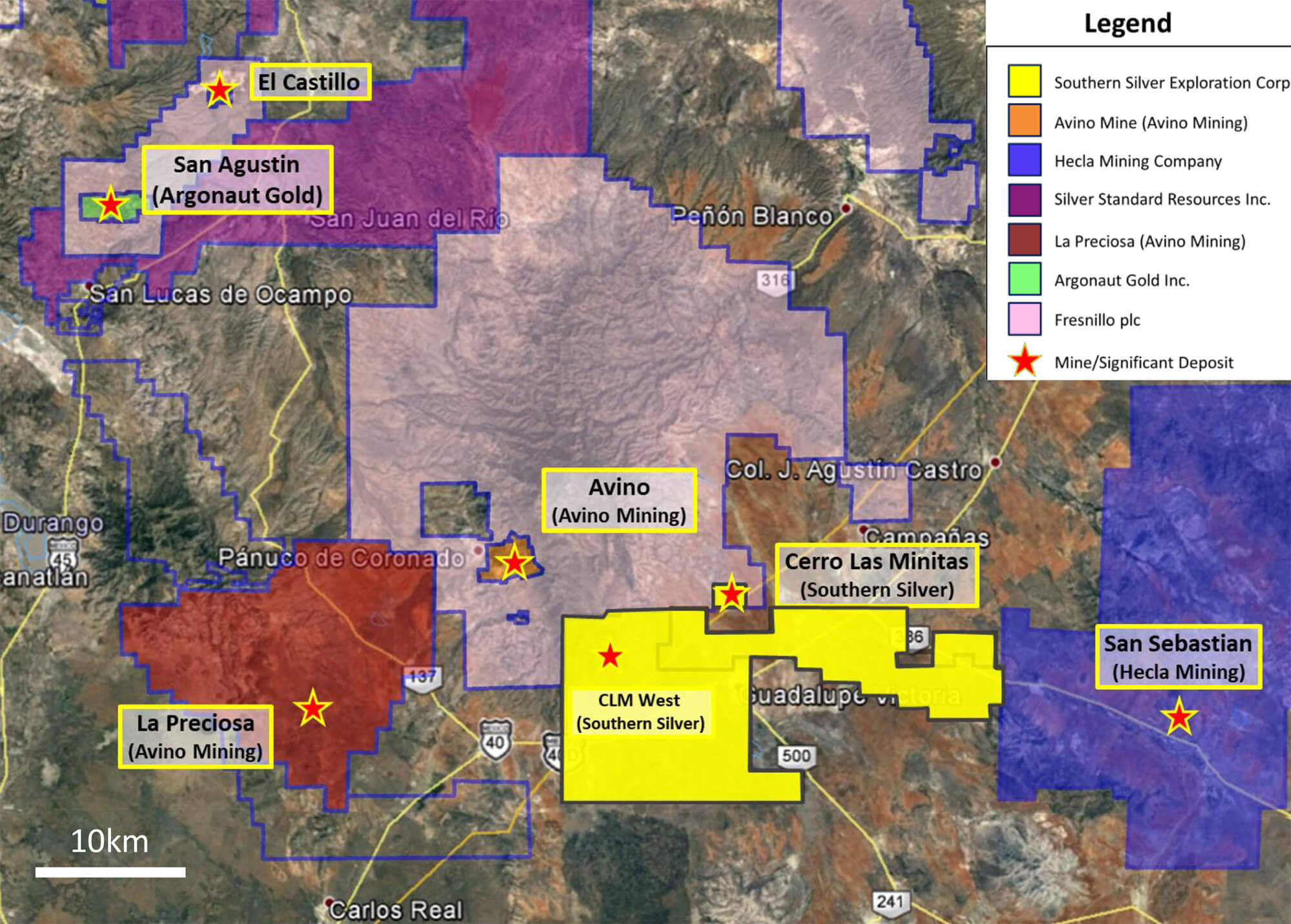

When Southern Silver Exploration (SSV.V) announced the results of the Preliminary Economic Study at its flagship Cerro Las Minitas. While the study did confirm the economic viability of the project, it failed to impress, and it did not provide a ‘second wind’ to the company.

What does the 2022 PEA show?

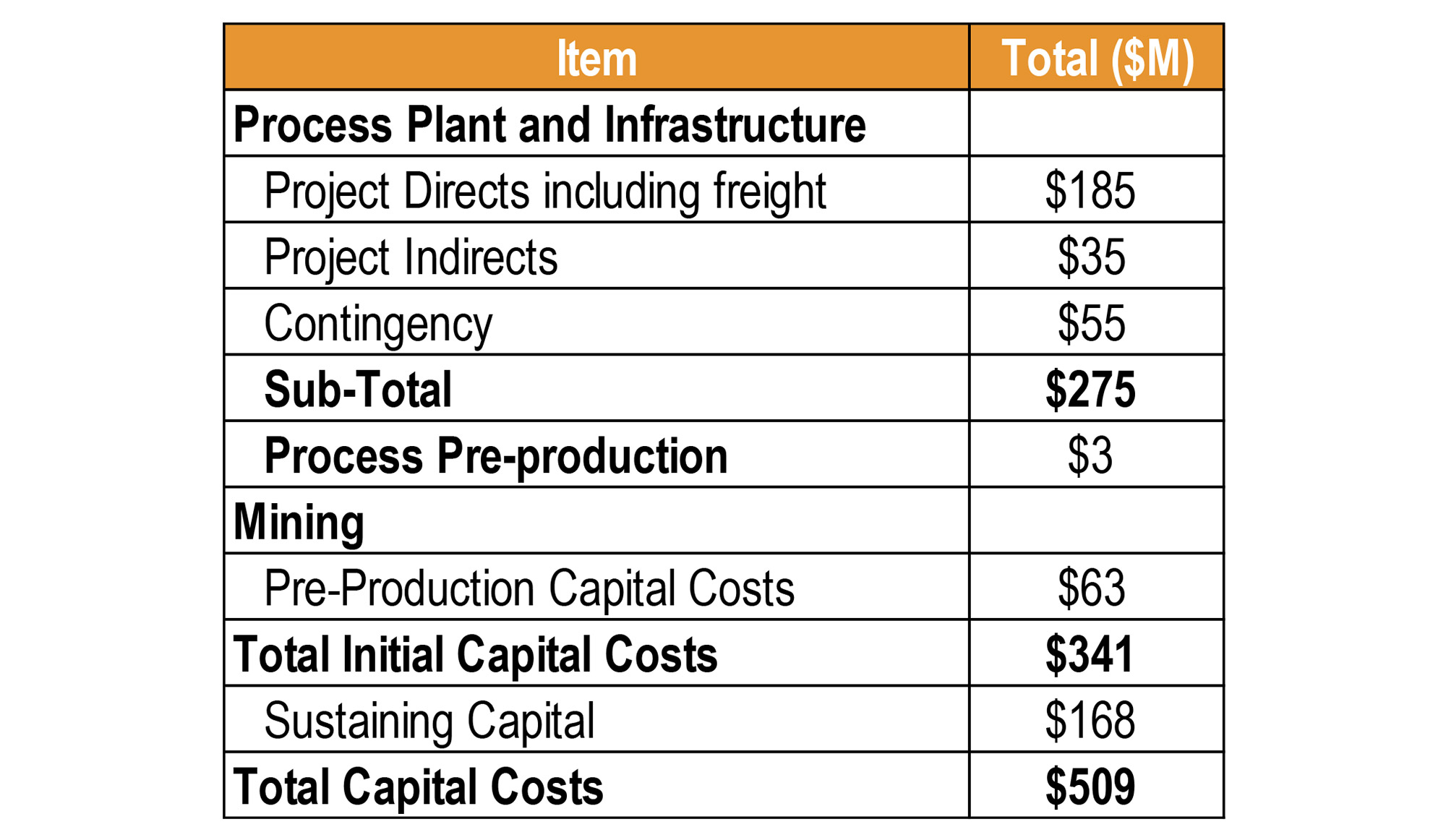

Just as a quick reminder to refresh your memory on the 2022 PEA: Southern Silver used a silver price of US$21.95 and a zinc price of $1.33 per pound as its base case scenario, and those are very acceptable long-term prices (we’ll discuss the sensitivity analysis in a little bit). The initial capex for the 4,500 tonnes per day operation is estimated at US$341M. This includes the equipment capex but also already includes the US$63M mining costs associated with the underground workings to access the first ore. Keep in mind the mill will be able to produce up to 5,500 tonnes per day in ‘short bursts’ and Southern Silver expects to beat the official nameplate capacity of 4,500 tonnes per day.

Of interest above is that the equipment capex (project directs and indirects) are estimated at just US $220M and a 25% contingency was slapped onto that. That’s remarkable as most contingency allowances we see tend to hover around 10-12%. By using 25%, Southern Silver already appears to be taking potential further inflationary impacts into consideration. Read: that capex number is pretty robust). The pre-production mining costs and sustaining capex (which will be related to the continuous underground development) came in lower than expected so that’s a little bit of a windfall.

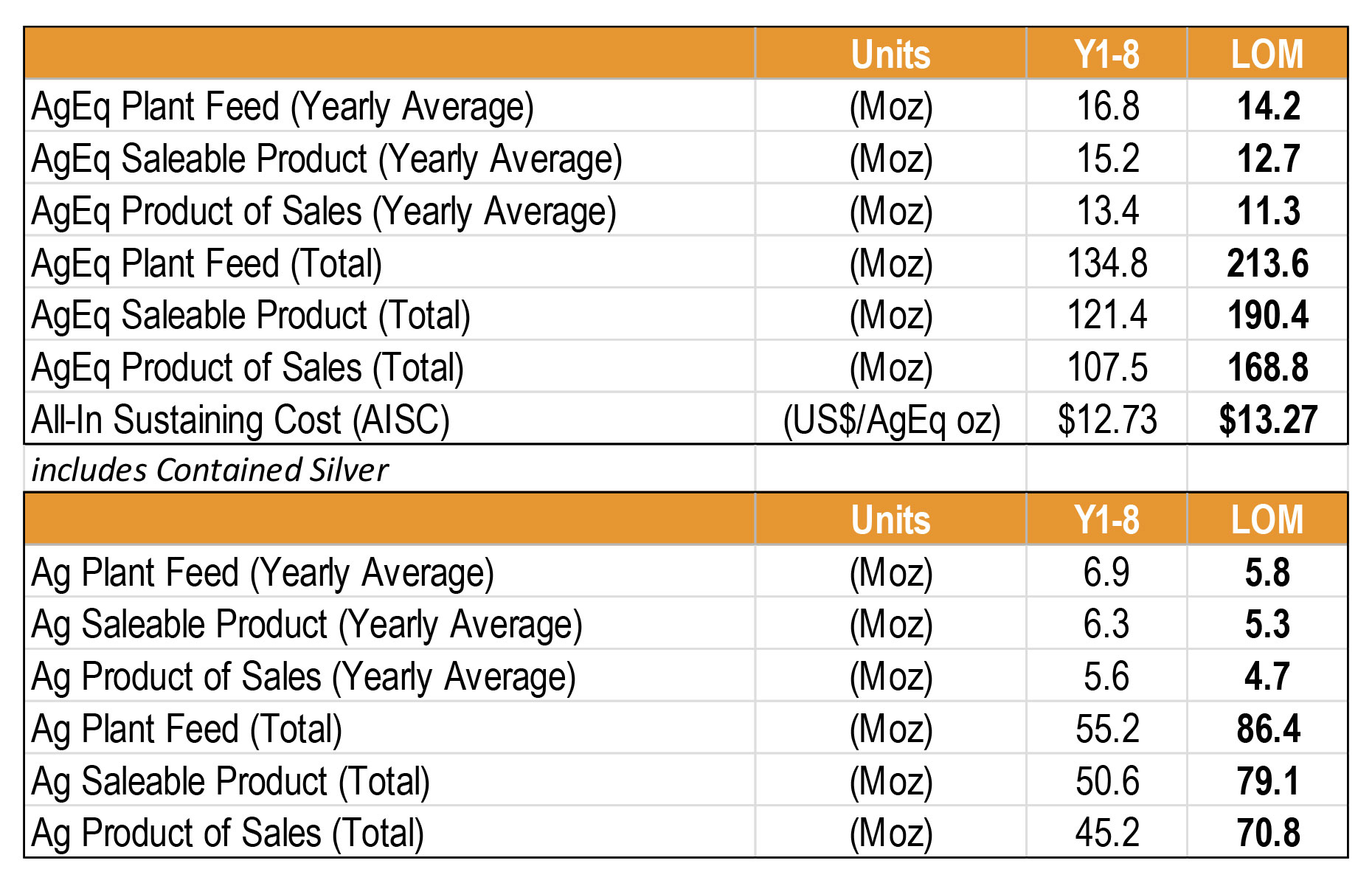

The ‘plant feed’ of 14.2 million ounces silver-equivalent mentioned in the press release is actually irrelevant, especially as the bullet points in the update correctly use an AISC per sold ounce of silver-equivalent. It doesn’t matter how much silver goes into the plant, the only thing what matters for an investor is what’s coming out on the other side and that’s 12.7 million ounces of silver equivalent. Of those 12.7 million ounces, about 11.3 million ounces silver-equivalent will be payable after deducting treatment and refining costs and penalty charges.

The AISC of $13.27 per ounce of silver-equivalent sold relates to the 11.3 million ounces of silver-equivalent and according to our calculations, if we would look at Cerro Las Minitas on a silver-only basis, the 4.7 million ounces of silver would be produced at an all-in sustaining cost of just US$1-1.5/oz after taking the by-product credits into account.

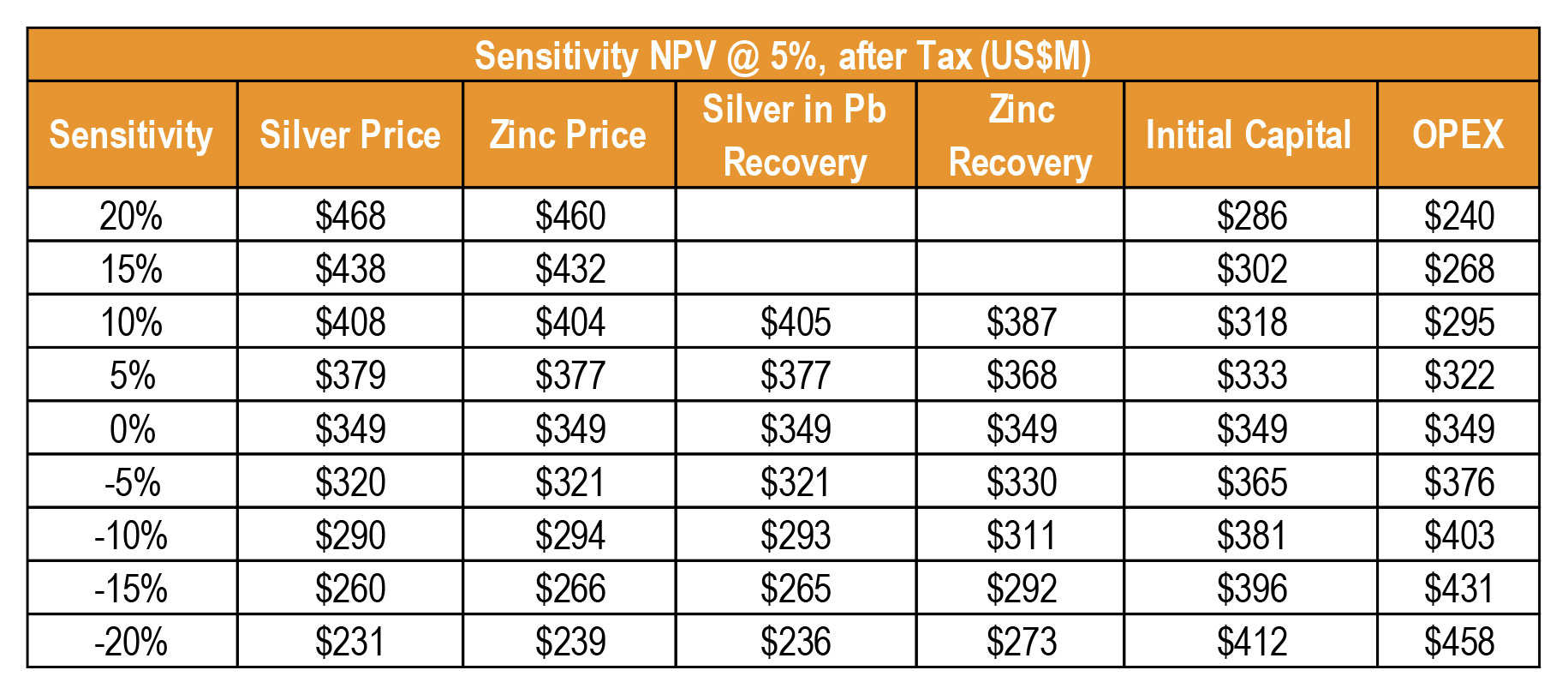

This results in a total after-tax NPV5% of US$349M using the base case prices of $21.95 for silver, $1.33 for zinc, $0.94 for lead and $3.78 for copper.

If we would use a zinc price of $1.05, the NPV5% would decrease by US$110 (in the -20% scenario in the table above). However, using $24.20 as a silver price would add US$59M back to the equation so the current lower zinc price does not necessarily have to be a deterrent to the project.

But as VP Exploration Robert Macdonald will explain below, the company has some irons in the fire to substantially improve the NPV and IRR of the project, even at a lower zinc price.

Sitting down with Rob Macdonald

Cerro Las Minitas

We would obviously like to start with the main project. Although you haven’t drilled at CLM so far in your financial year 2024 (which ends in April), the majority of the exploration expenditures were spent on Cerro Las Minitas. We see the geological and geophysics expenses have increased, can you elaborate on what’s happening in the field right now?

We continue to advance the Cerro Las Minitas project in several different ways as we focus on upgrading the economics of the project. We have completed some surface float sampling and ground VLF-geophysical surveys over portions of the larger property (in areas away from the known mineral resources). This serves two purposes: to maintain the annual exploration expenditures on various claims and to continue efforts to identify new targets on the property for future exploration.

However, much of the work that we have conducted through 2023 has involved a program of downhole UV/XRF analyses of drill core, mainly from the eastern deposits to assist further drill targeting on the project toward further resource expansion. The methodology involves utilizing ultra violet (UV) light to assess pathfinder element distribution, mainly “fugitive” manganese (Mn), in late calcite veins in the core. The manganese in the calcite fluoresces and the colour and intensity helps identify the potentially more productive parts of the mineralizing system. We use a hand held XRF analyzer to correlate fluorescence with specific pathfinder elements.

It is a type of analysis that is being popularized by companies like Reyna Silver (RSLV.V) and Western Alaska Resources (WAM.V). We think that it is effective and is helping to prioritize targets for the next stage of drilling.

The property taxes have also increased, which obviously is a standard phenomenon for Mexico-based mining projects. How will the annual holding cost to keep Cerro Las Minitas evolve over the next few years?

We are at the highest annual level of both taxes and exploration commitments on the property so that should remain stable for the immediate future.

Although you haven’t published news in a while, your MD&A reports are usually pretty interesting. During the second quarter, you completed additional work on recovering the gold from Cerro Las Minitas (as a reminder to readers; Cerro Las Minitas contains 29,000 ounces of gold in the indicated resource category and 85,000 ounces of gold in the inferred category at a grade of respectively 0.07 g/t ad 0.12 g/t). In the MD&A you mentioned 50% of the gold is recoverable by hot atmospheric pressure oxidation prior to cyanide leaching resulting in a 83.9% recovery (of that 50%).

What type of equipment would you need to apply pressure oxidation on the scale you anticipate to build out Cerro Las Minitas at. Any idea what the incremental capital expenditures would be to install a full-scale gold recovery circuit?

There is a valuable gold component associated in the CLM mineralization which was not addressed in the initial PEA. The bulk of the gold is “locked-up” in sulphides including pyrite and arsenopyrite which in our processing flowsheet reports to the tailings.

We will utilize what is called an AlbionTM extraction process to recover as much of this gold as possible.

The Albion Process™ technology consists of two key steps. The first step is mechanical liberation of gold/sulphides by fine grinding of the feed concentrate in an IsaMill™ Grinding Plant. The second step is chemical liberation achieved by oxidative leaching of the finely ground concentrate to break down the sulphide matrix and render the precious metals amenable to metal recovery processes such as cyanidation.

After grinding, the fine-grained slurry is added to Albion Leach Reactors. Oxygen is injected into the base of the reactors which converts the iron sulphides to primarily goethite, which allows the readily extraction of the gold through cyanide leaching.

The main costs in this processing are the IsaMill™, the leach reactors, oxygen, and limestone (to neutralize the mixture) and electricity. We are currently finalizing the scaling of the processing and how to incorporate the costs into the process flowsheet.

The Albion process is patented by Glencore; would it be as simple as just paying a license fee to be allowed to use Albion or is there more to it?

Yes, there will be a licencing fee involved, purchasing the necessary proprietary equipment and maybe some training.

And secondly, Albion has only been applied at about half a dozen mining projects in the real world, do you consider the technology to be sufficiently ‘proven’ to bank on?

The current PEA is an preliminary economic assessment of the CLM project. Our current testwork demonstrates, to the level of this current study, the potential viability of gold extraction from the tailings. but further testing will be required for more advanced, Feasibility-level work. Similar to many other aspects all of our current study.

Would the additional capex for a HPGR (High Pressure Grinding Roll) be justified for just a few tens of thousands of ounces of gold?

This is something that we are in the process of evaluating and incorporating into our economic model. The principles behind the processing are not that complex nor are the parameters (pressure and temperature conditions) under which the tests were conducted. This gives me confidence that gold can be extracted effectively from tailings and will add value to the project.

It was also mentioned about 21.5% of the gold is recovered in the copper concentrate. Are there any additional tweaks possible to further increase the gold recovery rates to the copper concentrate? Do you see any noticeable difference between oxide-hosted and sulphide-hosted gold mineralization?

I think that that is about as good a recovery as we can expect . Or at least certainly for this iteration of the PEA. The oxide gold readily leaches with about a 70% recovery which is fairly close to ideal recoveries from the sulphide mineralization. At this time, the intention is to run the oxide mineralization through the leach plant as well and in fact we may be able to use that material as the neutralizing agent in the Albion ProcessTM, thereby reducing the overall cost of processing.

You are currently working on an updated PEA after you and your team have identified several areas to improve on. Figuring out if the gold can be recovered was one of those pillars, but could you remind and elaborate on what the other areas of improvement are to – hopefully – boost the NPV and IRR in an updated PEA?

There are a number of opportunities to add increasing value to the project that we identified in an audit of the initial PEA that was completed earlier this year. These include:

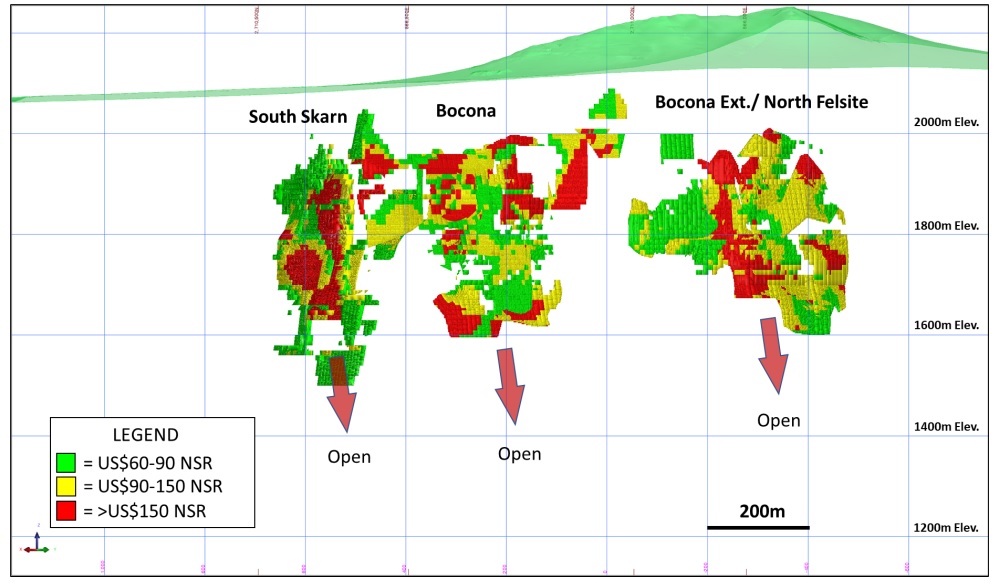

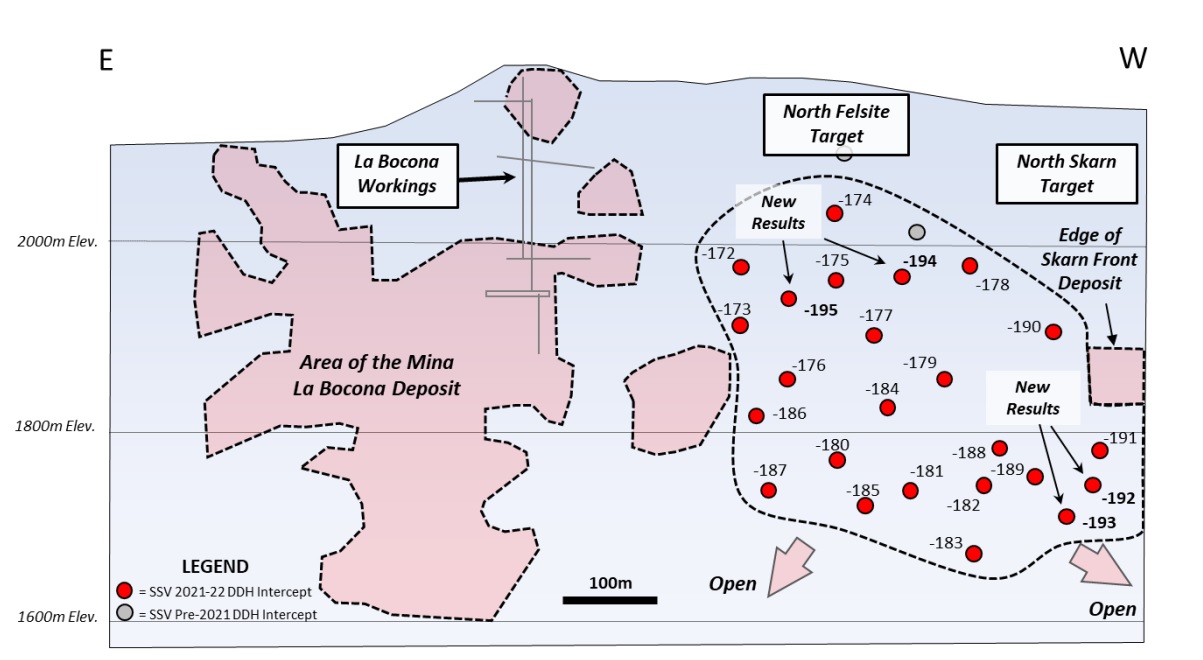

- The addition of new Mineral Resources from the North Felsite zone that were included in a resource update that we announced in March of 2023;

- Capital reduction by utilizing modular equipment in the project design;

- Some operating cost reductions as the result of incorporating more efficiencies into the process flowsheet;

These are in addition to adding sulphide and oxide gold revenues as described above.

We are confident that the combination of adding new resources and lowering operating costs will add tonnage to the project, reflected in both an increase annual average throughput of the processing plant and extend mine life. The new gold revenues should make the processed ore just that much more valuable. All of this helps support the bottom line on the project which in an environment of potentially increasing precious metal prices, should make the project look substantively better.

When do you expect to release the results of an updated PEA?

We are targeting the end of Q1 2024.

Oro

You also directed some efforts to the Oro property in New Mexico, USA. Although it predominantly was a copper-focused drill program, your press release announcing the assay results highlighted the rare earth elements you encountered in the rock. Can you elaborate on what this means for the project, and how important this development is?

Well, I think as you know, REEs are quickly being recognized as critical elements in the development of new technology hardware and in the clean energy transition. We noted after the completion of our four-hole drill program on the property in 2022, that hole OR22-012 contained elevated REE values.

We followed this up by selecting 39 pulps from that hole for re-analysis with a more robust analytical method which confirmed strongly anomalous Total Rare Earth Oxides (TREOs). The elevated rare earth values are associated with intervals of strongly enriched copper mineralization and may represent the potential for byproduct REEs at the Oro property. This would simply add value to the mineralization that we are currently exploration for on the property and could at some point, contribute to the viability of the overall project. However, more study is required before we know if there is potential for byproduct REE’s at the Oro property.

As your main focus will likely be directed to Cerro Las Minitas, does this mean you may be looking to find a partner at Oro, either to continue to explore for copper or Rare Earth metals?

Yes, at this time we feel it is best to find a partner for further exploration on the Oro property.

Corporate

Of course the Mexican presidential elections are a very important topic for the mining industry in Mexico these days. As you operate in Durango, have you noticed any difficulties in securing (drill) permits in the State?

At this time we have our drilling permits in place and valid for another 4 years. So in that regard we have not had any difficulty in the permitting process. We continue to monitor the situation and have taken steps with other companies and interested parties to educate and advocate for the mining industry in the State of Durango and Mexico in general.

Of note, is that despite the uncertainly, Mexico Business News reports that eight different mines are scheduled to start production in 2024. So, there may be some headwinds, but the right projects are still moving into production. We feel that Cerro Las Minitas is the right type of project that will become mine sooner than later.

At the end of October you still had a positive working capital of approximately C$2.5M. How long will this last you? There are approximately 14 million warrants expiring this year at C$0.25. May we assume you are keeping your fingers crossed for a better silver/zinc market and a good 2024 for junior stocks in general so you’ll see some of that warrant money coming in?

The current treasury should last us well into 2024. Our current plan is to announce the revised economics for the Cerro Las Minitas project, determine the nnext steps for the project and then raise the appropriate financing to continue to advance the project probably in mid-2024.

Conclusion

As the results of the Preliminary Economic Study at Cerro Las Minitas were just so-so, it is completely understandable the company decided to audit the study in order to find some low-hanging fruit to improve the economics. It sounds like Robert MacDonald and his team have identified several levers to pull in order to improve the economics.

We will be focusing on two elements in the updated PEA: Will the ratio NPV versus capex (which was just 1.02 in the initial PEA) increase? And will we see the IRR increase to above 20% (17.9% in the first PEA)? We are definitely hoping for a strong improvement of the Internal Rate of Return as an after-tax IRR of at least 20% is the minimum of what’s required to get people (and companies) interested in the project.

Disclosure: The author has a long position in Southern Silver Exploration. Southern Silver Exploration is a sponsor of the website. Please read our disclaimer.