Valterra Resource Corp. (VQA.V) has been a semi-dormant company for a while but that seems to be changing now with the acquisition of a Brazilian gold project. The laterite project is located in an area where small-scale and artisanal mining is booming, and Valterra appears to be confident it can hit the ground running and perhaps set up a small-scale mining operation in the not so distant future.

In order to fully understand the acquisition and the potential at the Lima project, we sat down with Joe Kizis and Rob McDonald, the two main geologists at the Manex group of companies to listen to their interpretations and expectations.

The project

At the end of May, you announced Valterra had entered into an agreement to acquire the Lima gold project in Brazil for C$500,000 through the outright acquisition of a Brazilian company. How did you stumble upon this project?

One of Valterra’s long-term European investors is part of the group that created the Brazilian company whose goal was to accumulate several relatively small, but high-margin “Laterite” gold deposits. VQA’s management and technical team agreed with the premise and agreed to combine the private company’s engineering, financial, and on-the-ground Brazilian business expertise with Valterra’s public Canadian market, promotion, and geologic expertise to make the idea work.

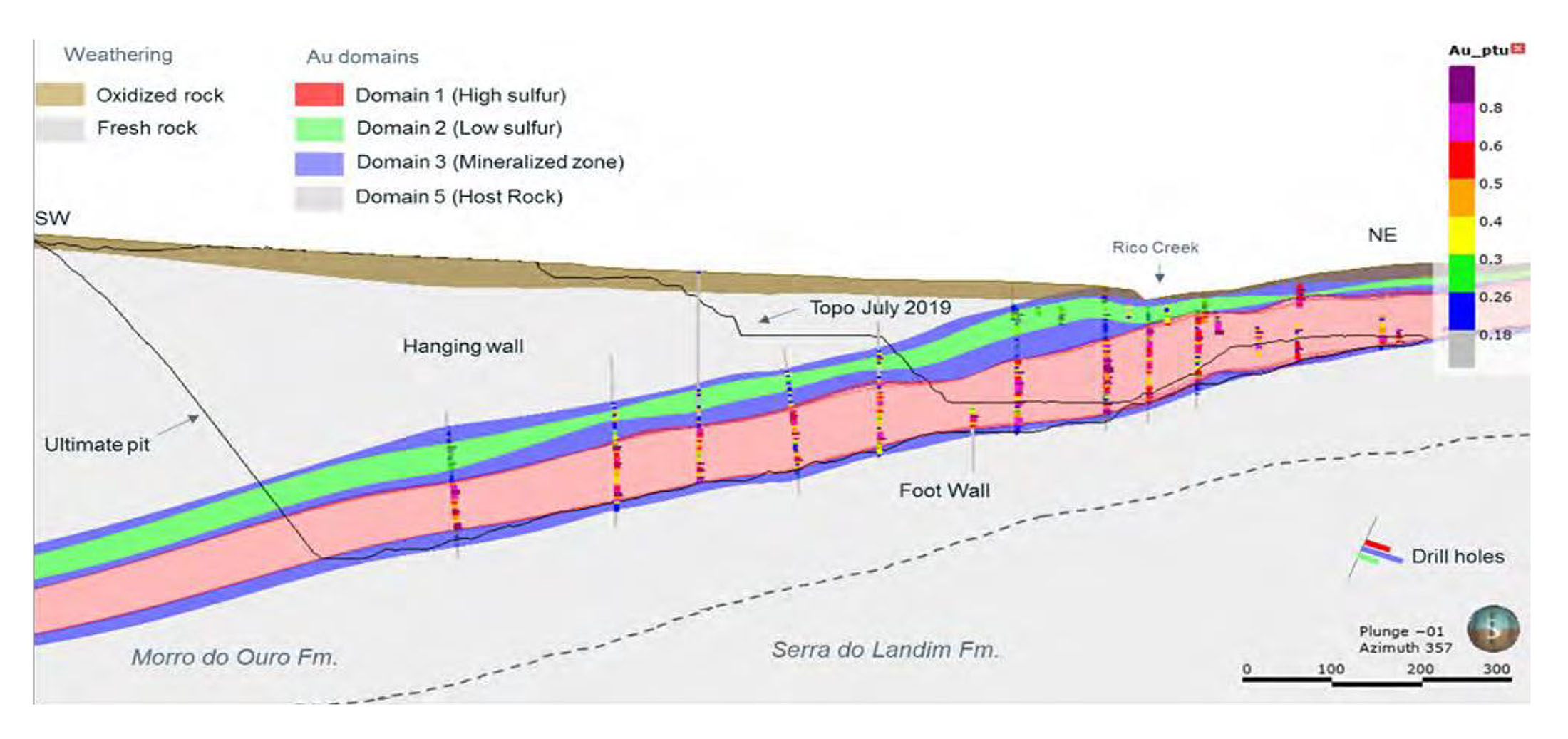

Laterite gold deposits can be highly profitable. They formed in a strongly weathered environment, which makes them simple to mine and simple to process. Often the gold grades are highest close to the surface, just below a thin leached zone.

Can you elaborate on the Poconé gold belt regarding its history, the current activities and how your new project fits the bill to apply a more ‘professional’ exploration approach?

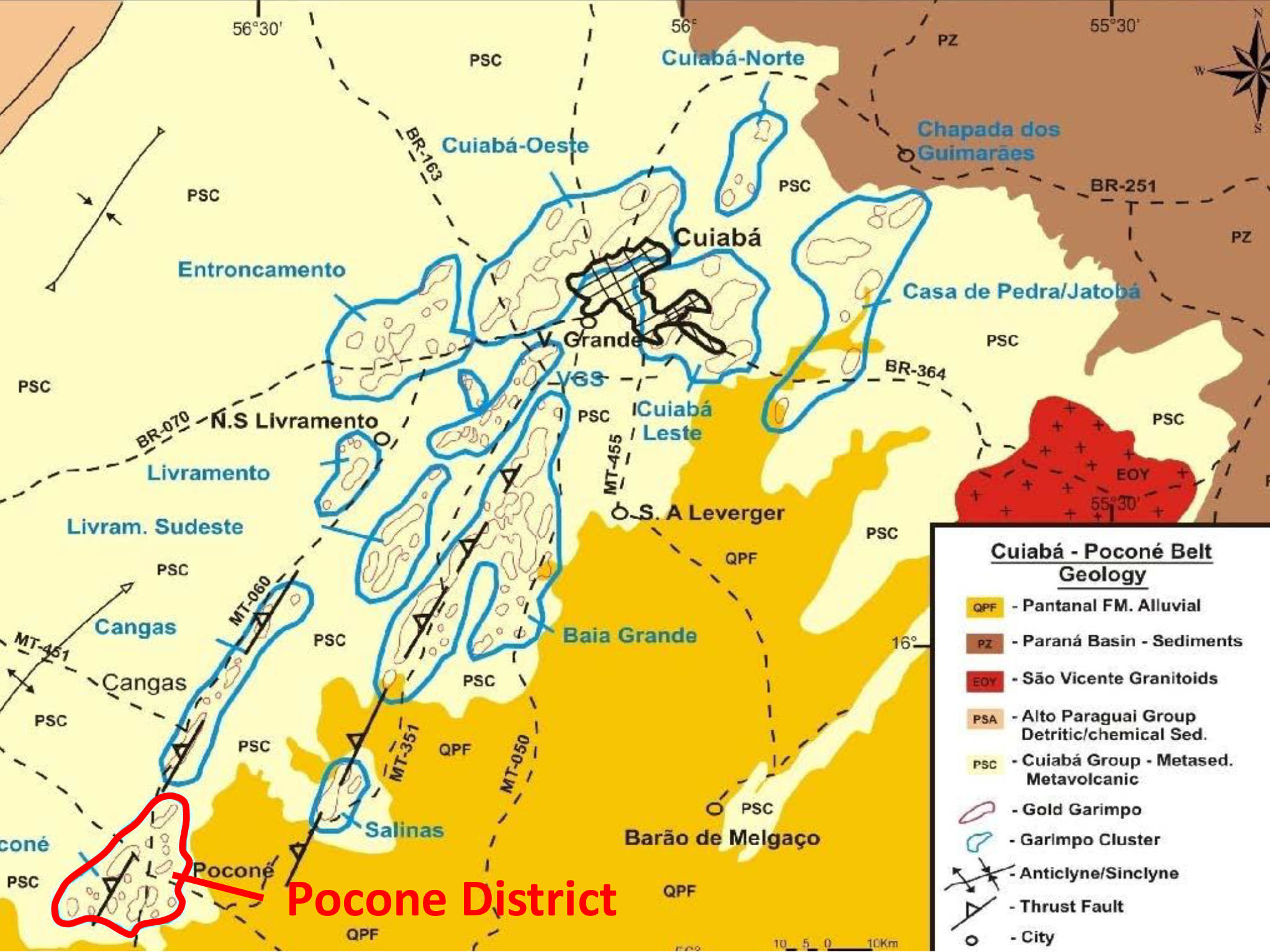

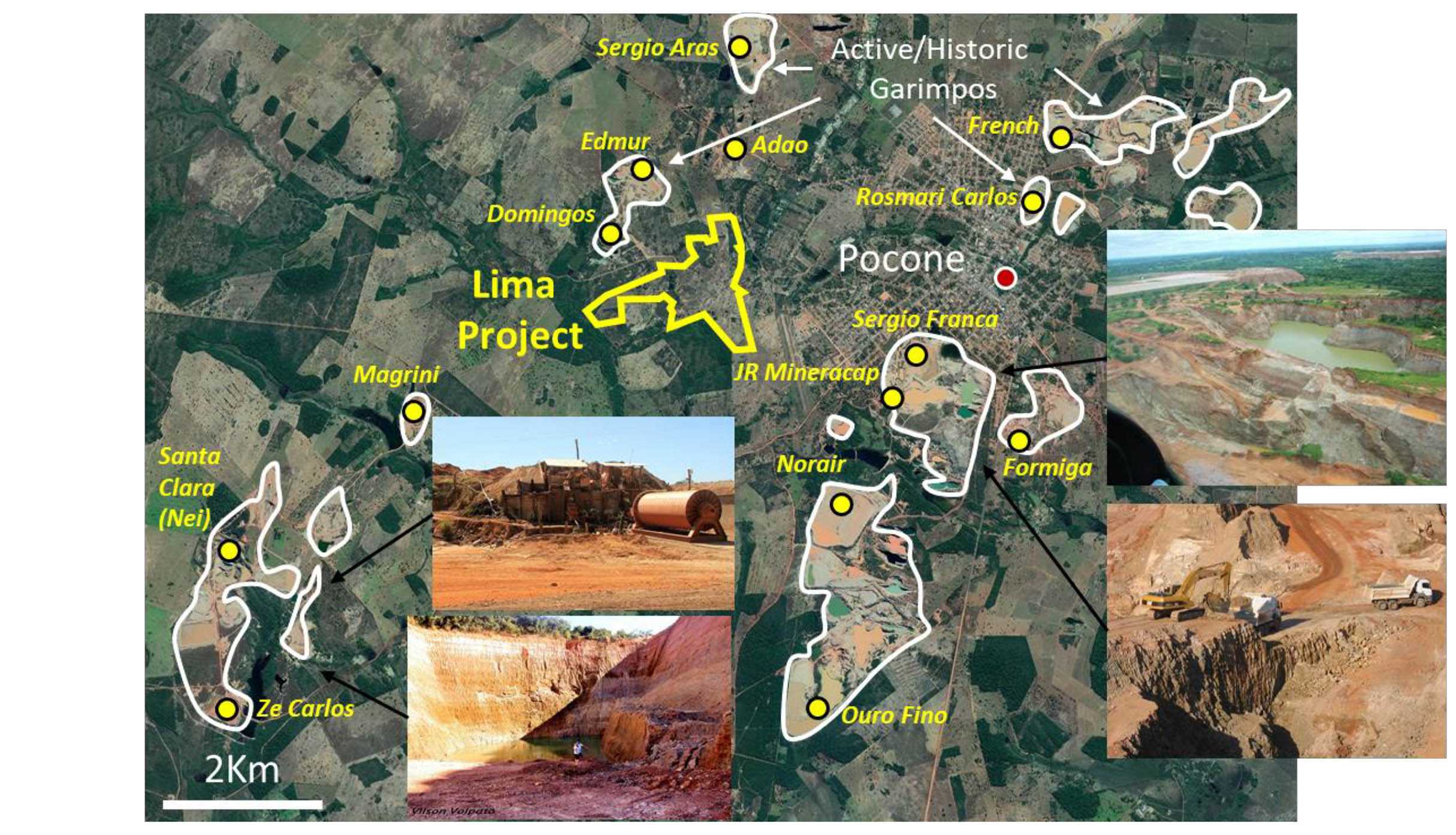

The Pocone-Cuiaba Gold belt has reportedly produced 6-12 million ounces of gold, generally averaging 1 to 2 g/t. The Pocone district itself comprises 17 operations producing 250,000 ounces annually. Mining to date has been by artisanal miners, and exploration has basically occurred by trenching to test for gold along trends. A few professional papers on the geology of these deposits describe complex geology processes followed by a gold-mineralizing event along faults that simply cut across that complex geology, which simplifies prospecting.

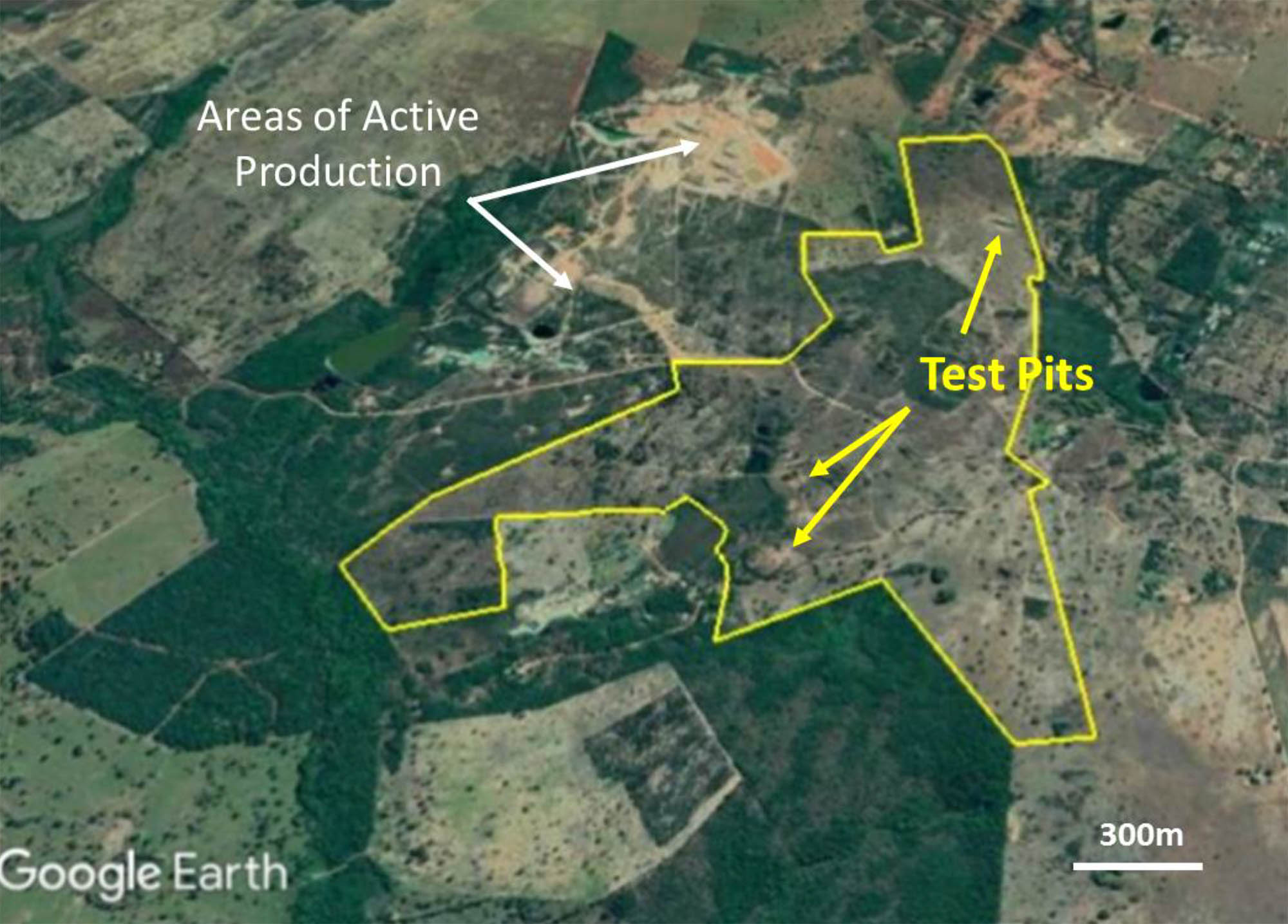

The Lima project is only 172 hectares, which is less than two square kilometers. Does the limited size of the property have a negative impact on your exploration plans? Do you plan on adding claims to increase the project to a more respectable size?

Most of the land in the district consists of freehold surface rights rather than claims, but the surface rights come with preferred rights to minerals owned by the State. VQA continues to evaluate other opportunities in the region.

5 of the 172 hectares at Lima have been mined. Can you elaborate on the historical grades and recovery rates of these mining activities in the past few years?

Very little hard data is available on specific production by artisanal miners at Lima; however, a look on GoogleEarth shows significant surface mining in the area. Several fairly large open pits on surrounding projects trend towards Lima. VQA has hired an independent geologic consulting firm to investigate records and collect samples from the limited cuts available at Lima.

In the Lima project presentation, you draw a comparison with the Kinross Gold (KGC, K.TO) owned Paracatu gold mine in Minas Gerais. Paracatu currently has a total reserve of 8 million ounces with an additional 4.4 million ounces in the combined resource categories. Can you elaborate on the similarities you see between Lima and Paracatu? This must be predominantly from a geological perspective as the average reserve grade at Paracatu is just 0.4 g/t.

The geologic setting is similar and Paracatu has already produced 8 million ounces of gold, having begun production in 1987. Initial production must have been at a much higher grade where intense weathering upgraded the bedrock mineralization in laterite. Although the Laterite-enriched deposit was mined years ago, the bedrock gold deposit is quite large, and with the capital returned long ago, still profitable even at low grades. Only the highly weathered, near-surface Laterite has been tested at Lima. Laterite does not create gold, only enriches existing gold in bedrock that is being intensely weathered. Other Laterite deposits have higher grade gold mineralization in bedrock, so the bedrock grade at Lima is completely unknown and will be a longer-term objective of exploration.

There are small-scale mining activities in the region, and in your presentation you are mentioning it would be possible to purchase a small mill to process the ore. Can you elaborate on the permitting process in Mato Grosso? What would be required to start small-scale production?

Permitting for the small-scale surface mining at the Lima project is done through membership in a local mining cooperative. Membership is available only to Brazilian companies and Brazilian residents. Our acquisition of the Pocone Mining company allows us this access.

Furthermore, our people in Brazil are originally from the Pocone area and bring a certain amount of local knowledge and influence into our activities there. This is a key aspect to what we are doing and trying to accomplish. Richard Crew is an experienced ex-pat engineer that understands the mining side of laterite projects. Wallacy Goncalves is our operations manager, his family is from Pocone. He adds not only youth, vigour, and competent administration, but also a local element that allows acceptance of the Pocone company and its operations.

How should we interpret Valterra’s plans for the Lima project? With a surface area of less than two square kilometers we can hardly get excited about a substantial tonnage to be found on the tenements. Sure, only 5 of the 172 hectares have been mined so far, but Valterra probably didn’t just acquire the project for its small-scale mining operations?

We are investigating various opportunities in the belt but cannot comment on any at this time.

Corporate

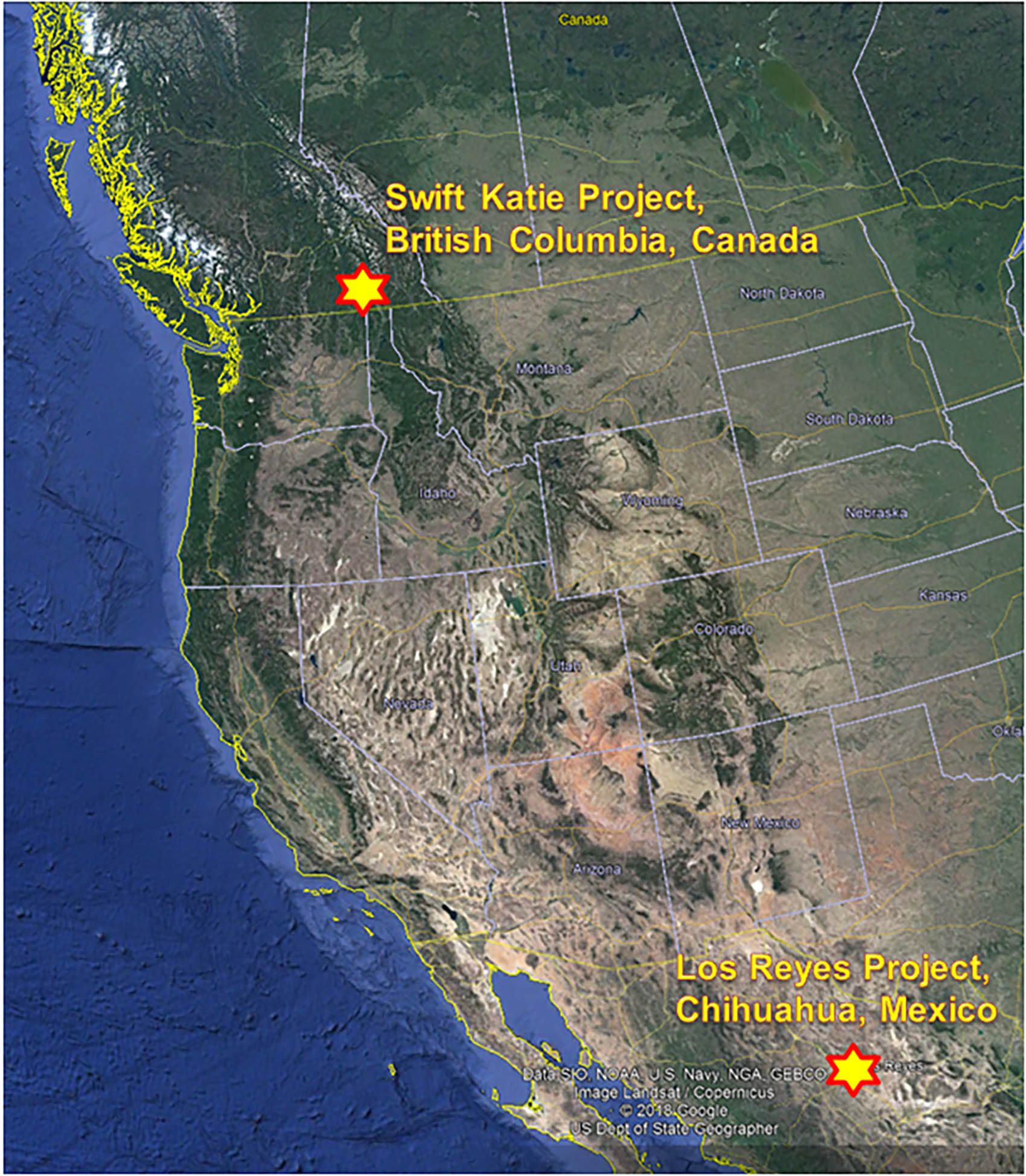

Does the acquisition of Lima indicate we should expect Valterra to drop some of the existing projects (Swift Katie, Los Reyes, Weepah) or at least put those on the backburner?

The near-term focus for VQA will be Brazil, other VQA assets are being evaluated.

You closed a C$1.4M financing in July. C$0.5M was needed to fund the initial acquisition cost of the project which means the remainder will barely be sufficient to cover the C$1M working capital deficit on the balance sheet as of the end of March of this year. Can you elaborate on the budgets (G&A, exploration) for this year?

Much of the accrued liabilities is with insiders that do not charge interest. Budgets are being evaluated at this time and we will update the market in due course.

Conclusion

With approximately 37.5M shares outstanding after a C$1.4M raise wherein 28.17 million units were sold with each unit consisting of one share and a full warrant allowing the warrant holder to acquire an additional share at C$0.10 for a period of four years, this appears to be an interesting acquisition for Valterra to bring the company back from semi-hibernation (its market capitalization had shrunk to just half a million dollars before this acquisition).

We are looking forward to seeing a strategic exploration plan to unlock the potential at the Lima gold project. The jury is still out and hopefully, the upcoming exploration plans will provide more details on the new direction the company is heading into.

Disclosure: The author has a long position in Valterra Resource Corp. Valterra is not a sponsor of the website, but other Manex Resource Group companies are.