A lot has happened since our previous update on West Point Gold (WPG.V) as the company completed an important round of drilling on the Tyro structure of its flagship Gold Chain project in Arizona demonstrating the project is open along the structure to the NE, SW and at depth. Furthermore West Point completed important initial metallurgical test work to determine the best approach to potentially recover the gold from the rock. The company also dropped a project (Jefferson North, Nevada as it didn’t want to spend in excess of C$5M cash on property payments in the next two years while it acquired a strategic new project in Nevada for shares.

And while all of this was happening, West Point also completed a C$8M financing, largely with institutional investors with Van Eck as most noticeable participant, currently holding a 12.5% stake. That financing boosted the current cash position to in excess of C$9M. This healthy treasury will allow the company to continue its exploration approach and hopefully this will result in a maiden resource estimate on the Tyro zone, which could be the basis to advance the project to the phase of economic studies – if warranted.

There is plenty of work to do, but West Point Gold is making good progress in systematically derisking the Gold Chain project by focusing on the advanced Tyro zone where the recently upgraded exploration target seems to confirm West Point Gold is exceeding its initial tonnage and grade targets.The lower end of the exploration target now points towards at least 1.25 million ounces of gold at an average grade of 2 g/t (which is high for an oxide-based gold project) while the higher end of the exploration target implies 3 million ounces of gold at an average grade of 3 g/t gold.

The recent drill results at Gold Chain confirm the potential of the Tyro Zone

West Point Gold has completed approximately 6,000 meters of drilling on the Tyro Main Zone, and the drill bit has yielded results that surpassed our expectations. The most recently released holes, published in July, once again confirmed the thick mineralized intervals with for instance 59.4 meters of 1.25 g/t gold, almost 69 meters containing 0.9 g/t gold and just under 37 meters containing 0.91 g/t gold.

While the grades may not sound too exciting, keep in mind these grades are a multiple of the average cutoff grade in similar deposits. Just a short hike to the south, the Moss mine, now owned by Mako Mining (MKO.V) uses a cutoff grade of 0.15 g/t in its 2021 technical report, so to say 0.9 g/t meets the threshold of what should be economic would be quite an understatement. While only the economic studies completed by independent third parties will prove the economics of a project, if a company can’t make 0.9 g/t gold in oxide mineralization work in Nevada or Arizona, something is very wrong. So while there is no resource or an economic study just yet, we are very encouraged by the progress West Point Gold has made.

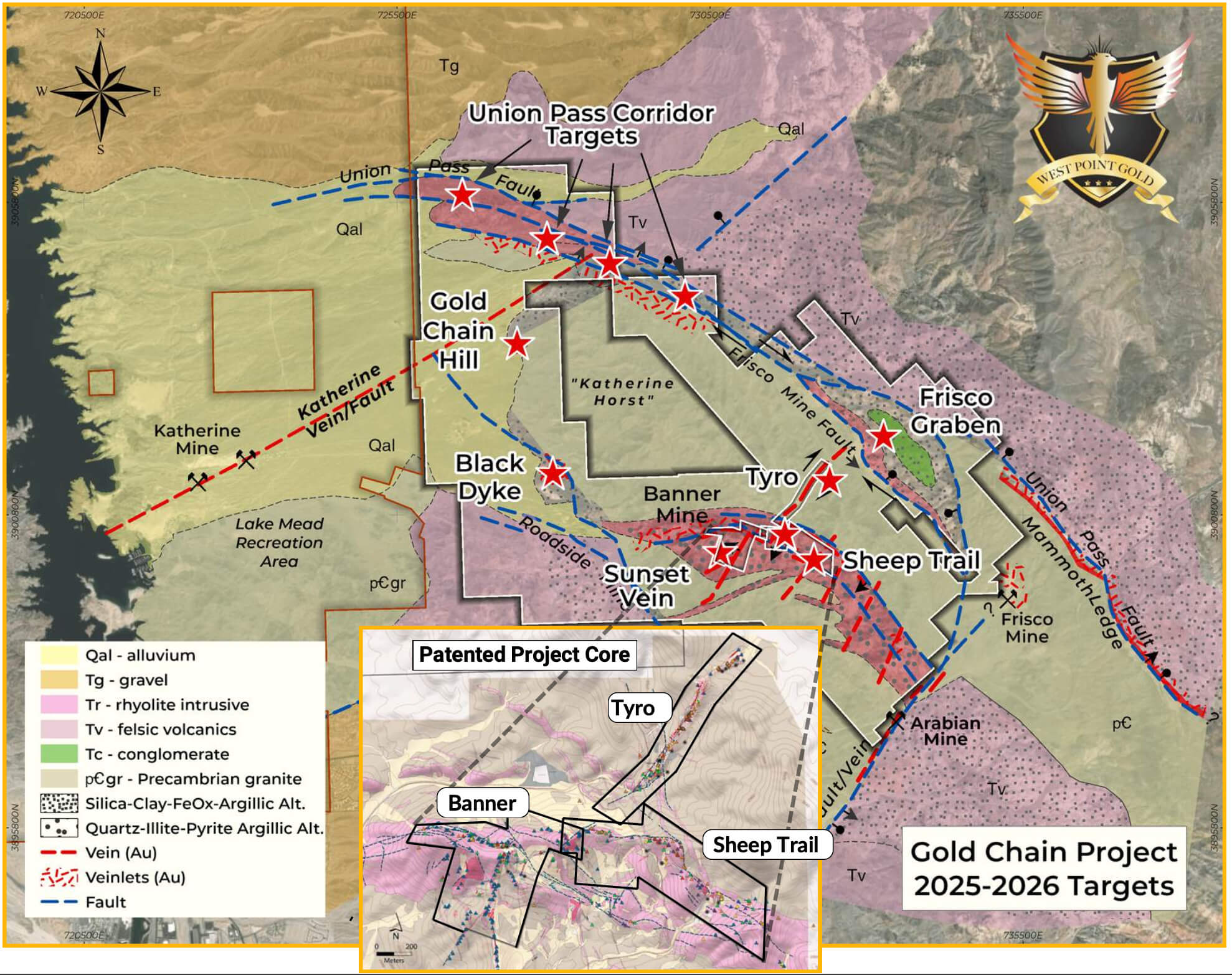

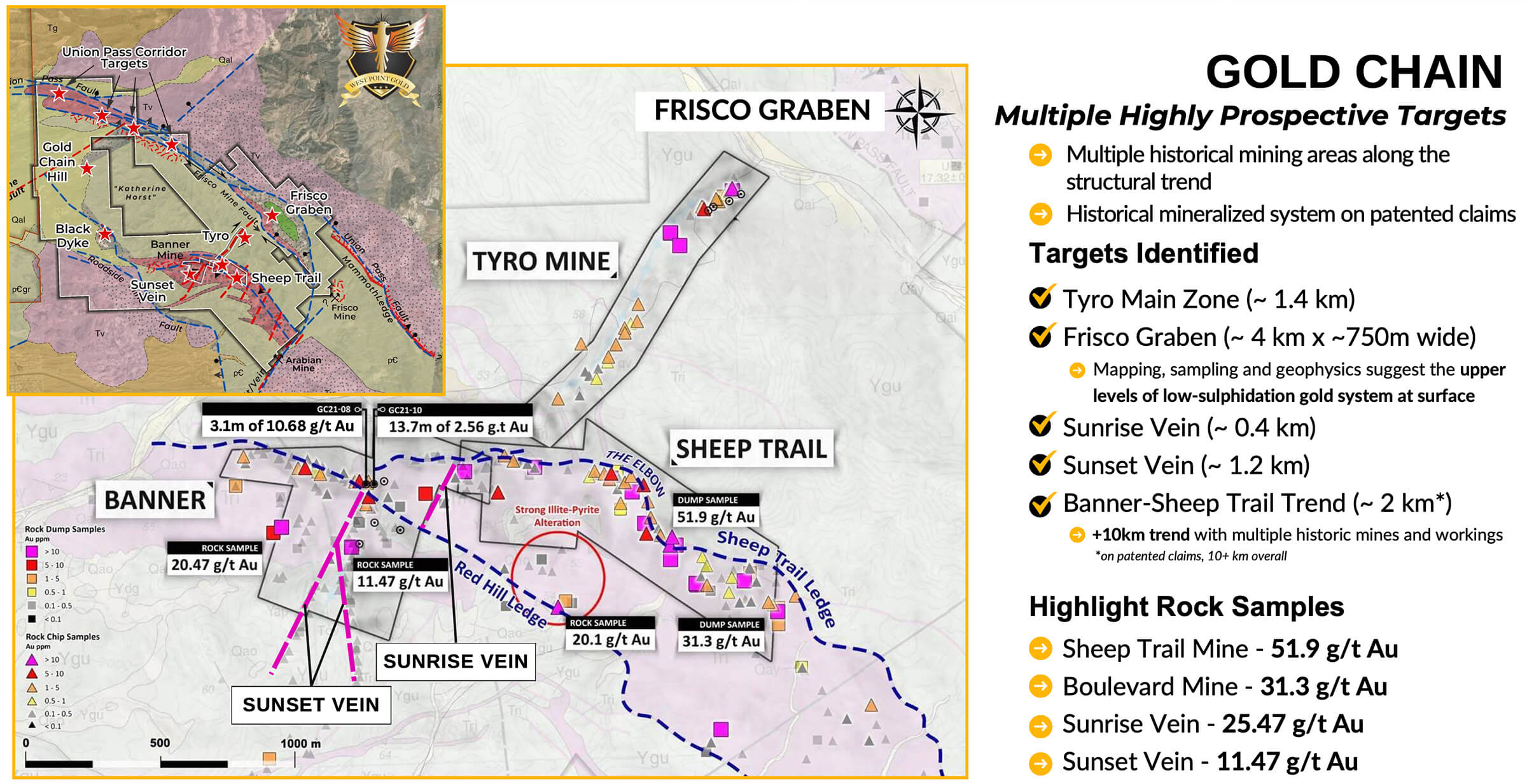

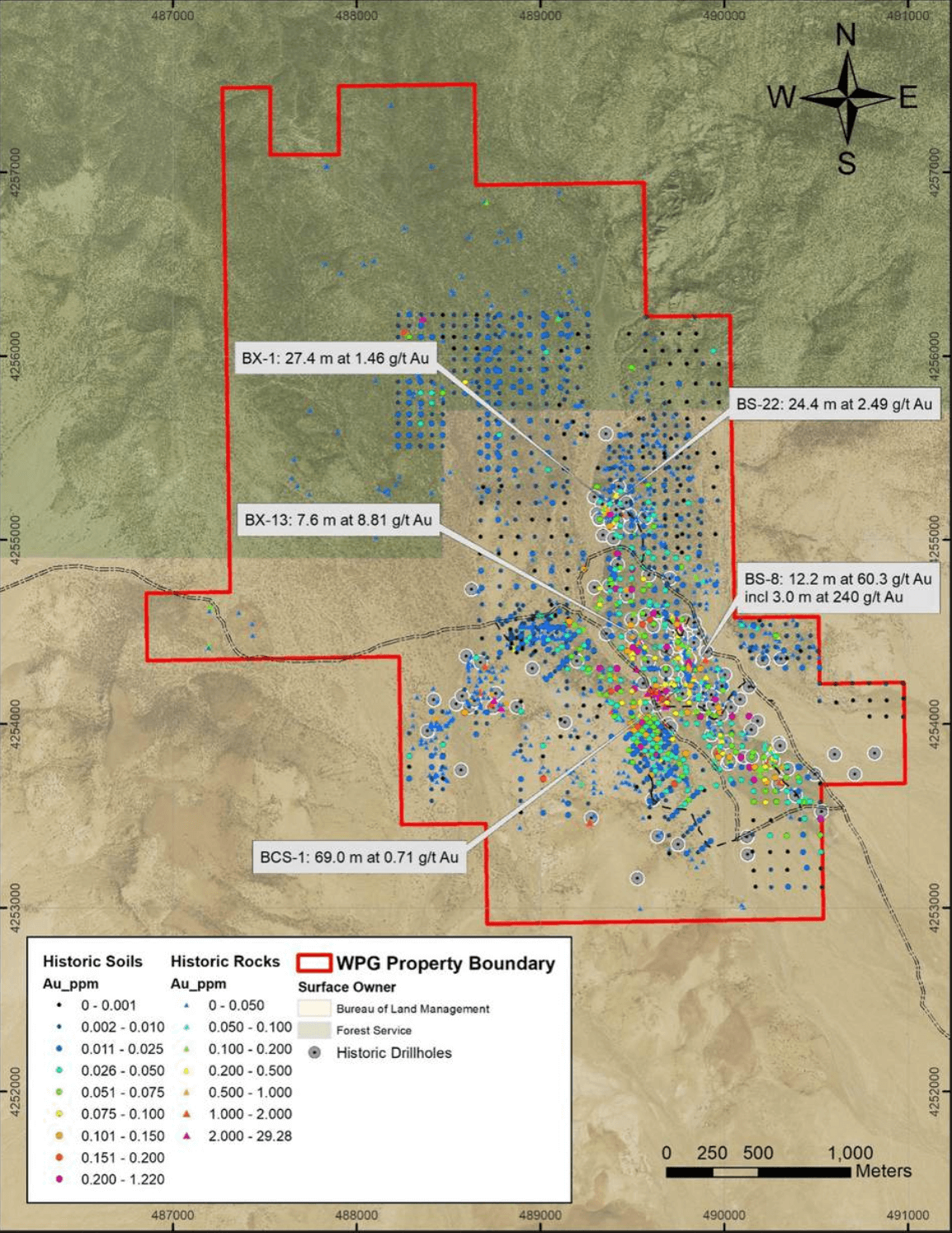

In its corporate presentation, West Point Gold mentions there are ‘multiple multi-million ounce targets’ on the Gold Chain land package. The image below highlights all exploration targets and some of the previously encountered high grade samples.

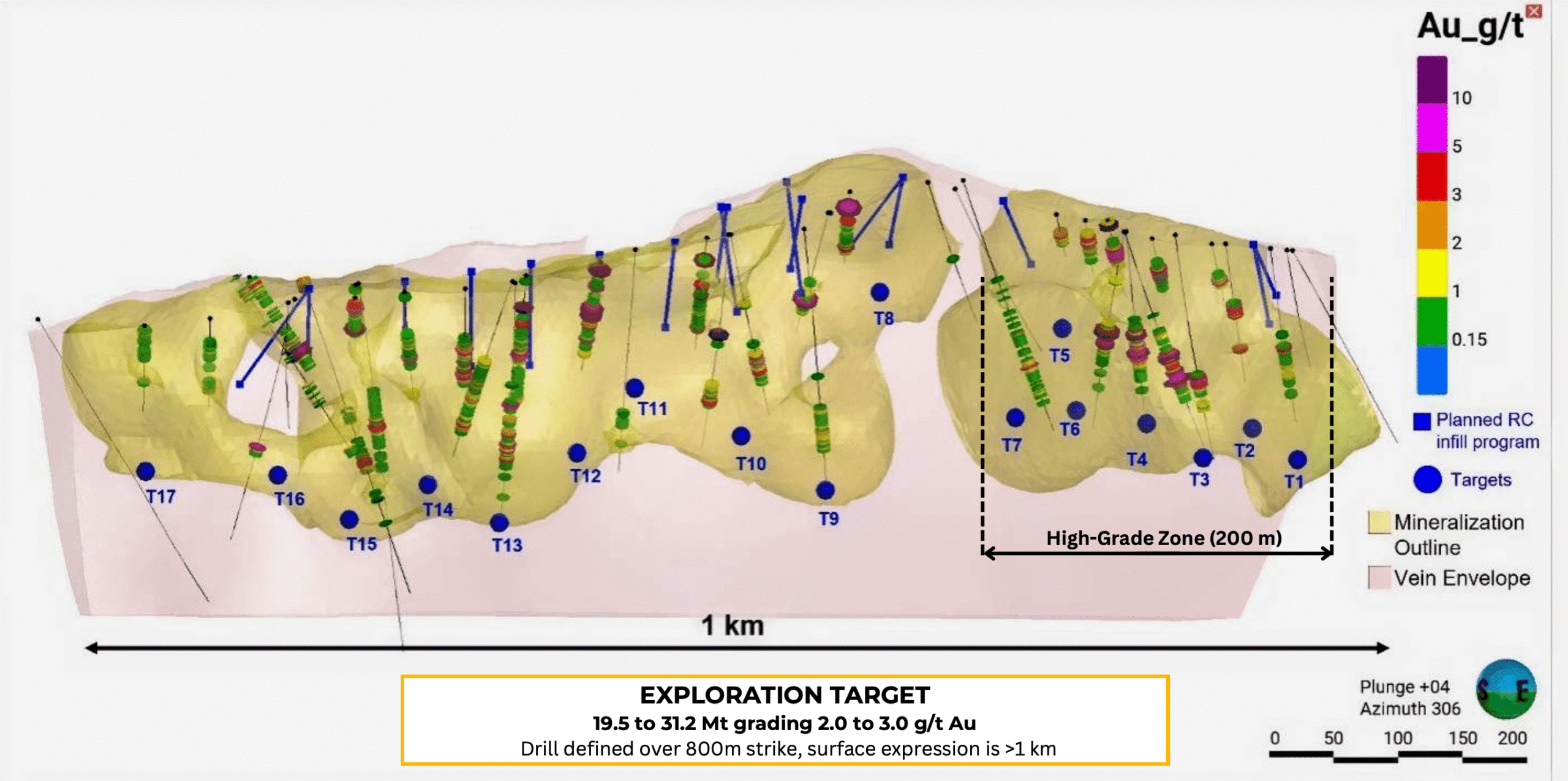

West Point Gold has been focusing on the Tyro Main Zone, which makes sense considering we agree this likely provides the easiest path towards a maiden resource estimate, but it is clear there are numerous targets on the land package. The Tyro Main Zone is a 1 km long surficial expression of a 3.4 km target that extends across the Banner Sheep Trail Fault. And those targets don’t all have to have multi-million ounce potential; having a handful of satellite deposits even with just a few hundred thousand ounces each would be value-accretive in a potential development scenario given the proximity to the Tyro zone.

The next steps at Gold Chain

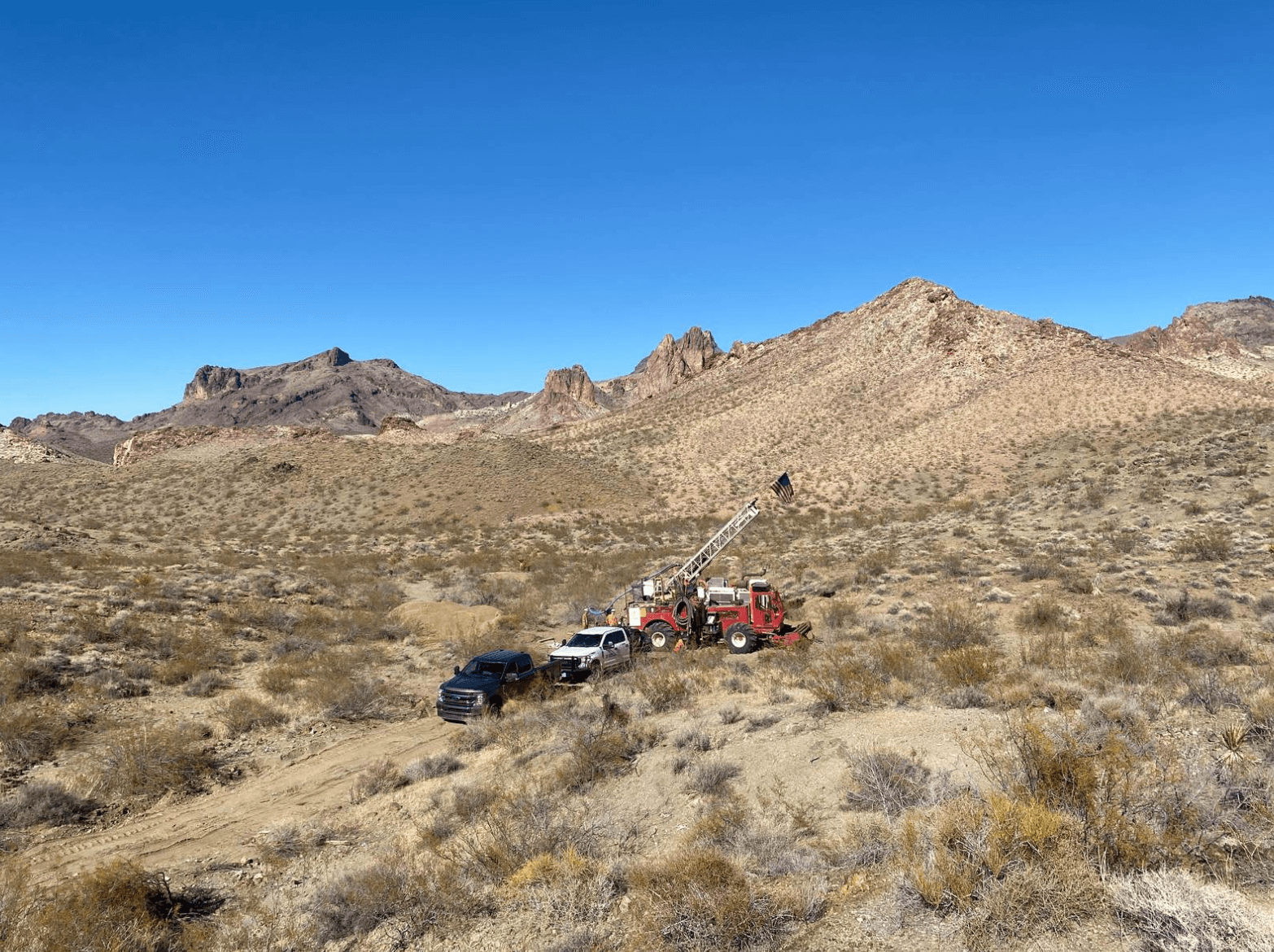

West Point Gold recently announced it kicked off another 10,000 meter drill program with a specific focus on extending the Tyro Main zone at depth, do some infill drilling at Tyro Main and drill-test some of the step-out targets, including the Frisco Graben.

But what really stood out in the company’s update was not WPG announcing a new drill program, but the update of its exploration target.

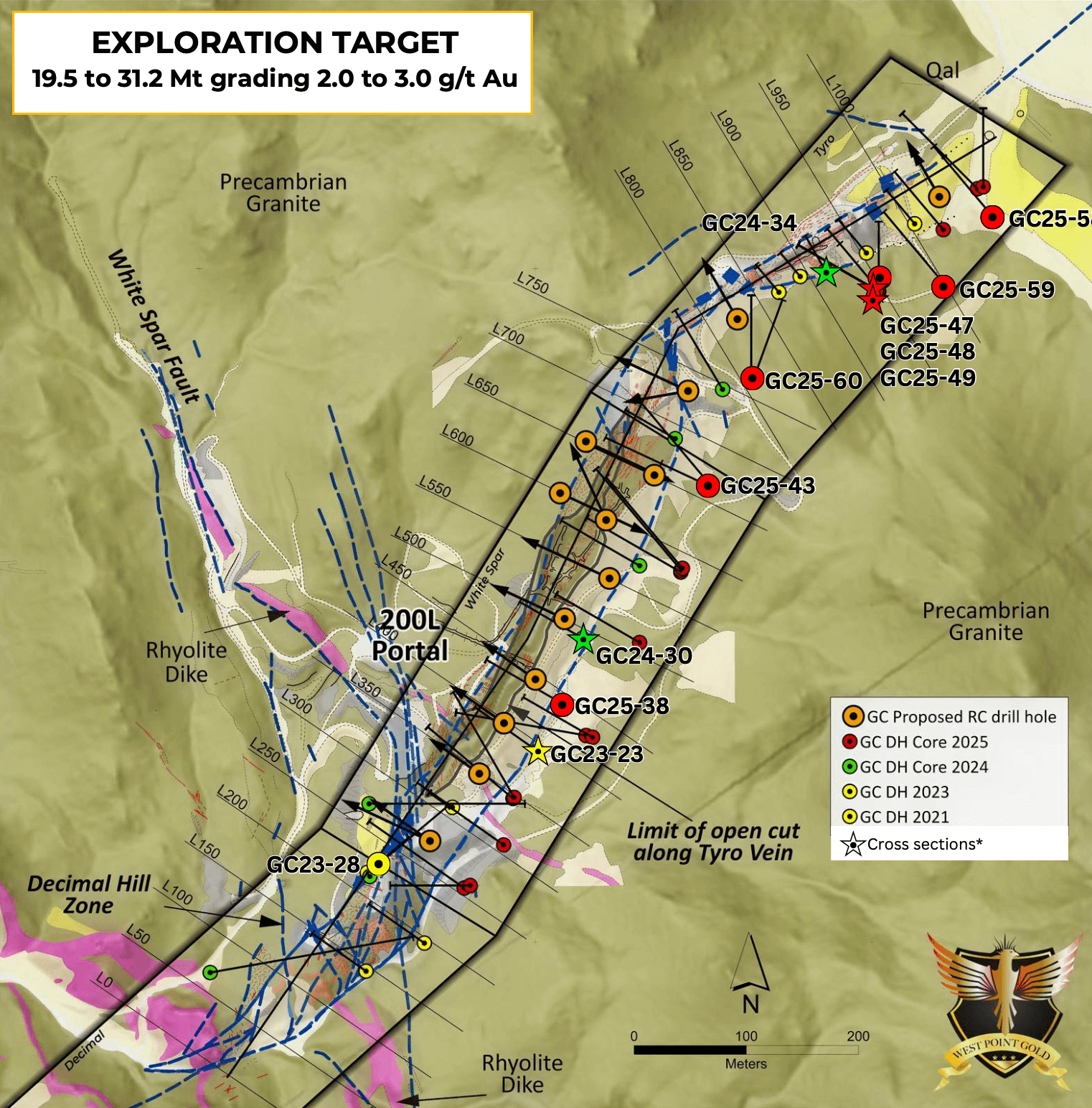

As you may remember, when West Point Gold was created, its initial exploration target was 15.6-31.2 million tonnes at an average grade of 1.5-2.5 g/t gold. Subsequent to the recent exploration success, the company has now updated and upgraded this to 19.5-31.2 million tonnes at an average grade of 2-3 g/t gold. This means the total amount of gold in the exploration target has now been upgraded to anywhere between 1.25 million ounces and 3 million ounces. While that still is a wide range, this certainly indicates West Point Gold feels very comfortable signaling to the market Tyro will exceed 1 million ounces of gold. Of course, exploration targets are just conceptual in nature and the current 10,000 meter drill program will provide a tonne of additional data.

Looking at how the exploration target was derived, West Point’s technical team used a footprint of 1,000 meters by 40-60 meters while the mineralization extends to a depth of 250-300 meters. That’s interesting because this means the exploration target is based on a strike length of just 1,000 meters of the 3.4 kilometer long structure (and 800 of that 1,000 meters has already been drill-defined). The anticipated strip ratio will be one of the key elements to keep an eye on when/if West Point gold releases a maiden resource. Based on the current wireframe model, it looks like the strip ratio will be low for the top layer of the mineralization, gradually increasing as the mineralization goes deeper. But it is tough to quantify that at this point, and hopefully the next round of drilling will provide more data points to get a better understanding of what a prospective resource and potential development plan could look like.

Some of the new holes will be drilled in the direct vicinity of holes 47-48-49 and that will be very interesting as holes GC25-47 to 49 intersected 50.3 meters of 3.76 g/t gold, 41 meters of 4.33 g/t gold and 62.5 meters of 4.73 g/t gold. Two additional holes further to the north east of Tyro Main, towards the Frisco Graben returned weak mineralization, but that could be explained as the real drill target is located deeper as the mineralization moves further towards the Graben. The upcoming drill program will contain a few additional holes around these previously intercepted thick and high-grade results.

The metallurgical test work allows the company to tick yet another box

Having gold in the ground is one thing. Being able to mine it and recover it at a profit is a whole different question. Although the company doesn’t have a maiden resource yet, it is already trying to tick all the required boxes, and completing a preliminary metallurgical test program is a very important box to tick.

The initial metallurgical test work (based on a bottle roll test of 23 holes) demonstrated the gold at Tyro, is primarily oxidized and thus could likely be recovered with cyanide using conventional processing methods. Gold recovery rates ranged from 32% to 86% while silver recovery rates ranged from 34% to 80% during the test phase. The recovery rates were very depending on crush size (finer material enjoyed a higher recovery rate versus the more coarse material) while the initial test program confirmed the consistency in the recovery rates: the depth or the grade of the sample had no real impact on the recovery rates, while the lime and cyanide consumption levels were well within the expected parameters.

The next phase of the metallurgical test work will likely use a small-scale bulk sample to further finetune the process as this will help to determine the optimal crushing size and leach time. Additional met work, perhaps in combination with a maiden resource calculation at Tyro, would put West Point Gold in a strong position to start working on a Preliminary Economic Assessment.

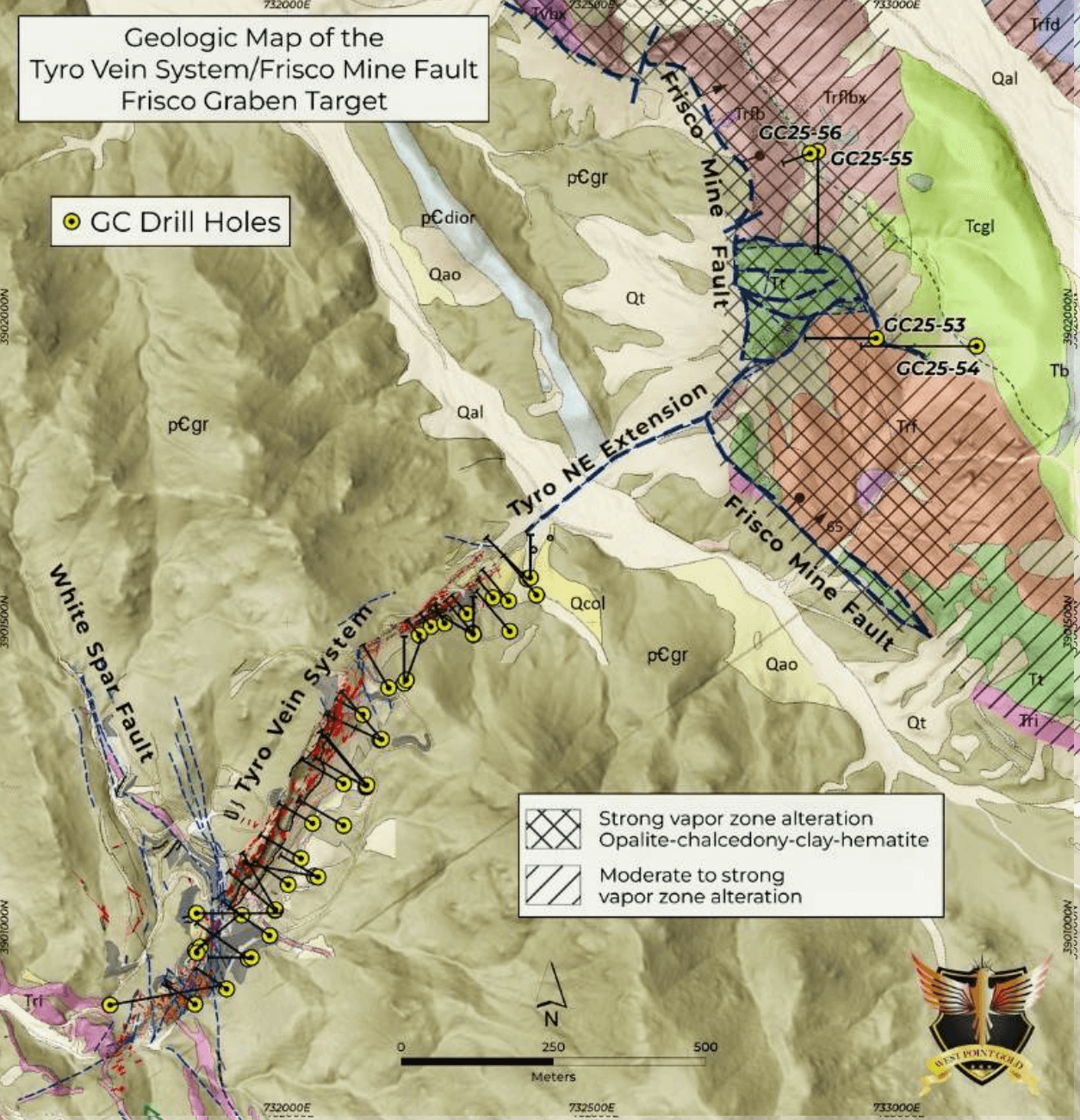

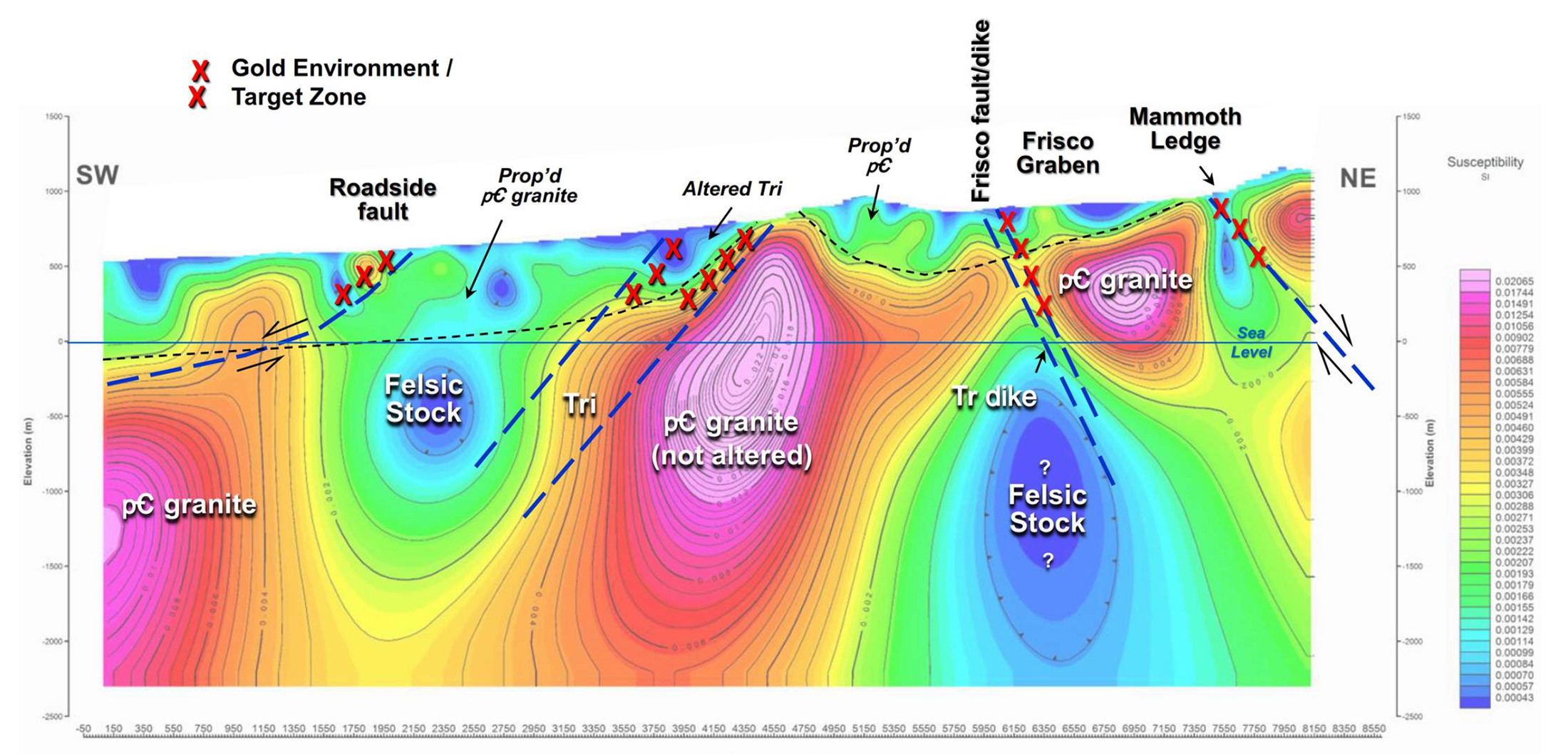

The drill holes into the Graben didn’t immediately return good grades – and that’s alright

While our attention remains on the Tyro zone where we see the best potential to rapidly move towards a maiden resource estimate, the company also drilled four holes in the Frisco Graben target. As a reminder: The Frisco Graben is an interesting exploration target as it appears to be a pretty similar target to the Silicon deposit that’s currently being expanded by AngloGold Ashanti (AU). As you know, AngloGold’s project in Nevada (including the assets it acquired as part of the Corvus Gold takeover where West Point CEO Quentin Mai was working in corporate development) is located on the same Walker Lane Trend, so it’s not surprising to see initial similarities.

We considered this to be the ‘blue sky’ target on the Gold Chain land package, as it will be easier to generate immediate and tangible value from the at-surface gold mineralization at Tyro, and in our previous publication we mentioned a 15-20 hole drill program would likely to be the best way to figure out this Graben, so the recently completed 4 hole drill program is really just a very preliminary ‘first pass’.

The four holes that were drilled at the Graben (for a total of just under 1,100 meters of drilling) encountered anomalous gold values (with all intervals still below 0.1 g/t gold) immediately below the Frisco Mine fault. Although no relevant gold grades were detected, the company’s technical team remains quite upbeat on the Graben target as the press release mentioned the ricks drilled are oxidized and altered (which further confirms the potential for gold mineralization at depth) while the lab results contained mercury in the assays, and that’s the first time this pathfinder was encountered at Gold Chain. Mercury traditional is a good indicator for gold in low-sulphidation epithermal systems.

Based on the data from the drill holes, the company now believes it had exited the graben at the Frisco Mine fault, and above the desired location and/or elevation which means the expected ‘boiling zone’ at the intersection of the clay-rich alteration with the fault remains untested.

The exploration update on the Graben target was very technical and appeared to be geared towards readers with a technical background (institutionals and corporates) rather than the average retail investor. And although CEO Quentin Mai confirmed the Frisco Graben ‘remains a compelling target that warrants follow-up drilling’, we expect the immediate attention and focus to turn towards the Tyro main zone and the other oxide-hosted mineralization on the Gold Chain land package. Meanwhile, West Point Gold can work on securing the drill permits for new drill locations at the Frisco Graben, as the ideal drilling locations appear to be to the south and east of the recently completed holes.

While the Frisco Graben remains a valid exploration target, the focus of the recently announced 10,000 meter drill program will be on the Tyro zone (including the Sunset area, which really is part of the Greater Tyro zone). We agree with that approach, as it certainly will be easier to pick the low-hanging fruit and perhaps work towards a maiden resource calculation at Tyro.

Adding a project in Nevada to the asset base

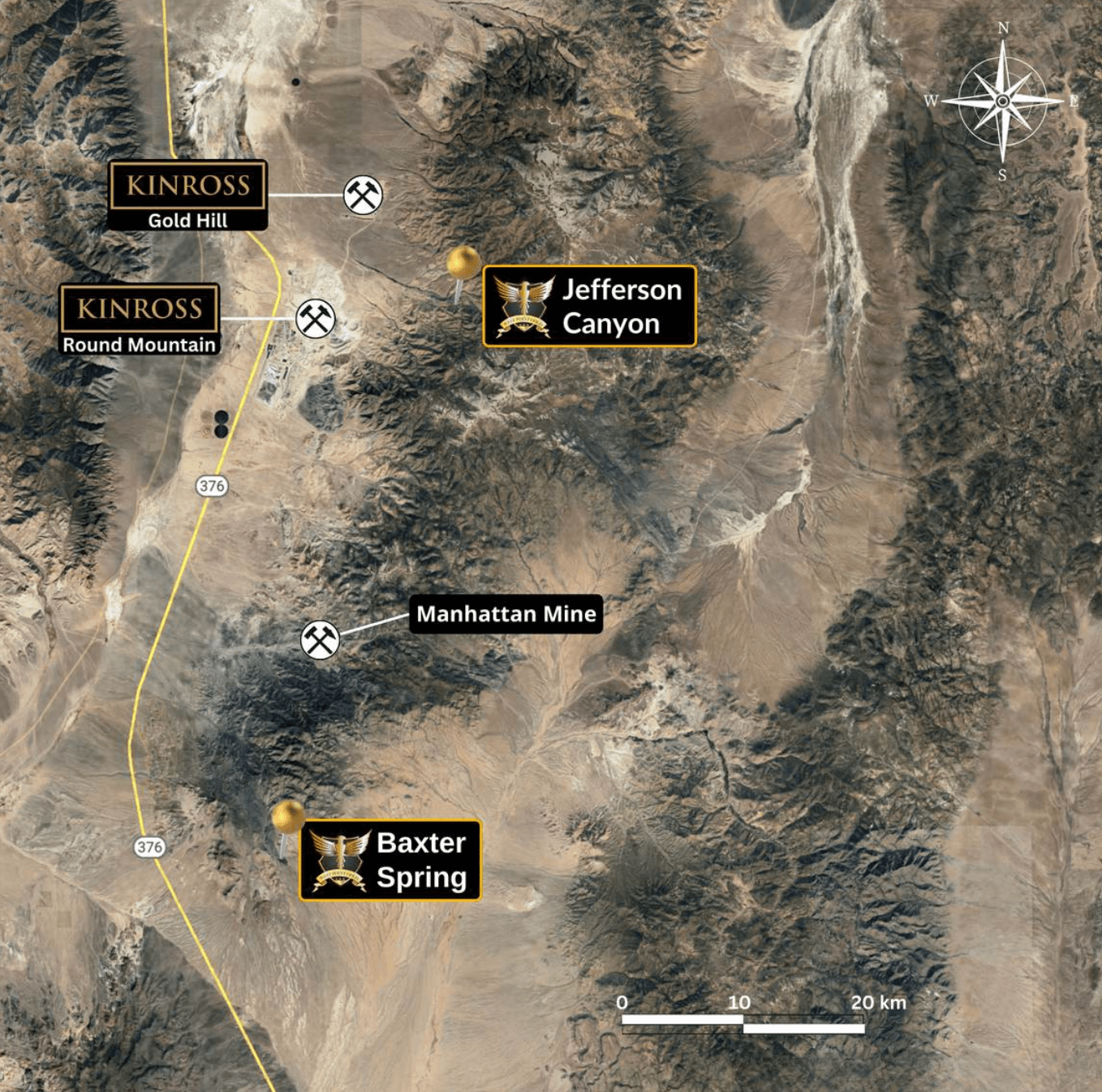

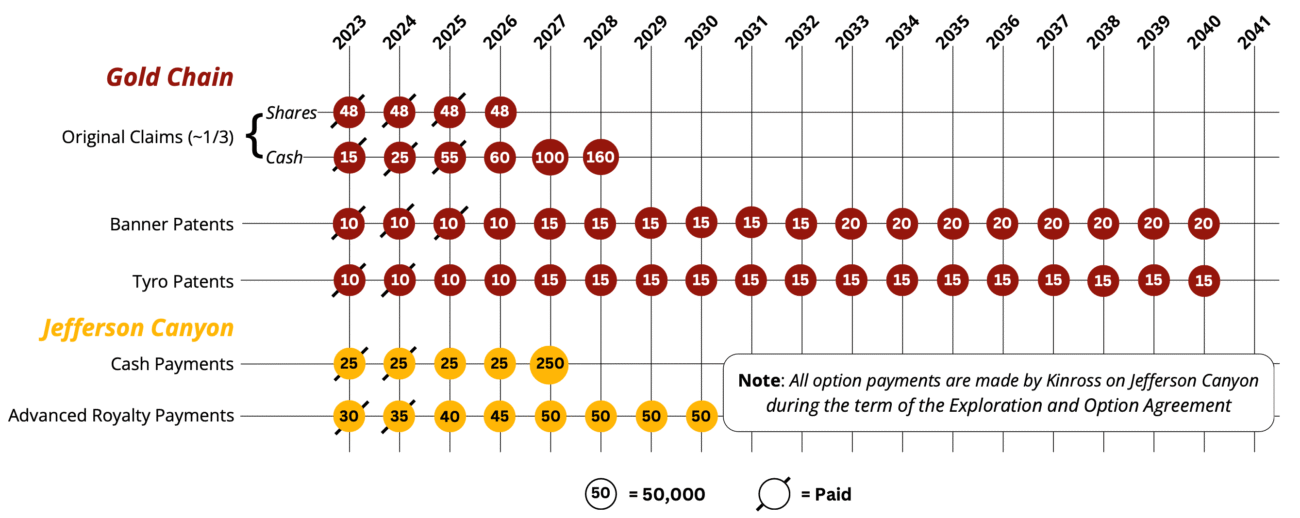

Last week, West Point Gold announced it has entered into a share purchase agreement to acquire full ownership of the Baxter Spring project through the acquisition of Baxter Gold, a private Canadian company.

Baxter Spring is a relatively advanced stage project as past operators completed almost 13,000 meters of drilling (of which 1,850 meters of core drilling) in 128 drill holes. The bullet points below highlight some of the most impressive historical assay results.

The project is an advanced stage exploration project in Nevada’s Nye County, approximately 40 kilometers south of the Round Mountain Mine (operated by Kinross Gold (K.TO, KGC) and the 137 unpatented federal lode claims are on BLM (the southern half) and US Forestry Service (northern half) land. The historical exploration activities have identified multiple zones of mineralization with vein structures within the zone of oxidation and within 300 meters from the surface. Deeper drilling encountered the Lower Plate rocks of the Roberts Mountain Formation at depths of 400 to 700 meters. Some of these rocks exhibit hydrothermal alteration features associated with Carlin-type epithermal gold mineralization.

Acquiring Baxter Spring does not mean the company is shifting gears. Gold Chain definitely remains the flagship project (the recently started 10,000 meter drill program and upgraded exploration target are a testament to that), but it indicates the technical team and corporate development team remain on the lookout for opportunistic acquisitions.

We wouldn’t be too thrilled if West Point Gold was chasing grassroots exploration projects but given the abundance of drilling and millions of dollars in historical exploration expenses, Baxter Spring shows some resemblance to Gold Chain when West Point Gold picked it up.

The consideration consists of 13.5 million shares of West Point Gold, subject to a lock-up period whereby every six months a quarter of the shares become free tradeable. The project remains subject to a 2% NSR payable to a subsidiary of Liberty Gold Corp (LGD.TO).

The company is cashed up after its raise

In June, the company completed a C$8M raise, priced at C$0.45 per unit. Each unit consisted of one common share as well as half a warrant with each full warrant allowing the warrant holder to acquire an additional share at C$0.55. This means that, if all 8.9M warrants in this financing get exercised, West Point Gold will receive an additional C$4.9M in net proceeds.

The sizeable financing happened at an 80% premium to the previous financing (which was priced at C$0.25 with a ½ warrant at C$0.40), and happened right after the company’s share price was able to catch a bid and reached the C$0.60 level. Unfortunately very few of the C$0.40 warrants were actually exercised which mean s the company couldn’t count on those cash proceeds to keep the exploration program on the flagship project going. That’s a pity, but fortunately the majority of the C$8M financing was taken up by institutional investors, and we noticed the Van Eck VIP Global Gold Fund disclosed a position of 644,500 shares and 322,250 warrants in its Q2 overview. This means Van Eck acquired the securities in the C$0.45 financing, and this further increases the credibility of this management team and the project. It’s our understanding some of the other Van Eck Funds also participated in the financing.

Conclusion

West Point Gold was initially hoping to see more of the C$0.40 warrants being exercised to keep the treasury at a reasonable level, but unfortunately that plan didn’t work out and a private placement was the only way to raise enough dough to keep the exploration engine humming along nicely. This definitely puts the company in a comfortable position on the financing front, the cash will of course be spent on exploration activities in the next year or so, and hopefully this will culminate in a strong maiden resource calculation on the Tyro zone while highlighting the additional exploration potential on the other mineralized zones on the Gold Chain land package.

With approximately C$9M in cash in the bank, West Point Gold is well-capitalized to continue to aggressively explore the flagship Gold Chain project and we hope to see assay results starting to roll in in the near future.

Disclosure: The author has a long position in West Point Gold. West Point Gold is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our full disclosure.