The one issue with a flight towards liquidity is that even companies that don’t deserve to be sold off are also victims of a relentless sell-off even though they are doing everything right. Taiga Gold (TGC.C) for instance is one of those companies. Although it has cashed up with enough cash to last for about three years and although a large cash flowing mid-tier producer is spending its money on the Fisher gold project in Saskatchewan, Taiga couldn’t escape the liquidation session.

Taiga raised money at C$0.09 in February but is now trading approximately 5% higher at C$0.095 for a current market capitalization of C$7.5M (including over C$1M in cash), which is less than what SSR Mining has been spending on the Fisher property (C$7.8M as of the end of Q3 2019, including in excess of 21,000 meters of drilling).

Taiga Gold: a spin-off from Eagle Plains Resources

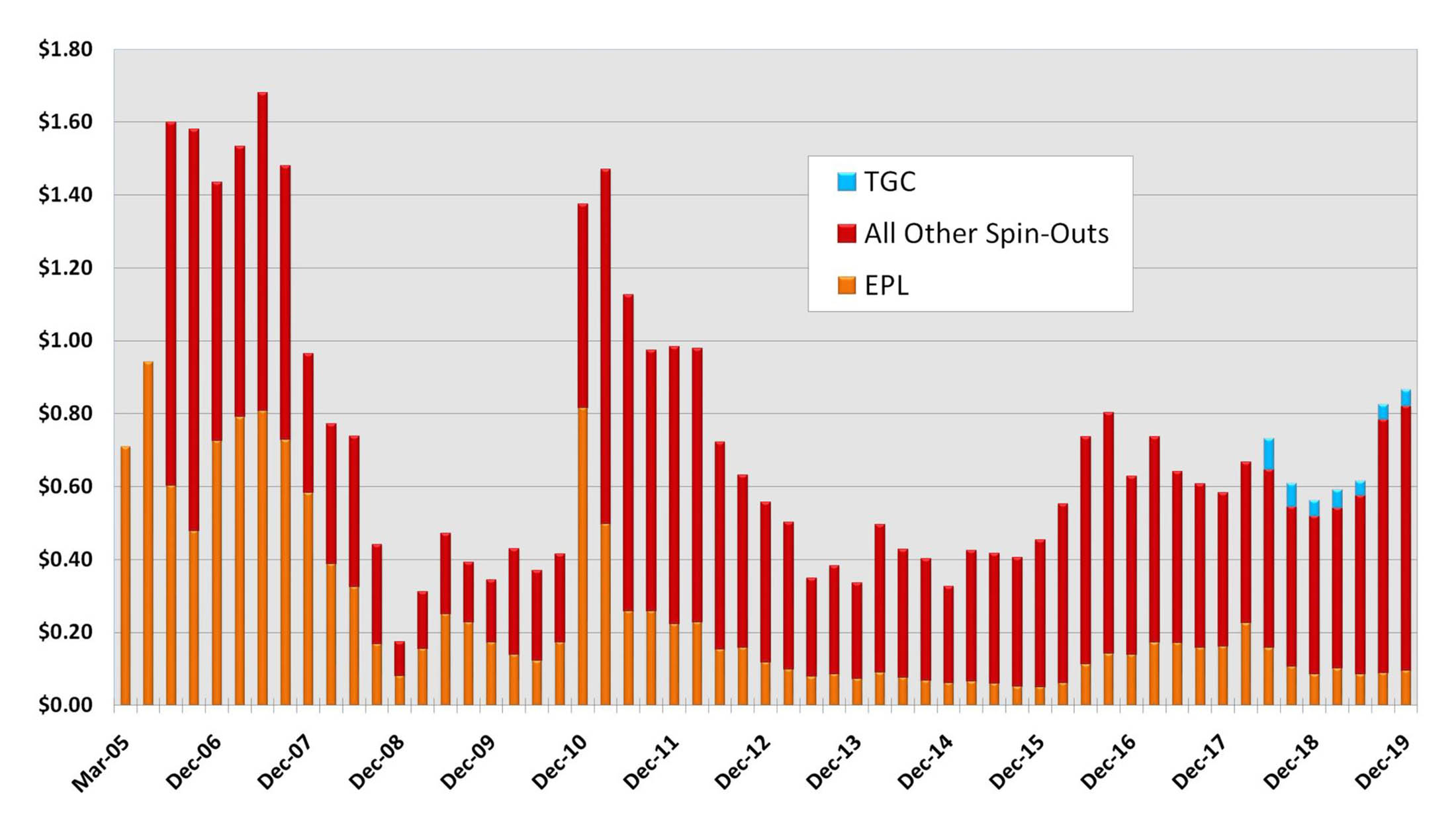

It’s impossible to discuss Taiga Gold without referring to the ‘parent’ company Eagle Plains Resources (EPL.V). Eagle Plains has been around for a while as a ‘project generator’. It finds/stakes/acquires projects which it subsequently tries to advance either using its own money or the money from potential optionees that would then be earning a majority stake in the project. But rather than just keeping all properties, Eagle Plains has decided to spin out the projects that are sufficiently advanced to fit in the portfolio of a standalone company.

Eagle Plains has done this before with Copper Canyon Resources which started out as a joint venture with NovaGold (NG, NG.TO) but at the end NovaGold acquired Copper Canyon in an all-share deal with a value of in excess of C$60M(and even higher if Copper Canyon shareholders kept the NovaGold shares they received). Eagle Plains learned a lot from the Copper Canyon deal. Whereas it didn’t retain a stake in Copper Canyon, Eagle Plains did retain a 19.9% stake in the Taiga Gold spinoff and has now been diluted down to 15.31% (12.16 million shares).

We will discuss Eagle Plains’ business model in a later report including an interview with CEO Tim Termuende but we would like to emphasize this: Eagle Plains doesn’t spin-out companies for the sake of spinning them out. It only does so when it thinks the SpinCo has a good chance of success to survive as a standalone and ultimately become a take-out target. About a decade after spinning off Copper Canyon Resources, Eagle Plains decided the Fisher gold project was in a position to be spun off, and that’s when Taiga Gold was created with joint venture partner SSR Mining (SSRM, SSRM.TO) committed to spending serious exploration dollars on Taiga’s flagship – Fisher property.

The Flagship Fisher project: SSR Mining is spending a tonne of money

Taiga Gold was spun out of Eagle Plains Resources in April 2018 whereby shareholders of Eagle Plains received 0.5 shares of Taiga Gold per share of Eagle Plains they owned.

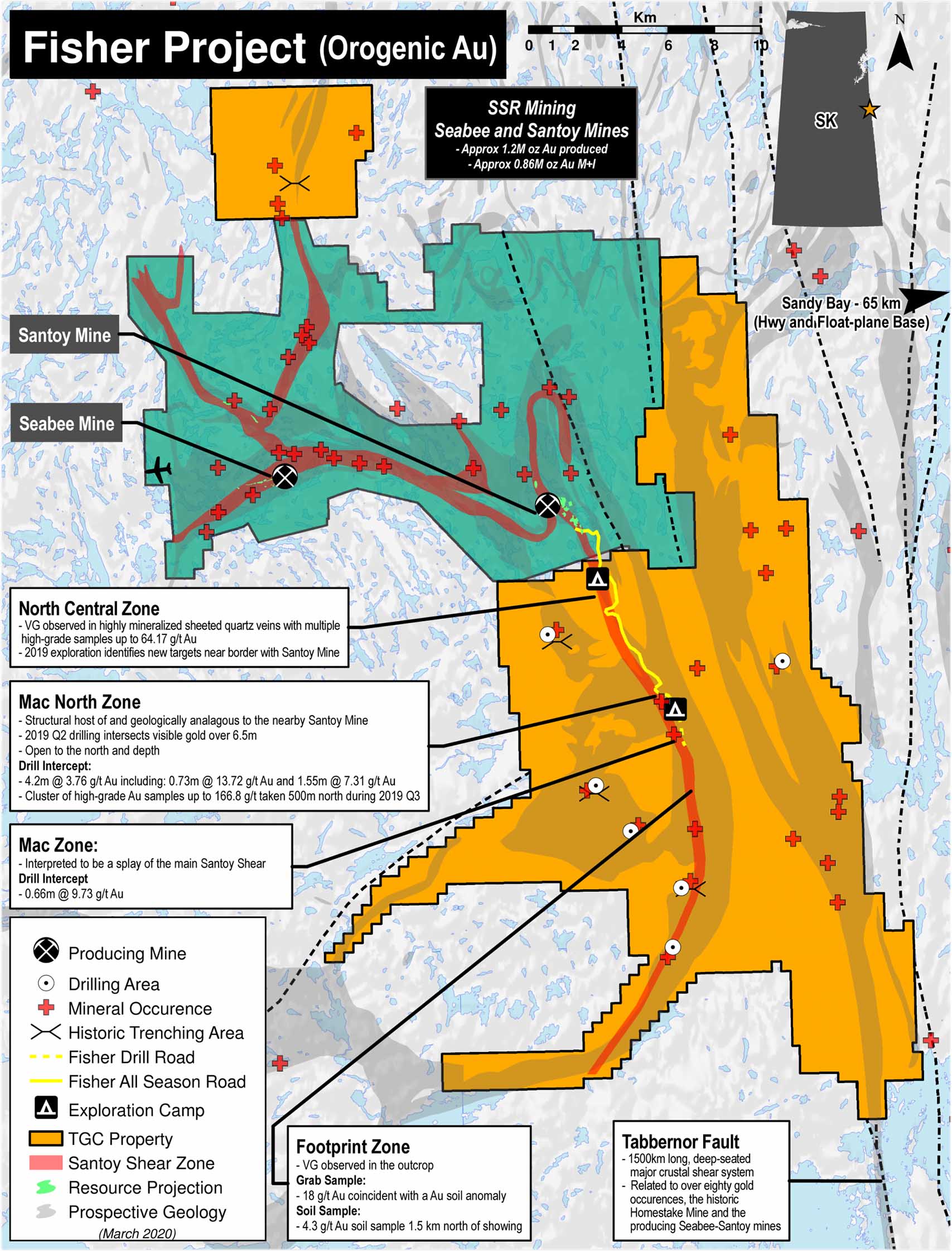

The main asset of Taiga Gold was (and still is) the Fisher gold exploration project in Saskatchewan. About half a decade ago, Eagle Plains had researched gold project acquisition opportunities amidst a market downturn and identified an area along the Tabbernor fault in the region of Claude Resources’ Seabee gold mine. A series of projects were staked, securing a large strategic position along the Tabbenor Fault just before SSR Mining swooped in and acquired Claude Resources. The Fisher property was quickly optioned to SSR Mining while Aben Resources (ABN.V) entered into an earn-in agreement to obtain a majority stake in the Chico property, located a bit further to the south along the same Tabbernor Fault. For now, the Leland and Orchid projects remain fully owned by Taiga Gold but should new joint venture partners come knock on Taiga’s door, we have little doubt the company will be listening to any potential offers to collaborate on the exploration front.

Back to Fisher. Eagle Plains was able to stake the property at a very low cost and just weeks after SSR Mining approached Claude Resources to acquire that company for its low-cost Seabee gold mine, discussions between Eagle Plains and SSR Mining were already underway whereby SSR Mining ultimately signed an option agreement allowing it to earn a stake of up to 80% in the Fisher project.

To earn an initial 60% stake in the project, SSR Mining was required to spend C$4M in exploration within a 4 year period, as well as paying C$100,000 in cash upon signing and C$75,000 per year during that 4 year period (one final payment of C$75,000 will be due in October of this year). By January 2020, SSR Mining had already doubled the required C$4M exploration expenditures and is currently working on a 12,000 meter drill program at the Fisher which is estimated to bring these expenditures to triple the $4M obligation.

SSR Mining will only earn the 60% stake once it formally notifies Taiga Gold it has met the requirements. So at this point, the property is technically still 100% owned by Taiga Gold despite SSR having greatly exceeded the exploration spending requirements. Once SSR provides the formal notice to Taiga Gold, it will have a one year period to acquire an additional 20% interest (to bring its stake to 80%) for a C$3M cash payment to Taiga Gold. Taiga Gold will also hold a 2.5% NSR on the Fisher property of which 1% can be purchased for C$1M. On top of that, once SSR Mining decides to form the joint venture, it will be required to make C$100,000 in annual cash payments as advance royalty payments to Taiga Gold, further reducing Taiga’s reliance on capital markets (see later).

So why is SSR Mining so interested in Fisher?

In a recent presentation given at the PDAC conference in Toronto earlier this month, SSRM VP Corporate Development John DeCooman confirmed the reserves at the Seabee mine will be depleted in 2024. While we would expect some of the existing resources to be converted into additional reserves, it’s clearly in SSR’s best interest to keep the mine open as long as possible to build on and reap the rewards of their $337M investment to purchase Claude Resources and avoid that investment from becoming a liability due to obligations of decommissioning and reclaiming the mine and tailings facilities. And as the Seabee mine is the company’s highest-margin mine (the All-In Sustaining Cost per produced ounce of gold was $755/oz in 2018 and $812/oz in 2019, with a ‘pure’ cash cost well below $500/oz) and at the current gold price, the Seabee mine alone will generate roughly $70M in pre-tax free cash flow. And that is why SSR Mining will complete 100,000 meters of drilling in Saskatchewan in 2020 (divided 50/50 between brownfields drilling and greenfields drilling). And that’s a serious step-up from the less than US$9M it spent on exploration in the Greater Seabee area in 2019.

SSR Mining has been working on its own land package (and will complete 37,000 meters of greenfield drilling on its own land in 2020) but is currently embarking on a 12,000 meter drill program on the Fisher property. Or as VP John DeCooman said during his PDAC presentation ‘the best spot to look for a new mine is somewhere along this trend’. And pretty much the entire Tabbernor trend is owned by Taiga Gold.

And there have been some preliminary exploration successes (which obviously is the reason why SSR Mining is following up with a 12,000 meter drill program which we estimate will cost almost as much as Taiga’s current enterprise value right now.

In the 2019 summer exploration season, the field team took over 6,000 samples (80% soil samples, 20% rock samples) and has confirmed the continuity of a gold-bearing trend over a 13-kilometer strike length. A 7,500 meter drill program carried out the previous Winter, prior to this sampling program, intercepted in the last hole of the program 6.5 meters of core with visible gold which assayed 4.2 meters of 3.76 g/t gold included 1.55 meters of 7.15 g/t gold and 73 centimeters of 13.72 g/t gold. This represents the first intercept of mining width above cutoff-grade while another nearby hole contained1.5 meters of 10.2 g/t gold.

Okay. These assay results are interesting but SSR Mining obviously needs to see more and that’s why the producer is shifting into a higher gear as this is the final year of the 4-year earn-in period. There are no penalties for SSR Mining to continue exploring beyond this 4-year deadline, so it will be equally interesting to see if SSR formally notifies Taiga it has completed its spending commitments, or if it will just continue to explore the Fisher land package without formally notifying Taiga.

Another interesting point will be seeing if SSR Mining is willing to fork over C$3M in cash to acquire an additional 20% stake in Fisher. Depending on the findings this year it could make more sense for SSR Mining to try to just acquire full ownership of the project. Given Taiga is currently trading at an enterprise value of less than C$7M, SSR Mining could easily lock up the entire Tabbernor belt by acquiring Taiga Gold as a whole as it would then also control the Leland, Orchid and Chico properties which are all within trucking distance from the Seabee milling infrastructure.

Keep in mind this is just speculation from our side and if we would have to pick our most likely scenario, we would guess that SSR Mining will continue exploring the Fisher for gold resources before making its decision to formally notify Taiga Gold of completing the requirements to form a 60/40 and subsequently 80/20 joint venture.

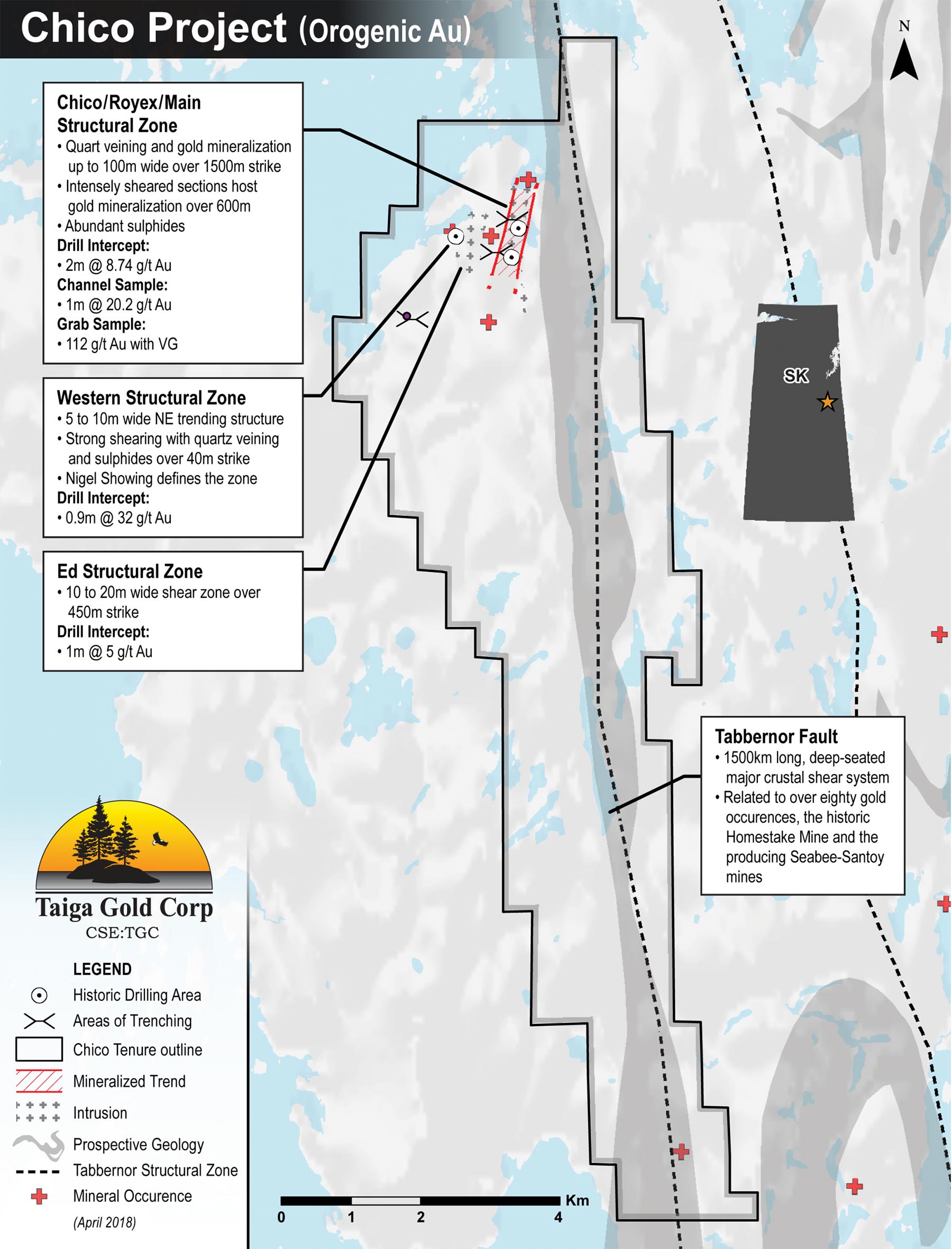

Chico

We would also like to briefly highlight the Chico property, which is located south of the Fisher along the Tabbernor trend. The Chico property is located in Saskatchewan, just 45 kilometers southeast of the Seabee Gold Operation, owned and operated by SSR Mining. The project has been intermittently subject to exploration programs by the previous owners of the project. The historical data records indicate Hudson Bay Exploration was the first company to do some preliminary work at Chico as it completed an Electro-Magnetic survey in the early 70’s. Other operates came and went over the course of several decades, but it took until 2002 when the property was acquired by Northwind Resources, before the exploration activities accelerated as the latter discovered a new gold zone: the Wingnut zone. Grab samples from this zone returned anomalous and high-grade gold values (up to 41.35 g/t gold), and Eagle Plains Resources (now: Taiga Gold) was obviously keen to continue to work on this property.

Aben Resources and Eagle Plains were planning to drill the Chico project in 2018 but Eagle Plains (as project operator) had suspended the planned (and permitted!) drill program at Chico to continue consultation with the local communities. Exploration activities have been suspended until a new agreement with those communities has been reached.

Fortunately, the earn-in terms to reach an initial 60% stake in the property were relatively straightforward for Aben as the company is required to spend C$1.5M in exploration (within 4 years), issue 1.5 million shares and pay C$100,000 in cash to Eagle Plains (with Taiga Gold now obviously usurping the commitments Aben made to Eagle Plains) to complete the first part of the option agreement. Aben Resources could subsequently earn an additional 20% in the property by making an additional C$50,000 cash payment whilst issuing an additional 1 million of shares. On top of that, Aben would be required to spend an additional C$2M in exploration expenditures on the property within 2 years.

The other properties remain 100% Taiga

Keep in mind Taiga only has joint venture agreements on the Fisher and Chico properties and the two other properties along the Tabbernor fault remain fully owned by Taiga Gold. Taiga is doing some work on them (and has been expanding the Orchid land package recently) so perhaps more interested parties show up to do some work on those properties as well.

We will discuss the Leland and Orchid properties in a later update report.

Taiga took advantage of a financing window and is now cashed up

It’s simply stating the obvious when we say these equity markets have been tough and remain very difficult for exploration companies to raise money. Taiga Gold made the good decision to upsize and close a private placement financing in February.

The company raised C$1.4M in a non-brokered hard dollar financing by issuing 15.55 million units with each unit consisting of one share and a full warrant whereby the warrant holder can exercise the warrant at C$0.18 during a 24 month period. Should these warrants end up in the money, an additional C$2.8M will end up in Taiga’s treasury. The financing increased the share count to 79.44M shares. Issuing full warrants usually makes people nervous/scared about an ‘overhang’, but keep in mind on June 6th about 3.94M warrants with a strike price of C$0.20 will expire so the net warrant increase will remain limited to just over 11.5M warrants.

We are still waiting for the company to file its full-year financial results for FY 2019, but as of the end of September (the Q3 financials are the most recent financials available), Taiga had a working capital position of around C$160,000. Despite running a very tight ship, it hardly is a surprise the company ran out of money by January so the raise didn’t really come out of the blue.

Taiga originally announced a C$540,000 raise. That’s not a lot of money but the truth is, the company doesn’t need a lot of money. SSR Mining is doing the heavy lifting on the Fisher property, and the exploration efforts on its own properties are low-cost.

Just to provide you with some numbers. In the first nine months of FY 2019, Taiga Gold reported C$315,000 in expenses. That’s an overhead cost of just over C$100,000 per quarter and just over C$400,000 per year and this includes the G&A, and the travel and promotional activities. An additional C$167,000 was spent on exploring its own projects. Given this extremely low burn rate (C$350,000 per year if the company would go into hibernation mode, defer exploration, travel and IR expenditures), the C$540,000 Taiga was looking to raise would have been sufficient to cover 1.5 years of expenses. Additionally, SSR Mining needs to make a final cash payment of C$75,000 as part of its earn-in deal with SSR Mining so that will also take care of a part of the overhead expenses.

Long story short: completing a C$1.4M raise means Taiga won’t have to return to the markets for about three years (if no exploration is being conducted at all).

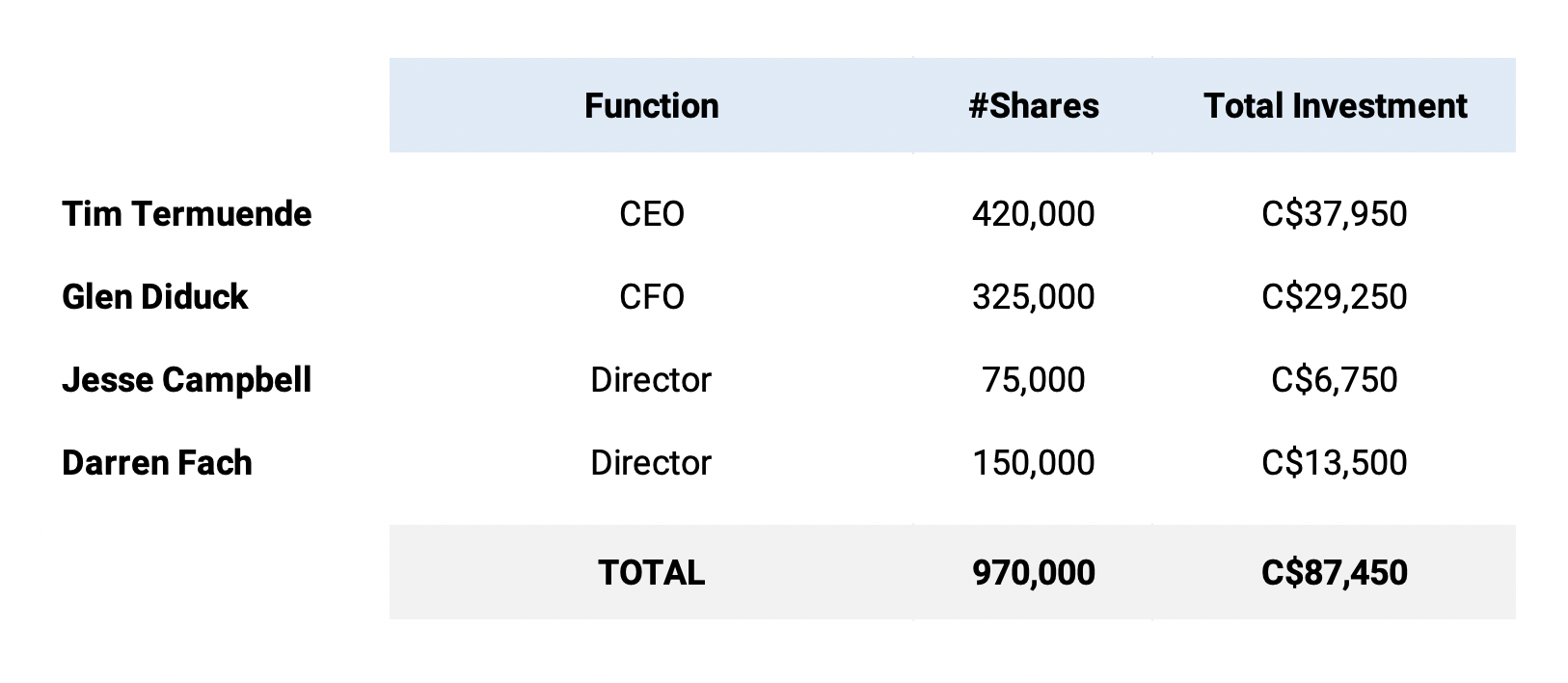

And what’s more, we have seen substantial insider buying as since the beginning of this year, four insiders have spent a combined C$87,450 on buying stock (of which most part was in the financing).

Conclusion

2020 could be a pivotal year for Taiga Gold. SSR Mining will complete yet another drill program (bringing the total amount of meters drilled in excess of 33,000) and conduct another large sampling program to develop further drill targets. It may also decide to establish a 60% ownership in the Fisher project by the fourth quarter of this year. That will start another clock: once SSR Mining reaches the 60% ownership threshold, it has one year to decide whether or not it will fork over C$3M in cash to acquire an additional 20% stake in the project.

Whatever happens, Taiga is sufficiently cashed up to ‘ride it out’ and see what happens at the end of the 4-year earn-in period (which ends in October this year). SSR Mining will have spent roughly triple the required C$4M earn-in and considerably more than Taiga’s current market capitalization on exploring the Fisher project.

There is no guaranteed outcome here, but as SSR Mining’s Vice-President mentioned earlier this month ‘the best spot to look for more gold is along the known mineralized trend’. And with the management and board of Taiga spending almost C$100,000 of their own money on buying more stock, the interests of the Taiga team are well-aligned with the smaller shareholders.

Disclosure: The author does not have a long position in Taiga Gold yet. Taiga Gold is a sponsor of the website.