From a mental perspective, it’s never easy to initiate a position in a company whose share price has just five-folded in the past six months. That’s what happened to Vanstar Mining (VSR.V). The share price has moved from below 30 cents in November to over C$1.30 now and has performed most other gold equities.

Sure, gold is up as well, but it looks like the market is waking up to the opportunity the Nelligan project presents. While IAMgold (IMG.TO, IAG) is the majority owner of the project and is calling the shots, Vanstar negotiated a sweet deal for itself back in the day as the company retains a 20% free carried interest in this multi-million-ounce deposit in Québec, a Tier-1 mining region. Retaining 20% of the future cash flows without having to contribute a single dollar to the current exploration activities and construction capex could be very valuable down the road and the current market capitalization of C$69M could really be just the beginning as the 1% NSR on the project could generate as much as the current market capitalization in pre-tax cash flow.

The Nelligan project will be the main value driver for Vanstar Mining

While Vanstar Mining has three assets (Nelligan, Amanda, Felix), we will solely be focusing on the Nelligan project in this initial report as we believe this advanced stage project to be the main value driver for Vanstar.

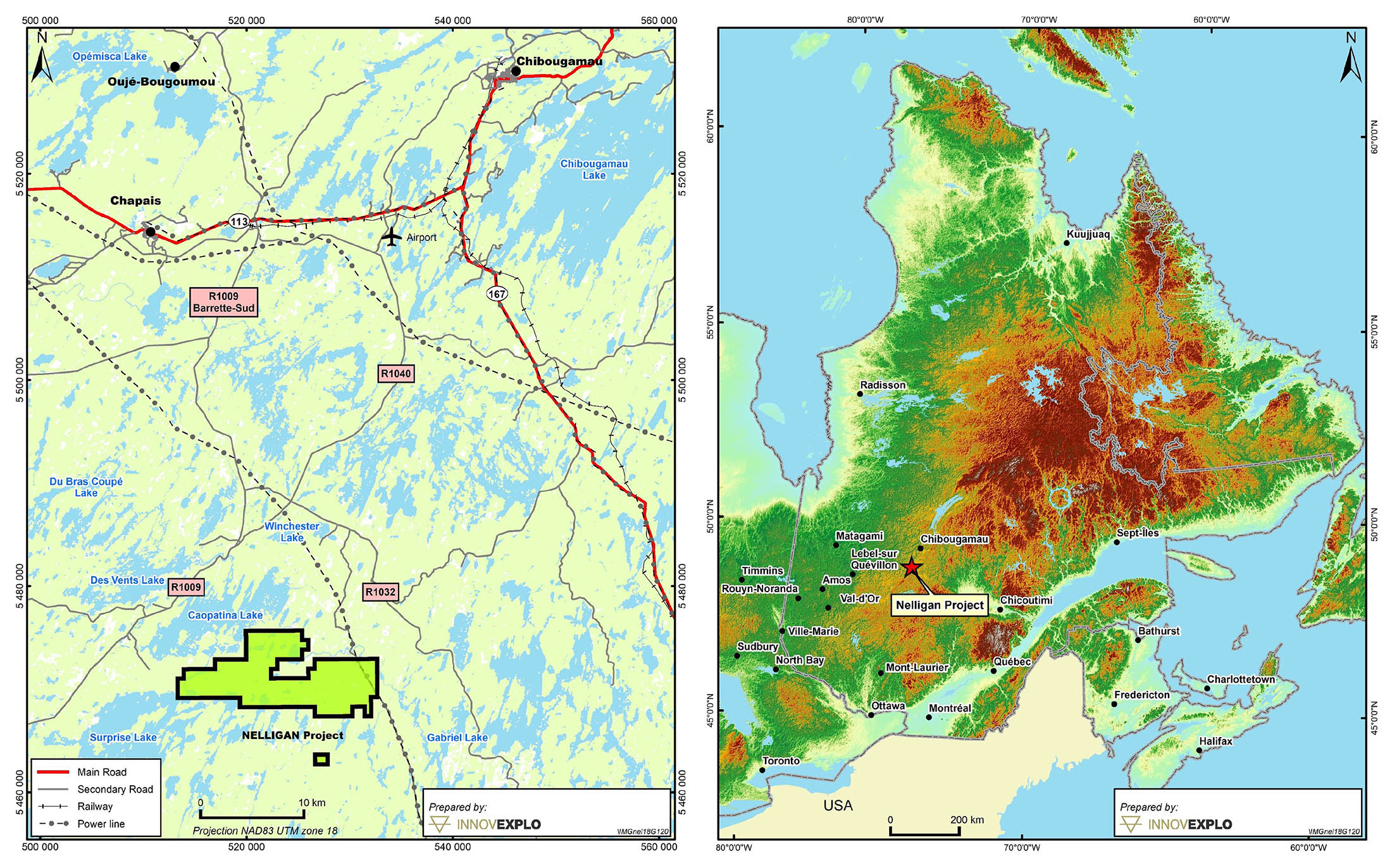

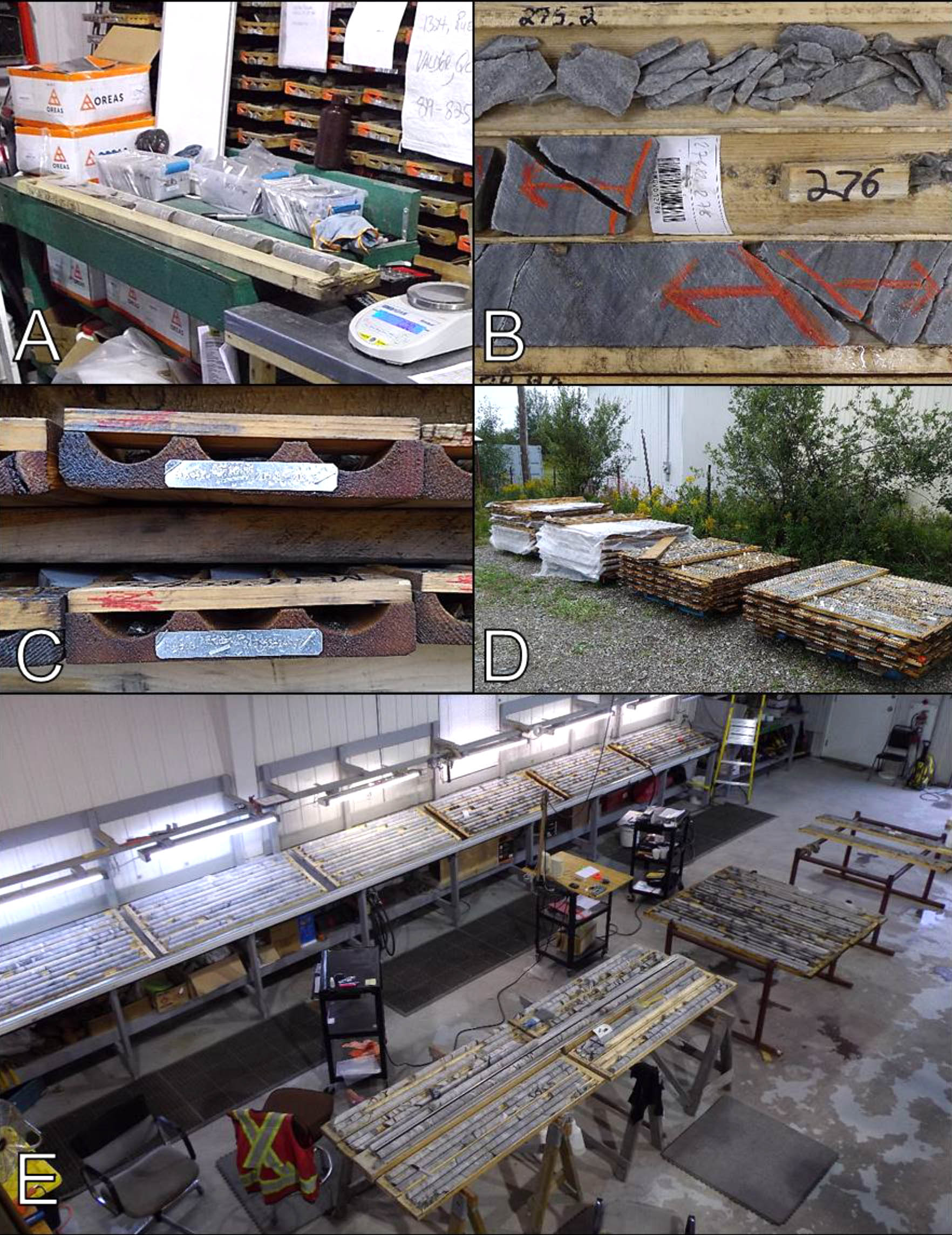

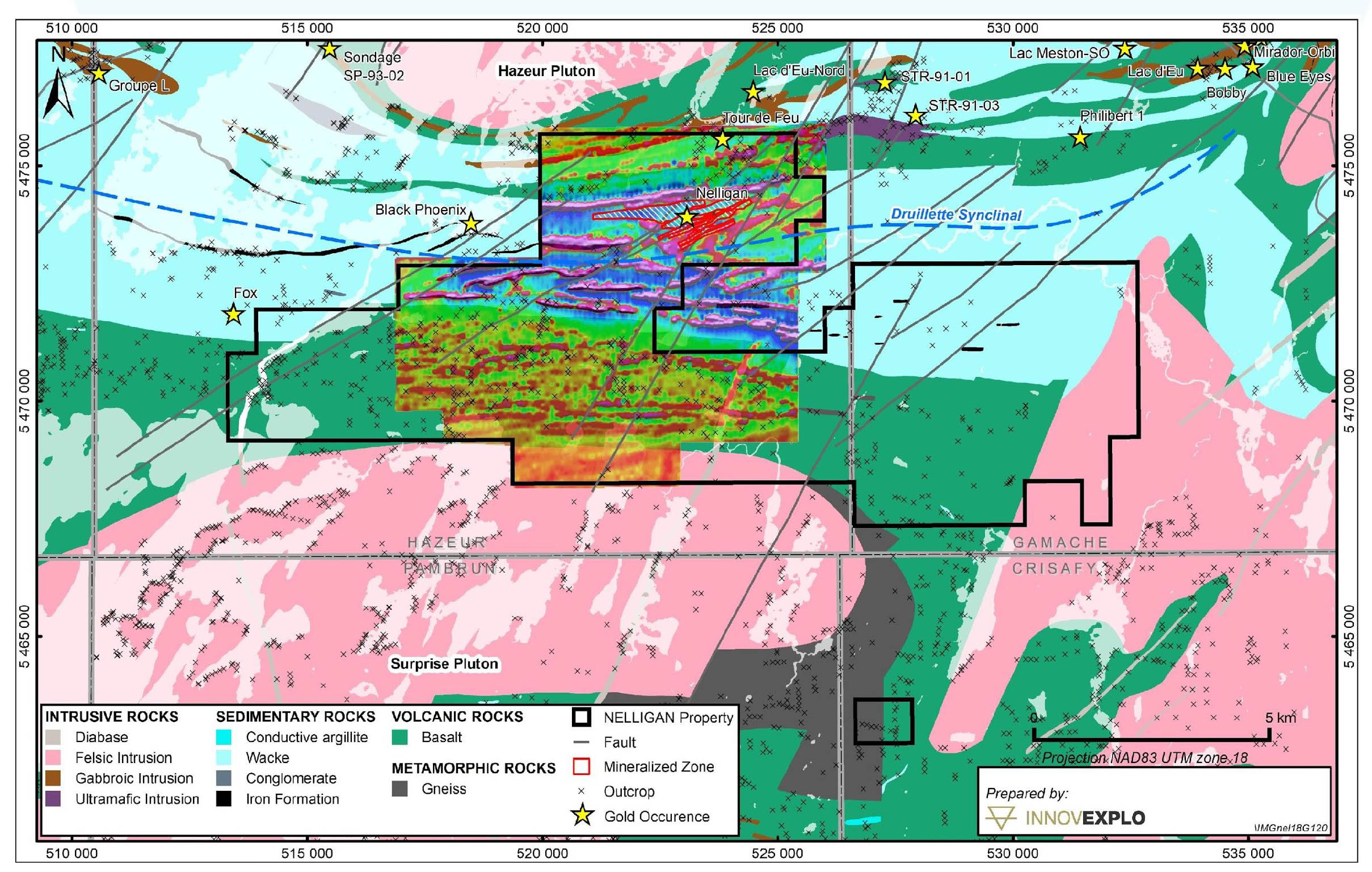

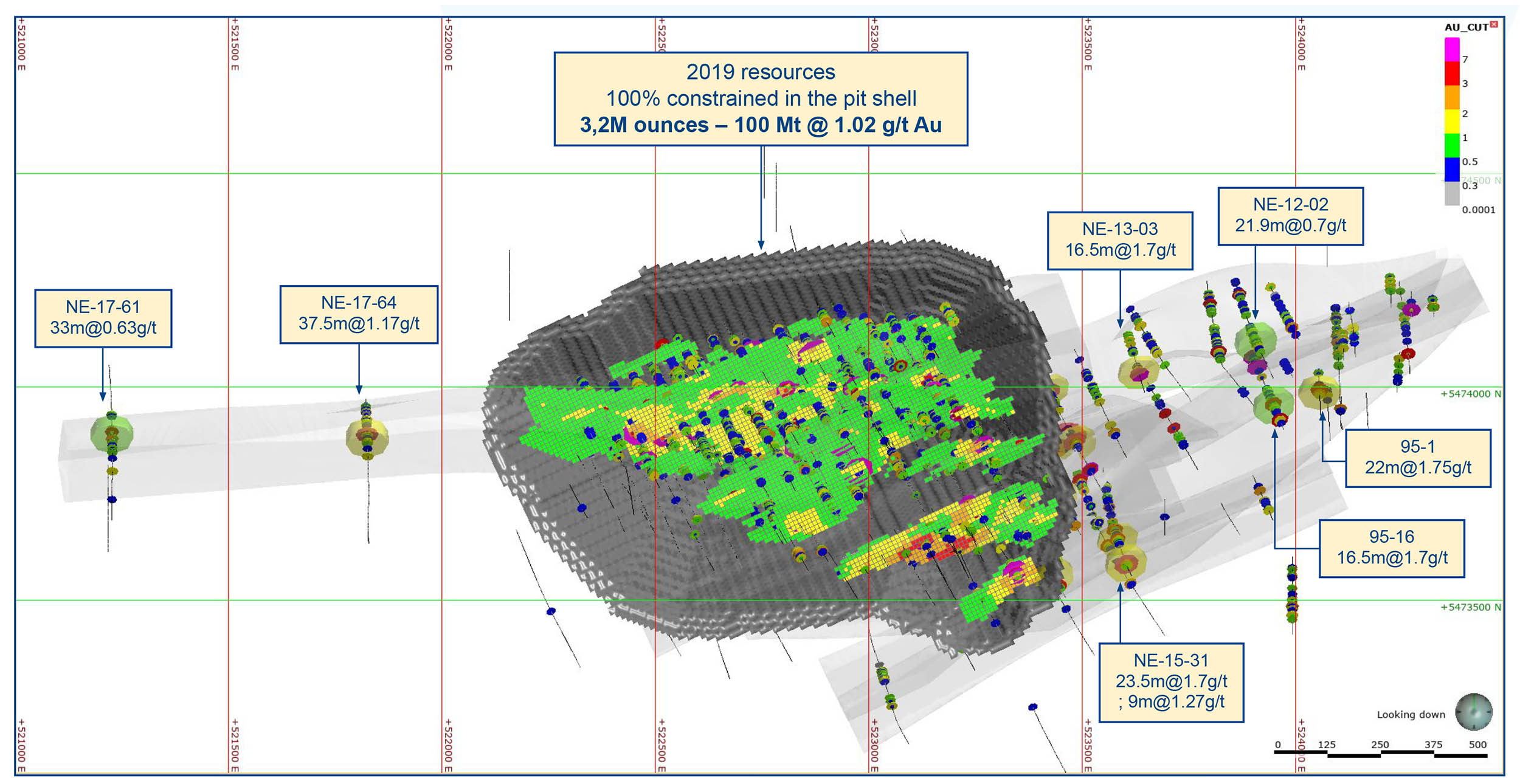

The project is located about 300 kilometers northeast of Val D’Or and about 60 kilometers southwest of Chibougamau in Québec, one of Canada’s Tier 1 mining jurisdictions. The total size of the project is almost 10,000 hectares (100 square kilometers) and after a 5-year long exploration agreement between Vanstar and IAMgold (which is earning an 80% interest in Nelligan), the initial resource estimate in Q4 2019 came in at a very enticing 3.2 million ounces of gold.

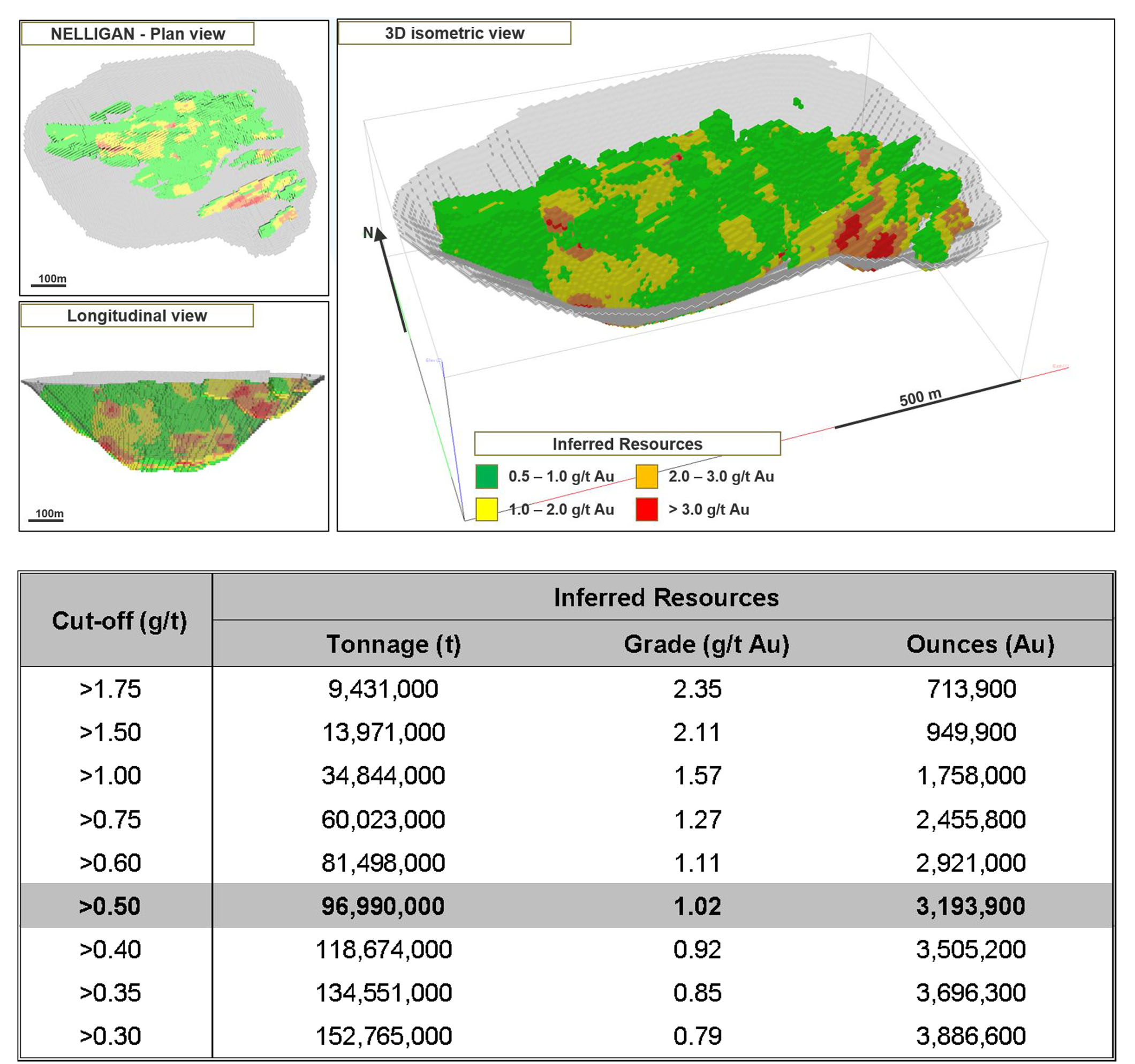

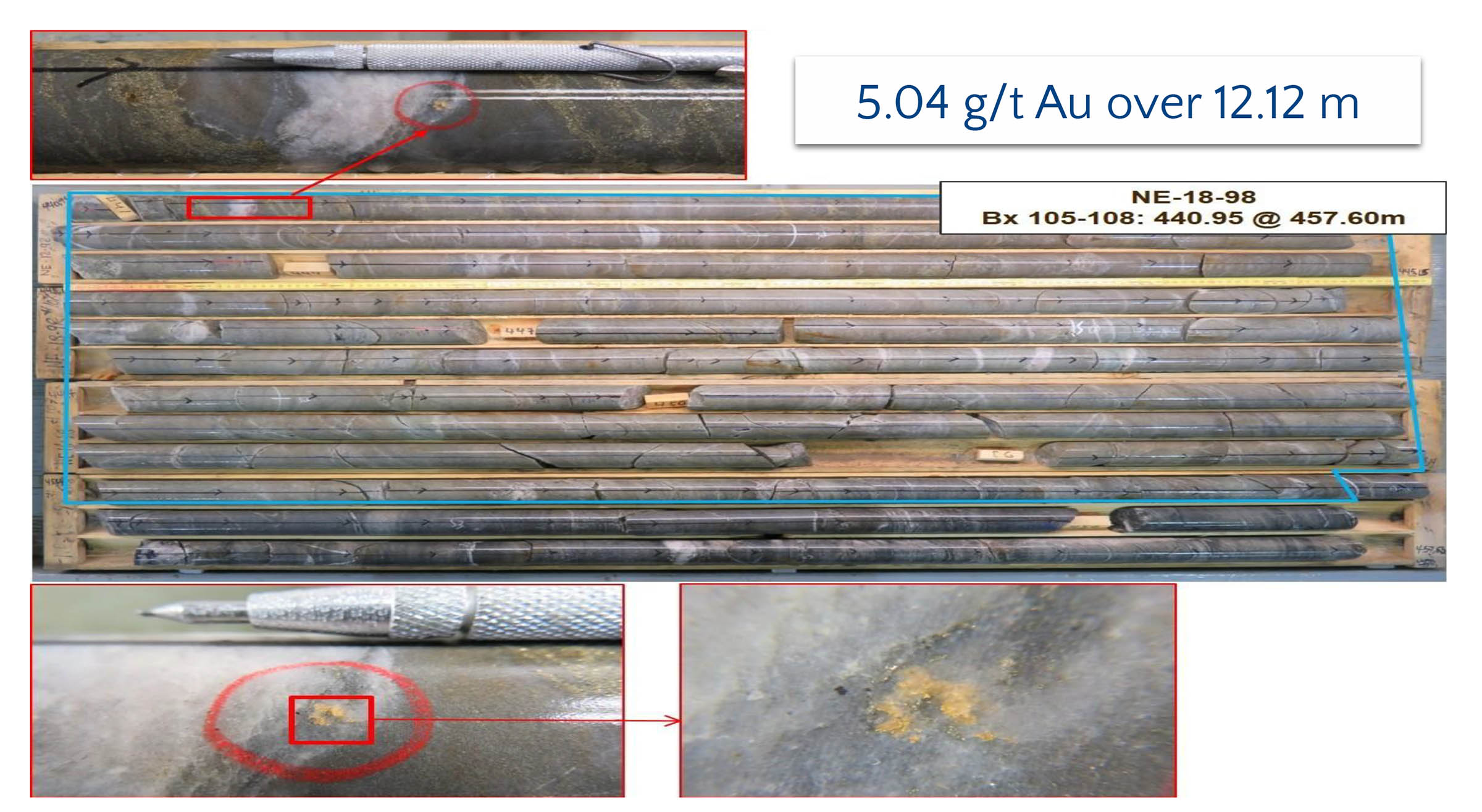

This resource is based on drilling off a 3.5 kilometer long and 1.5-kilometer wide zone with a drill spacing that’s sufficiently narrow to allow for an inferred resource calculation.

As you can see in the image above, there is a decent correlation between the cutoff grade and the average grade of the resource. The pit shell was based on a gold price of C$1,650 per ounce and with gold trading roughly 40% higher, IAMgold may be considering lowering the cutoff grade in the next resource update. Reducing the cutoff grade from 0.5 g/t to 0.4 g/t would increase the gold resource by approximately 10% to 3.5 million ounces, but would also reduce the average grade by around the same percentage while the strip ratio may decrease so future cutoff grades will be based on trade-off studies taking both important elements (average grade and strip ratio) into account.

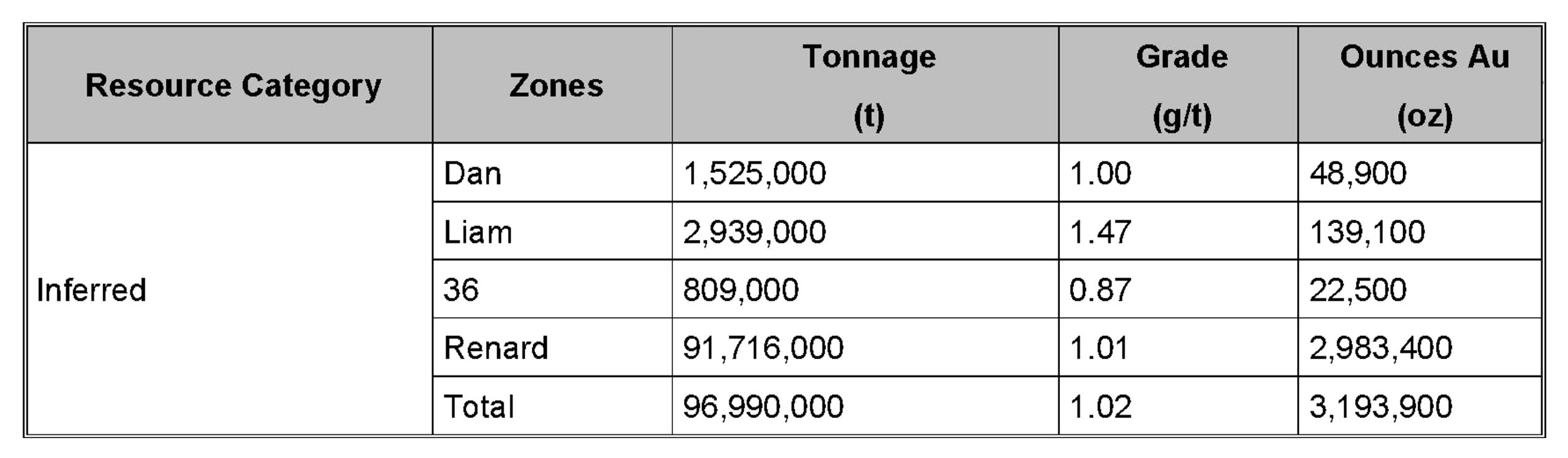

The 3.2Moz gold resource can be broken down in four distinct zones of which the Renard zone hosts in excess of 90% of the ounces.

No economic studies have been prepared for the Nelligan project and the maiden (inferred) resource estimate will very likely serve as a stepping stone to further unlock the value of the project. Fortunately for Vanstar Mining, the company isn’t required to spend a single dollar on exploration. It can let joint venture partner IAMgold do the heavy lifting.

The earn-in agreement with IAMgold explained

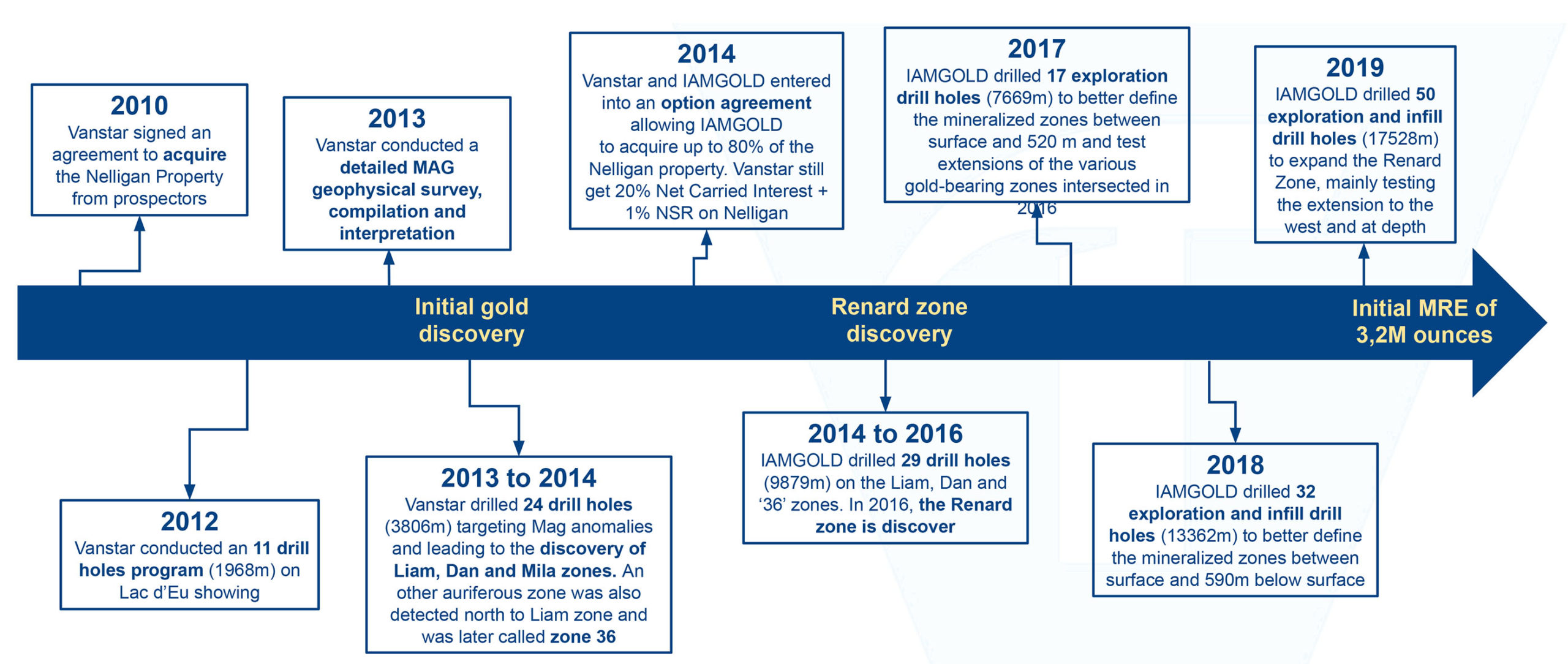

The Nelligan project has been around for a while, and in 2014 Vanstar was able to attract IAMgold (IMG.TO, IAG) as a joint venture partner. The original agreement called for a gradual earn-in based on cash payments and exploration expenditures and was subsequently amended in 2018.

It doesn’t really matter what the original requirements are as everything now boils down to this: IAMgold owns 75% of the project and can earn 80% by completing a feasibility study on the project (which we estimate is still 3-4 years away and will require an additional C$50-60M to be spent from here on including additional (infill and expansion) drilling and completing all relevant studies).

Additionally, on top of retaining a 20% free carried interest, Vanstar will retain a 1% Net Smelter Royalty on the Nelligan project. Owning a 1% NSR on a 3M+ ounce gold deposit in Québec could be very valuable by itself.

The main question now is: what is this stake worth to IAMgold?

Without an economic study confirming the resource can effectively be mined at a profit, it’s tough to put a value on Vanstar as the value pretty much is in the eye of the beholder. Assuming Vanstar will end up with a 20% economic stake in the project, one could argue a valuation based on an ‘ounce in the ground’ amount would make the most sense. Fine. But that still doesn’t change the issue: do we use C$50/oz in the ground? C$100/oz? C$150/oz? The truth will probably be somewhere in that range but it remains quite arbitrary to just use a ‘dollar per ounce’ amount. Having a free carried interest should result in the resource being valued towards the higher end of that range as there are no financial risks regarding the development of the asset. But we should also keep in mind the resource is still 100% in the inferred resource category and the viability hasn’t been proven yet, so more work needs to be done before a positive feasibility study will be published.

Secondly, the same issue has to be dealt with to determine the value of the 1% NSR. There are 3.2 million ounces in an inferred resource estimate but the value of the NSR will be based on the amount of mineable ounces.

Perhaps we should have a different approach. The question isn’t also just ‘what is it worth to IAMgold?’, but also ‘does IAMgold really want to tolerate a small partner that doesn’t have to spend any money but gets all the upside benefit from further advancing the asset?’.

The answer could very well be ‘no’. At this point, IAMgold has already secured its majority ownership in the project and the project appears to be sizeable enough and profitable enough (this still has to be confirmed in an official economic study, but a grade of 1.02 g/t for an open-pit mine in Québec should be viable at the current gold price as management has indicated the strip ratio should be ‘low’ but hasn’t provided a guidance on the strip ratio) for IAMgold to start thinking about developing it.

IAMgold may be very interested in trying to consolidate ownership in the project before actually completing a feasibility study as moving the project forward until it establishes an 80% stake could be a win-lose scenario (a win for Vanstar but a lose for IAMgold). After all, if it provides a feasibility study, it will have the right to make an offer to acquire the remaining 20% of Nelligan, but conversations with the management confirmed that any offer IAMgold makes (based on the NPV of the project) does not have to be accepted by Vanstar Mining. Vanstar is absolutely allowed to decline an offer, even if it would exceed the Net Present Value of the 20% stake, so IAMgold would probably prefer to remove this risk before even thinking about funding the asset.

Because let it be clear: the free carried interest means Vanstar will be carried all the way into commercial production. Vanstar won’t have to contribute a single dollar to the initial construction costs and will only have to start contributing on a pro-rata basis once commercial production has been reached.

This basically means IAMgold will have to secure funding for 100% of the capex while it will only have an 80% economic interest in the project and banks and (alternative) lenders probably won’t be too impressed by this value proposition.

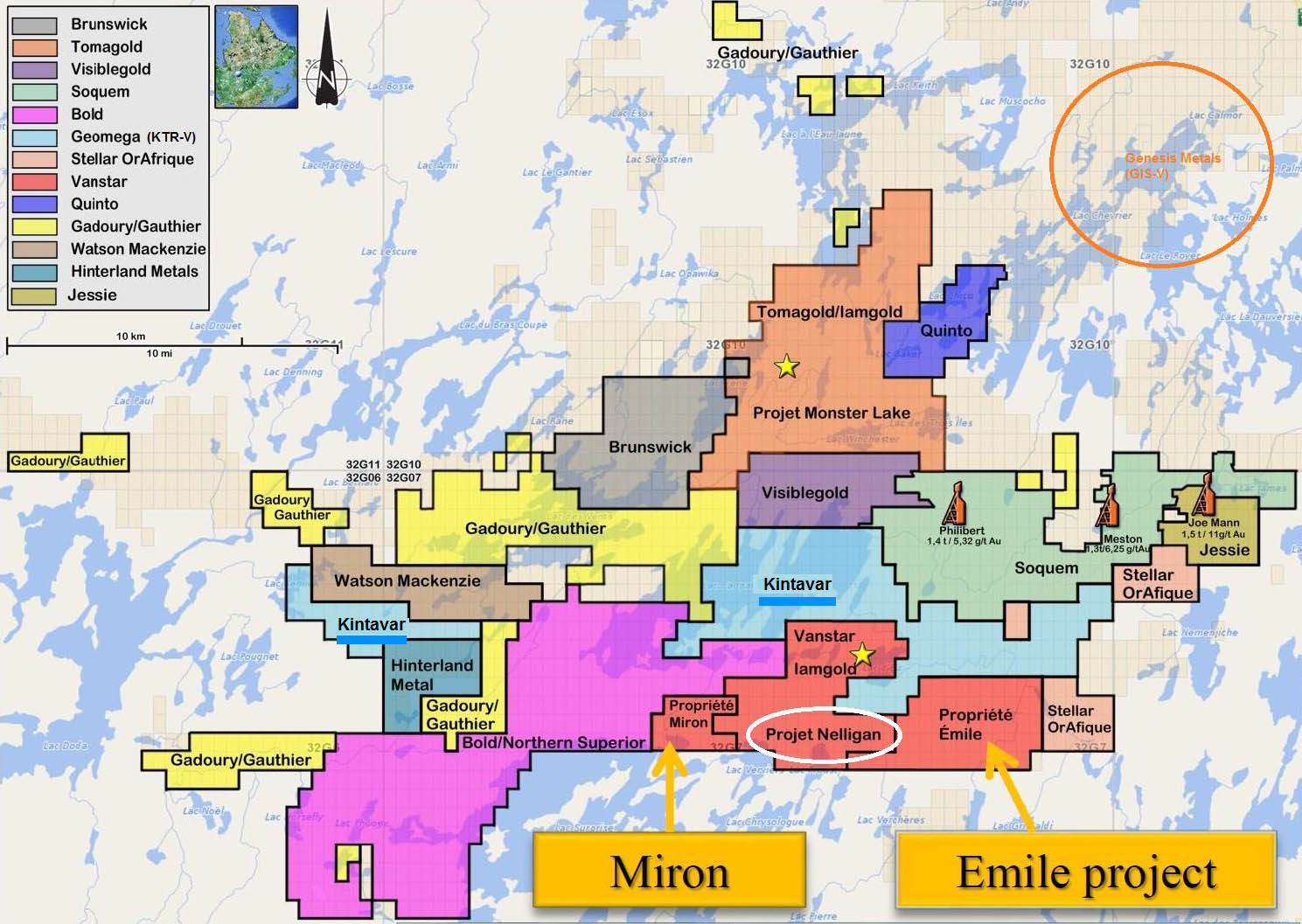

IAMgold could also pretend to play hardball and reduce its exploration pace at Nelligan. But we don’t think this will happen as we believe IAMgold tipped its hand a few weeks ago when it signed an earn-in agreement with Kintavar Exploration (KTR.V) on its Anik property. And where is Anik located?

Right, it’s bordering the large Nelligan project. With the Anik earn-in deal, we think IAMgold has shown it is very interested in the district and is trying to get its fingers in several pies in a first step towards consolidating the entire area as on top of the agreements with Vanstar Mining and Kintavar, IAMgold also already owns an option to earn a 75% stake in the Monster Lake project which is less than 20 kilometers further north.

Vanstar’s management team & board

Guy Morissette – CEO & President

Mr. Morissette has been involved in Canadian mining for over 30 years. He has founded and developed several mining exploration companies. From 1993 to 1996, he held the position of President at Silver Star Resources Inc., which later became Perlite Canada Inc. From 1997 to 2000, Mr. Morissette was President of Golden Gram Resources Inc., which became Golden Gram Capital Inc. He also founded Essor Resources, Canaco Resources and Eider Resources.

Bernard Lapointe – Director

Bernard Lapointe has extensive business experience, having spent more than 35 years in the resource sector in exploration and project development. He founded Arianne Resources in 1997 and headed the company until 2013 that became Arianne Phosphate. Mr. Lapointe contributed to the discovery and development of the Lac à Paul project located in Quebec, one of the largest phosphate projects in the world. Mr. Lapointe is now a semi-retired geologist, consultant and private investor. He sits on several technical and strategic committees of public and private exploration companies and is a lecturer of exploration funding at the Université du Québec à Chicoutimi.

He holds a B.A. in Geology (Montreal) from a Master’s degree in Structural Geology (Chicoutimi) and a Ph.D. in mineral resources of the Université du Québec (Chicoutimi).

Conclusion

At this point, Vanstar Mining can just sit back, relax, and enjoy the ride: IAMgold is doing all the work and investing all the money while Vanstar will just get ‘diluted’ down to a 20% free carried interest. A free carried interest that could easily be worth half a billion Canadian Dollar (if we would assume 3 million recoverable ounces assuming there will be additional resource growth, and an attributable 600,000 ounces being produced at an AISC of US$1100/oz (note: this is just for calculation and demonstration purposes only, $1100/oz is not an official company guidance as there are no economic studies on the Nelligan property), the sum of the pre-tax cash flows at $1700 gold exceed US$360M. On top of that, Vanstar’s 1% NSR will apply on the 80% stake owned by IAMgold as well so in a 200,000 oz/year production scenario, Vanstar will effectively have an attributable production of 39,600 oz/year (99% of a 20% interest) where it will generate a margin of $600/oz and an additional 2,000 ounces (1% NSR on 200,000 ounces) at a margin of $1700/oz. Again, this example is only meant for illustrative purposes only to explain how a 20% free carried interest and a 1% NSR will work.

Granted, we are cutting a few corners here and there is absolutely no certainty IAMgold will actually make an offer to acquire Vanstar Mining. IAMgold could be perfectly happy to just earn its 80% stake, carry Vanstar into production and then just continue in an 80/20 joint venture in which case Vanstar shareholders will have to wait an additional decade before seeing the company generate any cash flow. But while this clearly is a valid possibility, it wouldn’t be IAMgold’s smartest move as controlling 100% of the project is worth something as well. And keep in mind that in the past few years, IAMgold has a history of buying out its minority partners in a joint venture (and just a few years ago it acquired Merrex Gold which it had a joint venture with).

There are no guarantees in life. And we don’t want to make it sound like a potential Vanstar-IAMgold tie-up is a ‘done deal’. We are just saying it would make a lot of sense for IAMgold to explore options to acquire Vanstar before the 20% free carried interest (+1% NSR) is established. Maybe IAMgold first wants to complete a PEA to check the economics of the project and that’s fair enough. But we dare to bet that one day IAMgold will be back at the negotiation table trying to get rid of the free carried interest as it clearly is a thorn in its side and it doesn’t make much economic sense for a senior producer to carry 100% of the financial risk for less than 80% of the proceeds.

Disclosure: Vanstar Mining is not a sponsor of the website, but we have been compensated by a third party. The author currently has no position in Vanstar Mining.