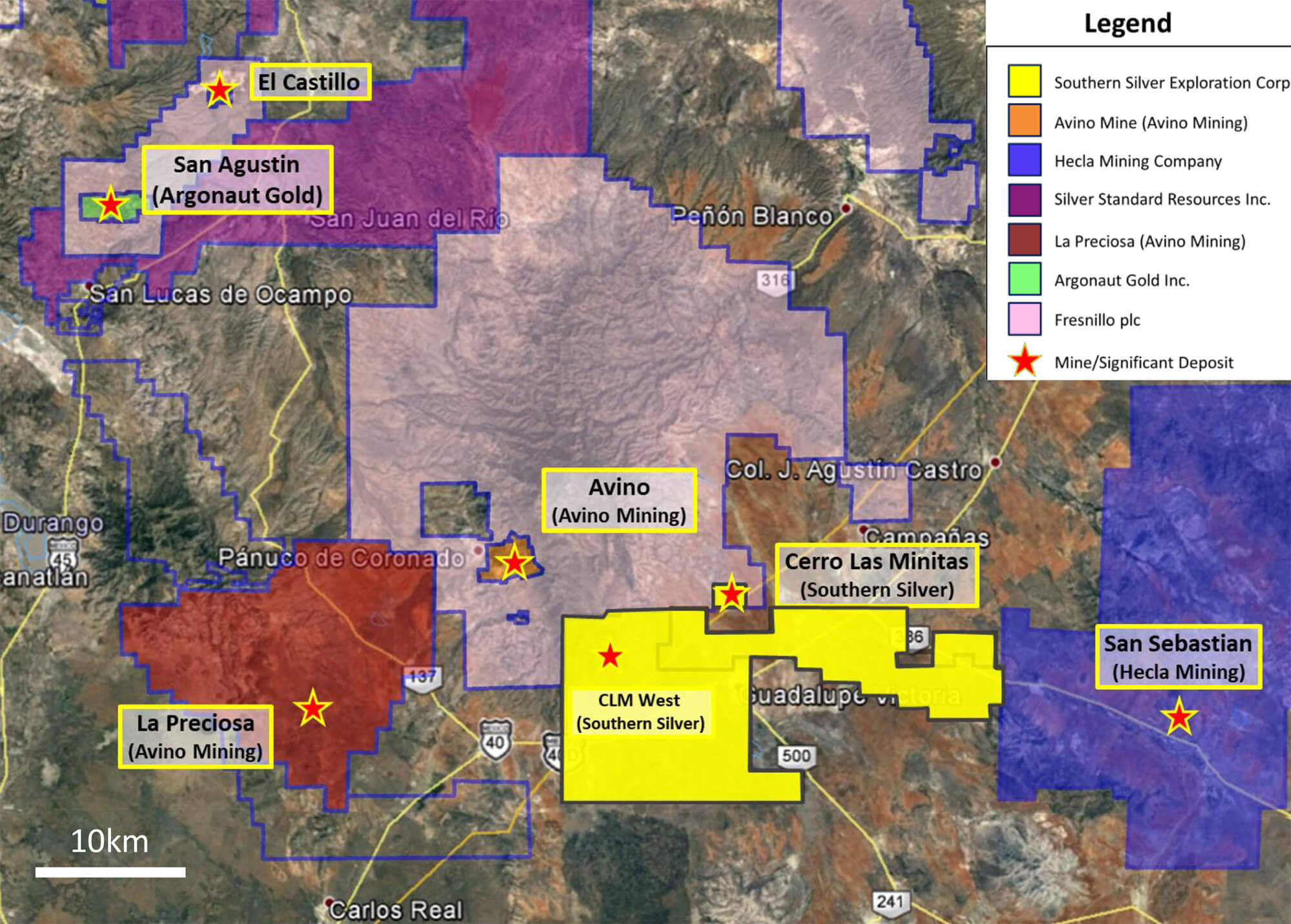

When Southern Silver Exploration (SSV.V) released its maiden Preliminary Economic Assessment on the flagship Cerro Las Minitas project in August of 2022, the results were okay but not impressive. Fortunately, Southern Silver identified four important elements that it thought to have the potential to improve the NPV and IRR substantially. That new study has now been published and while we are waiting for the entire technical report to be filed, we would like to already discuss the summary provided by the company.

And just to be clear, although companies with assets in Mexico are currently out of favor due to all the rumors and attempts to ban open pit mining. That’s irrelevant to the Southern Silver story as Cerro Las Minitas would 100% be an underground mine. The PEA does not take a single tonne of rock from an open pit, and the entire mine plan is based on an underground mine. Even if (and that’s still a big if) there would be a ban on permitting new open pits, this should have no impact on Southern Silver. In fact, a ban on open pit mining would likely be positive for Southern Silver as the permitting process could likely go a bit faster if the administration doesn’t have to deal with open pit permit applications.

We don’t expect all open pit mining to be banned (we would be wrong of course), but the main takeaway is that Cerro Las Minitas is an underground project and all chatter about not permitting new open pits is just white noise.

The company did what it promised, and the economics improved

The main purpose of updating the PEA was to improve the economics, and Southern Silver definitely achieved the desired result. The mine plan was tweaked a bit and rather than focusing on a 4,500 tpd scenario, the company and its consultants settled for a higher throughput of 5,300 tonnes per day. That obviously meant the anticipated capex decrease didn’t occur but on a pro forma basis, the capita intensity improved. Whereas the capex per tonne of annual capacity was US$210 in the 2022 PEA, this improved to US$201/t.

Other parameters did improve: despite an 18% throughput increase, the mine life was extended by in excess of 2.5 years due to the ability to add an additional 5 million tonnes of rock to the mine plan. And that’s why, despite the higher initial capex (which increased to US$388M), the NPV increased pretty substantially to US$501M.

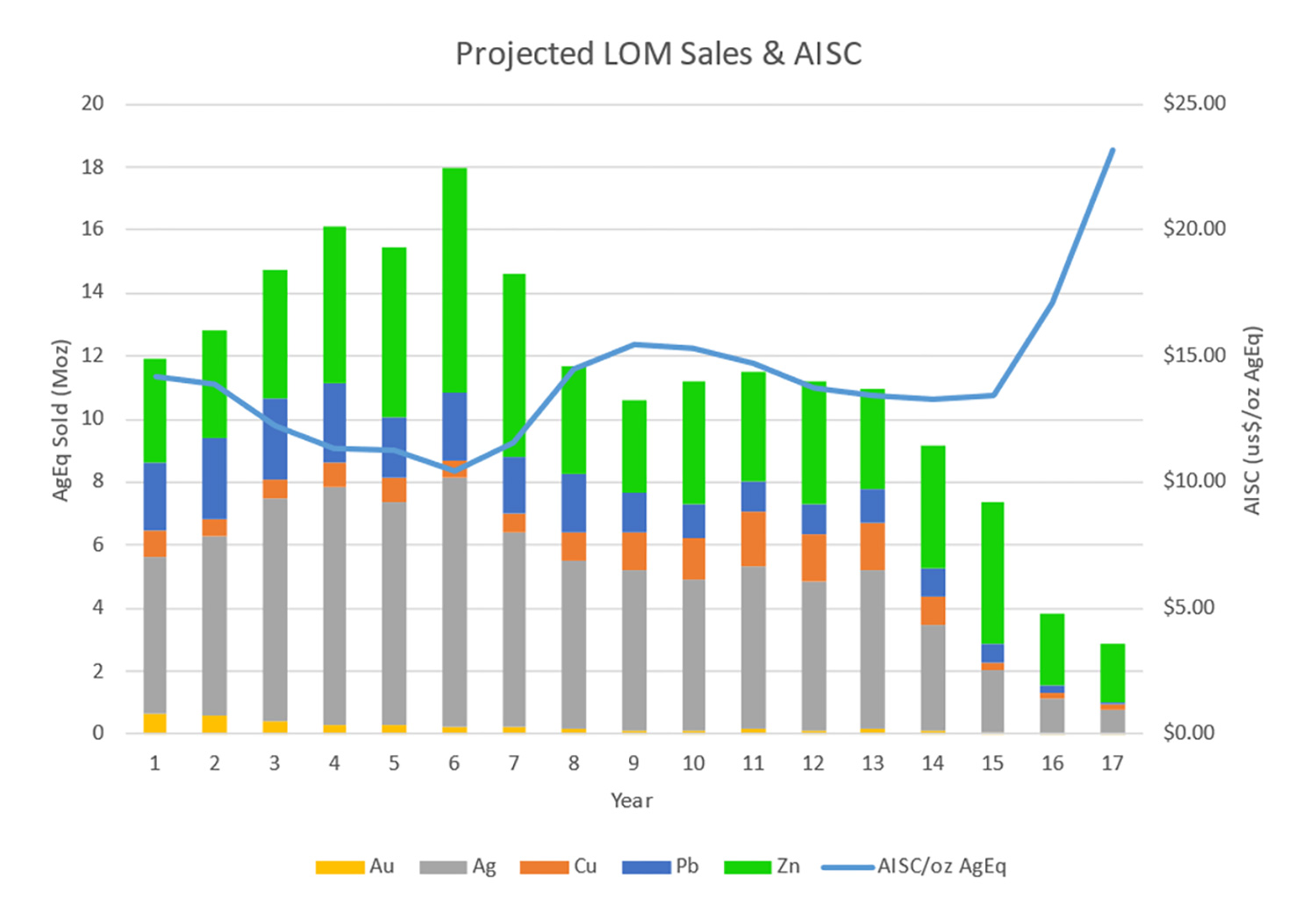

The average daily throughput of 5,300 tonnes per day indicates the mine will produce approximately 11.4 million ounces of silver-equivalent per year, including 4.9 million ounces of pure silver.

Southern Silver presents the project and its operating costs on a silver-equivalent basis. While we are usually allergic to that, especially as the pure silver production of 4.9 million ounces per year is very respectable, we understand why, as silver represents less than 45% of the total revenue in the base case scenario. The net revenue generated from zinc sales is slightly lower than the revenue from silver sales, so Cerro Las Minitas could be seen as a primary-silver polymetallic project.

The total All-In Sustaining Cost (‘AISC’) is estimated at US$13.23 per ounce of silver-equivalent over the entire mine life but as you can see below, the average AISC in the first 14 years of the mine life remains firmly below US$12 and the AISC only starts to increase at the tail end of the operations when the output decreases.

For those who would like to see the AISC per ounce of silver, a quick calculation based on the average production cost over the entire mine life indicates the AISC per ounce of silver would likely be close to zero on a by-product basis, using the base case scenario metals prices for the base metals.

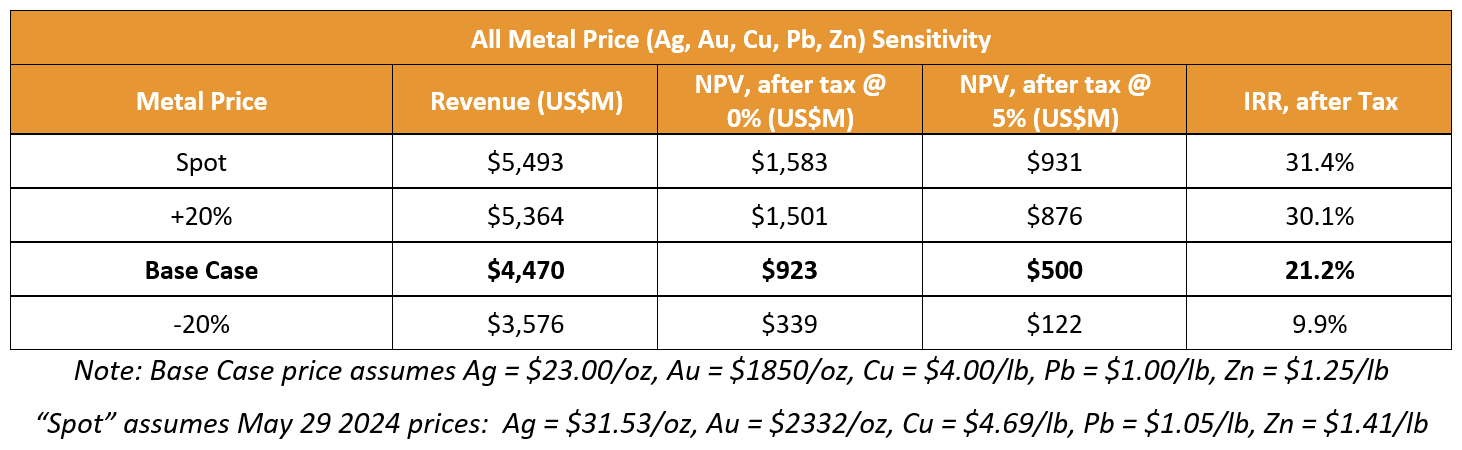

In that base case scenario, the company used a silver price of $23/oz, as well as $1850 gold, $4 copper, $1 lead and $1.25 zinc. This results in an after-tax NPV5% of US$501M but as the summarized sensitivity analysis below shows, the leverage on the commodity prices remains high. Using a scenario with commodity prices of 20% above the base case scenario, the after-tax NPV5% increases to US$876M while the IRR jumps to in excess of 30%.

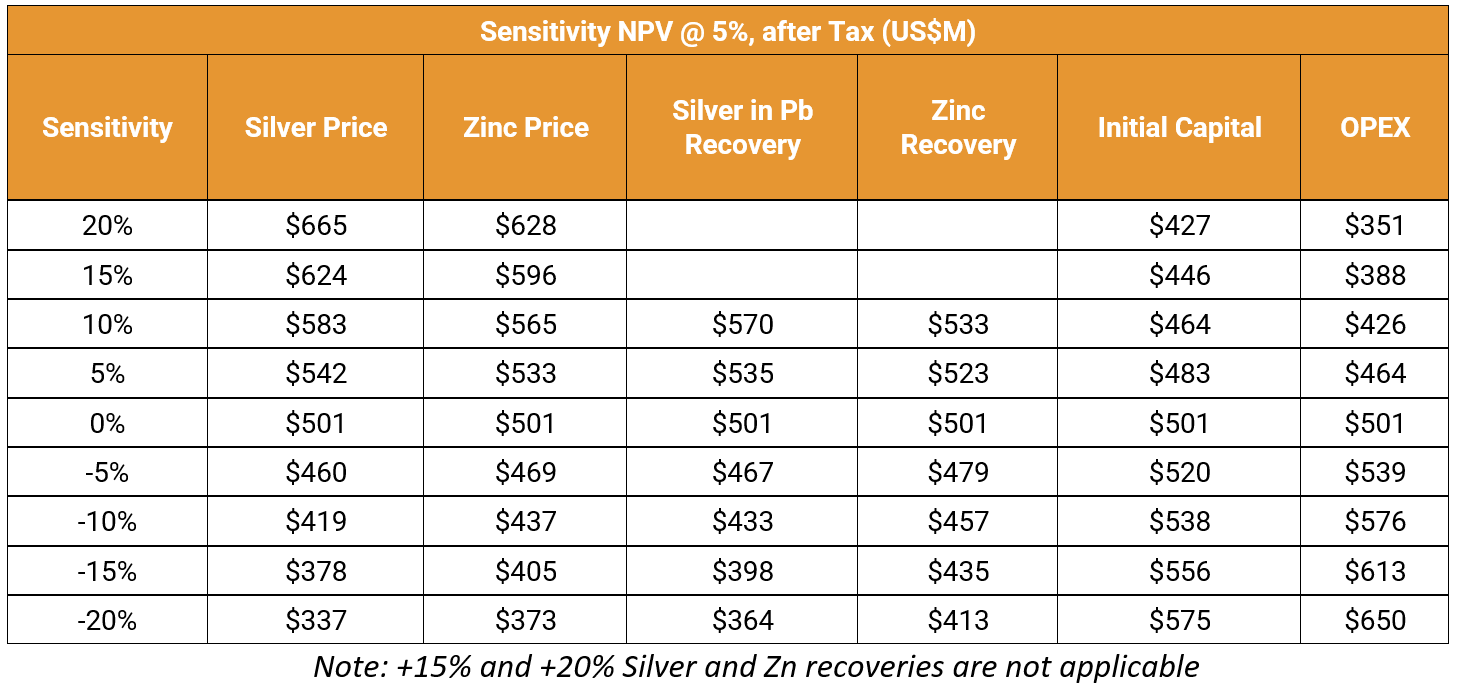

And just like last time, Southern Silver also provided a more detailed sensitivity analysis which allows you to ‘play around ‘using the different input prices. Let’s say you expect the silver price to be 10% higher than the $23 base case scenario but you’re not bullish on zinc and expect a flat zinc price. The table below shows a 16% NPV increase to US$583M.

What if you expect a 15% silver price increase in combination with a 5% zinc price decrease? According to the sensitivity table, you’d record a $123M gain on the silver side while conceding about $32M on the zinc side. While you cannot simply deduct the $32M from the $123M as there will be different implications (timing of the silver and zinc sales, impact on taxes,…) it at least gives you an indication of how sensitive the Net Present Value is when it comes to the metal prices.

Additional possibilities to improve the project

Although the company was already able to incorporate several updates to the PEA which definitely improved the results, there are still some other potential improvements.

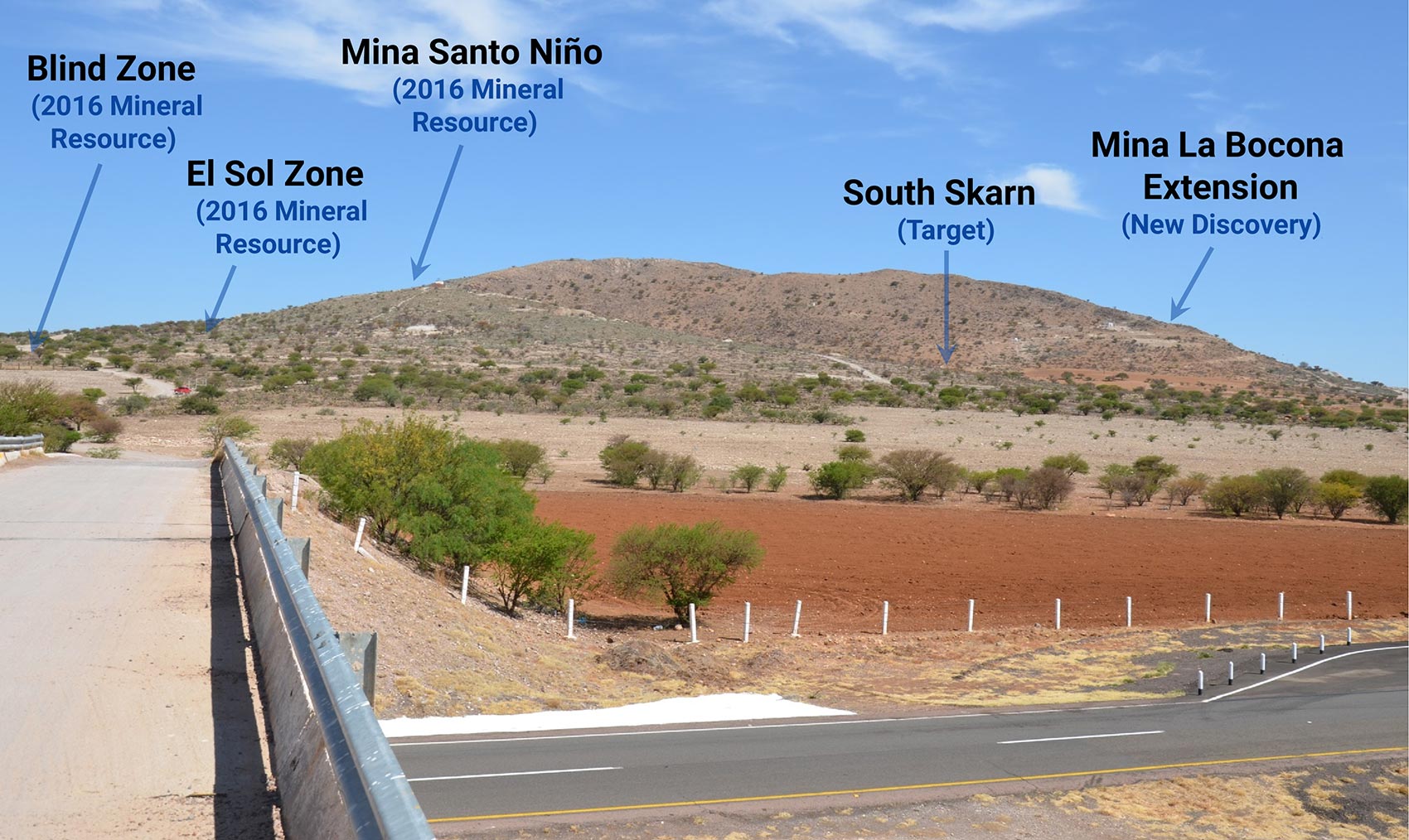

The company mentions there still are gaps in the current resource model as the eastern and northern sides of the Cerro remain under-drilled. Additional mineralization that could be added with an infill drill program could further enhance the total tonnage and metals output. Additionally, the potential additional tonnes would be mined early on in the mine life, thereby maximizing the impact on the NPV.

Additionally, Southern Silver thinks there is a possibility of further reducing the capex and opex through pre-concentration of the mill feed. This process can often involve new-ish technologies that have not been fully proven on an industrial scale and, as a result, were left out of the Base-case financial modelling. However, in time, pre-concentration could have a greater impact on the project as the processing technology becomes more proven, but more work needs to be done before incorporating the effects in future studies.

Most of the improvements, however are already included in the updated PEA. The throughput increased, the gold is now recovered and sold and the mine life was extended thanks to adding another 5 million tonnes of rock to the mine plan.

Conclusion

With an NPV to capex ratio of approximately 1.30, the updated PEA is substantially better than the ratio of 1.02 in the first PEA. The higher initial capex has been more than offset by the longer mine life and the higher metal prices.

We will provide a more detailed update once the company files the entire technical report, but so far, we like what we see in the company’s update. Southern Silver’s current market capitalization of C$80M versus the after-tax NPV5% of approximately C$650M means the company is currently trading at approximately 0.11 times the after-tax NPV5% using $23 silver and $1.25 zinc and at approximately 0.08 times the after-tax NPV using $26.5 silver with an unchanged zinc price.

Disclosure: The author has a long position in Southern Silver Exploration. Southern Silver Exploration is a sponsor of the website. Please read our disclaimer.