employ the prospect generator strategy at our secondary assets as we can look to continue to monetize some of these projects without having to dilute through share issuance and we are getting close to bringing in additional partners at some of other 100% projects in the Basin.

The recent capital raises improve Skyharbour’s capital position

Skyharbour’s ability to raise money this year seems to confirm there’s renewed interest in the uranium sector and this has a positive impact on the financial position. According to the most recent financial results, Skyharbour had a working capital position of C$1.95M as of the end of June, and subsequent to the end of Q2, it did complete a C$1M capital raise which will boost the working capital position towards C$3M and even after completing the summer drill program, we can reasonably expect Skyharbour to end this quarter with a working capital position of around C$2M.

Meanwhile, the company is keeping its share count in check and including the August placement, Skyharbour now has 92.6M shares outstanding as well as 5.5M options (including the recent 1.8M option issue at C$0.20) and 41.5 million warrants. That’s only marginally more than the 43M options and warrants as of the end of June as the 7M warrants at C$0.22 that were issued in the August placement were basically replacing 0.2M options (at C$0.30) and 5M warrants (at C$0.60) that expired unexercised in July and August.

Skyharbour now has 27 million warrants with a strike price of C$0.22 (with expiry dates in 2022 and 2023) and if exercised, these could add almost C$6M to Skyharbour’s treasury. Of course, at the current share price these warrants aren’t in the money yet but if the momentum in the uranium sector continues, combined with hopefully additional exploration success at Moore, those warrants could get in the money and provide an additional source of cash to the company.

Conclusion

Something seems to be moving on the uranium market and although we have been wrong several times before about the timing of the bottom, it now looks like the drop to $20/pound in 2017 was indeed the bottom where after the uranium price slowly started to trend upward. The recent price jump in the first semester was a welcome confirmation and now both the contract price and spot price of uranium are trading above $30/pound. This isn’t sufficient to justify the construction of new uranium mines but we can clearly speak about an uptrend now. And Cameco restarting its Cigar Lake mine is very likely a sign of a tightening of the spot market: if Cameco was convinced it would still be able to source tens of millions pounds of uranium on the spot market to deliver into long-term contracts, it probably wouldn’t have reopened the mine yet.

Skyharbour is in an interesting position as not only is the company making progress on its fully-owned Moore uranium project in the Athabasca Basin (where drill results should be available in the next few months) but its two joint venture partners are also advancing two other projects in the Basin which is and remains the ‘place to be’ for high-grade uranium exploration.

Disclosure: The author has a long position in Skyharbour Resources. Skyharbour Resources is a sponsor of the website.