Elysee Development Corp (ELC.V) is definitely surfing the waves of the regained momentum in the resource sector as the company posted a stunning net income of C$0.133 per share in the second quarter of the year, bringing the total earnings for the first half of the year at C$0.153 per share. That’s an extraordinary result if you know Elysee was trading at less than C$0.20 earlier this year.

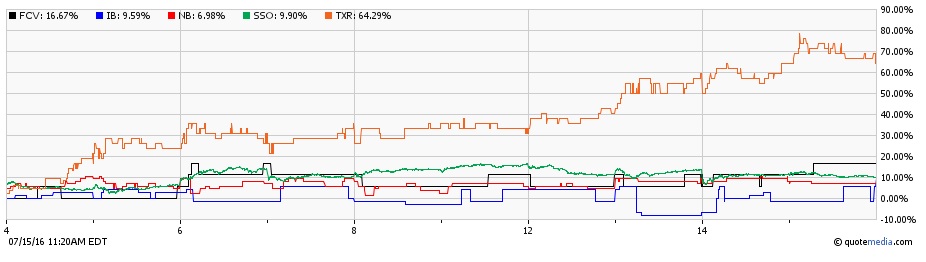

The Net Asset Value of the investment portfolio was estimated at C$0.51 per share as of at the end of June, but as the share price of several of the company’s investments continued to climb since the cut-off date, we believe the current NAV is closer to C$0.55 based on the recent performance of the company’s top-5 positions (Silver Standard Resources (SSRI, SSO.TO), Focus Ventures (FCV.V), NioCorp Developments (NB.V), TerraX Minerals (TXR.V) and IBC Advanced Alloys (IB.V)).

Source: tmxmoney.com

Elysee can still take advantage of new investment opportunities, as the company had approximately C$2.3M in cash (C$0.11 per share) as of at the end of the previous quarter. The Normal Course Issuer Bid is still in force, and the company has repurchased 200,000 shares in the first half of the year. This didn’t decrease the net share count as the company’s executives exercised 650,000 options. An additional 475,000 options are expiring on Monday whilst another 475,000 options will expire at the end of September. Both option series are priced at C$0.20 and exercising them will increase Elysee’s cash position by C$190,000, but will have a negative impact on the NAV/share. Based on the situation of May 31st, the NAV would increase to C$11.1M but as the share count will increase to 22.2 million shares, the pro-forma NAV/share would drop to C$0.50.

We don’t particularly mind this as the management team of Elysee has proven it knows what it’s doing as the total NAV of Elysee increased by C$0.12 per share in just six months (after paying a dividend of C$0.02 per share earlier this financial year). Elysee’s share price increased by 42% since our initial report, but the NAV is still 67% higher than the C$0.305 the company is currently trading at.

Shareholders could also start to hope for a nice Thanksgiving gift from Elysee Development as in our discussions with Executive Chairman Guido Cloetens, a special dividend has not been ruled out but this will obviously depend on the performance of the investment portfolio in the current quarter.

Go to Elysee’s website

The author has a long position in Elysee Development Corp. Elysee is a sponsor of the website. Please read the disclaimer