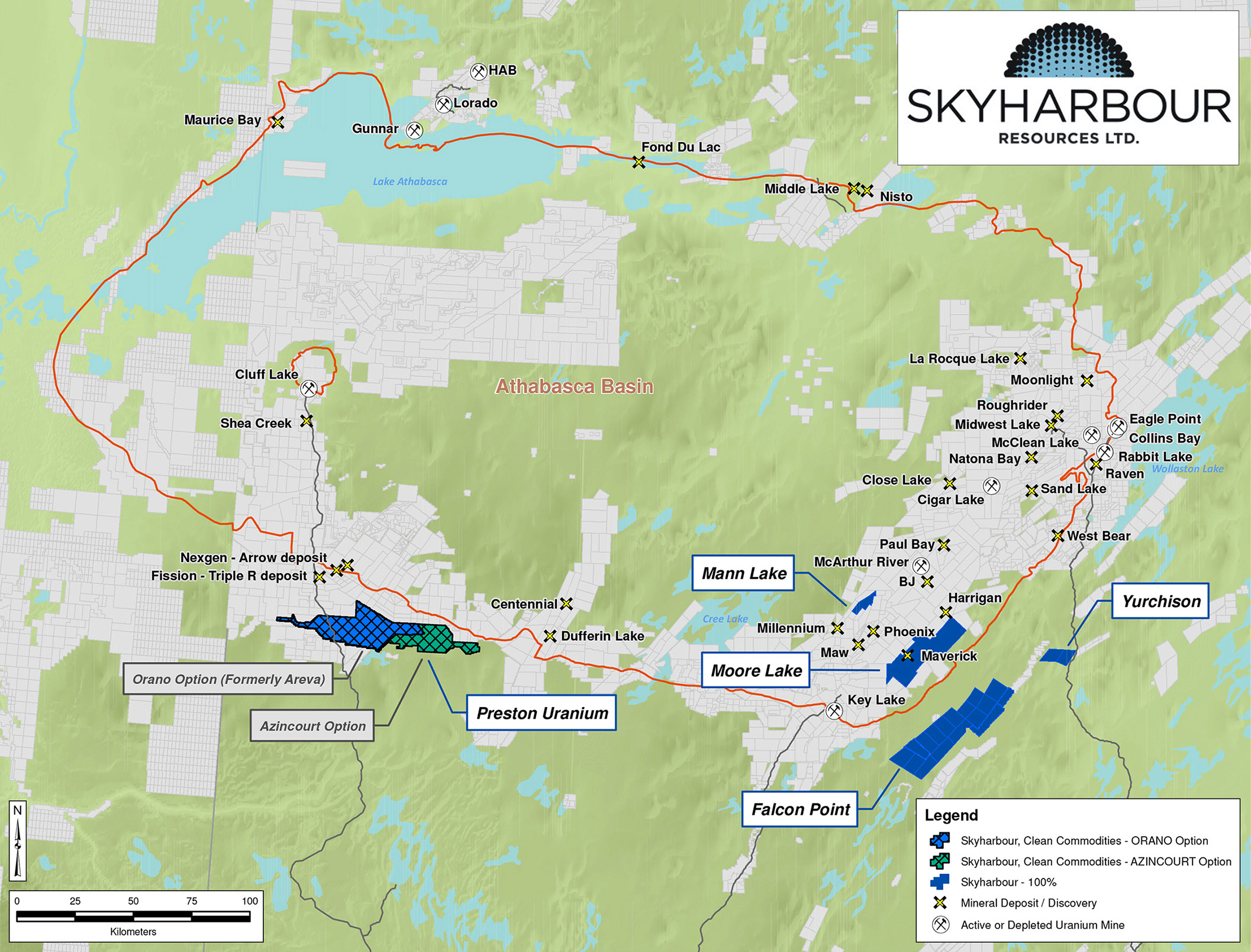

After gathering and interpreting all information of the previous exploration programs, Skyharbour Resources (SYH.V) will be active on three fronts in the coming months. It will drill its own Moore uranium project where it has now earned a 100% ownership through an earn-in agreement with Denison Mines (a large strategic shareholder of Skyharbour), while joint venture partners Orano (ex-Areva, currently unlisted) and Azincourt Energy (AAZ.V) have started their winter drill campaigns as well.

On a combined basis, up to 9,100 meters of drilling is planned, of which only 3,000m will be paid for by Skyharbour. The three separate exploration programs should result in a steady news flow in the second quarter of this year.

Drill program 1: East Preston (JV with Azincourt Energy and Clean Commodities)

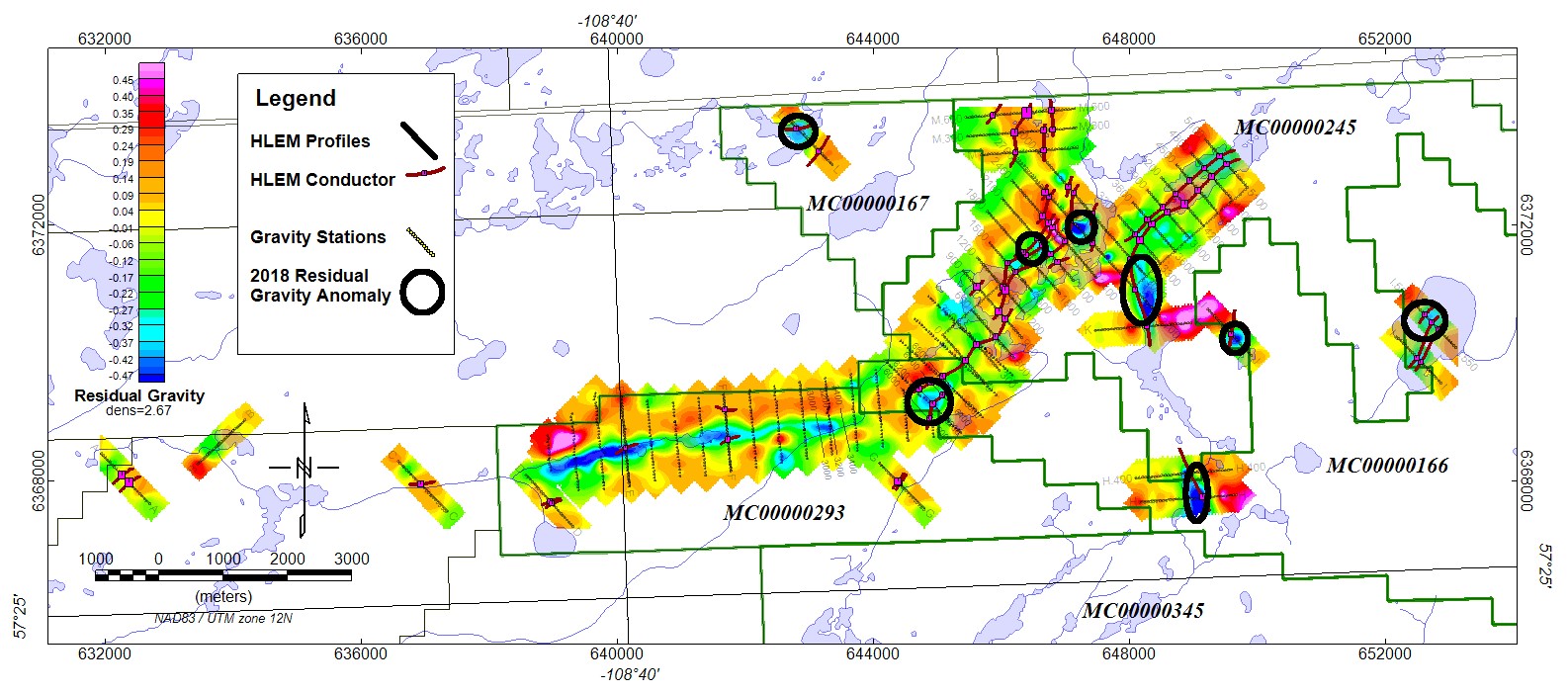

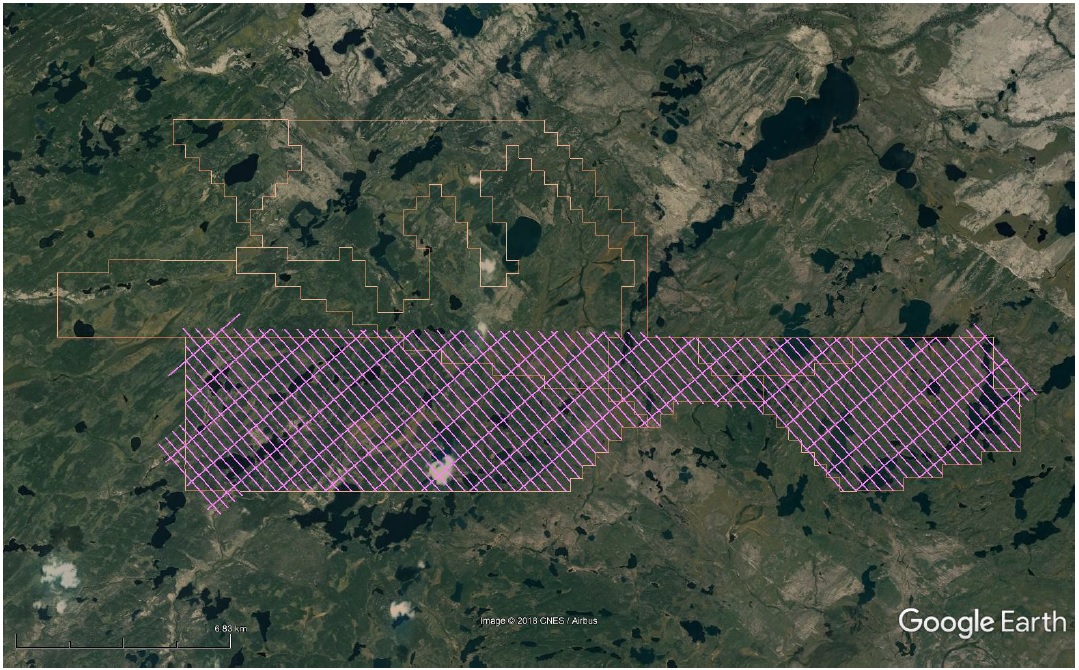

Let’s start with the East Preston joint venture project where Azincourt Energy is earning a 70% stake in the property. Azincourt has been working hard at East Preston as the company has now followed up on its previous exploration programs that included airborne surveys to detect the conductive trends, and figure out the locations of the conductor axes.

Azincourt achieved this through using a gravity survey, searching for gravity lows which is often associated with alteration and in some cases uranium mineralization. The company also completed more geophysical exploration activities with a specific focus on finetuning the existing targets along the so-called Swoosh corridor, while also defining new drill targets within new corridors that have never been drill-tested. An airborne survey of almost 500 line kilometers has also helped to further finetune the highly prospective exploration targets. With the completion of this VTEM survey, the entire East Preston land package has now been subject to VTEM surveys.

It’s perhaps also important to remember the exploration targets at the East Preston zone are similar to NexGen Energy’s (NXE.TO, NXE) Arrow uranium deposit which contains in excess of 348 million pounds of high-grade uranium. This is interesting as Azincourt and Skyharbour are chasing a similar type of basement-hosted uranium deposits. And this might be the right place to expect these types of deposits as East Preston appears to be in a conductive trend that runs parallel to the trends that host the Fission Uranium (FCU.TO) and NexGen deposits, and the trend that hosts the Centennial uranium deposit, owned by Cameco (CCO.TO, CCJ).

After analyzing all data from these exploration programs, Azincourt feels sufficiently confident to embark on a 10-15 hole drill program for a total of 2,000-2,500 meters that will drill-test the high-priority targets in the interpreted corridor. According to Azincourt’s announcement, its Five Island Lake drill target is considered to be one of the most prospective geological targets on the property.

And as a reminder: Azincourt is earning a 70% stake in East Preston from Skyharbour Resources and Clean Commodities (CLE.V) by making C$1M in cash payments while also spending C$2.5M on exploration during a three year period.

Drill program 2: Preston Uranium (JV with Orano and Clean Commodities)

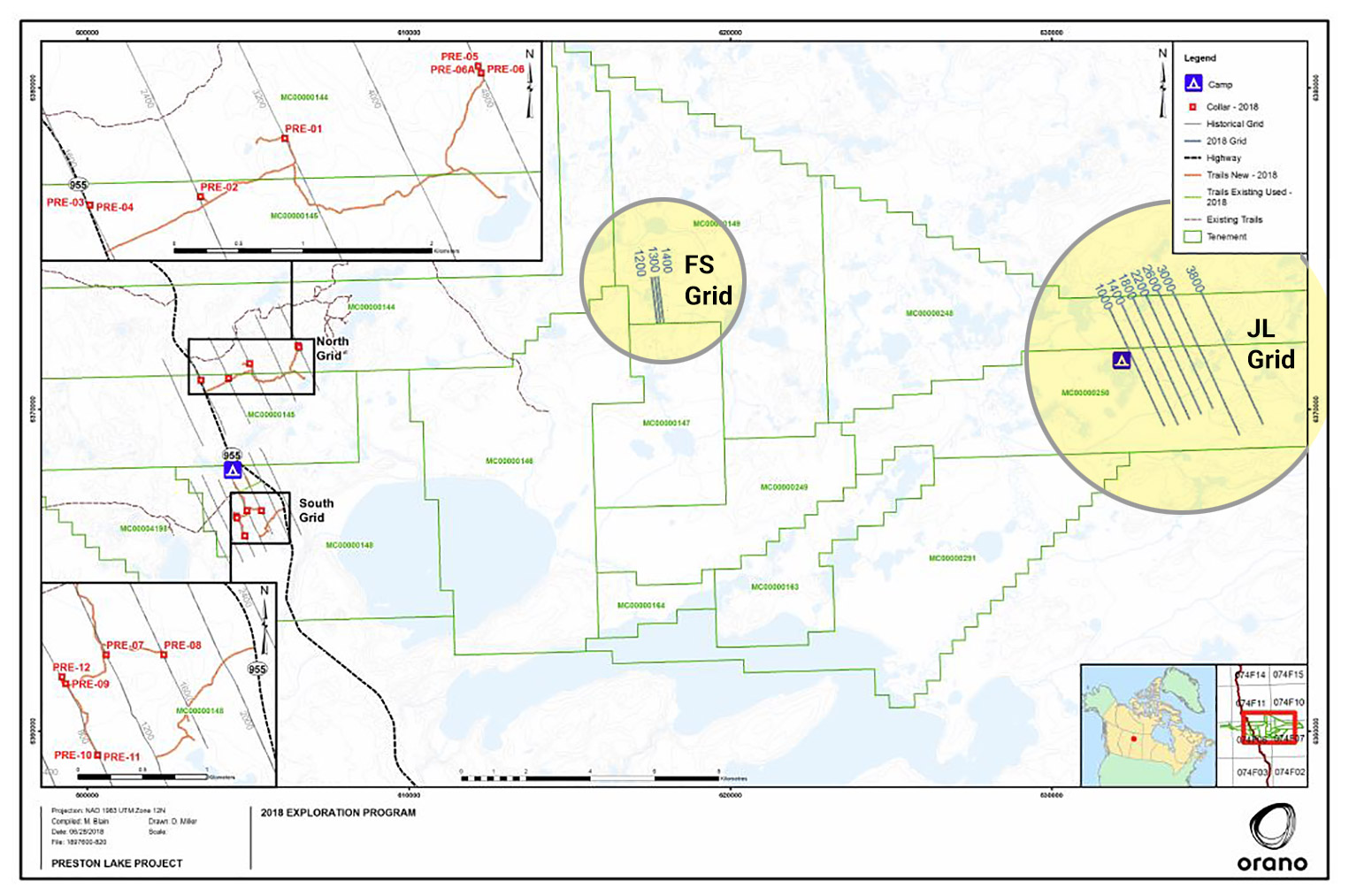

Orano also seems to be pretty keen on getting active in the field as the French conglomerate is planning to complete a ground geophysical exploration project at the Canoe Lake target which will consist of almost 40 line kilometers of ML-TEM (Moving Loop Transient Electromagnetic) to follow up on a conductive zone.

That’s great, but what we really care about is the current 3,600m drill program on two of the other high-priority targets Orano has outlined.

At the FSA target, Orano’s previous exploration programs defined two conductors with a total of 6 drill targets. Orano’s suspicions to find more uranium mineralization were strengthened after assaying an outcrop for uranium mineralization. Finding 47 ppm and 62 ppm of U3O8 at surface is quite interesting and definitely justifies the focus of the current drill program.

A second target at Preston that will be drilled by Skyharbour is the JL target, which was identified in 2017 through the discovery of new outcropping material where thorium-related anomalies were detected. Whereas the FSA target contains six drill targets, the JL target hosts no less than 21 drill targets so there’s plenty of work to do for Orano. Not all drill targets will be tested in the current drill program, as Orano has budgeted for a 11-15 hole program for a total of just 3,600 meters. That’s enough to get a better understanding of what’s going on beneath the surface at Preston, but keep in mind the drill program really is just a ‘first pass’.

Orano will be spending C$2.2M on exploration this year, which once again confirms the French appear to be quite aggressive to push forward to earn up to a 70% stake in the project.

As a reminder, Orano will secure the 70% stake upon completing C$700,000 in cash payments and C$7.3M in exploration expenditures on the property over a six-year period. Orano has already spent approximately C$2.3M on the property, so after completing this year’s planned C$2.2M in exploration Orano will have spent C$4.5M of the required spending with C$2.8M in spending to be completed to establish the 70/15/15 joint venture.

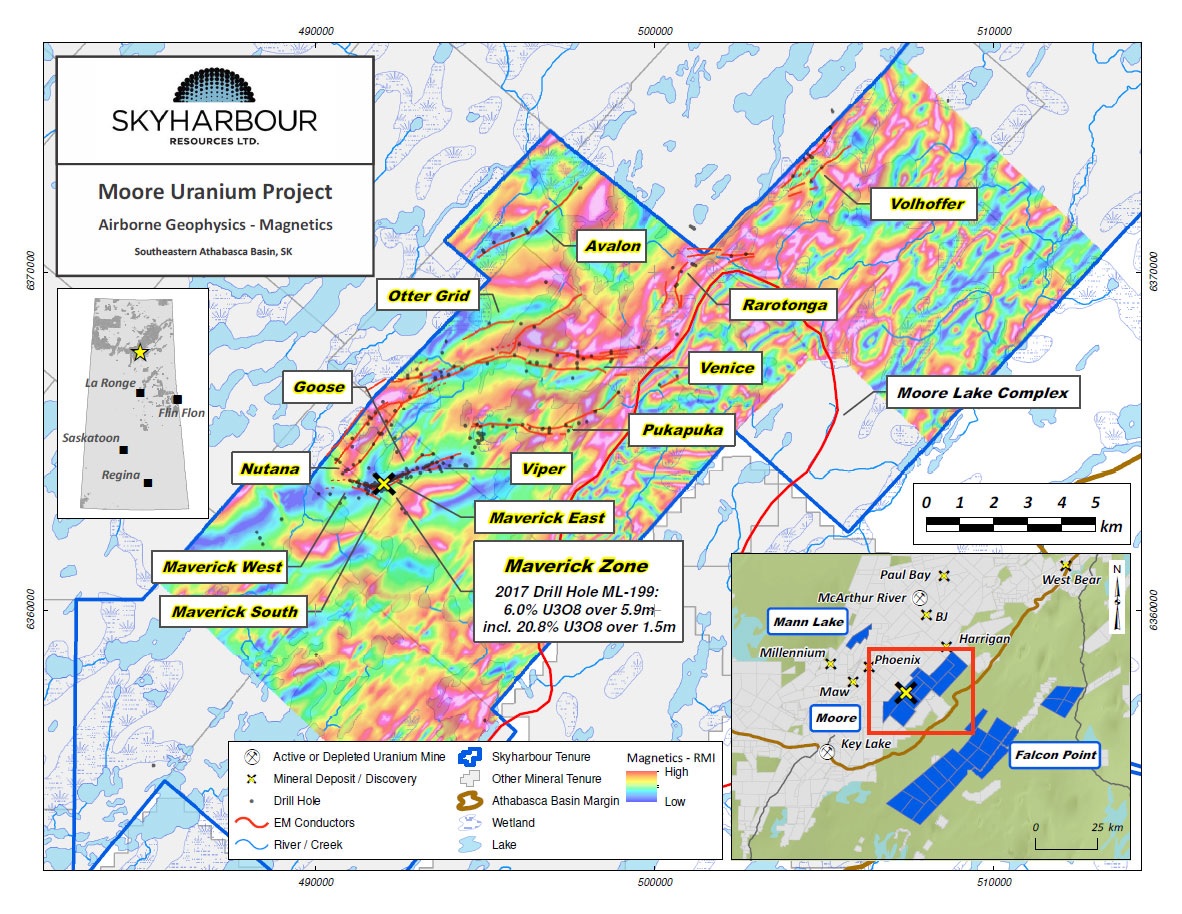

Drill Program 3: Moore Uranium project (100% owned)

No two without three, and the drill program which will probably have the biggest impact on Skyharbour’s future will be at the flagship, high-grade Moore Uranium project where it has earned a 100% stake.

At Moore, Skyharbour will complete at least 3,000 meters of drilling after already having completed 3,800 meters of drilling in its summer/fall campaign in 2018 wherein it encountered almost 1.8 meters containing in excess of 3% U3O8 and a thicker interval of 15.2 meters at an average grade of 0.56% U3O8. More important than the thickness of the intercept is the fact that the uranium mineralization mostly appears in the basement rock, which could pave the way for additional discoveries below the unconformity. Plenty of reasons to drill a few more holes at the Maverick corridor to test the potential of underlying feeder zones that deposited the unconformity-hosted uranium mineralization that was previously identified.

Hole 14 encountered 3.11% uranium over 1.8 meters within a thicker but lower-grade interval of 15.2 meters at 0.56% U3O8 which is one of the thickest intercepts at Maverick to date. Keep in mind that a grade of 0.56% corresponds to approximately 12 pounds of Uranium with a current gross value of $480/t (using a uranium price of $40/pounds). So while a U3O8 grade of 3.11% is absolutely excellent, 0.56% is still very good. This interval was encountered at a depth of 264.5 meters, which is relatively shallow. An additional feature of this hole is that the majority of the interval has been encountered in the basement rock below the unconformity.

Hole 15 was drilled at the western end of the Maverick zone and encountered 2.91% U3O5 over 1.5 meter within a thicker interval of 7.8 meters containing 1.33% U3O8. The same remark is valid here. 2.91% U3O8 is excellent, but 1.33% is really good as well and that’s the equivalent of approximately 29 pounds of uranium per tonne of rock. This grade could best be compared to one ounce of gold per tonne of rock (if that makes it easier to put it into perspective).

This interval was encountered at approximately the same depth downhole as in hole 14 (just over 264 meters). What’s interesting at hole 15 is that the 7.8 meter interval also contains very high cobalt (0.44%) and nickel (1.62%) values. Using a cobalt and nickel price of respectively $25/pound and $5/pound, this adds an additional $415/t to the gross rock value.

A few additional holes of in the recently commenced 8-10 hole, 3,000 meter drill program will target the Otter Grid area. We are actually looking forward to the Otter Grid drilling as Skyharbour will be following up on previous drill holes that did intersect pathfinder elements and anomalous uranium values, but both drill holes were lost before actually reaching the optimum target depth. The Company is using a more modern drill rig to prevent previous drilling problems and any high-grade uranium found here would be a new discovery.

Skyharbour’s financial situation

As of the end of December, Skyharbour Resources had approximately C$2.4M in working capital, including C$2.36M in cash. Not a bad situation to be in, considering the company has spent in excess of C$1.6M on exploration. All exploration expenditures were capitalized and come on top of the C$1.03M spent on corporate overhead (although a good chunk of the almost C$400k in consulting fees in the first nine months of the year are directly related to the exploration activities as well).

As C$1.62M of the C$2.65M in total cash expenditures in the first nine months of the year were spent on exploration and evaluation, 61% of the total amount of dollars spent by Skyharbour goes straight in the ground. And if we would assume C$200,000 of the consulting fees is related to the exploration programs (only C$190,000 of said fees were payable to related parties), this ratio increases to approximately 69%, which is high for an explorer.

Conclusion

Interesting times in the Athabasca Basin, that’s for sure, and Skyharbour Resources and its partners will be very busy over the next few weeks. We still appreciate Skyharbour’s strategy to use the cash provided by joint venture partners to explore two of its other projects while SYH itself focuses on its Moore Uranium project.

Drill results should start to come in around April / May, and with approximately 9,000 meters of drilling to be reported on, the second quarter should be news-packed and we are obviously hoping for either a new discovery at the JV properties and/or expanding the known mineralization at the Moore project.

With a current market capitalization of C$23M, Skyharbour’s share price probably won’t need much to move, given the recent developments in the general commodity markets where new discoveries are met with tonnes of excitement. But as always, the proof will be in the pudding, and let’s wait for the assay results.

Disclosure: Skyharbour Resources is a sponsoring company. We have a long position. Please read the disclaimer