Minera Alamos (MAI.V) has successfully completed the change of land process on its La Fortuna gold project which required the company to make a payment to SEMARNAT in order for the Mexican authorities to issue the formal approval for La Fortuna. Rather than delaying these permits, Minera Alamos decided to take a C$2M loan from its strategic shareholder Osisko Gold Royalties (OR.TO, OR), which has a duration of 18 months and has an average interest rate of LIBOR +8.5%. The interest will be compounded on a monthly basis, and will be payable on the maturity date.

As Osisko’s ultimate goal is obviously to secure NSR’s and streaming deals on Minera Alamos’ assets, it’s not surprising to see Osisko maintaining the right to convert the C$2M loan in a 1% Net Smelter Royalty on the La Fortuna project, as part of the comprehensive Royalty Option Agreement which was announced and executed in 2017. As part of that agreement, Osisko is entitled to buy a 4% NSR on La Fortuna for a total cash consideration of C$9M.

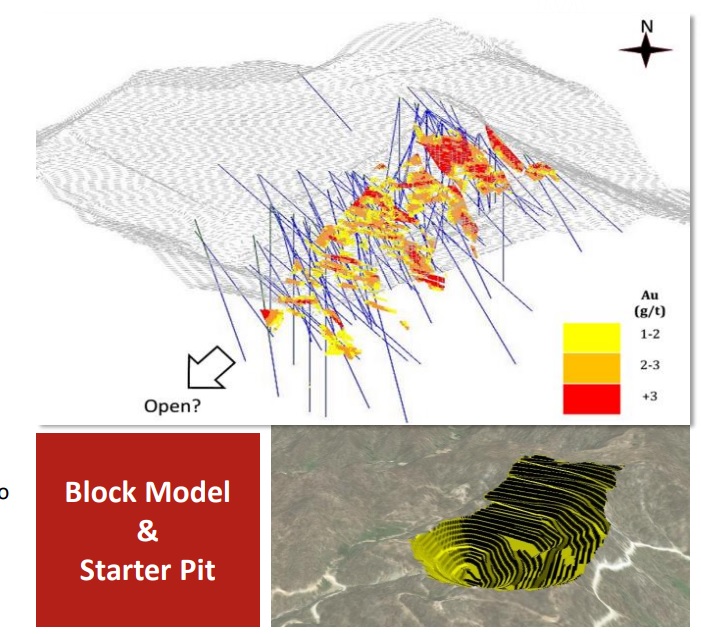

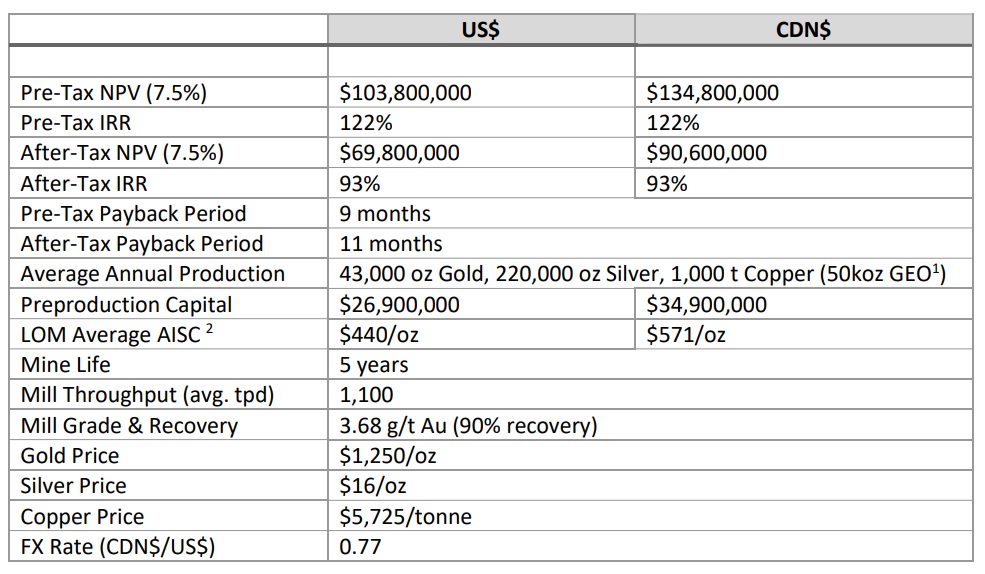

As a reminder, the Preliminary Economic Assessment on La Fortuna indicates the project could be a real cash cow for Minera Alamos. The PEA calls for a total gold production of 215,000 ounces of gold at an AISC of less than US$450/oz. Considering the initial capex is estimated at just US$27M, the after-tax NPV7.5% of La Fortuna is estimated at US$70M (C$95M) after taking the royalty payable to Argonaut Gold (AR.TO) into account, but before the impact of the additional 4% NSR to Osisko Gold Royalties. We estimate the impact of this 4% NSR to be approximately US$9-10M, which leaves C$82-85M on the table for Minera Alamos. Divided over 301 million shares, it’s safe to say the after-tax NPV7.5% of La Fortuna is worth a multiple of the company’s current share price. On top of that, you get all other projects as well as the exploration upside at La Fortuna thrown in for free.

Go to Minera’s website

The author has a long position in Minera Alamos. Please read the disclaimer