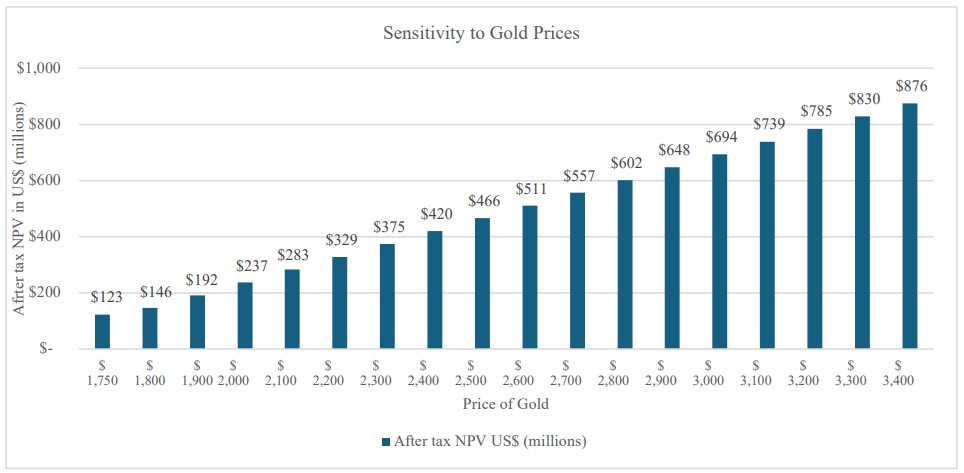

Freeman Gold (FMAN.V) has released an updated sensitivity analysis for its flagship Lemhi gold project in Idaho. Using a gold price of US$2200/oz now results in an after-tax NPV5% of US$329M and an after-tax IRR of 28.2%. The company also highlighted a scenario with $2900 gold resulting in an after-tax NPV5% of US$648M while at $3200 gold, this would increase further to almost US$800M, as you can see on the table below.

The economics also take an updated capex and opex into consideration. The initial capex is now estimated at US$215M with an additional US$105M in sustaining capex. This ultimately results in an anticipated AISC of US$1105/oz for the average annual production of just under 76,000 ounces of gold during an 11 year mine life wherein a total of just over 850,000 ounces of gold will be recovered and sold.

Disclosure: The author has a long position in Freeman Gold.This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.