Earlier this week, Stockhouse.com published an interview with Max Porterfield, the CEO of Callinex Mines (CNX.V). We thought Chris Parry did a good job in this interview and would encourage you to read it in its entirety here.

If you’re a copper producer/explorer, 2015 will be one of those years remembered as ‘the worst of times’, that is, unless your company is named Callinex Mines.

While few year-long bag-holders who got in after March 2015 will be holding parties celebrating large personal profits, there’s definitely reason to celebrate when your investment made it through the worst market year for a long time, reasonably intact – and those who got in 13 months ago are enjoying gains of 50%+. While others have fallen hard, Callinex’s 2015 share price was as consistent as any volume-traded company I’ve seen.

The company raised $4.5m despite challenging markets, added to their technical team, earned a 100% interest in their Flin Flon Project, and added claims in good standing beyond 2020.

If you believe copper has life in 2016, and many do, Callinex has positioned itself well. So with PDAC happening soon and the company on show when it does, we asked President and CEO Max Porterfield to describe the opportunity, the outlook for precious metals, and what you might have missed about one of the top performing miners on the Venture last year.

- How would you describe your company’s opportunity to investors?

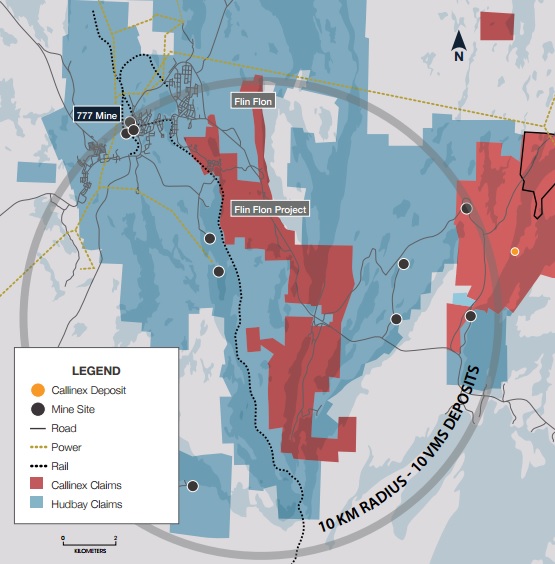

Callinex is one of the very few juniors actively drilling and we are located next door to HudBay’s (HBM, HBM.TO) 777 Mine in Flin Flon, Manitoba, which has less than four years of reserves remaining. Brent Cook was recently featured on BNN and he noted only that 5% of the 1,200 juniors have the people, projects and capital to actively conduct exploration.

Callinex has the people, project and capital to deliver continued shareholder gains. Our technical team, which includes three former PDAC award recipients for major discoveries, has continued to demonstrate their value with two new discoveries within the last six months at our Pine Bay Project. Furthermore, the Company is well positioned for continued exploration with over $3 million in cash and a supportive shareholder base that includes private equity investor Resource Capital Funds.

- 2015 has obviously been a tough year for much of the resource sector. Would you say it was tougher than 2014 for your company, about the same, or easier?

2015 was a transformative year for Callinex whereby we raised over $4 million and provided shareholders with equity gains of over 50% despite a downward trend for the resource sector in general.

In addition to raising capital, we attracted top technical talent and conducted significant data compilation to support exploration programs in 2016 and beyond. Our investors appreciated this diligent approach and early results have been very encouraging with two new discoveries at our Pine Bay Project located within the prolific Flin Flon mining district.

- Are you expecting 2016 to be a break-out year for your company? If so, why? If not “break-out”, how would you describe your expectations for 2016?

Callinex had a break-out year in 2015 and was one of the top performers on the TSX Venture. With that being said, our team is very excited to complete two major drilling programs this year totaling 10,000m. We plan to expand the size of our two newest discoveries and this could be the catalyst that our shareholders are looking for to deliver even larger returns in 2016.

- What could governments and regulators do to clear barriers to success for public company miners/explorers going forward?

Globally, I believe governments need to fully appreciate the benefits of mining which includes building infrastructure, creating employment and significant direct and indirect tax benefits.

Callinex is fortunate to be working in the Flin Flon Greenstone Belt of Manitoba where the government has cleared many barriers already. With over 85 years of continuous production over several cycles, the government understands the value of mineral production and exploration activities. Manitoba has an exploration assistance program whereby we can receive an exploration rebate up to $200,000 per year. Also, all exploration work we conduct receives double the work credits. These sorts of economic incentives, combined with a streamlined permitting process, should be adopted by many other jurisdictions to promote mining investment and job creation.

- In your opinion, what will be the next commodity to surge when resources make their comeback, and why?

We view copper as providing best returns within the next five years based on an impending supply-demand deficit. Compared to gold, where the majority of supply has already been mined, the copper market is almost entirely dependent on mine supply which requires higher prices to meet demand growth. Nearly all copper supply comes from very large projects that have multi-billion dollar costs associated with exploration, development and construction. These are exactly the type of projects that have been sidelined or postponed in the downturn.

Scotiabank already noted that an impending supply-demand deficit is inevitable in their opinion as the average large copper project takes over 10 years to advance to production. Based on this lead time to production, and the current mine life at the major mines, prices will need to increase significantly to facilitate project development.

We may be seeing the trend change with copper prices up 7% from mid-January and investment in the sector assuming prices will be much higher. Japanese mining conglomerate Sumitomo just purchased a 13% interest in the Morenci copper mine for US $1 billion. Perhaps more interesting is that Sumitomo implied a valuation of approximately $3/lb for copper rather than the current spot price of approximately $2/lb, implying a commodity price gain of 50% according to one notable fund manager.

- What is the most common mistake public resource company execs make, in your experience?

Many executives are disconnected from the market realities and are unwilling to undertake transactions that could benefit their shareholder base.

- What is the most common misapprehension investors have about your company?

The most common misapprehension about Callinex is that we are early-stage. I think this relates to the label of “exploration” stage; however, we don’t classify ourselves as fitting that mold. Our strategy is significantly de-risked from that of an exploration company as we already have several deposits within our district-scale land package and we are adjacent to established mining infrastructure. Given that this infrastructure is running out of feed, we believe there may be opportunities to avoid the capital expense associated to mine building and advanced exploration. This could result in less dilution to our shareholder base than might associated with developers seeking project funding, let alone that of an ‘early-stage’ company.

- What will it take to make mining cool again?

Shareholder profits.

Go to Callinex’ website

The author holds a long position in Callinex Mines. Callinex is a sponsor of the website. Please read the disclaimer