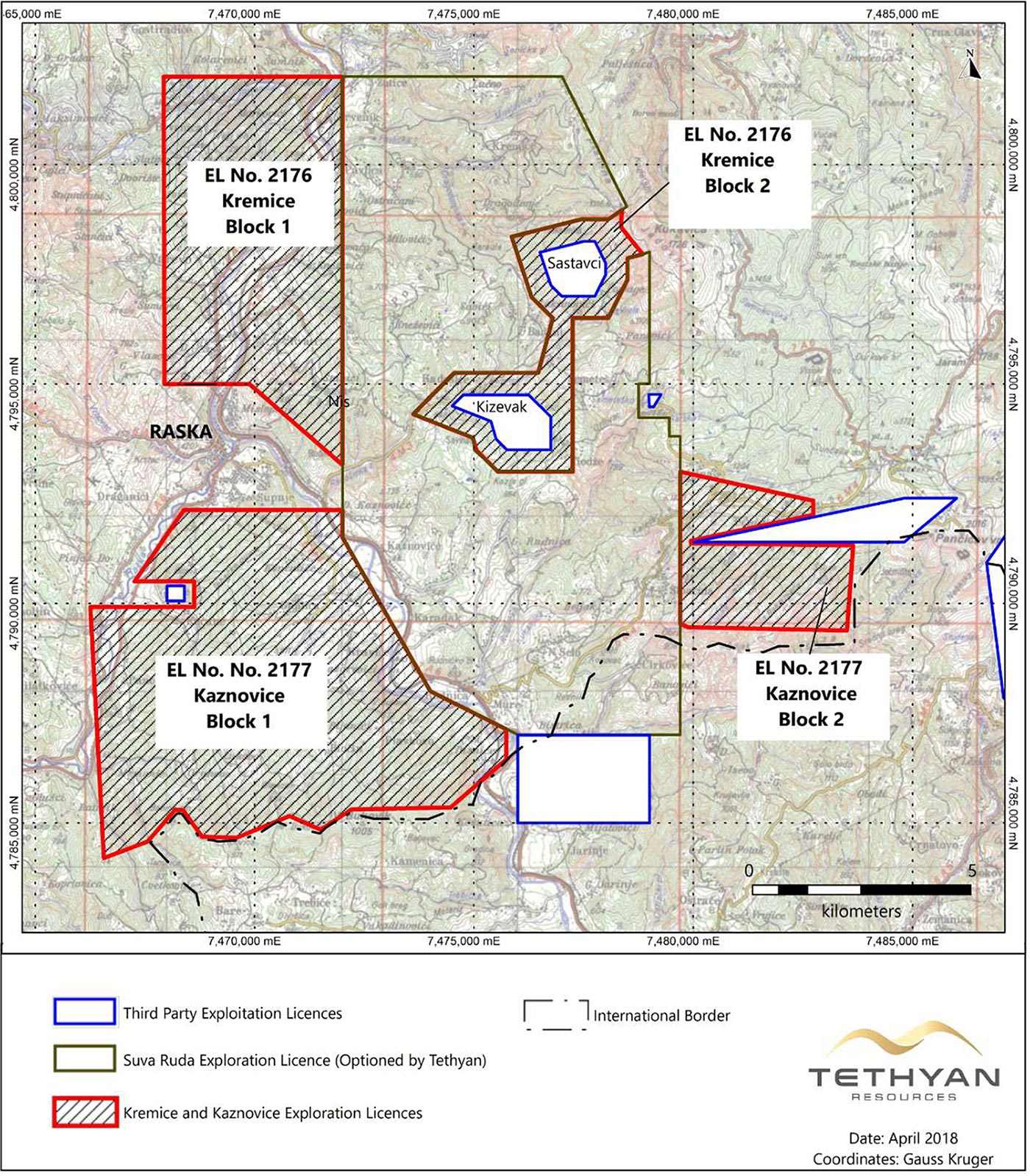

When we released our initial report on Tethyan Resources (TETH.V) in June (see here) we thought it was a good idea for Tethyan to start exploring in the immediate vicinity of the past-producing base metal mines in the Trepca district in southern Serbia. Considering the average cost to drill was expected to be less than C$200/meter, it made a lot of sense to immediately drill-test the low-hanging fruit.

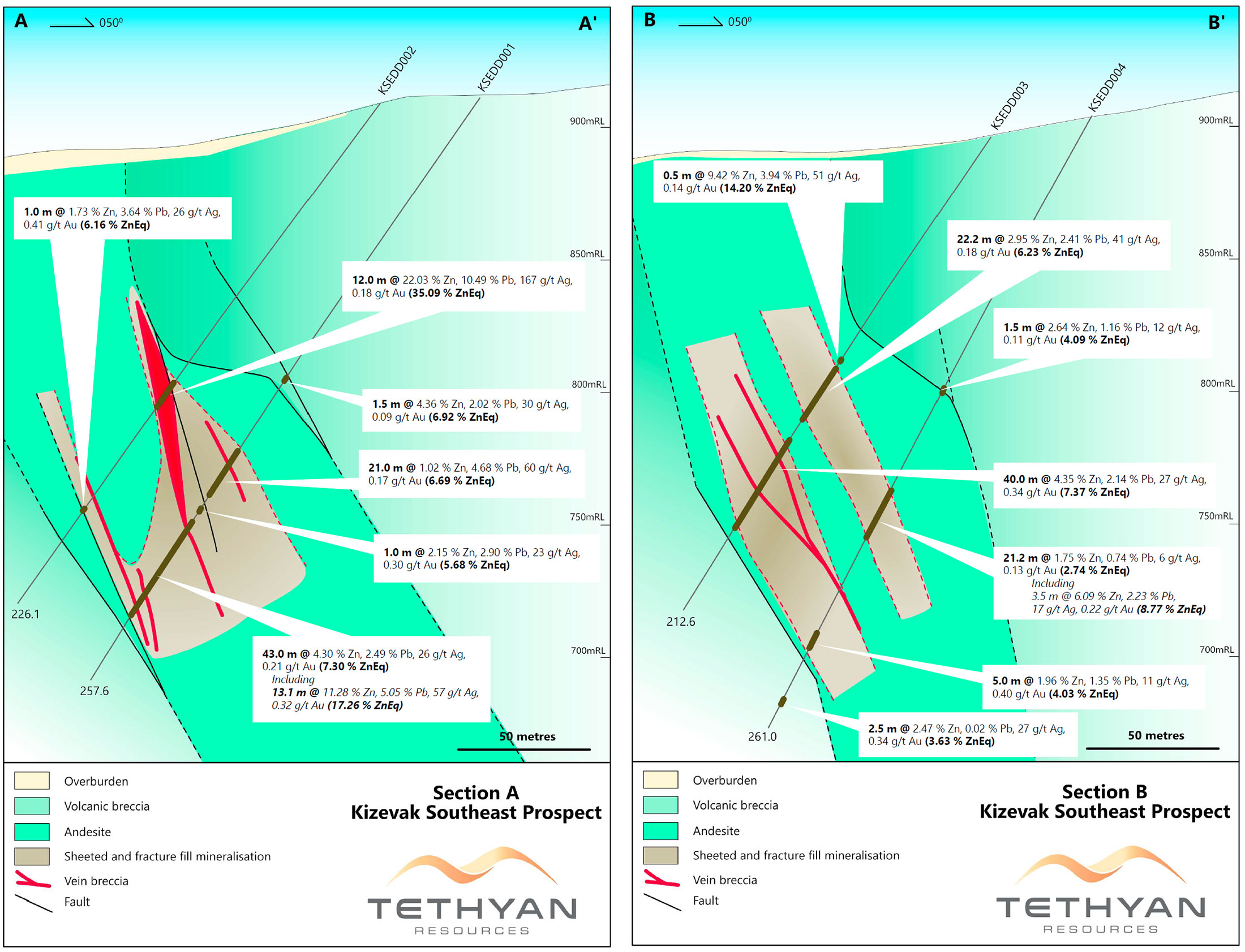

And Tethyan succeeded. All four holes intersected zinc-lead-silver mineralization and especially hole 2 revealed an eye-popping result with 12 meters of in excess of 32% ZnPb with 5.5 ounces of silver per tonne as additional bonus.

The first four holes of the Kizevak drill campaign returned absolutely excellent results

Tethyan has released the assay results of its drill program at the Kizevak project in Serbia much earlier than we expected and we think Tethyan requested the lab to apply the rush procedure, and with a good reason.

In the second hole of the drill campaign, the company intersected an absolutely stunning result of 12 meters containing 22% zinc, almost 10.3% lead and 5.5 ounces of silver per tonne of rock. Using a zinc price of $1.1/lb, a lead price of $1/lb and a silver price of $15/oz, this rock has gross value of in excess of US$830/tonne. Of course, the net value will be substantially lower as you’d still have to take the recovery rates and payability percentages into account, but 12 meters at a combined 32% ZnPb is massive. And if the recovery rate isn’t too low, the silver credit could actually take care of the mining costs…

The assay results from the three other holes are also very encouraging. The 43 meters of 4.3% zinc and 2.49% lead is interesting, and in a low-cost country like Serbia, a combined grade of 6.7% ZnPb should be viable. However, it’s more important to highlight the shorter (but still very wide) interval of 13.1 meters of 16.33% ZnPb with an additional silver credit of almost 2 ounces per tonne.

This is an extremely encouraging start of the exploration program at Kizevak. And although these four holes were drilled close to each other (which prevents Tethyan from building tonnage), it does confirm the company’s exploration strategy as the mineralization from the past-producing Kizevak mine appears to be continuing towards the southeast onto Tethyan’s land position.

It’s important to realize the historic Kizevak mine was an open pit mine, and the mineralization encountered in the first four holes appears to be within the first 200 meters from surface, so this project should be seen as an open pit mine extension to the Kizevak pit. Granted, the strip ratio will be relatively high, but as the cost to excavate the waste rock will be relatively low, and as the average grade of the mineralization is relatively high, an open pit scenario should be doable. It actually reminds us a bit of the potential mine scenario of Vendetta Mining (VTT.V) in Australia where the company is also planning an initial open pit (with a strip ratio we estimate to reach a maximum of 12:1 to 15:1) where after the (potential) underground development could start.

We discussed the drill results with CEO Fabian Baker to get a better understanding of the assay results. We were wondering why hole 4 returned the weakest results, considering this hole was drilled in between the historic open pit mine at Kizevak and the ultra-high-grade interval in hole 2. According to Baker, the different grades are caused by the normal variability in these types of deposits, and there’s a good chance the grades are increasing again at depth (again, it’s difficult to fully understand and interpret a mineralized system with just 4 drill holes, as Kizevak needs a lot more drilling to be fully understood).

But let’s not get ahead of ourselves. Kizevak needs a lot more drilling to develop a first resource, but the first assay results are definitely very encouraging considering the holes were drilled as a 1-kilometer step-out test from the historical Kizevak mine (which isn’t part of Tethyan’s land package).

Serbia is heating up, thanks to Zijin Mining

Serbia has been hot the past few weeks. Initially, China-based Zijin Mining announced an agreement with the Serbian government to acquire a majority stake in the gigantic multi-billion tonne Bor copper porphyry mine.

Zijin will invest $1.26B in the mine to upgrade the equipment and expand mining activities, will assume $200M in existing debt and has pledged to keep all 5,000 employees of the mine on the payroll. Keeping people employed was essentially Bor’s only goal as the mine has never been optimized to maximize the production and/or cash flows.

The acquisition of a majority stake in Bor was followed by the same Zijin making an all-cash offer to acquire Nevsun Resources (NSU, NSU.TO) for C$6 per share, beating Lundin Mining’s (LUN.TO) cash offer of C$4.75 per share. So Zijin Mining will be spending in excess of US$2B on Serbian assets, and this puts the country’s mineral potential back in the spotlight.

Although Tethyan Resources’ Rudnica project isn’t located in the same mineral belt as the Timok and Bor projects but in a semi-parallel belt to the south, Tethyan could definitely benefit from the renewed attention of large copper assets. The first drill programs at Rudnica unveiled long low-grade assay results typical for copper-gold porphyry assets, and it’s clear there’s ‘something’ in the ground at Rudnica. The total size is undetermined and the economics haven’t been established yet (it probably wouldn’t be viable at the current copper and gold prices), but Tethyan continues to work on Rudnica and is planning a 3-hole, 1,500-meter drill program to drill-test the Rudnica North zone where previous exploration programs are showing a magnetic high, a chargeability high and a large copper-gold-molybdenum anomaly at surface.

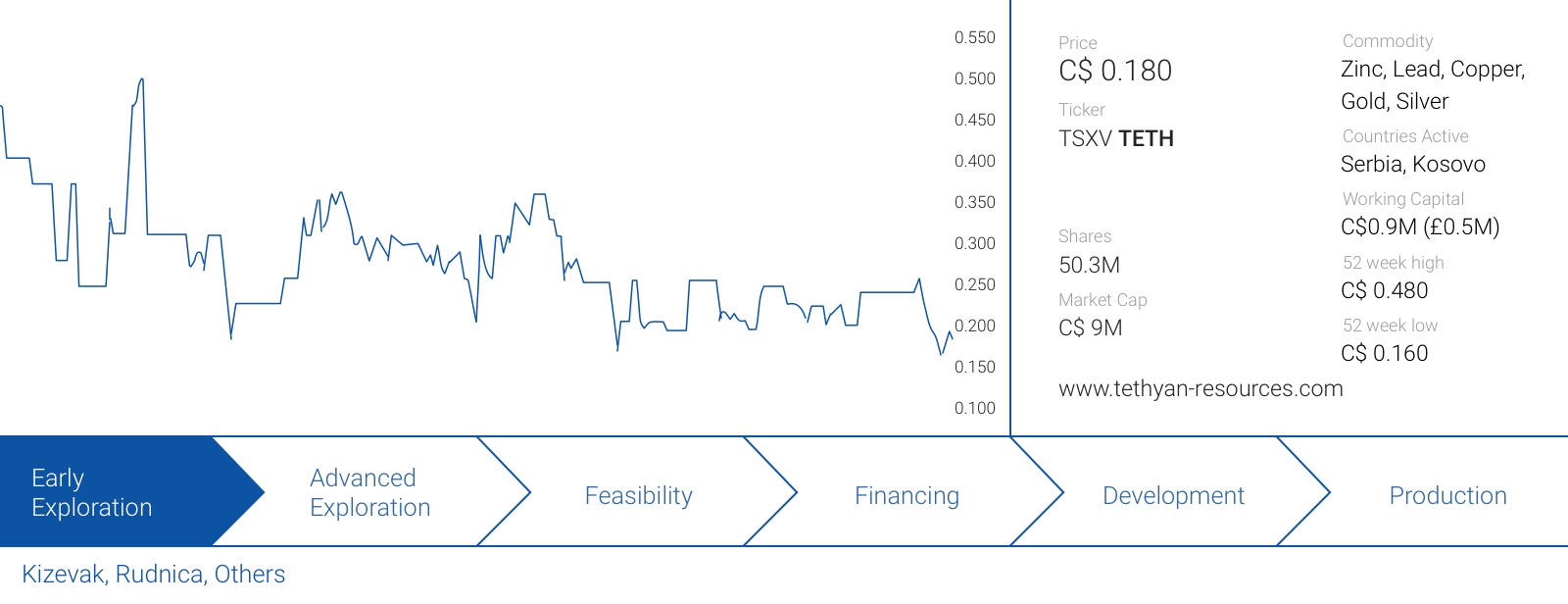

Tethyan’s balance sheet now boasts a positive working capital position

Tethyan completed a private placement in August raising C$1.5M in fresh capital at C$0.25 per share. This topped up the treasury and after having completed the four drill holes at Kizevak, we estimate Tethyan’s working capital position to be approximately C$0.9M (530,000 GBP) right now. Tethyan will probably have to raise some cash to make sure its planned drill program at Kizevak doesn’t get cut short.

The share count has increased to 50.3 million shares after completing this private placement and after taking the 7M share payment to Dr. Vukcevic and the 4.05M shares as part of a debt conversion into account.

Conclusion

The first four holes drilled at Kizevak confirm the validity of Tethyan’s exploration theory as the company successfully picked up the mineralization approximately one kilometer away from the past-producing Kizevak mine. These four holes really are just the beginning of what should be an extensive exploration program at Kizevak aiming to build tonnage by stepping out along strike and drilling some deeper holes to establish the continuity of the mineralization at depth.

It’s early days for Tethyan in the Trepca mining district, but the company is sitting on some highly prospective ground.

Disclosure: Tethyan Resources is a sponsor of this website. We have a long position. Please read the disclaimer