We usually aren’t too excited about early stage exploration companies, but when those companies attract a big name with decades of experience under their belt, there usually is a good reason why people whose name and fame have already been established are joining a small company.

That’s the case at X-Terra Resources Inc. (XTT.V). This Québec focused exploration company has signed an option agreement to acquire the Veronneau property, and right after doing so, it appointed veteran Mr. Michel Chapdelaine to its board of directors and technical advisor to the company. After having worked in Québec for almost three decades (with his last position being Chief Geologist for Virginia Mines, which merged with Osisko Gold Royalties), it’s remarkable to see someone with his reputation accept a position at a small and unproven company!

The company will fully focus in the Veronneau property

Now all pieces of the puzzle have fallen into place, it’s very clear X-Terra Resources will spend most of its exploration dollars at Veronneau this year. After having entered into a purchase agreement to acquire claims that are part of the Veronneau Gold project, it signed an option agreement to acquire the entire surrounding property from private vendors.

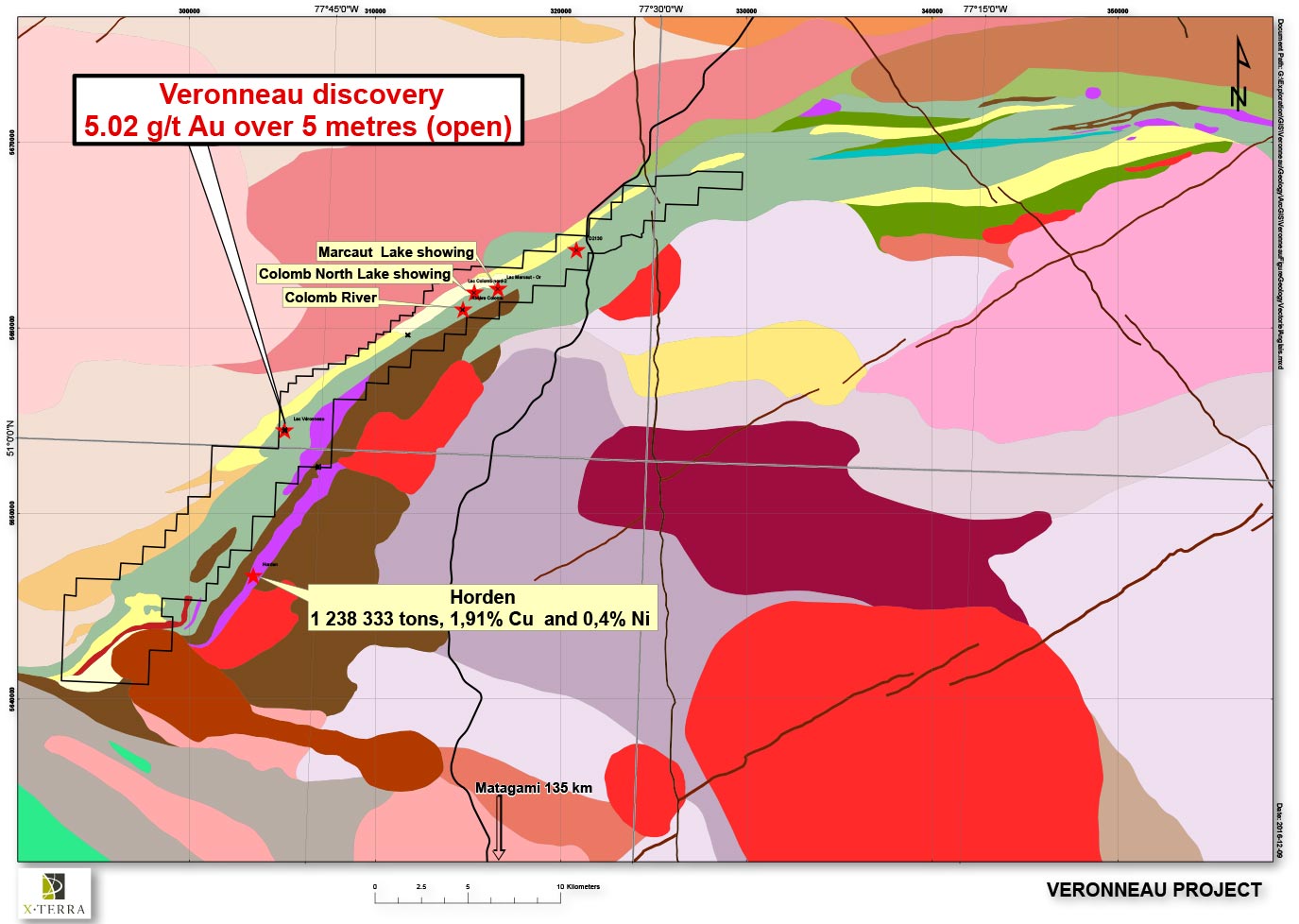

Veronneau is located approximately 135 kilometers north of Matagami in Québec, and after the recent property acquisitions, the company now covers the entire underexplored Colomb-Chaboullié greenstone belt. No modern exploration has taken place at Veronneau, and the most recent historical data date back more than 20 years when Cambiex reported drill intercepts of almost 4 meters containing in excess of 8 g/t Au, and three meters of 7 g/t Au.

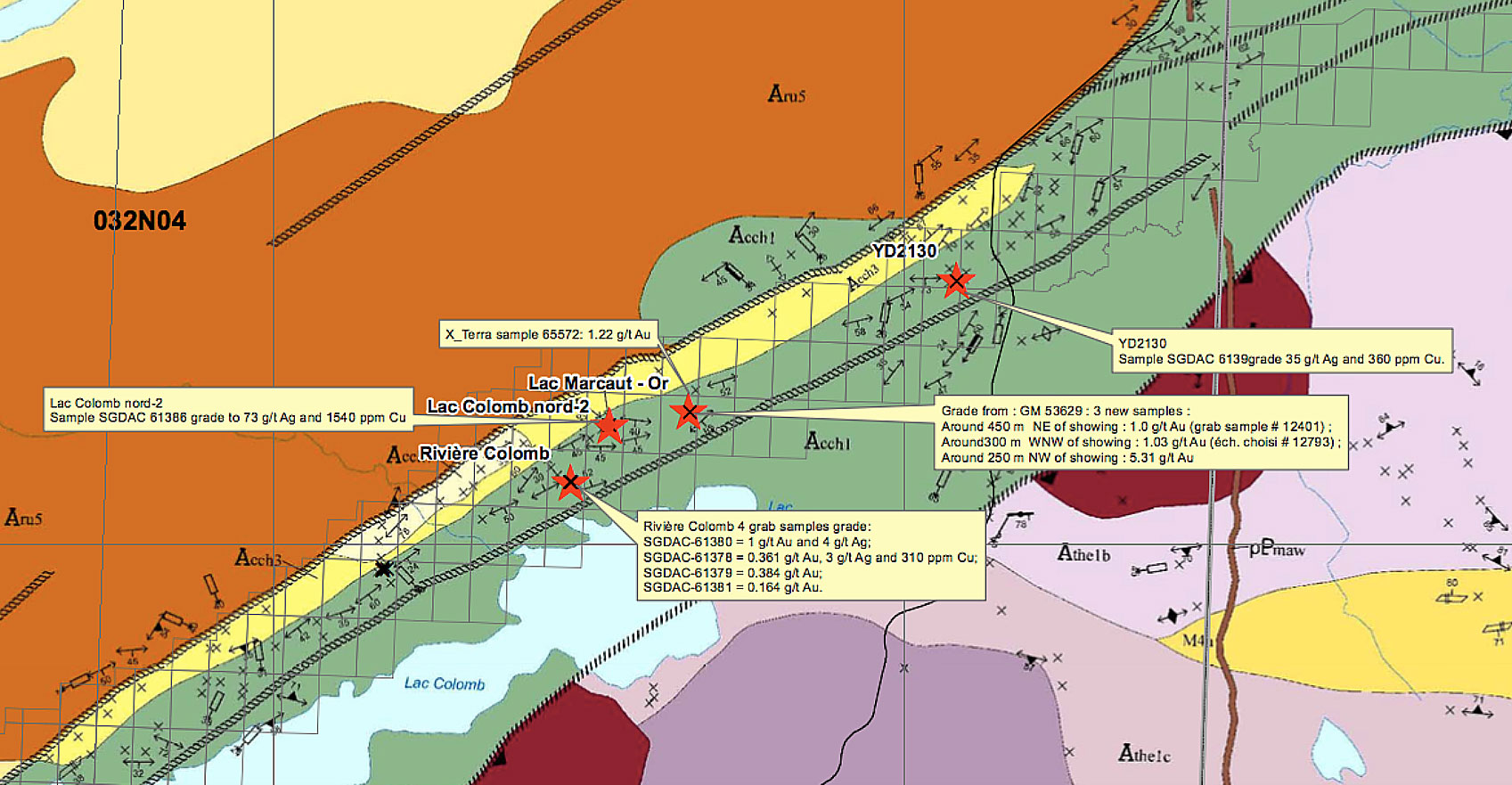

What’s really interesting is the fact a new gold showing was discovered in 2015 by geologists of the Québec ministry of natural resources whilst they were completing a mapping program of the area. The current owners of the property have subsequently completed a channel sampling program (summer 2016), with assay results of up to 2.39 g/t Au over a width of 4.5 metres. X-Terra also completed a sampling program during its due diligence phase (fall 2016), and with several samples returning gold values of in excess of 5 g/t Au (with some samples coming in at in excess of 10 g/t Au). Moreover, their limited channel sampling program returned 5.01 g/t Au over 5 meters and remains open in both directions, so that explains why the company was so keen to complete a joint venture deal with the current (private) vendors.

This deal has now finally been completed, and the technical team can finally roll up their sleeves and prove up the value of the project.

The acquisition terms are quite favorable

X-Terra Resources has negotiated a staged earn-in schedule for an initial 60% interest in the Veronneau property. It had to pay C$100,000 in cash and issue 1.25 million shares upon signing, and committed to spend at least C$250,000 on the property in the first six months after the formal agreement, followed by an additional 1.25 million shares due on the 12 month anniversary, earning its first 10% interest.

On the second anniversary, X-Terra has to pay an additional C$50,000 and issue an additional 1.25 million shares after completing C$1M in work expenditures on the property, to increase its stake in the project to 25%. In the third year, XTT can increase its ownership to 51% by spending another C$1M on the property, issue an additional 1.25 million shares and pay C$50,000 cash. And before the end of the fourth year of the option agreement, X-Terra has to spend an additional C$1.25M on the property to earn its 60% interest.

Long story short; X-Terra will have to spend C$3.5M, issue 5 million shares and make cash payments totaling C$245,000 to the current owners to earn a 60% stake in the Veronneau project. As all work expenditures are spread out over time, X-Terra has all the time it needs to maximize the efficiency of its planned exploration efforts.

The importance of Michel Chapdelaine as a director and technical advisor should not be underestimated

Sometimes it’s not the property which defines the quality of the company and very often it’s the quality of the management and exploration team which draws the most attention.

That’s why last week’s announcement of Michel Chapdelaine joining the company as a director actually is an important update. Mr. Chapdelaine definitely isn’t a ‘nobody’ on the Québec mining scene as he has been working on the ground for almost three decades.

His career looks very impressive as Mr. Chapdelaine worked for Virginia Mines (which merged with Osisko Gold Royalties a little while ago) where he became Chief Geologist after a 15 year stint at the company. He was instrumental in the discovery of the Éléonore gold mine which was discovered by Virginia Mines and later sold to Goldcorp (GG, G.TO) for $420M.

Needless to say Mr. Chapdelaine seems to have a good nose to find gold deposits, so when someone with his name and credibility joins a, with all due respect, nano-cap company like X-Terra Resources for its early stage Veronneau gold project, our interest is definitely triggered.

X-Terra will hit the ground running in 2017

What’s really interesting is the fact an electromagnetic survey has confirmed the continuity of the auriferous mineralization up to two kilometers towards the southwest of the Lac Marcaut showing (where Cambiex drilled its high-grade intercepts).

As you can see on the previous map, X-Terra’s entire Veronneau property contains numerous showings and even though a 2 kilometer long electromagnetic anomaly around the Marcaut Lake showing is already very interesting, the ‘real’ discovery on the Veronneau property was the channel sample of 5 meters containing 5.01 g/t Au open in both directions, located almost 15 kilometers towards the southwest of Lac Marcaut.

X-Terra won’t waste any time, and its geophysics team is on standby to immediately start a field program. On top of that, the company thinks it can mobilize a crew for an airborne survey within the next two weeks. According to CEO Michael Ferreira, X-Terra is planning a sizeable airborne survey with in excess of 1200 line-kilometers to be flown.

What’s an interesting feature is the fact the contractor who will execute the aerial survey will be able to provide X-Terra with a daily overview of the survey results. This should increase the efficiency of the program as this will allow the company to fine-tune the program on a daily basis, and we’re convinced Michel Chapdelaine will play an important role in his capacity as director and technical advisor to X-Terra Resources.

Team

Michael Ferreira, President & CEO

Michael Ferreira has been working with public and private companies as an independent advisor for more than five years, primarily in the junior mining sector and most recently, Mr. Ferreira was the Vice President Operations of X-Terra before being appointed to the President and CEO-role.

Sylvain Champagne, director & CFO

Sylvain Champagne is Chief Financial Officer of the Corporation. Mr. Champagne holds a B.B.A. degree from the Université du Québec in Abitibi-Témiscamingue. Mr. Champagne has extensive experience in the mining exploration industry, serving as Chief Financial Officer of Visible Gold Mines Inc. and Fieldex Exploration Inc., two companies listed on the TSX Venture Exchange.

Dr. Michael Byron, director

Michael Byron has more than 30 years of domestic and international experience in gold, base metal, magmatic nickel and PGE, REEs and uranium, diamond, and gemstone exploration. He is a professional geoscientist registered in Ontario and the Northwest Territories, and holds advanced degrees in Geology including a PhD from Carleton University of Ottawa, Ontario. Prior to Nighthawk Gold Corp., where he is currently the President and CEO., Dr. Byron served as Vice President of Exploration at Lake Shore Gold Corp. and Aurora Platinum Corp. where he was instrumental in advancing both initial start-ups including the resource expansion at Lake Shore that eventually led to the development of its Timmins West Gold Mine.

Dr. Byron was a co-founder and director of Falco Resources Ltd, and served as Vice President, Exploration from its inception until his resignation in May 2015. He is attributed with the rediscovery of the Horne 5 deposit – Falco’s premier asset, a polymetallic project you will definitely know as we have been keeping our eye on Falco Resources for almost a year now. You can read up on Falco Resources and its large underground Horne 5 deposit here.

Michel Chapdelaine, director, technical advisor

Mr. Chapdelaine played an important role at Virgina Mines, where he was instrumental in defining the Éleonore gold deposit in Québec which was subsequently sold to senior producer Goldcorp. With several decades of experience under his belt, Chapdelaine’s role as technical advisor to X-Terra Resources will help the company to maximize the efficiency of its exploration program.

Martin Dallaire, director

Mr. Dallaire obtained an engineering degree from the Université du Québec in Chicoutimi in 1992 and has more than ten years of experience in the financial industry, with particular expertise in managing and financing junior mining companies. His experience includes strategic planning, corporate structuring and reorganization, sourcing and structuring public and private financings, due diligence reviews and mergers and acquisitions. Mr. Dallaire is also President and Chief Executive Officer of Visible Gold Mines Inc. and Fieldex Exploration Inc., each of which is listed on the TSX Venture Exchange.

Financial situation

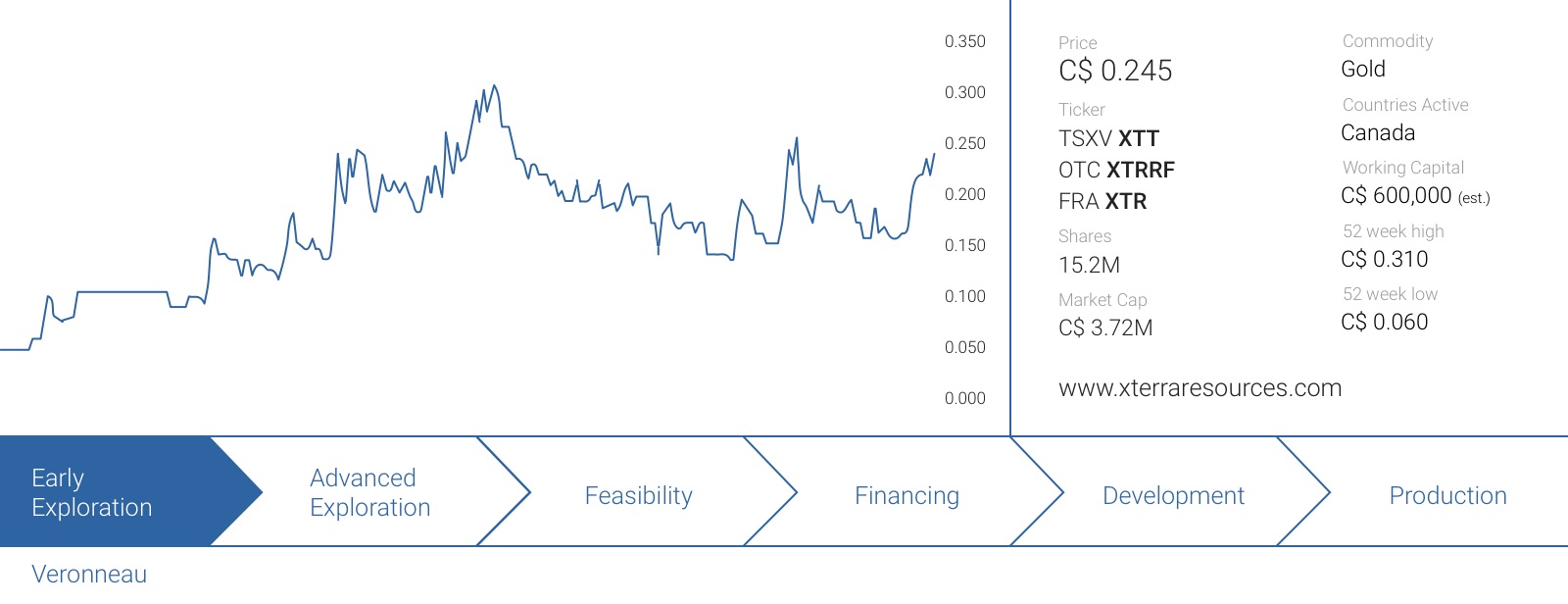

X-Terra Resources currently has 15.2M shares outstanding, giving it a current market capitalization of approximately C$3.7M. As of at the end of September, the company had a working capital position of almost C$275,000, but subsequent to the end of that quarter, X-Terra completed a private placement, raising C$457,500 in a placement priced at 15 cents per unit. We expect the company’s balance sheet to show a working capital position of approximately half a million at the end of the previous calendar year.

This should be sufficient to complete the aerial survey, but X-Terra will very likely need to raise more cash this quarter, and having added Chapdelaine to the board of directors might make this an easier task. Also keep in mind the Veronneau property is located in James Bay, Québec, so we would expect a portion of any private placement to be raised in flow-through funds as the majority of its annual budget will be invested in the property anyway.

Conclusion

The newly discovered Veronneau showing is very interesting, and the fact Mr. Chapdelaine, a senior geologist with decades of experience under his belt, is willing to join the board of directors of this small company is a huge boost for the credibility.

The earn-in agreement is very fair, and the exploration requirements are spread out in time, making it more feasible for a small company to fund the annual exploration programs. Now that the agreement has been signed, we expect X-Terra to immediately mobilize its field crews as the company will have to complete C$250,000 of expenses on the property to meet its first milestone. X-Terra Resources remains a grassroots exploration company, but by the end of this year, we will know if the company is (literally) sitting on a potential gold mine.

Disclosure: X-Terra Resources Inc. is not a sponsoring company, we were compensated by a third party. We have a long position. Please read the disclaimer