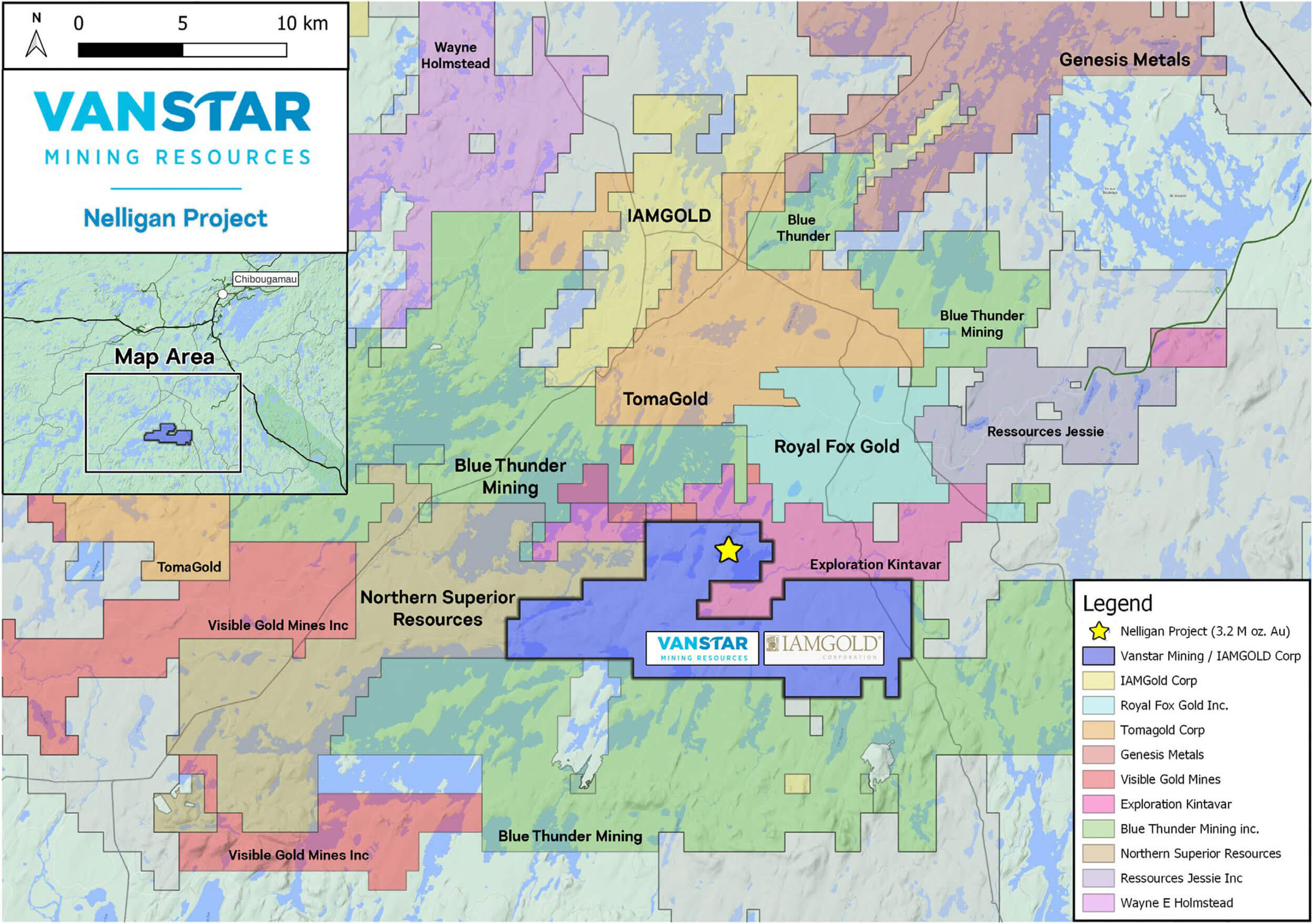

After reaching an all-time high of C$1.70 in 2020, Vanstar Mining Resources (VSR.V) share price has been sliding and has been trading in the C$0.30-0.40 range for over a year now. That’s surprising as the company has made good progress on the Bousquet-Odyno gold project it is earning in on from IAMgold (IMG.TO, IAG). Having the latter as a partner on the flagship Nelligan project likely didn’t help Vanstar Mining but judging by IAMgold’s spending pattern and plans for the winter season, IAMgold will continue the Nelligan joint venture and a winter drill program should be expected.

IAMgold continues to fund 100% of the exploration expenses while working towards earning an 80% stake in the project upon the completion of a feasibility study (which is still multiple years away as there isn’t even a Preliminary Economic Assessment on the property). And it’s important to know IAMgold will have to cover all of the expenses after establishing its 80% stake as Vanstar Mining has a carried interest and will be allowed to repay its share of the construction expenses using the cash flow generated by the project.

We sat down with CEO JC St-Amour to discuss the recent drill results on the Bousquet-Odyno project, the upcoming catalysts at Nelligan and the company’s financial health.

Sitting down with JC St-Amour, CEO of Vanstar Mining

Bousquet-Odyno

Before discussing the drill results, let’s take a step back here. You announced the option agreement with IAMgold on the Bousquet-Odyno project in March. How did this transaction happen? Did IAMgold suddenly find a project gathering dust on its shelves with you being the first choice given the cooperation at the flagship Nelligan project?

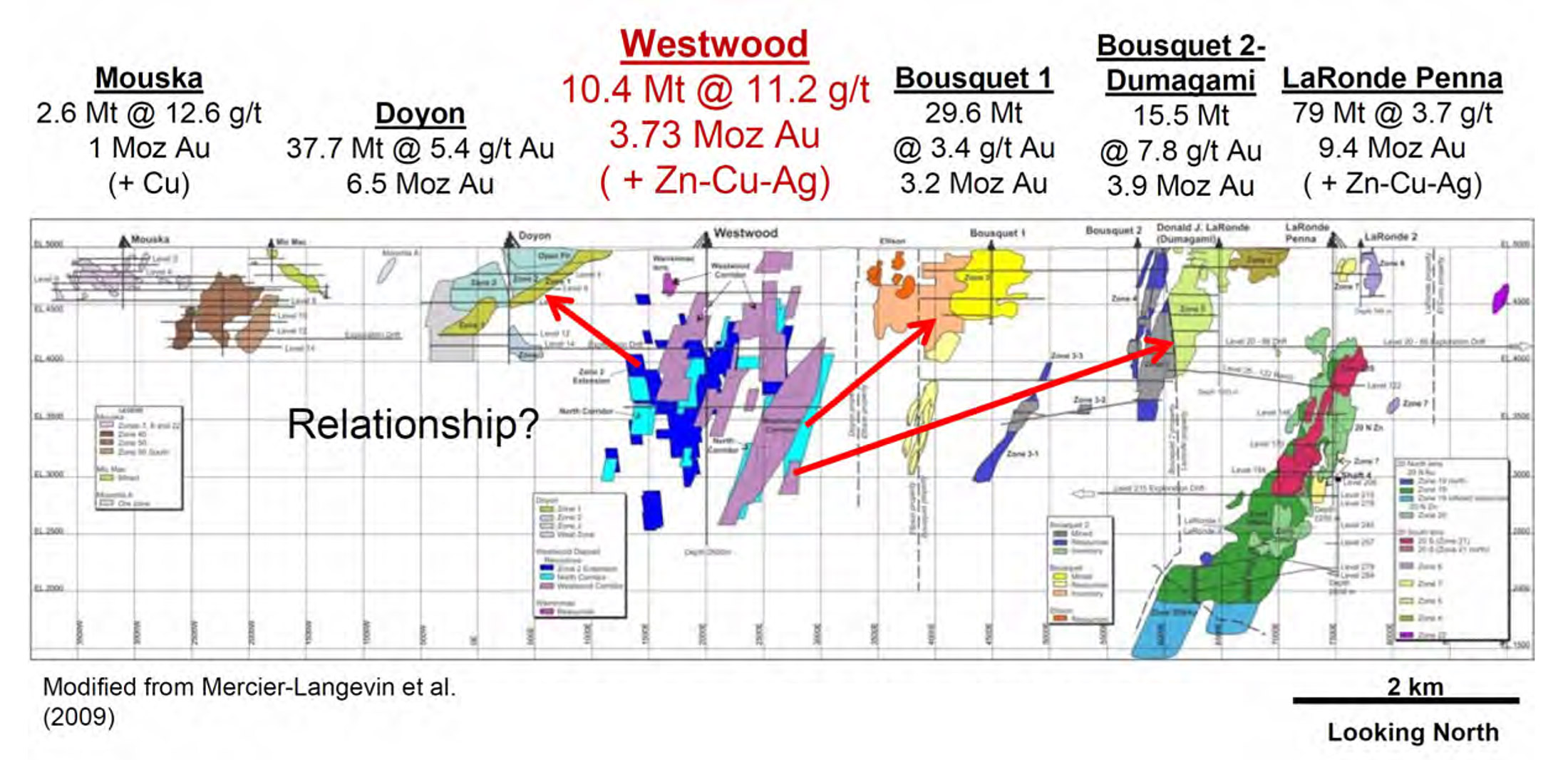

We were aware that IAMGOLD had the Bousquet-Odyno project and didn’t appear to be doing work on it. We believed their focus was on building the Côté project, which limited their exploration budget. With Nelligan being a strong asset for them, that was going to be a focus of exploration and Bousquet-Odyno was down the priority list in a sense. We also knew that the project was ideally located both from an infrastructure perspective but also along the Cadillac Break, which has been a very prolific gold producer in the past 120 years. We approached IAMGOLD for the joint venture. I believe they were receptive to us earning into the project due to our relationship with the company and because any exploration success there could add feed material to their nearby Westwood mill.

When you get the keys to a project like Bousquet, how do you deal with it? Do you start with a blank page as a fresh set of eyes could bring new ideas to the table? Or did Vanstar just pick up where IAMgold left off?

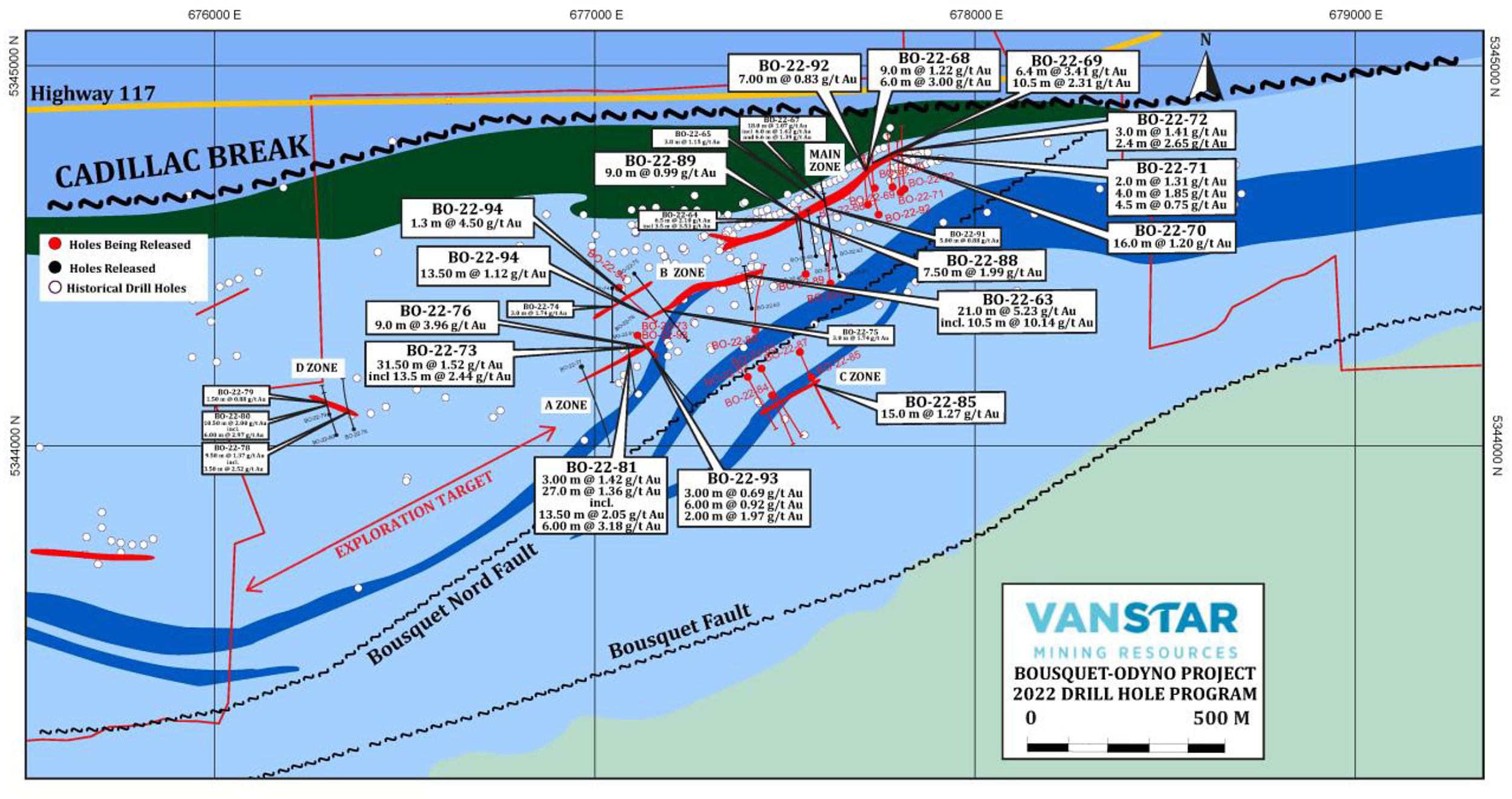

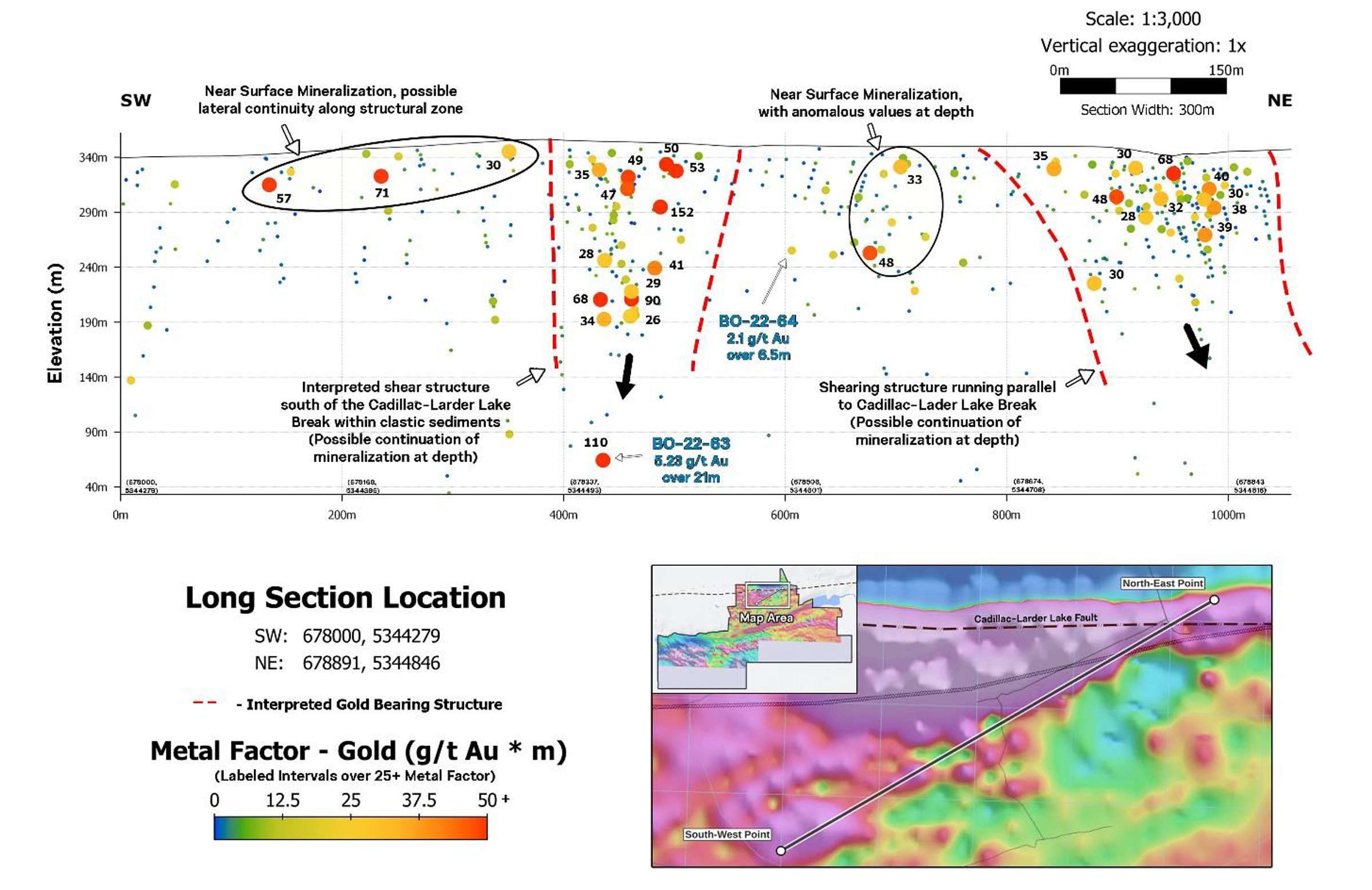

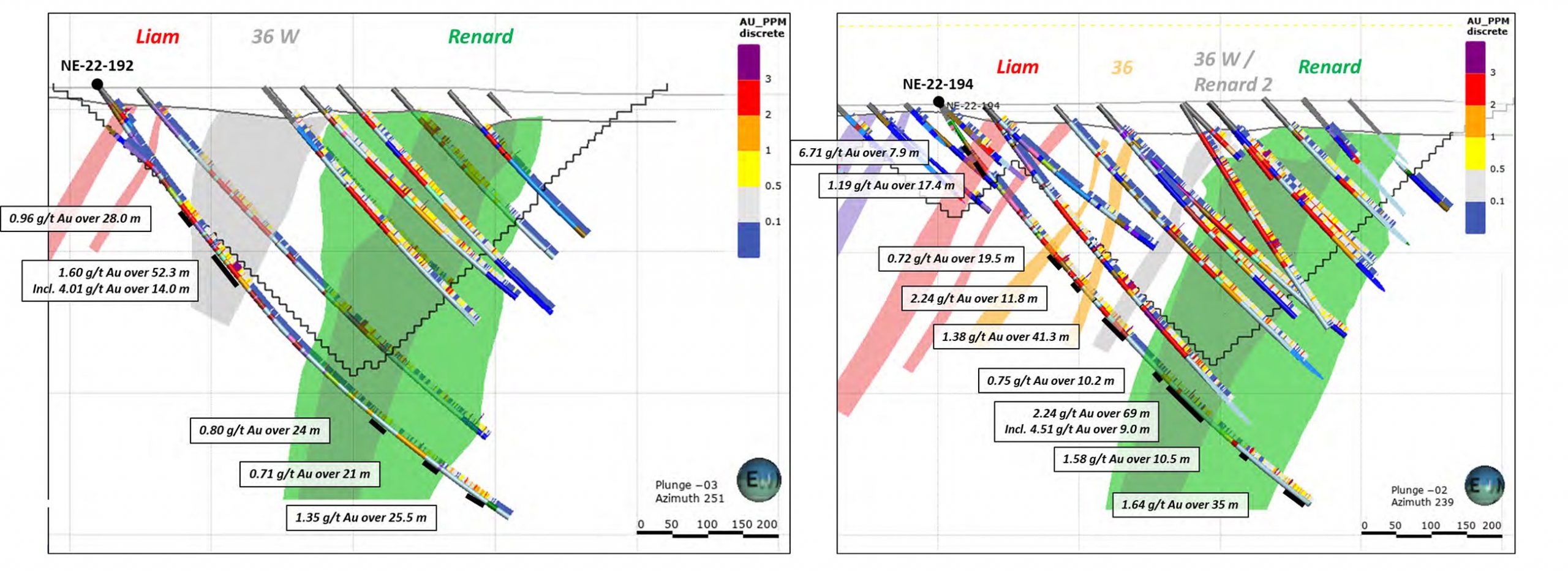

It is a bit of both. We have the benefit of IAMGOLD’s experience on the project as well as their presence on the operating committee. As operator we also have the ability to direct exploration. From previous drilling, there were obvious targets that needed to be explored, both near surface and at depth. Most of the historical drilling on the project was near surface, less than 200 m deep, and we could see that certain high-grade zones seemed to be open at depth. Many projects in this area along the Cadillac Break have found the richest parts of their deposits at depth and have been mined to depths of kilometers. So we believe that this project has considerable potential as we drill deeper. At the same time, there is also potential as we drill along strike, where there is little drilling to date.

May we assume you are very pleased with the results of the 2022 drill program at Bousquet? Hitting gold in all of the 32 holes is a phenomenal success ratio pretty much every exploration company out there is likely jealous about. Of course, not all holes were exceptional in grade and/or width, but you must be pretty pleased.

You are right that we were very happy with the results. As well as every hole intercepting mineralization, we’ve identified new zones along strike, found areas where the deposit widens near surface, and found higher grades at depth. Our very first hole test the down plunge extension of a high-grade shoot and returned an intercept of 10.5 m grading 10.14 g/t Au, demonstrating the potential at depth. We also had wide intercepts near surface, including 31.5 m grading 1.52 g/t Au within 100 m of surface, indicating that there is also open-pitable potential. Our results definitely justify further work to expand on the work completed to date.

In a comment on the most recent drill results, it was mentioned ‘the D-Zone could be in a mineralized cross-structure which opens up new targets on the project’. Could you elaborate on this statement and how the recent D-Zone drill results may impact your exploration approach?

The gold zones at Bousquet-Odyno lie within roughly east -west trending sedimentary rock contacts. The historical drilling has been mostly focused on these contacts and have been generally successful at discovering gold mineralization. The mineralized zones are at time off-set from each other along north-south trending structures such as fault zones or shear zones. At Zone D, there are indications that the mineralization could be related to one of these north-south structures and this interpretation opens up targets along this structure, which has not drilled before. Success along this structure would open up other target along these structures elsewhere on the property.

Now you are getting a better idea of the location of the stacked gold zones, are you also able to figure out the thickness of the zones, or do they pinch and swell?

The Bousquet-Odyno property contains a gold system on the scale of kilometers in which we can see pinching and swelling where the swells are related to folding within the system. The folds zones may be responsible for thickening of the gold system with higher gold concentrations. Identifying and defining these areas will be important in identifying open-pitable material near surface.

Is there another deposit in the Abitibi Greenstone belt (ideally with a similar ‘stacked zone’ system) that could be a good comparison for Bousquet?

The Bousquet-Odyno system is typical of other gold deposits along the Cadillac Break. There are a number of mines that have similar deposit styles. Agnico Eagle’s (AEM, AEM.TO) Lapa Mine as well as the former open pit Doyon Mine had similar parallel gold structures. The Lapa Mine was mined down to a depth of more than 1 km. This project was located along a drag fold within the Cadillac Break.

How much of the required C$4M to obtain a 75% stake in the project have you already spent after this most recent drill program?

To date we’ve spent approximately C$1.5 million on the project. That was the amount of flow-through funds that we needed to spend by the end of this year. Bouquet-Odyno gave us the best risk-reward ratio and so it was the obvious choice for our exploration expenditures. We now have over 3 years to spend the remaining $2.5 million, so we are at no risk to needing to raise funds in a poor market to advance this project.

Nelligan

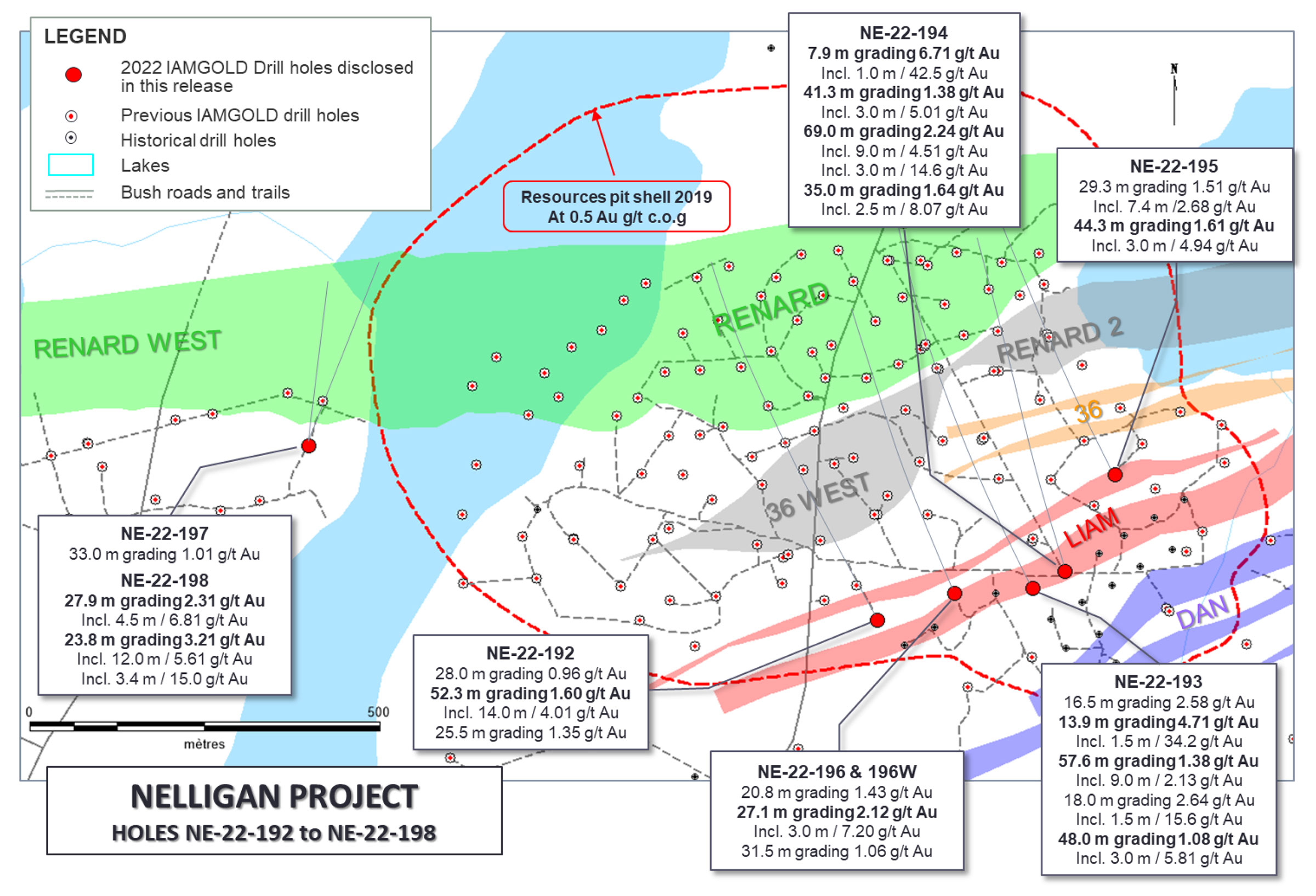

After another successful drill program last winter, we can likely expect an updated resource calculation to be released within the next few years, followed by the NI43-101 report early in the new year. It’s obviously all in the hands of the independent consultants, but do you reckon drill spacing on some of the sections is already tight enough to have some ounces in the indicated resource category, or should we just expect everything to still be in the inferred category?

Yes. The 2021 program included an infill drilling campaign. I would expect that the updated resource will grow significantly with additional inferred resources, but it will also include higher confidence resources in the indicated category.

IAMgold is obviously in a bit of a tough spot as the massive capex overrun at the Coté Gold Project requires all available resources and liquidity. Do you reckon IAMgold will take advantage of the lakes freezing over to get a winter drill program underway?

I believe that Nelligan is a world class asset and that it is the obvious project for IAMGOLD to advance towards production over the coming years. It appears to be the obvious next project that the company should construct after Côté .IAMGOLD does need to worry about its financial position, but the Nelligan project is important enough that I believe it will get an exploration budget for the coming year.

What do you think is the critical mass to reach before IAMgold can start to think about a PEA? Or would a larger producer like IAMgold just get everything ready for a PFS-stage study first and skip the PEA stage?

There are a number of factors to consider prior to moving ahead with an economic study, including determining the possible development scenarios with appropriate scope and terms of reference. A major point is that the Nelligan deposit remains open in all directions, meaning it could potentially grow significantly from here. This could significantly affect an economic study and effectively render one that is conducted too early obsolete as the project grows. As a result, they may choose to continue exploration to find the limits of the deposit before moving ahead towards a PEA or PFS.

Corporate

How much of the flow-through dollars do you still have to spend this year?

We have now spent all the flow through funds we were required to spend this year. We will close this year with likely about C$2.7 – 2.8 million in the bank with no flow-through expenditure requirements

Now you have an active agreement on the Bousquet-Odyno project, may we assume Amanda and Felix are on the backburner as it looks like you are in a position to create more value at Bousquet as secondary property?

The Bousquet-Odyno has a good risk-reward ratio so it is high on our priority list of projects. We will consider our options with respect to other projects that we have in our pipeline, including potential join ventures.

Any parting thoughts?

I believe that Vanstar is a low-risk exploration investment. We have a carried interest in a world class deposit (Nelligan) where we don’t have to spend any money to advance it all the way to production. If market conditions are not there to support our value when it comes to raising exploration funds, we simply have to let our joint venture partner advance the project and create value for us.

Conclusion

Vanstar Mining currently just has a market capitalization of approximately C$17M while it is on track to earn a 75% stake in the Bousquet-Odyno gold project from IAMgold while it currently has a 25% stake in the flagship Nelligan project (that stake will be reduced to 20% when IAMgold completes a feasibility study on the project). A resource update on Nelligan should be published shortly and if we would use an anticipated 4.5-5 million ounces of gold (note: this number is for illustrative purposes only and most definitely not an official guidance of the company, but we don’t think we will be off by too much), the 25% stake would represent 1.1-1.25 million attributable ounces of gold. And even if we would use a 20% stake upon the completion of a feasibility study, the resource attributable to Vanstar Mining would be approximately 1 million ounces.

We understand the market is a bit skeptical about IAMgold’s ability and willingness to continue to push the Nelligan project forward while it is experiencing cost overrun related headaches at the massive Coté Gold Project in Ontario. That being said, we do expect to see a winter drill program at Nelligan which should confirm IAMgold is still very interested in advancing Nelligan.

Disclosure: The author has a long position in Vanstar Mining. Vanstar Mining is a sponsor of the website. Please read our disclosure.