Our long-time favorite Iron Ore Holdings (ASX:IOH) has received buyout offer from competitor BC Iron (ASX:BCI) which is currently producing 4.5M wmt per year from its 75% owned Nullagine project, […]

Tag: #IronOreHoldings

Juniors That Can Deliver the Goods

Now more than ever, investors simply can’t afford to wish upon a star and hope the drill bits will deliver something; they need to focus on miners that have what […]

Iron Ore Holdings – Update

In February, Iron Ore Holdings (ASX:IOH) agreed with Mineral Resources (ASX:MIN) to combine their forces at IOH’s Iron Valley Project, which contains 260 million tonnes at an average grade of […]

Iron Ore Holdings secures mining lease

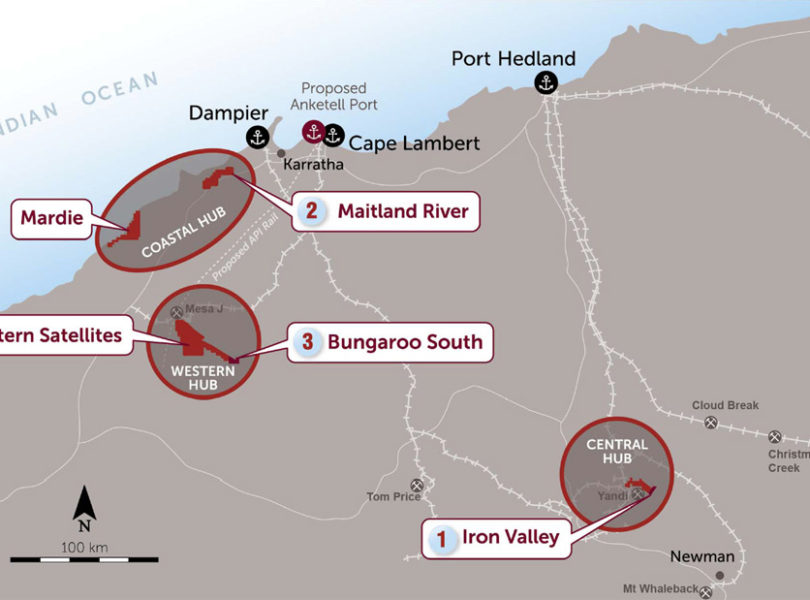

Iron Ore Holdings (ASX:IOH) has announced the receipt of a mining license for the Bungaroo South and Dragon iron ore deposits, in Western Australia. Those deposits contain approximately 260Mt of […]

Report: Mining Top 2012

The Caesars Report Mining Top for 2012 only contains mining stocks we believe will perform better than their peers this year. Our aim is to outperform the markets, through picking […]

Report: Mining Top 2011 – Roundup

2011 was an extremely disappointing year, as the Mining Top 25 closed with a return of -22.215%, underperforming the S&P by 18.89%, but outperforming the TSX Venture by 15.72%. We […]

Report: Mining Top 2011

The Caesars Report Mining Top 25 for 2011 is composed entirely out of mining shares we believe will be the best performing stocks in their sector this year. Our aim […]

Report: Mining Top 2010 Roundup

2010 was a good year to be in mining stocks. Our Mining Top for 2010 ended the year at +45.73%, outperforming the S&P index by +33.03%. It’s now time to […]