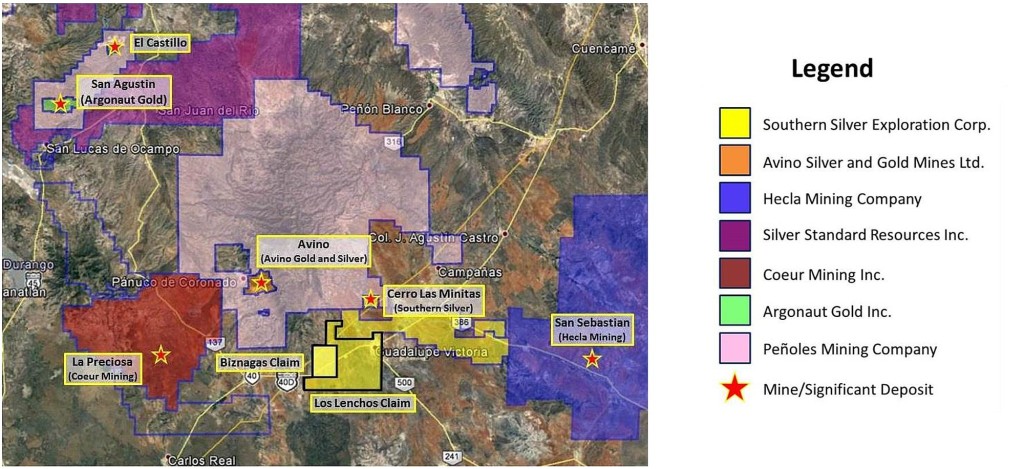

Now the commodity prices seem to be stabilizing at attractive levels with silver at just over $25/oz and zinc at $1.28/pound, Southern Silver Exploration’s (SSV.V) Cerro Las Minitas project is getting ready for its moment in the spotlights. Southern Silver secured full ownership of the project in 2020, filled up its treasury and started an additional drill program.

Assay results have been rolling in on a continuous basis and recent exploration results have indicated the company’s new exploration target appears to be realistic.

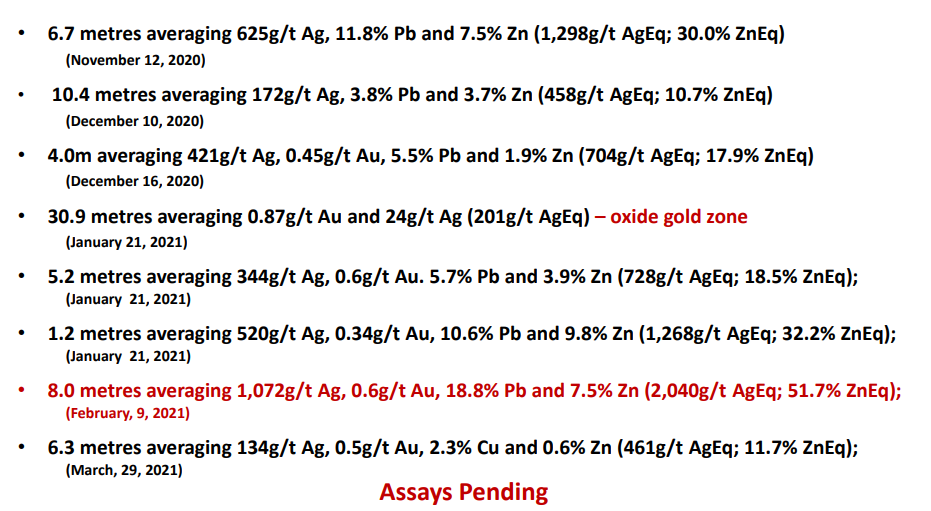

The recent drill results confirm a resource expansion is realistic

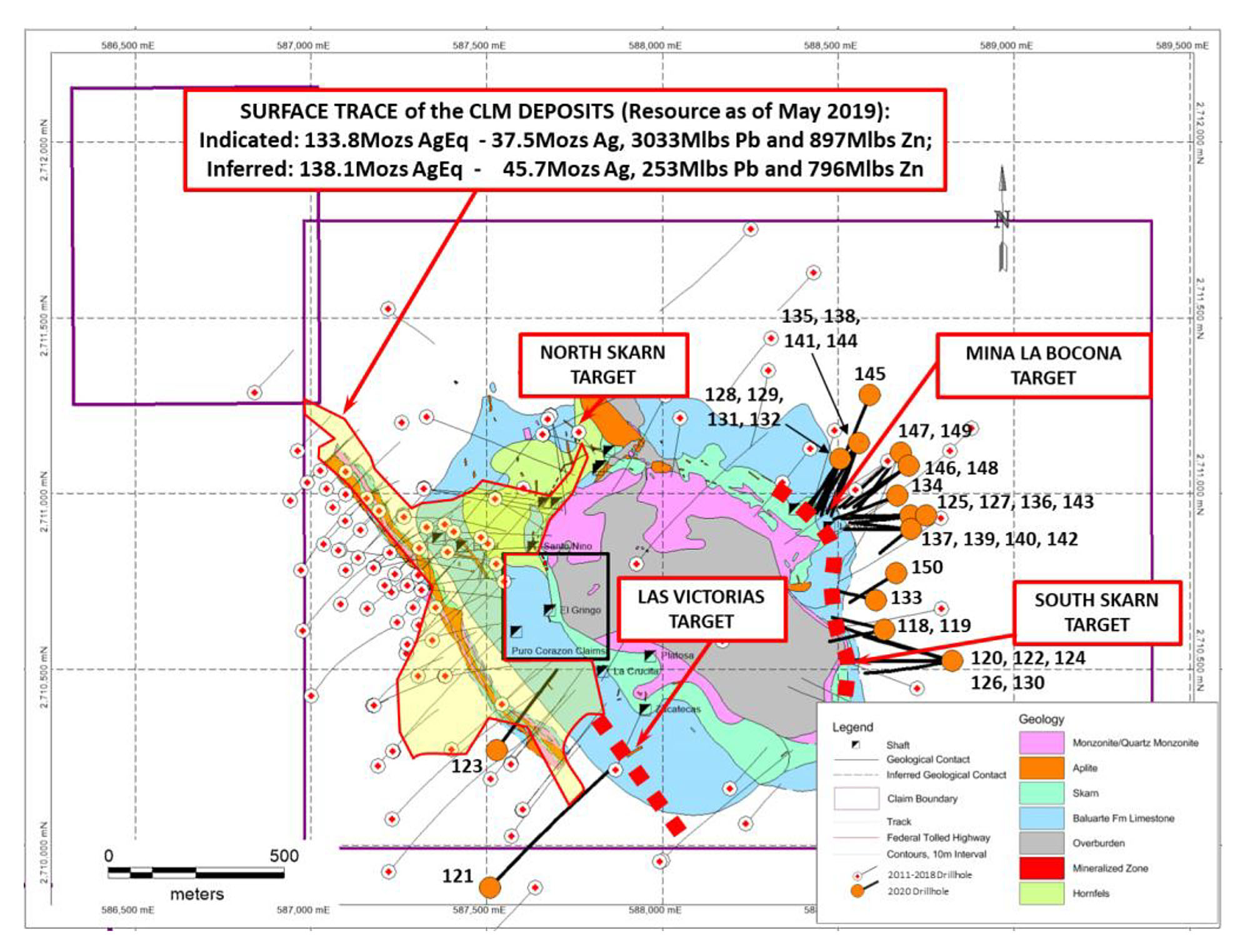

Southern Silver’s winter drill program has been very successful as most of the holes indeed hit the exploration targets. That’s not only good to increase the confidence in the existing resource estimate, it also validates the exploration target at Cerro Las Minitas. As per the corporate presentation, Southern Silver has an exploration target of 350 million ounces silver-equivalent (consisting of silver and a bunch of base metals of which zinc is the main component), which would be a step-up from the current total resource estimate of 272M ounces silver-equivalent (of which 83 million ounces are actually silver).

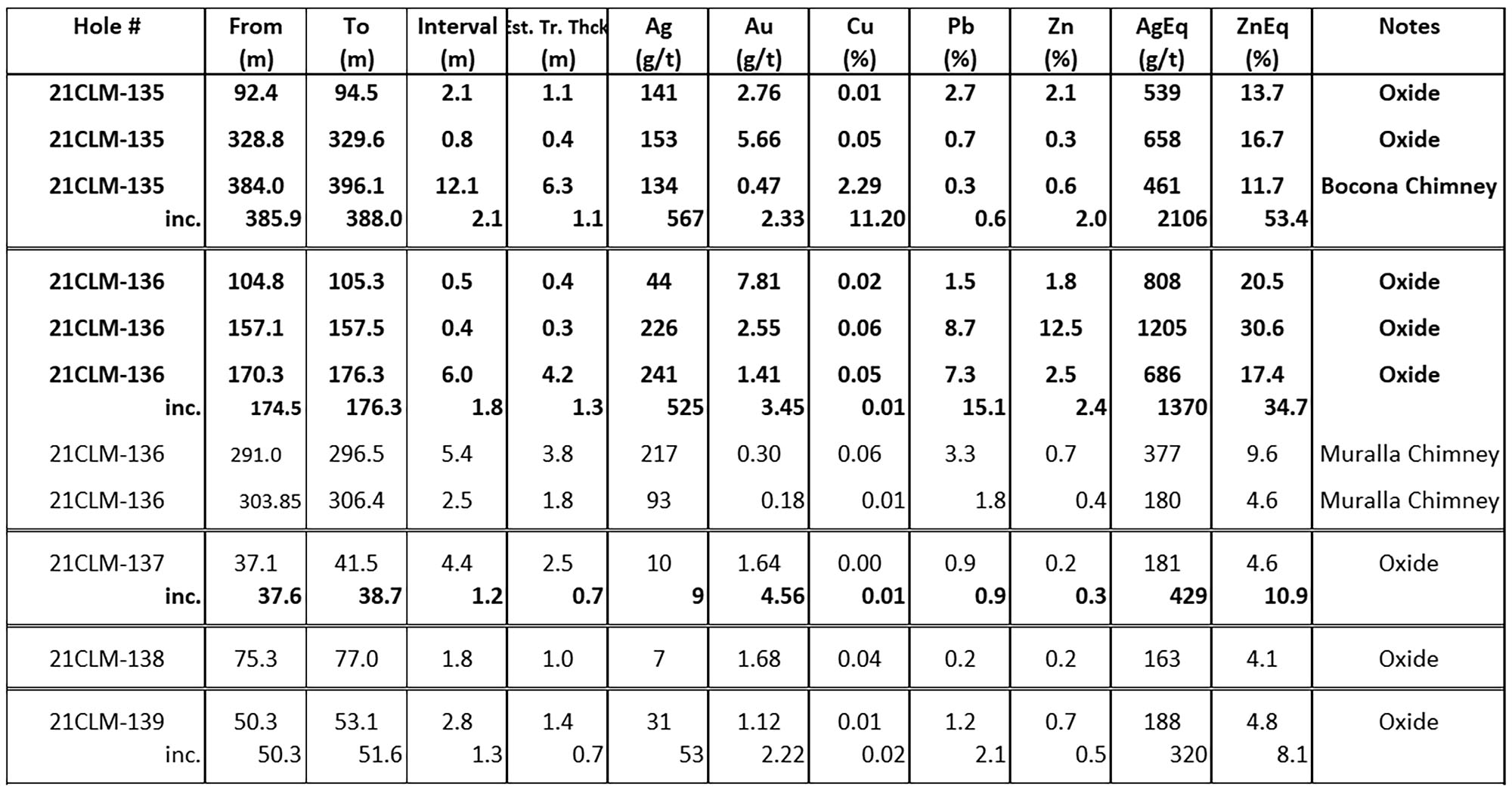

The highlights of the recent drill programs speak for themselves: the drill bit continues to intersect mineralization that should be considered above cutoff grade.

Southern Silver is on a roll here and the recently disclosed assay results from the Mina La Bocona target further confirm Southern Silver hasn’t found the limits of the mineralization in the greater Cerro Las Minitas region yet.

The grades are good, the (true) widths are acceptable and in line with the expectations but the main takeaway here is that the exploration efforts towards the east of the property are paying off.

The Mina La Bocona and South Skarn targets will be very important to pursue resource growth and the recent drill results confirm this was the right decision made by the Southern Silver management team. The recent positive La Bocona drill results (released just yesterday) confirmed the mineralization is extending from the previously intercepted mineralization at the Muralla chimney. Cerro Las Minitas is still growing and we are looking forward to seeing the next resource update. While Southern Silver has an exploration target of 350 million ounces silver-equivalent for Cerro Las Minitas, we aren’t sure this target will already be reached in the next resource update, but the 300 million ounce mark seems to be pretty achievable.

A quick recap of our previous economic model

Southern Silver has a NI43-101 compliant resource estimate and has provided the market with updated metallurgical test results last year, but the company doesn’t have a Preliminary Economic Analysis yet.

We were curious last year to see what the potential economics of a potential mine at Cerro Las Minitas could look like, so we tried to put an economic model together, which you can find below. We’d like to emphasize these are our own calculations based on our own assumptions. These are NOT the official estimates from Southern Silver and as such, should be seen as a back-of-the-envelope calculation by us. Take it with the necessary grains of salt, but we think this economic model is pretty robust and reliable.

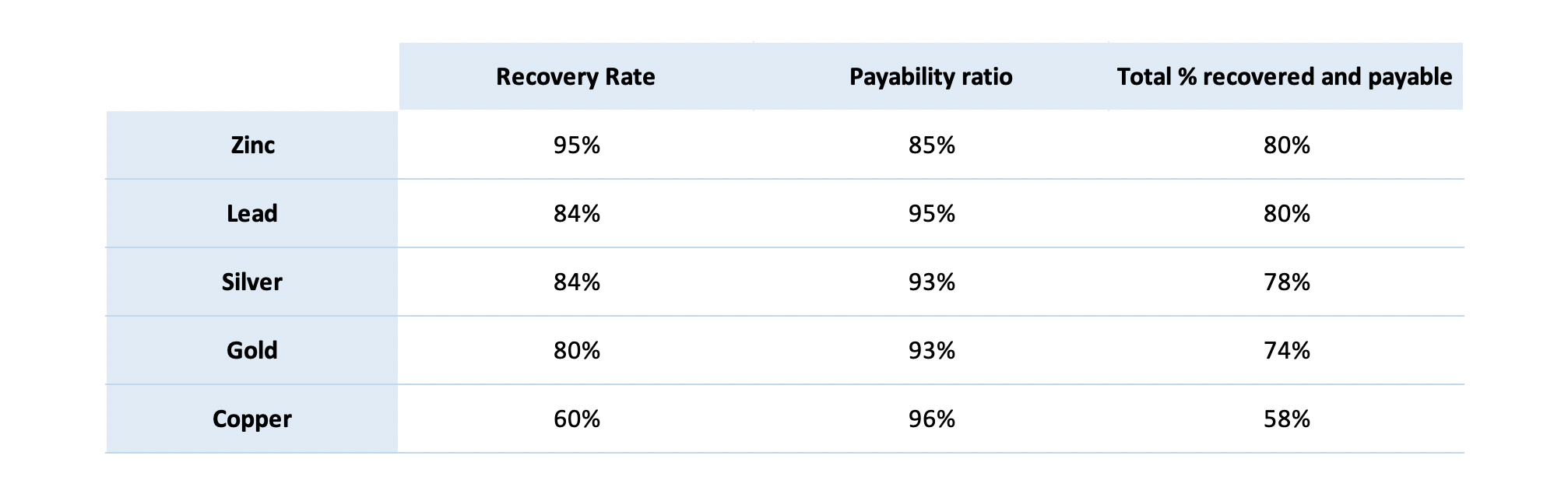

First of all, we established the total percentage of the metals that would be recoverable and payable. We used the data from the metallurgical test program completed by Southern Silver Exploration, applied the generally accepted percentage of payable metals. For instance, in a zinc concentrate, smelters only pay 85% of the face value of the zinc and don’t pay a cent for the first three ounces of silver per tonne of concentrate.

That’s why it will be important for Southern Silver to optimize its flow sheet to make sure as little of the silver ends up in the zinc concentrate: it makes more sense from an economic point of view to maximize the silver levels in a lead or copper/gold concentrate.

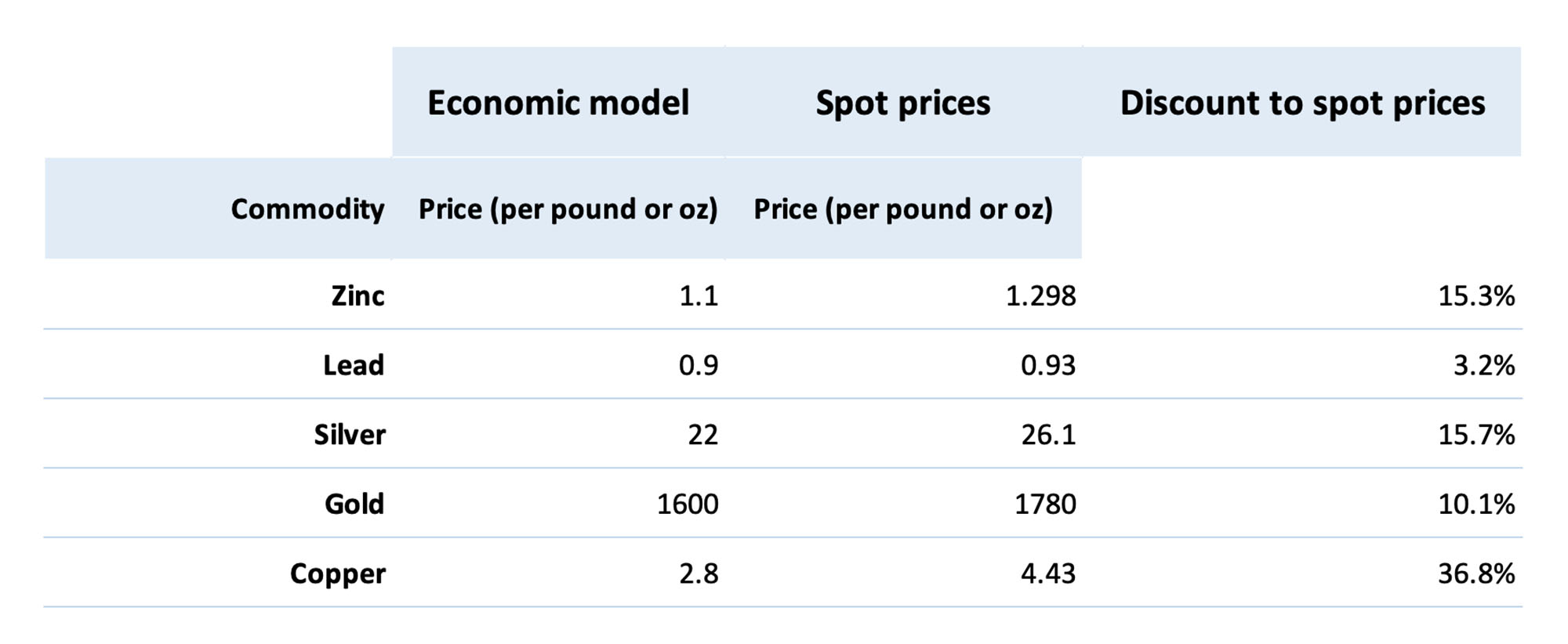

For the economic model, we will be using a rather conservative price deck. The table below compares the assumptions we will be using in the model with the current spot prices of the relevant metals.

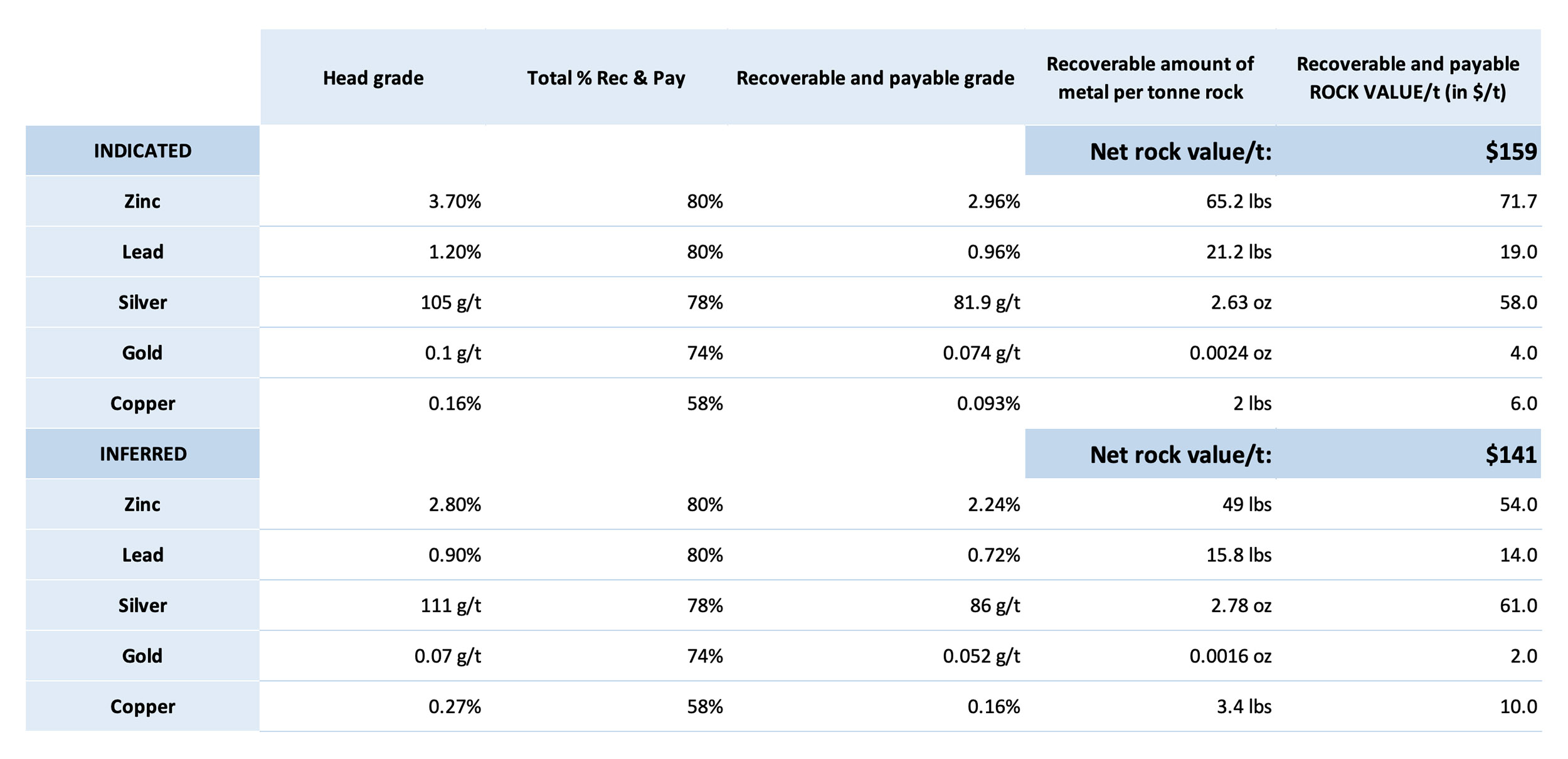

Inserting these prices in the model and applying the recovery and payability percentages results in the following table.

The average net smelter revenue per tonne in the indicated resource category is approximately $159/t while applying the same calculation to the inferred resource estimate results in a net recoverable value of US$141/t. These are nice increases from the $136/t and $121/t we ended up within last year’s calculation.

Now we have established the anticipated net smelter revenue per tonne, an important to mention here: there are no royalties on the Cerro Las Minitas project, which means the top line isn’t encumbered at all. While selling a royalty could be a possibility for Southern Silver to raise a portion of the equity element of construction financing, we are currently not including this in our calculations.

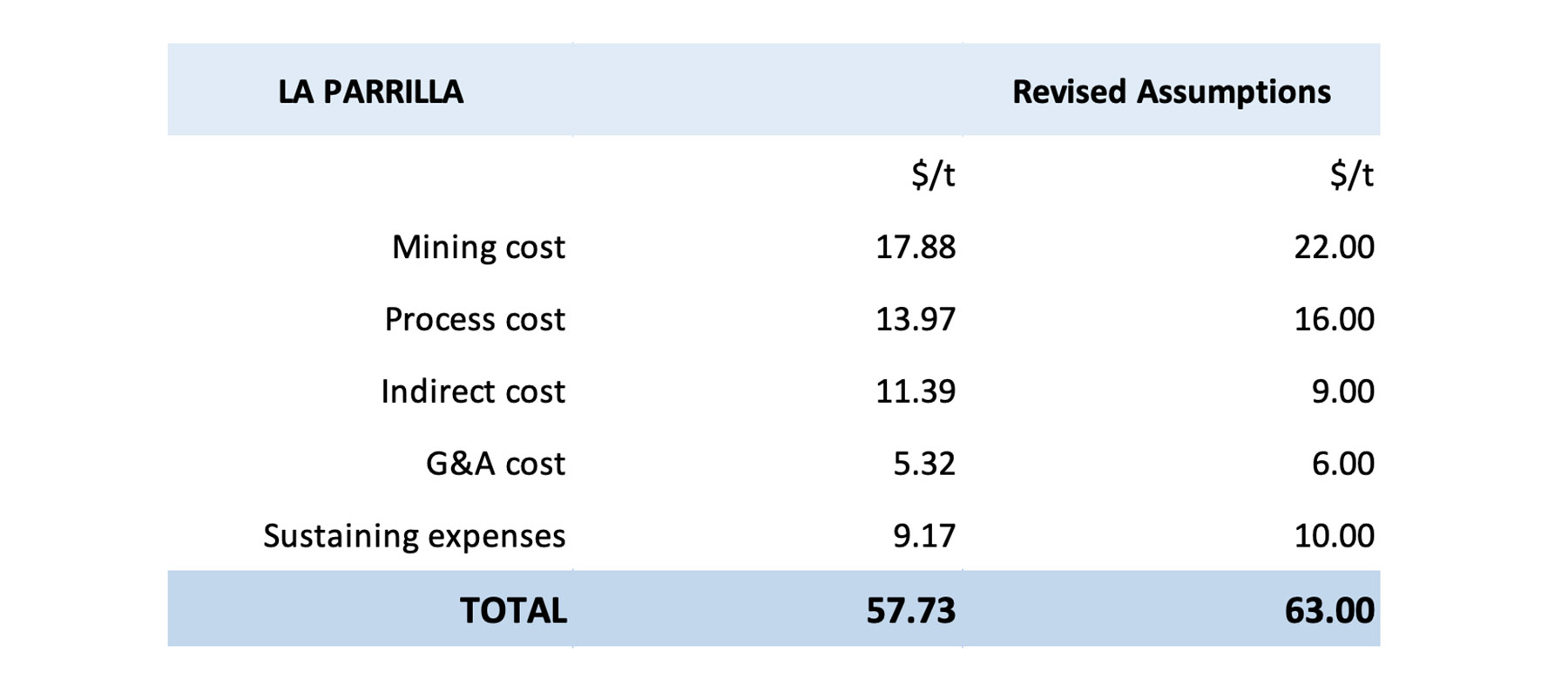

We will also continue to use the data used by First Majestic Silver (FR.TO, AG) in its economic studies on the La Parrilla mine in Mexico. However, to err on the side of caution, we have also tweaked those estimates a bit and will be using a total production cost per tonne which is approximately 10% higher than the economic study released by First Majestic Silver. Perhaps a small side note to the table below. We apply a 15% mining dilution to the $17.88/t mining cost estimated by La Parrilla as well as a 2.3% annual inflation since the study was completed. Of course, these are still just assumptions at this point so the jury is out on the effective potential mining cost and an upcoming PEA will provide more clarity on this element.

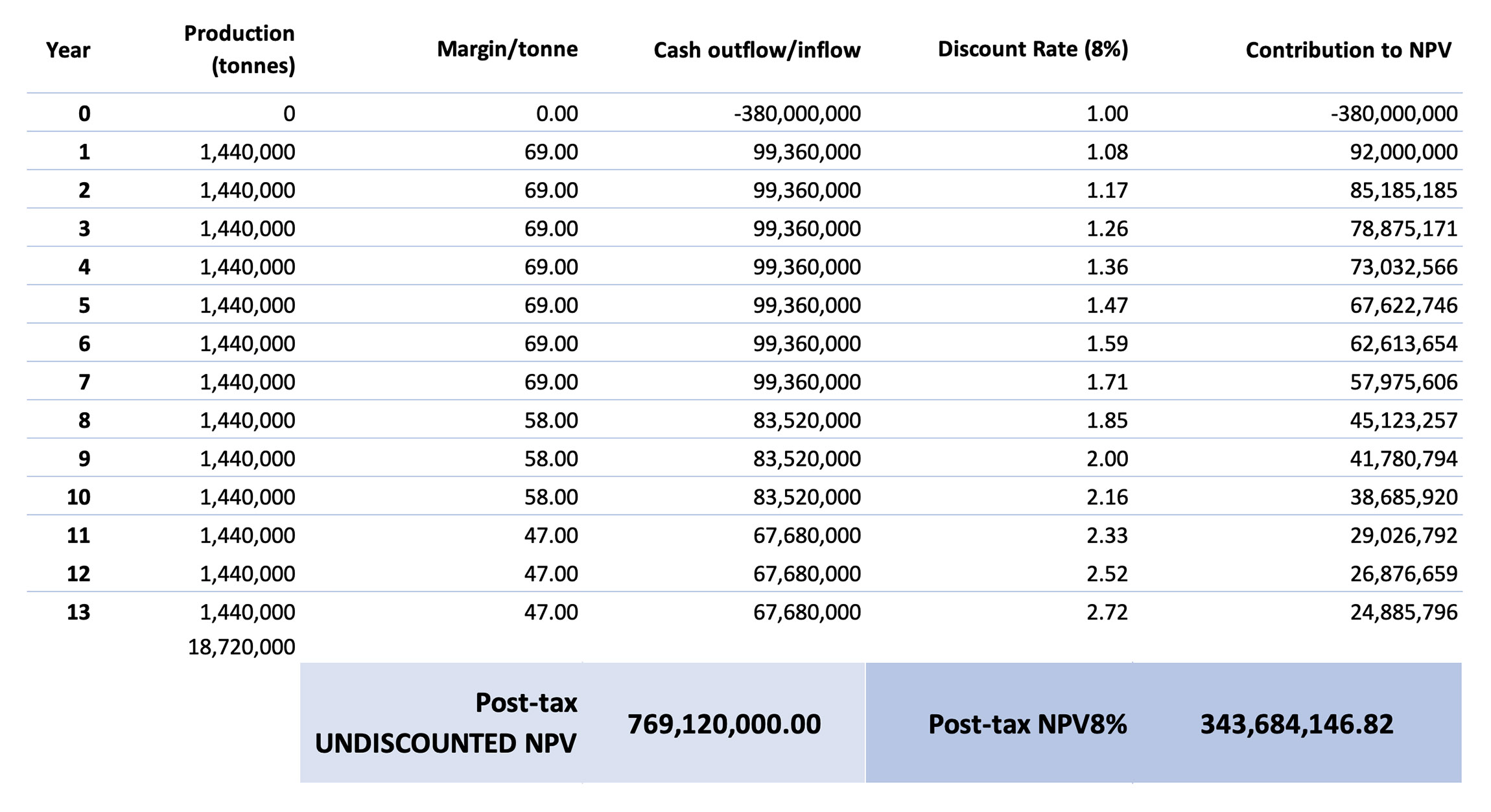

We will be using a capex estimate of US$380M for a 4,000 tonnes per day plant. We would like to emphasize the initial capex to develop a potential mine at Cerro Las Minitas is the main uncertainty at this point. We could be off $100M in both directions and our 4,000 tonnes per day scenario is an arbitrary assumption. Southern Silver may very well decide to investigate a 3,000 tpd of 5,000 tpd scenario depending on its trade-off studies. We’re going out on a limb here, but as you already know, this is just a back-of-the-envelope calculation for educational purposes only.

Given the net smelter revenue of $159/t for the indicated resources and $141/t for the inferred resources, the net margins could reasonably be respectively $96/t and $78/t (pre-tax and undiscounted).

Let’s now assume the higher-value indicated resources gets mined first for the first seven years, where after Southern Silver switches to the lower grade inferred resources for the subsequent 8 years (that’s obviously not a real-life scenario as the mine plan will be based on what’s the most opportune mining scenario rather than categorizing things as indicated and inferred). But as mentioned before, there’s no mine plan yet, so we will just have to work with assumptions here, again, this is just a back-of-the-envelope calculation.

Another assumption is to use a 10-year depreciation schedule for the initial capex, and using a total tax pressure of 40% (corporate tax + the specific mining taxes). This means that the total average tax per processed tonne of rock in the first 7 years will be 0.40 X [(1.44Mt X $96/t) – $40M) = $39M, or $27 per processed tonne. Note; we are using a depreciation of $40M per year as we expect Southern Silver to be able to depreciate some sunk costs. There are no sunk costs right now (as exploration has been expensed rather than capitalized) but we expect the company to start capitalizing certain expenses after the first economic study.

For years 8-10, the numbers are: 0.40 X [1.44Mt X$78/t) – $40M]= $29M, or $20/t.

For years 11-13 there will be no depreciation allowance and the tax pressure will be 0.4 X 78/t = $31/t.

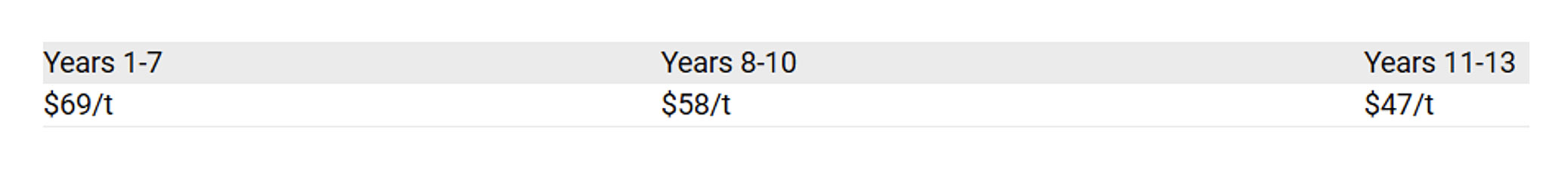

This results in the following after-tax cash margins per tonne of processed rock:

Putting these elements in an NPV model results in the following calculation:

An after-tax NPV8% of almost US$344M represents approximately C$430M using the current exchange rate. There are currently 241M shares outstanding (including the March payment to Electrum), with an additional 100M warrants and options (which we will discuss later). Based on the current share count, the after-tax NPV8%/share comes in at close to C$1.80.

Of course, there are a bunch of caveats here. First of all, the share count will likely increase between now and securing the construction financing and as the equity component of the anticipated capex will exceed US$100M, Southern Silver will likely face dilution if it decides to build the mine (and that decision is likely still 4-5 years out anyway).

On the other hand, our calculations don’t include any resource expansion and ignore the current spot prices. It provides a direction but certainly isn’t the holy grail.

Southern Silver’s bank account is still in a good shape

Southern Silver is spending its cash wisely. In the first nine months of the financial year (the period ending on January 31st), the company spent about C$3.1M in expenses (excluding share-based payments) of which in excess of C$2M was spent on exploration and evaluation. We see a similar ratio in the most recent quarter (also ending on January 31st, obviously) where the total expenses were C$1.5M including almost C$1.2M spent on exploration. In other words of every dollar Southern Silver spent in Q3 FY 2021, 80 cents ended up in the ground. A very admirable ratio.

Southern Silver has always had to work with tight budgets and that means the company has gotten pretty good with the actual budget management. As of the end of January, Southern Silver had C$9.5M in cash on the balance sheet but subsequent to the end of the quarter, it had to make a US$2M cash payment to Electrum as part of its acquisition of Cerro Las Minitas. This represented about C$2.5M in cash, and we now expect Southern Silver to end the financial year (at the end of this month) with about C$6M in cash on a pro forma basis.

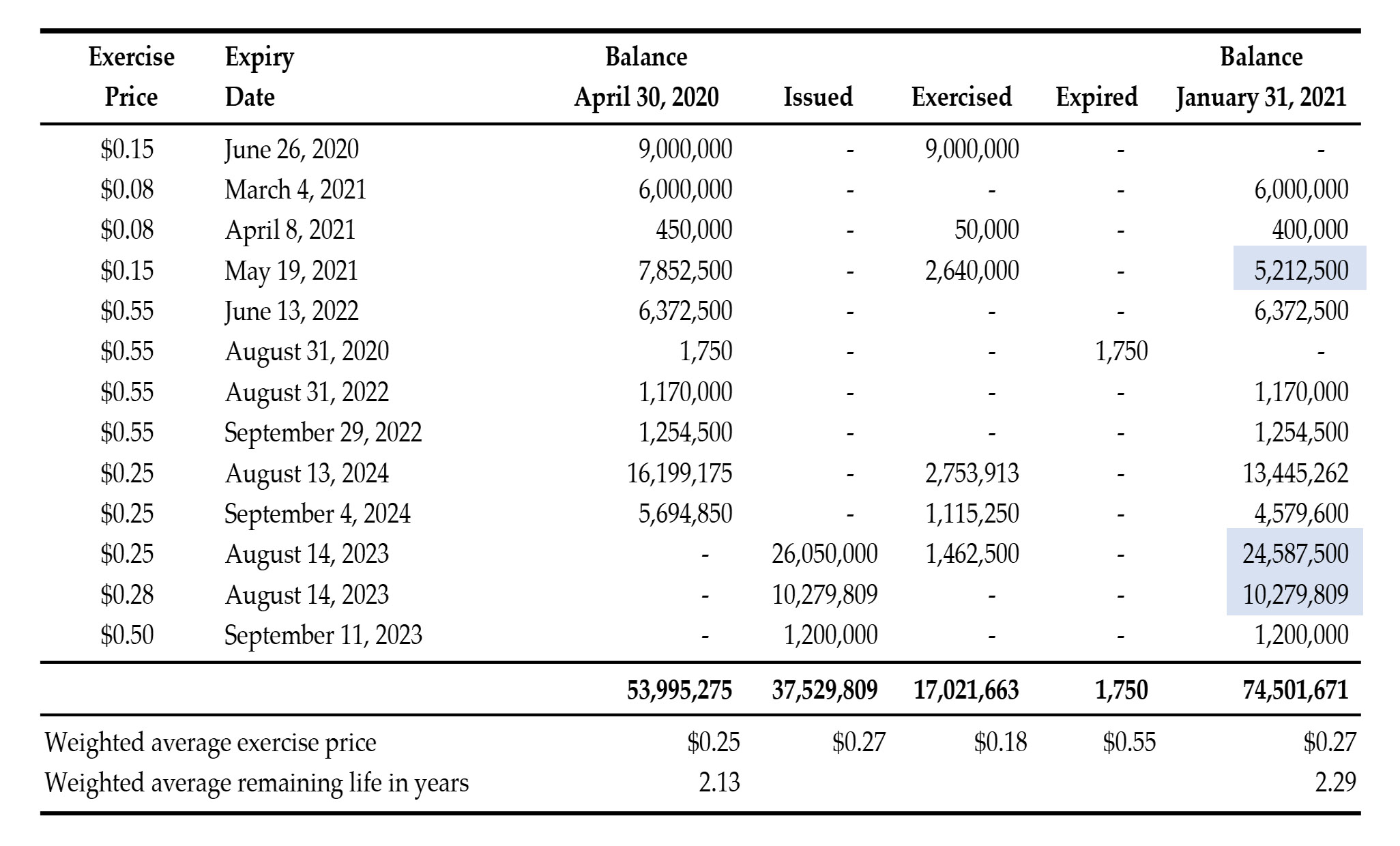

A lot will depend on how many warrants will have been exercised in the past weeks and months. As you can see in the image below, there are plenty of warrants that are currently in the money. The C$0.15 warrants expiring in May will undoubtedly be exercised (bringing in in excess of C$750,000 in cash) while the warrants issued as part of the August financings in 2020 are also all in the money.

Those warrants have an interesting feature. While the schedule above indicates the exercise price of the August 2023 warrants is C$0.25 and C$0.28, that’s only true for the first year. On August 15, 2021, the exercise price of the warrants will increase to respectively C$0.30 and C$0.33 before getting hiked again in August 2022 to C$0.35 and C$0.38.

By increasing the exercise price of the warrants, Southern Silver is basically providing an incentive to the warrant holders to exercise the warrants sooner rather than later. A warrant holder will be more inclined to pay C$0.25 now rather than C$0.35 in 18 months from now. Of course, not all warrants will be exercised: some investors will be happy to pay a little bit more down the road if it means the project has been derisked further.

In any case, The 24.6M warrants at C$0.25 and 10.3M warrants at C$0.28 have the potential to bring in an additional C$9M in cash. Assuming about half of them will be exercised before the first exercise price hike, Southern Silver can look forward to an additional cash inflow of C$4.5M. This would also put the balance sheet in excellent shape to make the final US$2M (C$2.5M) cash payment to Electrum in September 2021.

Conclusion

Southern Silver did everything right in 2020. It was able to acquire full ownership of the Cerro Las Minitas polymetallic project (with silver and zinc as main commodities) at a very acceptable price from former joint venture partner Electrum. This made the story a whole lot easier to market as the markets are more receptive to look at a company actually owning an asset versus being a minority owner.

Southern Silver also did the right thing by tapping the market for cash. Yes, the share count increased, but Southern Silver is now in a very enviable position: it has completed the purchase of the asset while it still has a high single-digit cash position on the balance sheet. On top of that, there are tens of millions of warrants in the money and this could provide an additional cash inflow.

As Southern Silver has had to bootstrap its exploration budget the past few years, the company knows how to get things done on a tight budget. And it’s refreshing to see the vast majority of the expenses are still invested in the project and G&A expenses remain quite low. The ongoing drill program should result in a resource expansion and this will be the basis for a preliminary economic assessment. That PEA will be the very first official economic study on the project and we are looking forward to seeing how our model holds up against the official study.

Disclosure: The author has a long position in Southern Silver Exploration. Southern Silver Exploration is a sponsor of the website. Please read our disclaimer.