Sometimes an existing mine or project could benefit from a new set of eyes for a fresh interpretation. That’s what happened when K92 Mining (KNT.V) purchased the mothballed Kainantu mine from Barrick Gold (ABX, ABX.TO) and now Rise Gold (CSE:RISE) is doing the same thing.

Sometimes an existing mine or project could benefit from a new set of eyes for a fresh interpretation. That’s what happened when K92 Mining (KNT.V) purchased the mothballed Kainantu mine from Barrick Gold (ABX, ABX.TO) and now Rise Gold (CSE:RISE) is doing the same thing.

At the end of January, Rise completed the acquisition of the past-producing Idaho-Maryland underground gold mine in California. In this report, we’ll have a closer look at the project, and discuss Rise’s intentions to bring it back into production.

The acquisition of the Idaho-Maryland gold mine was completed in January

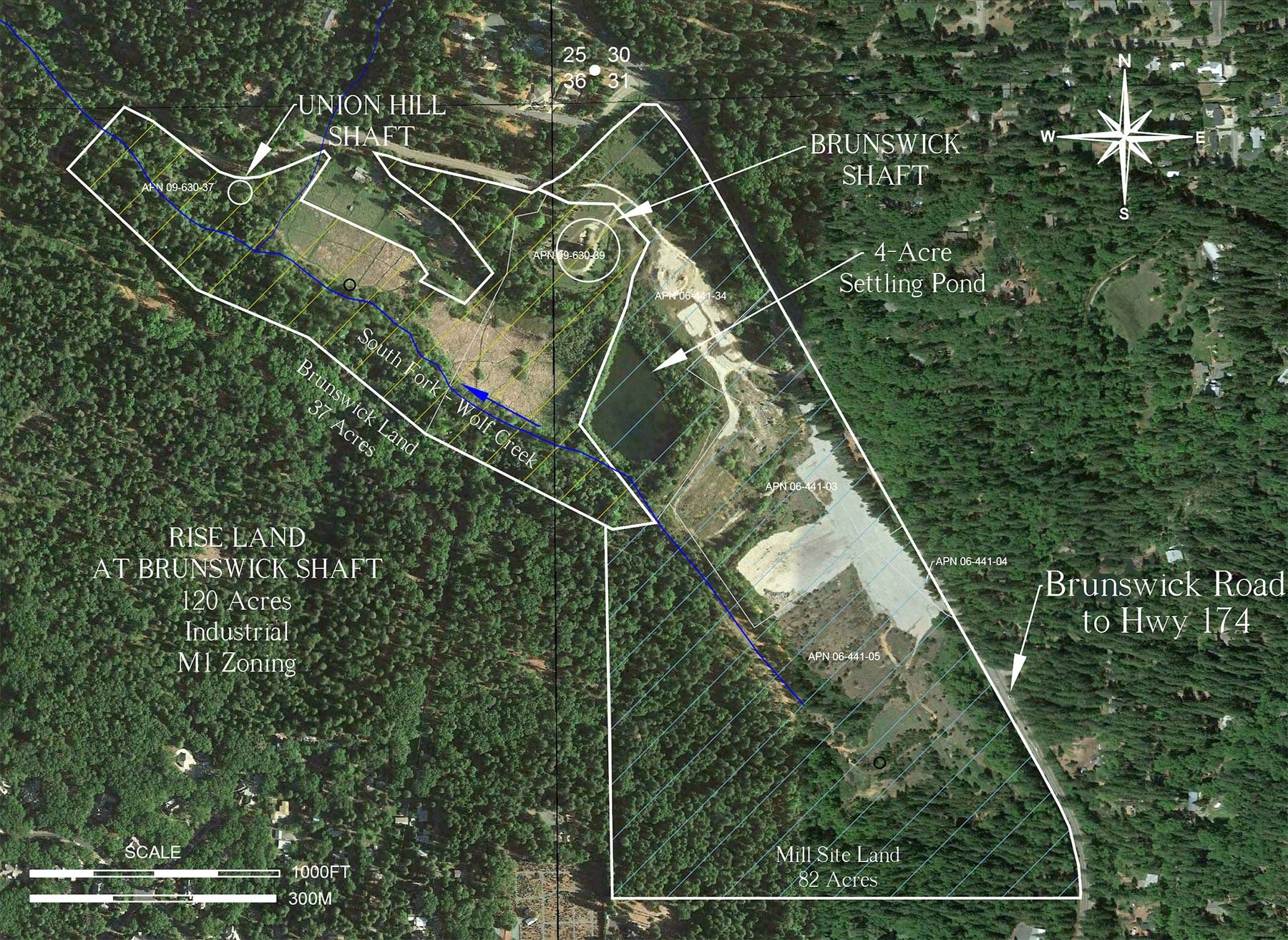

At the end of January, Rise confirmed it completed the purchase of the Idaho-Maryland gold mine for US$2M. The acquisition includes approximately 2,750 acres of mineral rights and the surface rights at the Brunswick shaft. This shaft extends to a depth of almost 1,000 meters and was the main production shaft back in the days so owning the land around this shaft is a big bonus.

The US$2M price tag was paid with the proceeds of a substantial C$4.2M capital raise which was completed in December 2016. Rise has issued 21 million units at C$0.20 with each unit consisting of one common share and one full warrant. Each warrant will allow the warrant holder to purchase an additional share at C$0.40 before December 23, 2018.

Rise completed an additional C$2M placement in May, and this should boost the cash position to north of C$2M, coming from C$600,000 as of the end of January. This multi-million-dollar cash position will allow Rise to hit the ground running after it identified several exploration targets at the Idaho-Maryland mine (see later). It’s also very important to know there are no royalties payable to anyone, and this could unlock several financing possibilities later on.

Shut Down as it was Reaching Full Potential

A closer look at the freshly-filed technical report

As mentioned before, the Idaho-Maryland project is a past-producing gold mine and historical resources indicate a total of 2.4 million ounces of gold were recovered from the underground workings. The average mill head grade was 17 g/t gold, which is substantially higher than the average grade of the current underground mines.

Due to the high grade and good infrastructure, the Idaho-Maryland mine was actually one of the largest gold mines in the country, and produced up to 130,000 ounces of gold per year before it was shut down by the government. This shut-down wasn’t caused by depletion or regulatory issues, but the US government simply wanted its labor force to focus on base metals to support the war-related production needs, and to call young men to enroll in the army.

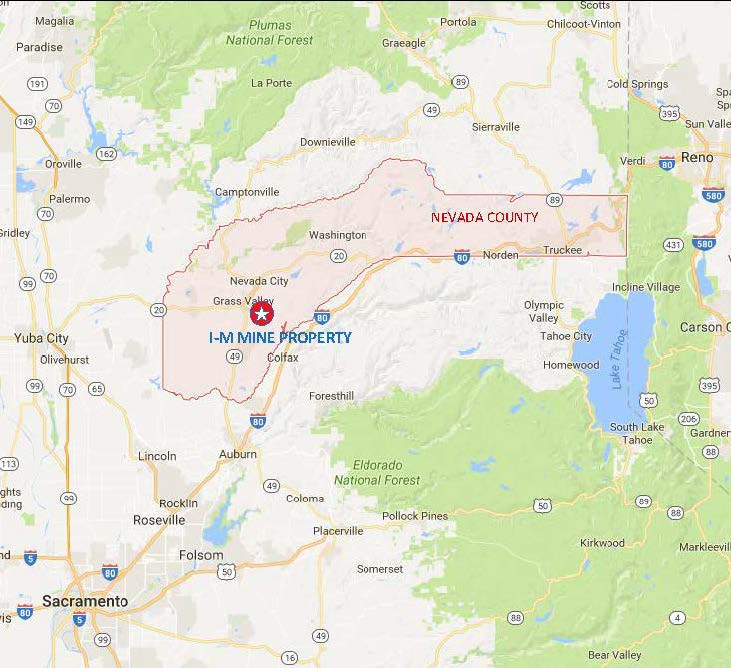

The mine indeed was one of the most prolific producers in the Grass Valley area, and Rise’s land package includes the mineral rights on approximately 2,800 acres whilst ‘owning’ 93 acres of surface land around the Brunswick shaft, which was constructed to access the Brunswick Block. This block, together with the Idaho and Morehouse mineralized systems, were the main sources of the gold that has been produced at Idaho-Maryland.

The Brunswick land position is located just a few kilometers from the city of Grass Valley, and actually falls within the city’s planning area boundary. According to the technical report, all parcels are located within the M1-District, a light industrial zone, which does allow underground mining, subject to obtaining a use permit. The fact the main zones are located on private land will definitely help the company, as it will be able to start up a permitting process without getting the Federal authorities (Bureau of Land Management and the US Forest Service) involved.

Another interesting feature is Rise’s option to acquire the Mill Site, which is located right next to the Brunswick land position. This has a total surface area of 82 acres, and has been used until 1991, where after the lumber mill site was dismantled and removed from the site. Rise Gold has paid a deposit of $600,000 to secure the right to purchase the mill site and will have to make a final payment of $1.3M before the end of September (which was confirmed in CEO Mossman’s recent letter to shareholders).

We have the impression Rise Gold is really proactive about its future needs, and securing the mill site years before it will even be able to make a production decision is a good example of the management’s long-term vision for the Idaho-Maryland mine.

As always, we encourage you to read the company’s technical report which has now been filed on SEDAR, but the Mindat website also has a really great overview of the history of the mine, and we can strongly recommend to read the overview here.

What’s the plan from here on? The numerous exploration targets deserve the attention

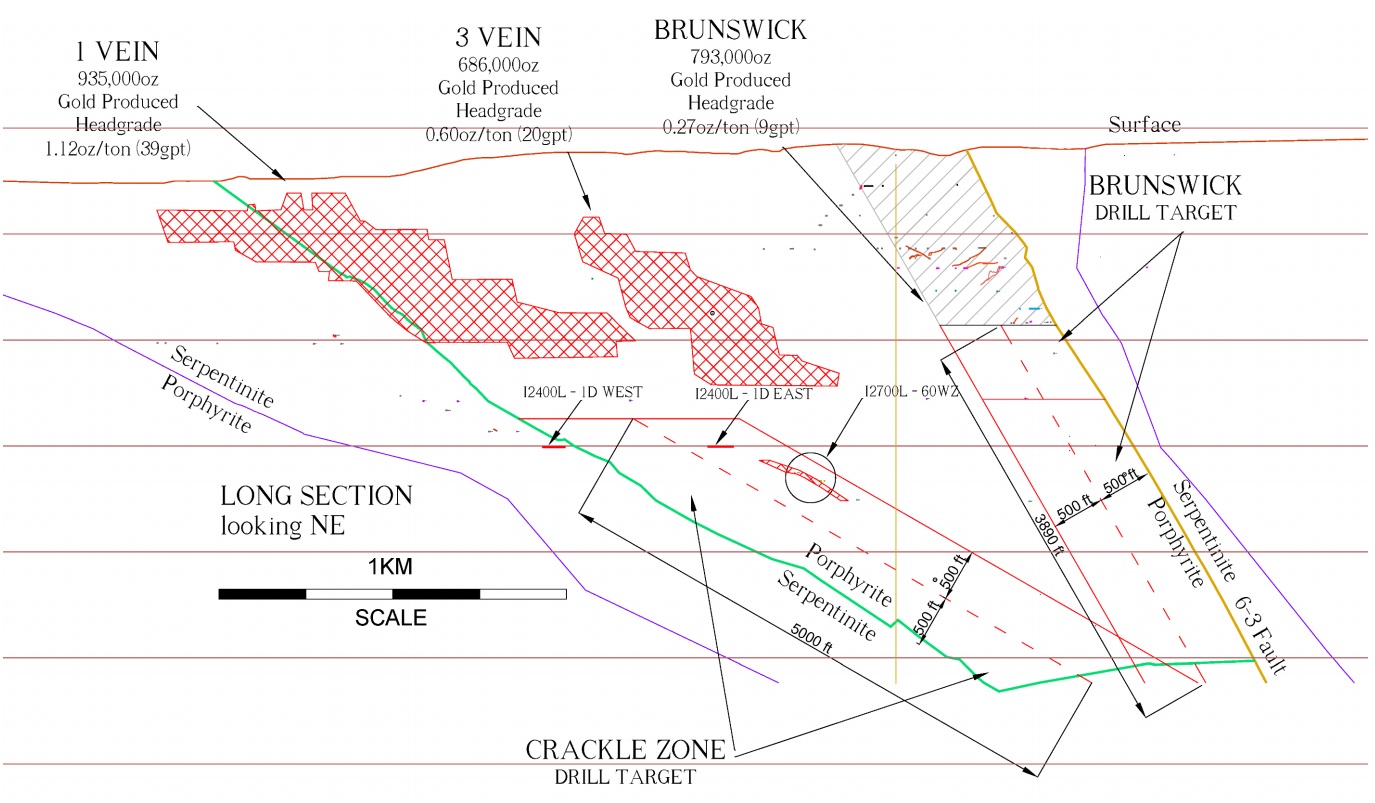

What’s really interesting is the fact the Idaho 1 Vein and 3 Vein were mined until a depth of 2,000 feet, but there’s no reason why we should assume there’s no additional mineralization at depth. After all, the nearby Empire Mine, which was operated by Newmont Mining (NEM) was mined to a total vertical depth of approximately 3,500 meters but the mineralization has been ‘followed’ until a depth of almost 6,000 feet.

For those readers who have been following the Integra Gold story, the Rise exploration story is pretty similar. Virtually all underground gold mines in the Val D’Or region reached a depth of 1500-2000 meters, and there was no good reason why the mineralization at Lamaque would remain limited to just a few hundred meters.

The story at Idaho-Maryland is pretty similar. The two veins have been mined until they reached a depth of 2,000 feet, but there’s no (scientific) reason why the gold mineralization wouldn’t continue at depth.

And that’s exactly what Rise Gold will try to figure out in the upcoming exploration programs.

Rise’s Idaho-Maryland project will require extensive exploration activities, but it will take a while before the true size and scope of the project will be confirmed as the company requested Amec Foster Wheeler to propose an exploration program for a C$600,000 budget, and Amec’s recommendation was to drill one deep, very deep hole targeting a total depth of in excess of 1,800 meters. This also means Amec agrees with our theory there’s no good reason why the high-grade gold mineralization wouldn’t be continuous at depth.

Amec’s recommended hole would encounter both the #1 vein below the mined levels, and also intercept the (potential) western extension of the Idaho 3 vein system. This deep hole would allow the company to provide one long and continuous intercept all the way to the Serpentinine contact zone as you can see on the next image).

Rise Gold has identified numerous exploration targets of which the ‘Crackle Zone’ sounds like an intriguing one to follow up on. The Crackle zone is a conceptual target based on the idea that the mineralizing fluids which are responsible for ‘dropping off’ the gold when the formations are being created may have formed a zone of quartz veins underneath the currently known Brunswick Block.

This is obviously just a theory, but when it’s a theory coming from a professor at Yale University, we (and the company) obviously take notice. Alan Bateman had a PhD in geology, visited the mine in 1948 and wrote an extensive report on his findings. Not only did he chair geology department of Yale University, he was also instrumental in the discovery and successful execution and development of the ‘expanded’ Kennecott mines in Alaska, for which he was included in the Alaska Mining Hall of Fame.

Basically, Bateman’s theory explains how the three main faults of the Brunswick Block might actually be converging at depth, having formed a large stockwork body. Apparently nobody has ever followed up on Bateman’s theory as the previous owner of Idaho-Maryland simply didn’t have the funds to put an extensive exploration plan together.

According to the theory, the Crackle Zone could have a size of 610 meter wide, could be 30-150 meters thick and extend over an area of 1,500 meters. Using an average thickness of 50 meters, the Crackle Zone could have a total volume of 45 million cubic meters and applying a density of 2.65, the total tonnage of this zone is approximately 100-125 million tonnes. These tonnes obviously wont all be mineralized or contain high-grade ore, but if anything, it does confirm this target is big enough to follow up on.

A second target is the old Brunswick mine, where at least seven veins remained underexplored or unexplored below the 1600 level. Only three levels were developed below the 1600 level at Brunswick, and just two veins were partially explored below this level whilst five other vein systems remained almost completely unexplored. Plenty of reasons to ‘dig deeper’ at the Brunswick mine.

And finally, the company identified the #1 and #3 veins as ‘interesting exploration targets’. Both targets are pretty valuable as the previous owners and operators of the mine were unable to follow up on the potential resources and exploration potential of these past-producing veins. In fact, one of the previous operators of the Idaho-Maryland mine gave up just a few meters before reaching the mineralization which would later grow out to become the #3 Vein.

Readers wishing to get into more details about the exploration plans and the targets should read the company’s very extensive update here.

Management

Ben Mossman – President, Director, and CEO

Mr. Mossman is a mining engineer with over 15 years of experience in the mining industry including experience in capital markets, project evaluation, acquisitions, mine operations, and development. Mr. Mossman has worked at eight producing underground mines with production rates ranging from 250tpd to 3,000tpd. Previously, as CEO, he lead the exploration, permitting, financing, construction, and operation of a profitable gold mine in British Columbia which was one of the only hard rock metal mines in the world to use pre-concentration (DMS) to eliminate all surface disposal of tailings. Mr. Mossman has been involved in several other mine start-ups, including as mine engineer at the Snap Lake Mine for DeBeers Canada and the Bellekeno Mine as Chief Engineer for Alexco Resource Corp.

Alan Edwards – Chairman of the Board of Directors

Mr. Alan Edwards is an experienced executive and engineer with over 35 years of experience in the mining industry. Mr. Edwards was the General Manager for three major mining operations in the United States and the Senior Vice President of Operations for Freeport Indonesia where he was responsible for the leadership of a workforce of over 6,000 employees. Mr. Edwards served as the Vice President Operations for Kinross Gold Corporation and as the Chief Operating Officer for Apex Silver Mines where he directed the successful construction of the $675M San Cristobal Mine in the difficult political climate of Bolivia. Mr. Edwards has served on numerous boards of public companies including as Chairman of AuRico Gold Corporation during a period of extensive growth which culminated into a successful $US1.5B merger with Alamos Gold. Mr. Edwards holds an MBA and Mining Engineering degree from the University of Arizona.

John Anderson (Triumph Gold) – Director

John Anderson holds a B.A. from the University of Western Ontario and is the co-founder of Aquastone Capital Advisors LP, a U.S.-based gold investment fund. With over 15 years of experience in the capital markets, Mr. Anderson’s specialty is identifying undervalued opportunities in the resource industry and investing capital into these situations. He has been involved in a number of small-cap companies, providing financing, investor relations, and corporate development services. Throughout his career, Mr. Anderson has raised in excess of $500 million in equity for a number of public and private companies in the United States, Canada and Europe.

Share Structure

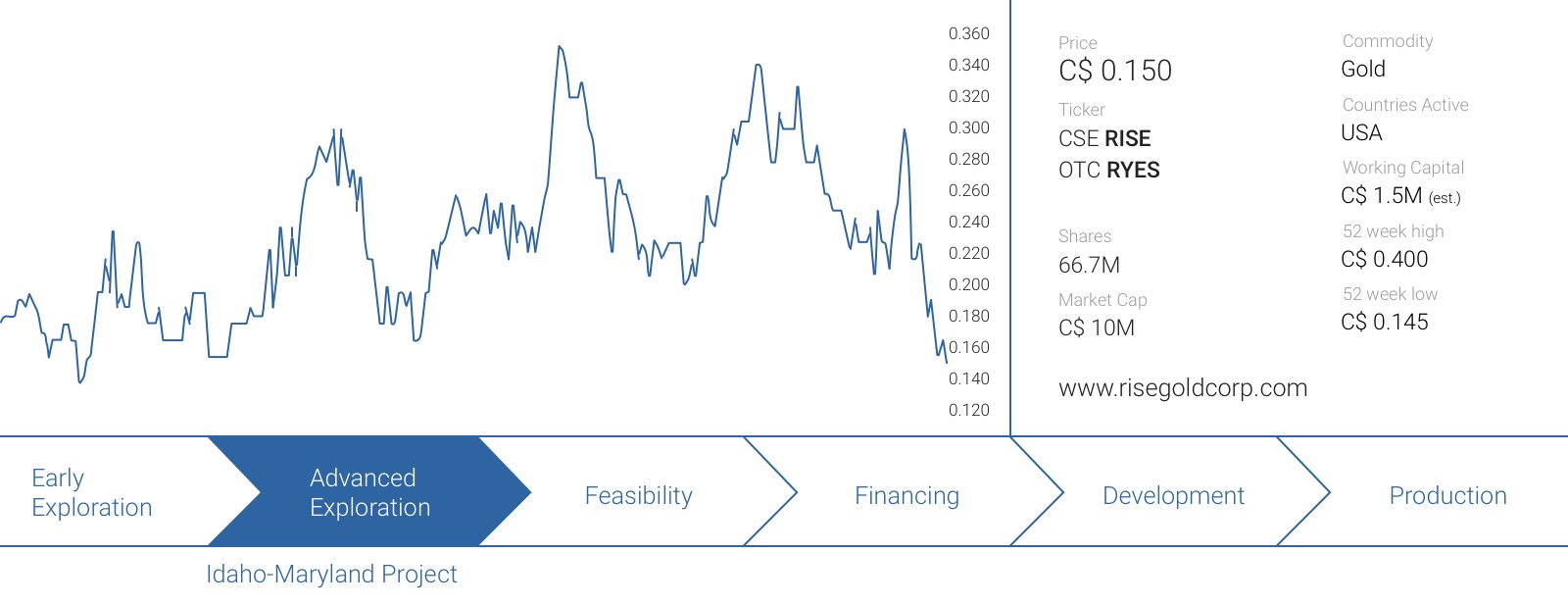

Rise Gold’s primary listing is on the CSE, and we realize this makes it more difficult for foreign investors to trade in the company’s shares, as most non-Canadian brokers don’t have trading access. Rise also has secondary listings on the Over-the-Counter (RYES) and we would imagine Rise will also try to obtain a German listing and to upgrade its main listing to the TSX Venture Exchange.

Rise Gold currently has 66.7 million shares outstanding, giving it a market capitalization of C$10M based on the most recent closing price of C$0.15.

Conclusion

Rise Gold’s team seems to be dedicated to restore the Idaho-Maryland mine back to its former glory after the previous operator seemed to be unable to ‘make it work’. The initial technical report from AMEC Foster Wheeler is very encouraging, and we would expect Rise Gold to hit the ground running in the fall after it has gathered all necessary data to kick off with its maiden exploration program.

The current market capitalization of C$10M is actually very low, and we would expect the company’s market value to increase once it ‘uplists’ to a better stock exchange.

Disclosure: Rise Gold is a sponsor of this website, we have a long position. Please read the disclaimer