As the silver price almost reached $40/oz in July, the renewed interest in the precious metal also allowed some companies to tap the financial markets to top up the treasury. Southern Silver Exploration (SSV.V) is one of those companies and after taking the over-allotment into account, a financing that was originally announced as a C$8M funding round ultimately allowed the company to raise C$15M. And this will likely lead to the highest cash position in the company’s history. It goes without saying this puts Southern Silver on a much stronger financial footing.

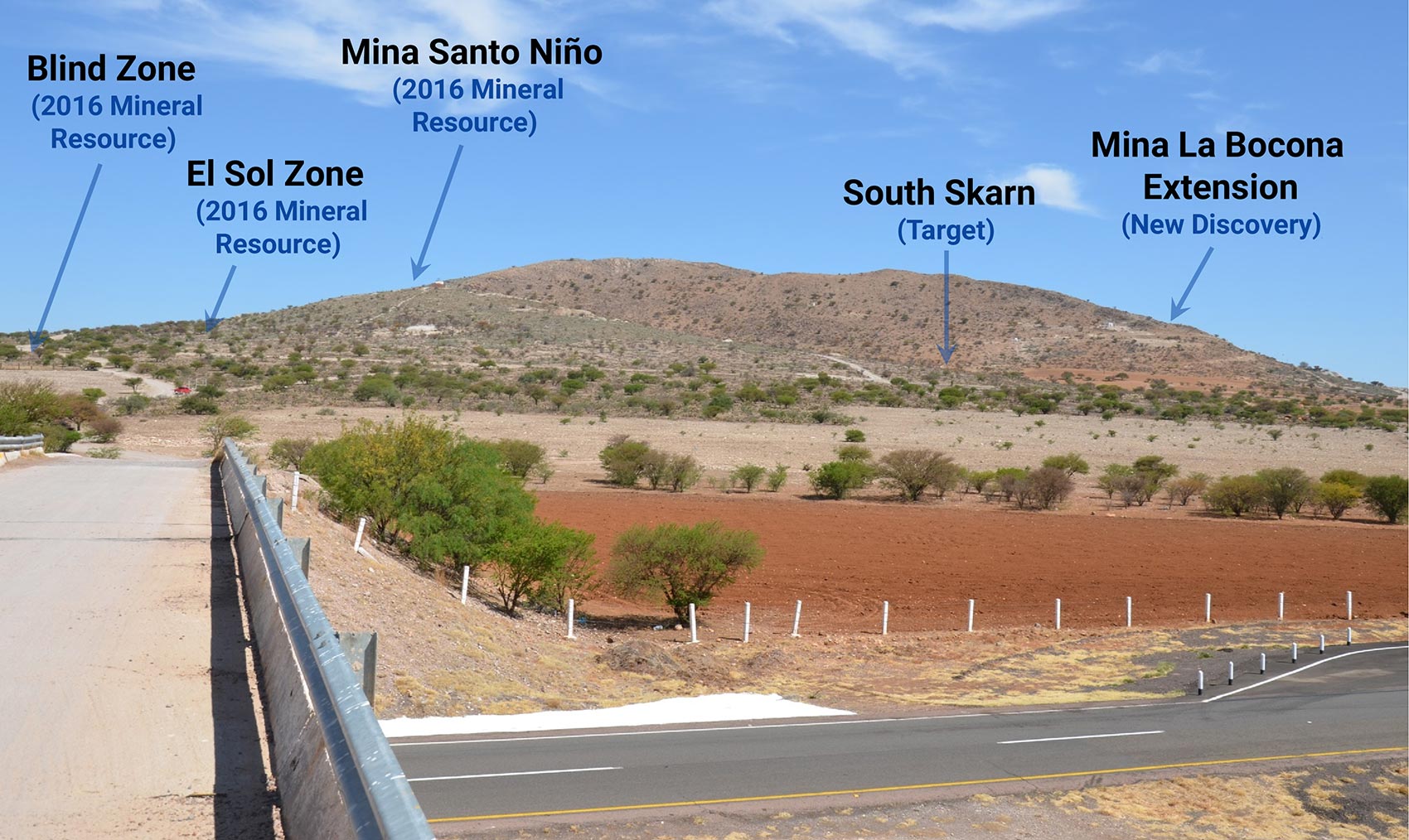

Although the company has added projects to its portfolio in the past few years, the advanced stage (underground!) Cerro Las Minitas project very much remains its flagship project and we expect a substantial portion of the funds to be spent on pre-feasibility study related activities.

The silver price is now 65% higher than in the base case PEA scenario

The main purpose of updating the PEA in 2024 was to improve the economics, and Southern Silver definitely achieved the desired result. The mine plan was tweaked a bit and rather than focusing on a 4,500 tpd scenario, the company and its consultants settled for a higher throughput of 5,300 tonnes per day. That obviously meant the anticipated capex decrease didn’t occur but on a pro forma basis, the capital intensity improved. Whereas the capex per tonne of annual capacity was US$210 in the 2022 PEA, this improved to US$201/t.

The average daily throughput of 5,300 tonnes per day indicates the mine will produce approximately 11.4 million ounces of silver-equivalent per year, including 4.9 million ounces of pure silver. This rises to 14.1Moz silver-equivalent per year, including 6.4Mozs silver over the first eight years of production.

Southern Silver presents the project and its operating costs on a silver-equivalent basis. While we are usually allergic to that, especially as the pure silver production of 4.9 million ounces per year is very respectable, we understand why, as silver represents less than 45% of the total revenue in the base case scenario. The net revenue generated from zinc sales is slightly lower than the revenue from silver sales, so Cerro Las Minitas could be seen as a primary-silver polymetallic project.

The total All-In Sustaining Cost (‘AISC’) is estimated at US$13.23 per ounce of silver-equivalent over the entire mine life but as you can see below, the average AISC in the first 14 years of the mine life remains firmly below US$12 and the AISC only starts to increase at the tail end of the operations when the output decreases.

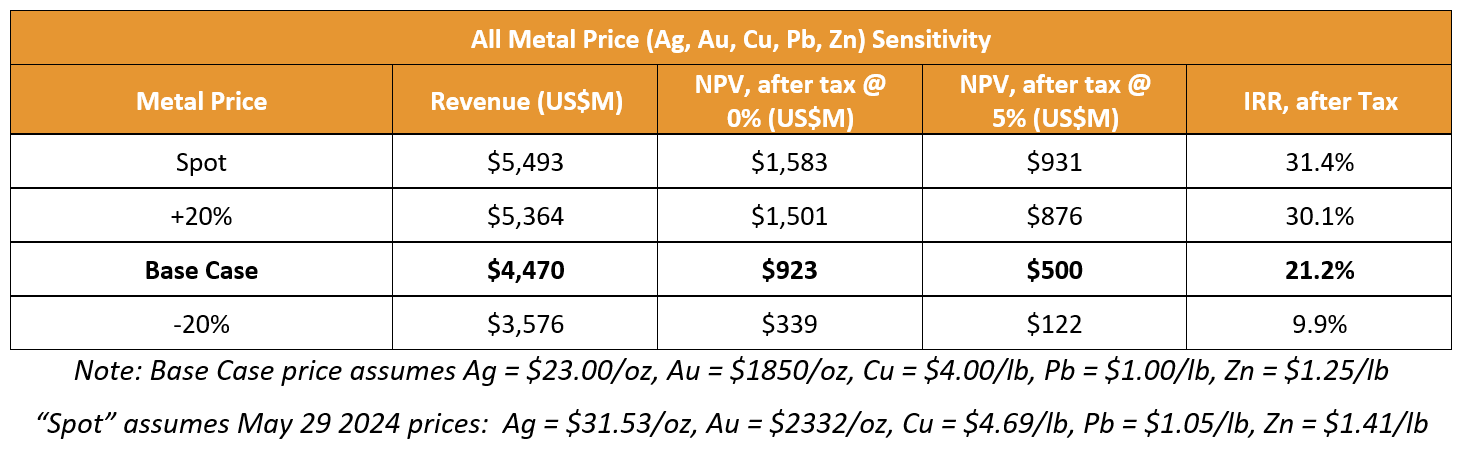

But what’s really interesting, is that the base case scenario in the 2024 PEA was based on a scenario with $23 silver and $1850 gold as main metal prices. The zinc price of $1.25 per pound is more in line with the current price ($1.28 as per the LME prices), but it goes without saying that applying the current metal prices would provide a tremendous boost to the NPV and IRR of the project. As part of its PEA, the company published the table below.

The total All-In Sustaining Cost (‘AISC’) is estimated at US$13.23 per ounce of silver-equivalent over the entire mine life but as you can see below, the average AISC in the first 14 years of the mine life remains firmly below US$12 and the AISC only starts to increase at the tail end of the operations when the output decreases.

The ‘spot case’ scenario uses $31.53/oz for silver, $2332/oz for gold, $4.69 per pound for copper, $1.05 per pound for lead and $1.41 per pound as the main zinc price. Gold and silver are now obviously trading at higher prices than in the previous spot price scenario (63% higher and 21% higher respectively), while the zinc price is currently relatively flat as it’s just 2% higher. The higher copper price has a smaller impact on the economics as the anticipated average payable copper production is less than 5 million pounds per year, and the current LME pricing for copper is slightly lower (a single digit percentage) than in the May 2024 spot price scenario).

If you look at the NPV5% on an after-tax basis in the Spot Case scenario above, the after-tax NPV5% increases to US$931M, which currently represents approximately C$1.28B at the current exchange rate of 1.373 CAD per USD. This means Southern Silver is trading at a substantial discount to the project’s NPV considering its market capitalization is currently just over C$90M (with an enterprise value of around C$75M). The current spot prices are even higher than the ‘spot case prices’ used last year, so the after-tax NPV5% is now likely closer to or exceeds US$1B/C$1.4B on an after-tax basis.

Catching up with Robert MacDonald, VP Exploration

We had a chance to catch up with Robert MacDonald, Vice-President of Exploration for Southern Silver.

Congratulations on the upsized financing. Raising C$15M is quite an achievement and as the over-allotment option was exercised, this will go in the books as your largest financing ever. Can you elaborate on the background of how this financing came to be? Did Red Cloud reach out to Southern Silver?

Thank you. We have a long-standing relationship with Red Cloud that allowed us to work with them in a very compressed timeframe to execute this financing.

Raising C$15M (before fees) will put you in a much more comfortable financial position. Could you perhaps briefly elaborate on the anticipated use of proceeds?

This financing gives us a tremendous opportunity to advance and add value to the Cerro Las Minitas project. The funds will be used for further infill drilling with some component of resource expansion, the advancement of baseline studies for permitting readiness, geo-metallurgical optimizations and engineering as we look to advance the Cerro Las Minitas project to a construction decision.

Let’s take another minute to look at Cerro Las Minitas. It has been a year since you published the updated PEA on CLM, and right now the spot price for silver is approximately 65% higher than the base case scenario in your study. Your sensitivity analysis even maxes out at a silver price of just under $28/oz. But based on your official numbers and the disclosed NPV5% of US$931M using 31.5 silver and 1.41 zinc, your after-tax NPV surely exceeds US$1B at the current metal prices? Has this resulted in additional interest in Cerro Las Minitas?

That is a good assessment of the effect of rising metal prices on the NPV of the project and a good benchmark for your readers to follow.

Yes, we have had additional interest in the project and the M&A market is heating up with the recent acquisitions of silver companies like Gatos Silver, MAG Silver and SilverCrest Metals.

Cerro Las Minitas is at an earlier stage than these most recent M&A stories in the silver space, however, we believe that this is just the start of a major silver bull run and that the M&A activity will inevitably transition to development assets like Cerro Las Minitas.

We see the near term potential to enhance CLM through the material increase of the mineable inventory, increase in mine production and to elevate the project’s metal output over a mine life with longevity and capital efficiency. This upside will be unlocked through both the drill bit and optimizing the operational strategy.

What is required to bring the project from the PEA level to a PFS level? And what’s the anticipated required budget to do so?

A PFS level of study requires M&I mineral resources, therefore further drilling is required on the project to upgrade the mineral resource into the M&I category. Since the release of our PEA, we have been proactively advancing various technical aspects in preparation for a future PFS. The technical elements that will feed into a PFS include: a refined mine design and mine scheduling based on the updated mineral resource; geotechnical and hydrology studies; detailed engineering on the processing plant location and design, including supporting infrastructure; and environmental baseline studies. Many of these studies are currently underway and we will use the additional funds to help fund this work over the next three years.

Is exploring for incremental gains at Cerro Las Minitas useful? We mean, if interested parties don’t pull the trigger while you are currently trading at less than 0.10 times the NPV5% at $31.5 silver, adding 4-8 million tonnes to the resource which should provide an additional $50M or $100M to the NPV (at constant metal prices) likely isn’t going to make anyone move (faster)?

We agree with your view of the current market sentiment. However, increasing the resource is only one component of the value upside at CLM. With inventory growth comes the opportunity for a higher scale operation and therefore greater metal output. This enhanced vision for the operation will be a focus for the future PFS. For us, the key to a rerating at SSV is to advance Cerro Las Minitas as quickly as possible to a fully-funded investment decision and commence construction of what we believe will be a very profitable mine with a relatively short payback period, especially at current metal prices.

How is the drill permit process going in the USA? Can we expect you to be active in New Mexico on the Oro and Hermanas projects this year?

At Oro we are looking for a partner to take on the next stage of work on the property and as copper prices firm up, we believe interest in the project will grow. We are currently planning an initial phase of drilling at Hermanas. Drill permits are prepared and all we require to commence mobilization is to post the bond. This will be our first program at Hermanas and we look forward to finally drilling the project.

Circling back to Mexico. Are you planning to do any work on the Nazas project now you have much more cash in the bank?

The Nazas project came with several large geological databases which we continue to compile, analyze and form our interpretation. We are finalizing our exploration plans which will form the basis for our environmental (drill) permit which will be submitted once this final work is completed. Like the Hermanas project, this will be our first program on this asset. It is in an exciting district, within 16km of Endeavour Silver’s (EXK, EDR.TO) Pitarilla project with the potential to develop significant silver-gold resources.

What do you currently think about the silver space? Although the silver price is up just 15% in the past three months, we have seen some of your competitors post triple digit share price returns. Do you think the renewed interest in the space is sustainable, or should we expect a stabilization period?

I think that there will be continued and expanding interest in the silver space. I expect the silver deficits that we have seen in the markets over the last several years will continue to support the silver price on a technical level and world-wide financial uncertainties will support silver and gold prices in the near to medium term. Of course, there may be consolidation in silver prices from time to time moving forward, but this is a good time to be in silver.

Conclusion

It is a pity the sensitivity table in Southern Silver’s 2024 Preliminary Economic Assessment doesn’t provide a NPV and/or IRR at silver prices above $35 per ounce as it would be interesting to see an ‘official’ NPV number at the current metals prices.

While the company initially planned to raise ‘just’ C$8M, the total financing proceeds will be C$15M, and this will allow the company’s technical team to deploy a lot more fire power to advance its pipeline of projects, and to take a big step forward working on the Cerro Las Minitas PFS. And again, Cerro Las Minitas is an underground project, and should therefore have a favorable permitting process in Mexico under the current administration. The company of course isn’t ready to kick off a permitting process yet, but but is being proactive on baseline data collection and permit readiness efforts.

Now the treasury has been filled again, we expect a strong news flow from the company after the summer months.

Disclosure: The author has a long position in Southern Silver Exploration. Southern Silver Exploration is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our disclaimer.