Arizona Sonoran Copper (ASCU.TO) acquired the past-producing Cactus Project mine site in 2019 when it completed a purchase agreement with a multi-state custodial trust and the Arizona Department of Environmental Quality to acquire Asarco’s former Sacaton Mine land parcels after the completion of a funded $20 million reclamation. The land package was subsequently expanded several times until its current size of about 5,700 acres.

The company completed a more straightforward Preliminary Economic Assessment in the summer of last year and is currently working to complete a pre-feasibility study. Meanwhile, the project has recently been vetted and approved by HudBay Minerals (HBM, HBM.TO) which acquired a 9.9% stake while Royal Gold (RGLD) purchased an existing 2.5% NSR for US$55M. It goes without saying the technical teams of those two companies (should) have carefully and thoroughly vetted the project and given the thumbs up before substantial amounts of cash were spent.

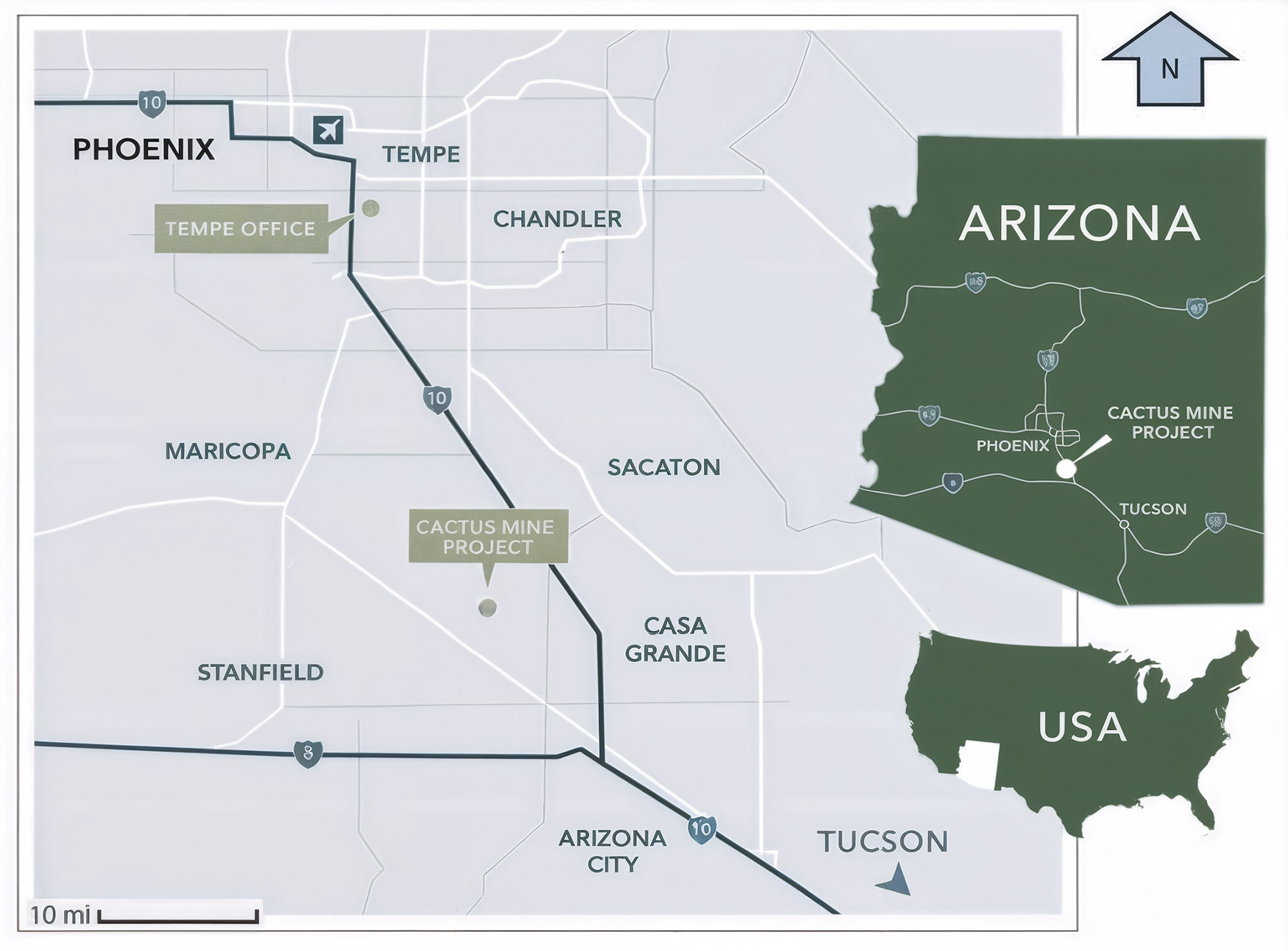

The Cactus Mine Site

When you look at maps, it’s clear the project isn’t located in No Man’s Land, but it’s really only when you visit the asset you get a feeling of how close everything is in a positive light. You can drive up to the mine gate within an hour after leaving Phoenix’ Sky Harbor airport. The town of Casa Grande is close enough but not too close, while there is a Union Pacific operated railway literally at the end of the ‘driveway’ to get to the mine site.

Infrastructure-wise, we have rarely seen a project that ticks so many boxes.

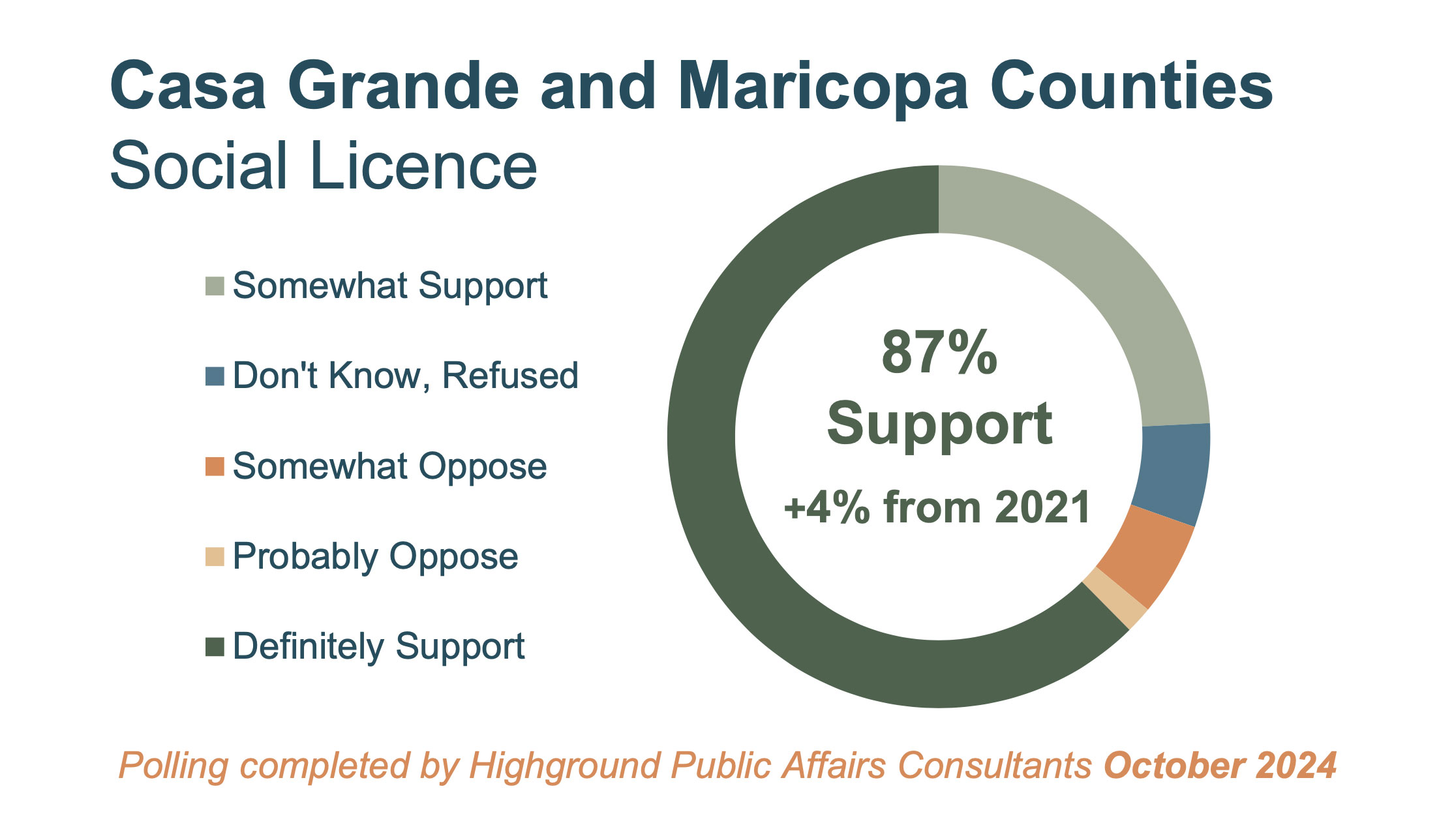

One of the elements we were most curious about was the proximity to Casa Grande. It’s good to be close to an existing pool of labor, but being too close could come with permitting issues. Arizona Sonoran has conducted multiple surveys to take the temperature of the local population and in the most recent poll in October 2024, about 87% of the respondents announced they are ‘in support’ or ‘somewhat in support’ of mining operations to restart at Cactus.

We asked VP Investor Relations Alison Dwoskin about the sample size of this survey, and were pleasantly surprised to hear there were about 600 respondents. The legitimacy of surveys are fully dependent on the amount of respondents to ensure it’s a representative sample.

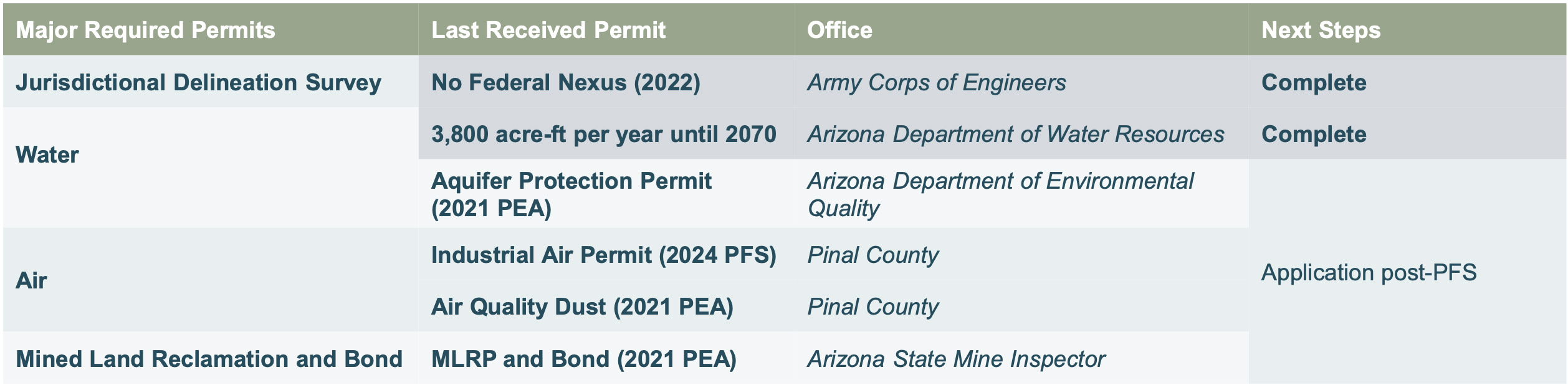

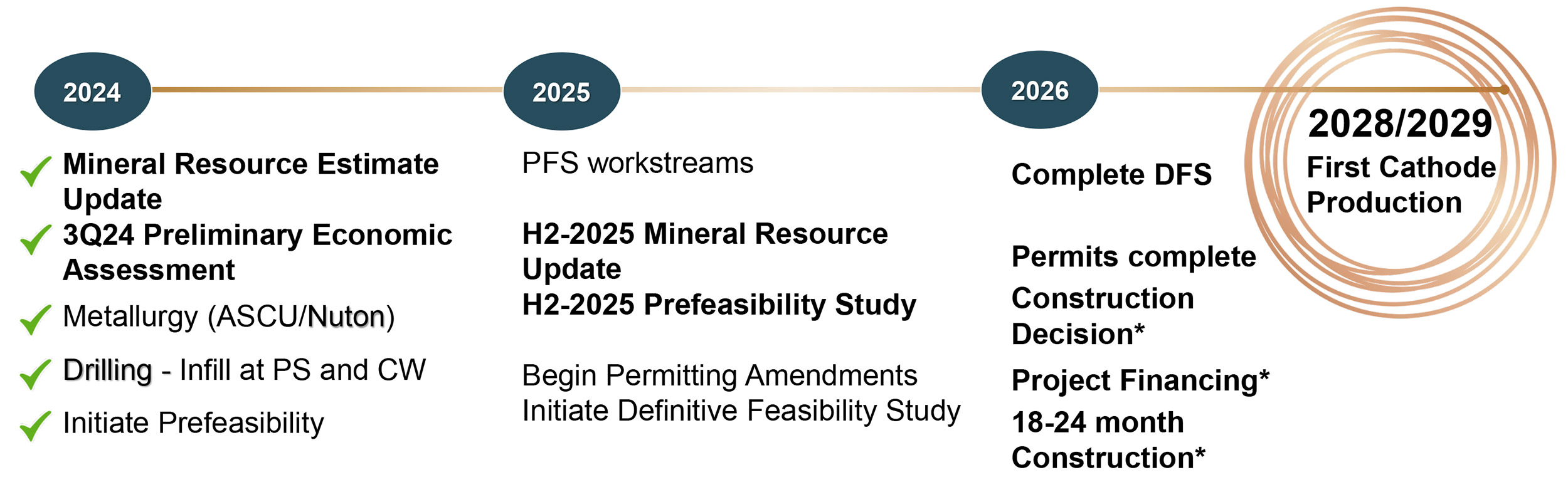

Of course, the proof of the pudding will be in the eating and Arizona Sonoran Copper will begin amending permits after the completion of its 2025 pre-feasibility study. Currently, the company is fully-permitted for its 2021 PEA pertaining to a portion of the current study.

Keep in mind the entire Cactus Mine project is located on private land which streamlines the permitting process with the State and County, meaning it is more straightforward with fewer hoops to jump through.

When it comes to permitting, it’s perhaps worth mentioning Arizona Sonoran already has the water rights for 3,736 acre-feet per year for the next 45 years. The water source is located from a non-potable aquifer, confirmed by the Army Corps of Engineers in a jurisdictional delineation survey to have no WOTUS.

The upcoming pre-feasibility study may contain positive surprises

Let’s first have a look at the results of the PEA before making the segue into the pre-feasibility study. The Preliminary Economic Assessment was published in the summer of 2024 and can thus still be relied upon when it comes to cost estimates.

The initial capex was estimated at US$668M and this was expected to be sufficient to cover a total average annual production of 172 million pounds of copper. The production rate in the first 20 years will be substantially higher at 232 million pounds per year while the AISC during those first two decades should also be a bit lower than the $2/pound mentioned in the economic study as average all-in cost over the entire mine life.

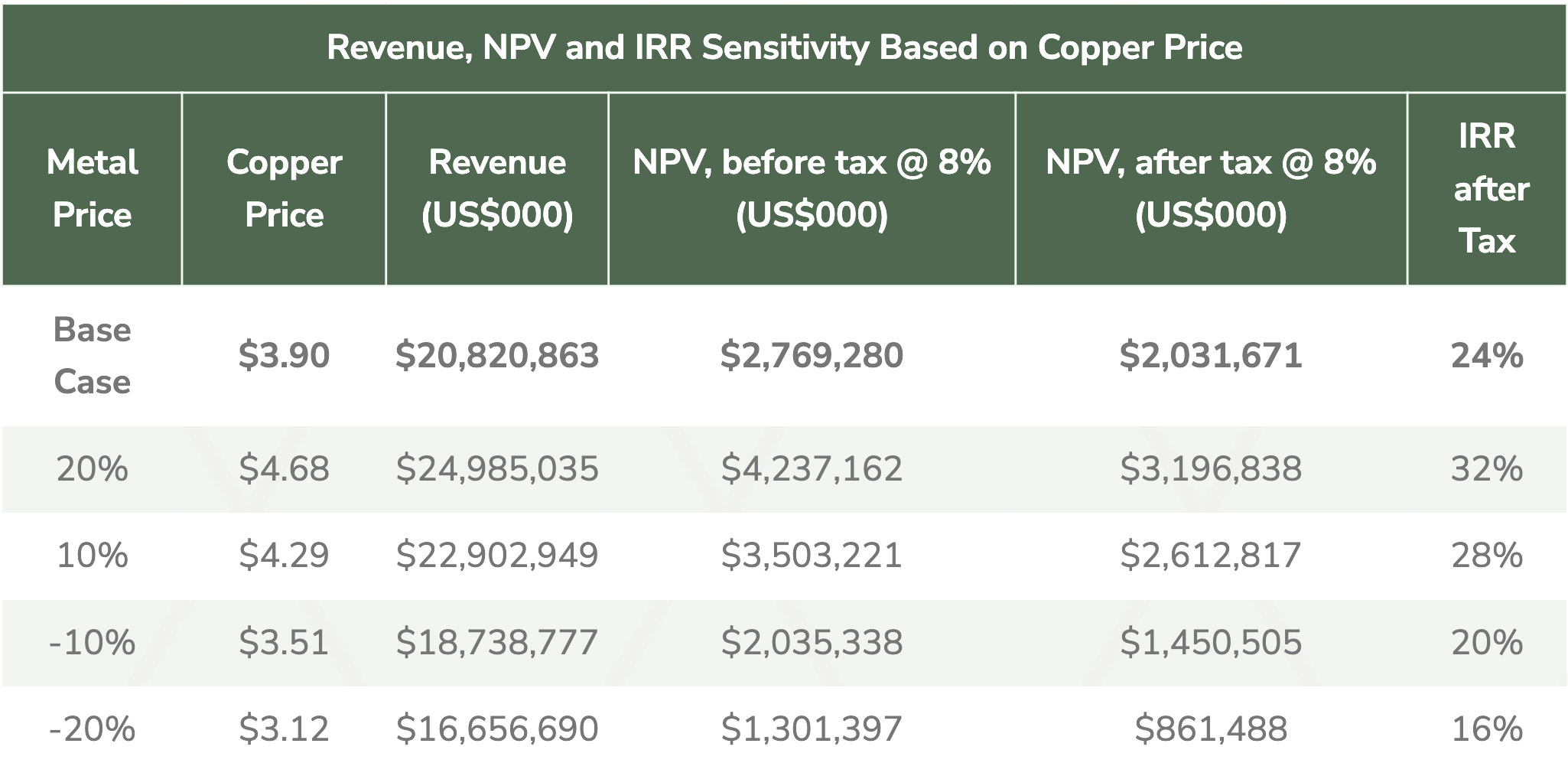

As per the technical report, the mine will produce and recover in excess of 5.3 billion pounds of copper, resulting in a free cash flow result of $7.3B (undiscounted but on an after-tax basis) using the base case copper price of $3.90 per pound.

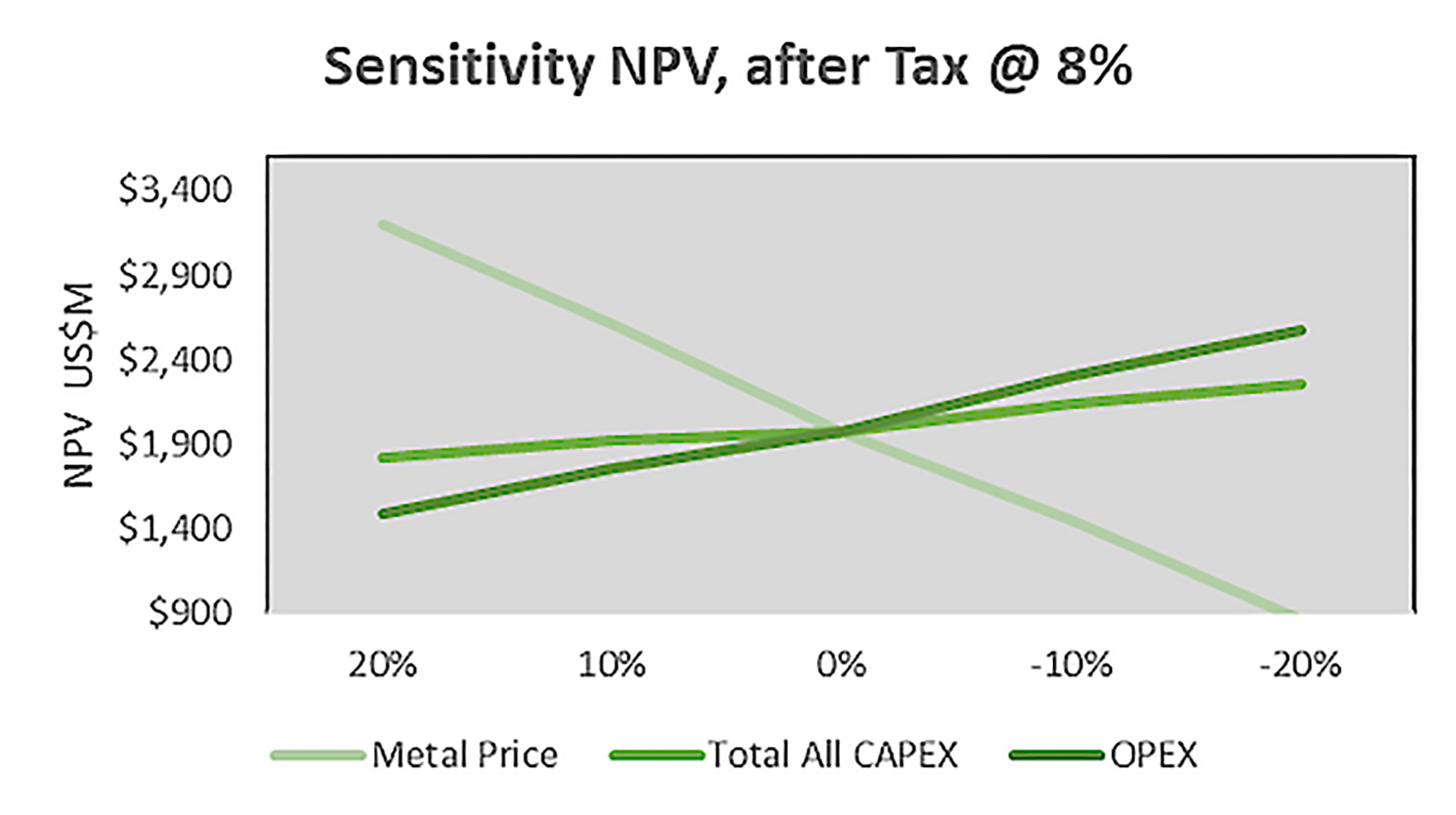

The PEA also contained a sensitivity analysis. Using a 10% higher copper price ($4.29 per pound) would result in an after-tax NPV8% of US$2.61B while even at $3.50 copper, the after-tax NPV8% would still come in at US$1.45B. In the base case scenario, which uses $3.90 copper, the after-tax NPV8% was estimated at US$2.03B with a 24% after-tax IRR.

Thanks to the low production cost of the copper at Cactus, the NPV:CAPEX ratio still exceeds 1, even if you’d use a 20% lower copper price ($3.12 per pound instead of $3.90) which speaks volumes to the strength of the project in a varying copper price environment.

As per the technical report: from a technical perspective, the project works and makes sense, even at a lower copper price.

Although the PEA already confirmed the viability of the project, there still are some possibilities to further improve the economics of the project. Arizona Sonoran is currently investigating the possibility to increase the annual throughput from the currently envisaged 24 million tonnes per year. This should be possible at a very low up-front cost but has the potential to further unlock efficiency benefits and economies of scale.

Additionally, Arizona Sonoran is looking into the current three stage crushing plant and perhaps one or more of the stages could be made redundant. In its update on May 8th, the company mentioned it has deployed a surface continuous miner to test the potential efficacy of that type of equipment. Arizona Sonoran used a third-party continuous miner to get a better idea of run rates. These of course vary depending on the type of rock as the throughput will of course be lower in conglomerate versus the more brittle layers closer to surface. When we visited the mine, the surface miner was being demobilized and based on the comments provided by the third-party operator of the continuous miner, the trial seems successful. Which means it now is up to the independent consultants engaged by Arizona Sonoran to work on the trade-off studies and determine the impact of the surface continuous miners. It sounds like two crushing stages may become obsolete while the need for blasting could be reduced as well and that could certainly help the company with its social license.

In any case, the pre-feasibility study will be ready later this year, and it will be interesting to see which improvements will be included in the PFS versus the PEA.

Not counting on Nuton – but it would be a positive catalyst if the project option gets exercised

One of the largest shareholders is Nuton, a subsidiary of Rio Tinto, focusing on leaching primary sulphide material. As the Cactus Project contains primary sulphides, Nuton is currently conducting test work on Cactus material.

Even more important than running metallurgical tests is the fact that Nuton also has the right to acquire a stake in the Cactus project, provided some (value-enhancing) criteria are met.

As per the original option agreement, and understanding the Mainspring asset is now ‘material’ to the Greater Cactus project, the trigger event is based on a 20% increase in the after-tax NPV8% compared to the ASCU pre-feasibility study, due in 2H 2025. If that’s the case, Nuton will have the option to acquire between 35% and 40% of the Cactus project for a cash payment based on 65% of the NPV multiplied by the attributable percentage it is looking to acquire. Using the 2024 PEA’s after-tax NPV8% of C$2.0B (as an example to explain how the formula works), Nuton could acquire a 40% stake in the project for 65% * 40% * $2.0B = $520M.

While it’s still early days and we shouldn’t expect to see the results of the Nuton pre-feasibility study before 2026, it’s not easy to see a scenario where the Nuton PFS will indeed see a 20% higher after-tax NPV8%. Not because the technology doesn’t work (we are expecting to see primary sulphide leaching recovery rates of 75-85% versus the 25% in the base case scenario) but because the processing of the sulphide material only happens after year 20 in the end of the mine life which means any improvements will be heavily discounted. Just to give you an idea; discounting $1 of cash flow in 15 years from now back to today using a discount rate of 8% results in a total discount of in excess of 70%. So for every $10M in incremental cash flow in Y15, only $2.9M will be included in the NPV calculation. Looking at the results of the Preliminary Economic Assessment, the after-tax NPV8% at $3.90 copper was $2.03B. This means the Nuton technology needs to create an additional $406M in value on the after-tax NPV8 basis to be allowed to exercise the option. Note: we are using the PEA numbers in the example above, but we would like to emphasize the final decision will be made by comparing the respective pre-feasibility studies.

While we are not ruling out a 20% lift in the after-tax NPV using the Nuton technology, we are not counting on Nuton exercising its option to acquire a 35-40% stake in the Cactus project. And if they do, that would take care of pretty much Arizona Sonoran’s entire equity component in the construction financing package should a construction decision be made. The 2026 pre-feasibility study including the impact of the Nuton technology will be very important to determine the path forward.

Attracting HudBay Minerals

Although Arizona Sonoran already had Nuton/Rio Tinto in its share capital, earlier this year it completed a raise with HudBay Minerals whereby the latter acquired 11.96M shares for a total of C$20M. Additionally, Nuton exercised its top-up right to maintain its 7.2% stake and this resulted in an additional 0.9M shares to be issued at the same terms.

This means Arizona Sonoran Copper is currently very well-funded with approximately US$31M (in excess of C$40M) in cash on the balance sheet. This will allow the company to go full steam ahead with all its plans in Arizona while it doesn’t have to lift its foot off the throttle when it comes to doing more engineering work and optimization studies.

Management

George Ogilvie, President, CEO and Director

George Ogilvie has 35+ years in mining, with a track record of turning around distressed companies. As CEO of Battle North, he led its recovery from insolvency to a C$100M+ financed project and eventual sale at a 45% premium. He previously revitalized Kirkland Lake Gold and transformed Rambler Metals from exploration to production. Ogilvie holds a B.Sc. in Mining & Petroleum Engineering, is a Professional Engineer, and has a South African Mine Manager’s Certificate.

Nicholas Nikolakakis, VP Finance and CFO

Nicholas Nikolakakis has over 27 years of finance and executive experience in the mining industry, having raised over US$2 billion across various transactions. He was CFO at Battle North (acquired by Evolution Mining) and Rainy River Resources, and previously served as VP Corporate Finance at Barrick Gold, where he led major financings including a US$1B project deal and a US$1.5B credit facility. He also held senior roles at Placer Dome and North American Palladium. Nick holds a Geological Engineering degree from Waterloo and an MBA from Ivey Business School.

Bernie Loyer, SVP Projects

Bernie Loyer is a Project Mining Executive with over 35 years of global experience, including 20+ years in Latin America. He joins Arizona Sonoran as Senior VP Projects, bringing expertise from leadership roles at SolGold, Goldcorp, Torex Gold, and BHP Billiton. A mechanical engineer fluent in English and Spanish, he holds multiple patents in process and material handling equipment design. He has led major mining projects across Ecuador, Mexico, Argentina, and Chile, and previously served as VP at FLSmidth Minerals overseeing global process technology.

Nicholas Hayduk, VP General Counsel and Corporate Development

Nicholas Hayduk is a corporate lawyer with over 23 years of experience, including 16 years in executive roles at public mining companies. He has held senior legal positions at Excellon Resources, Battle North, Lundin Mining, Kinross Gold, Goldcorp, and Placer Dome. Nick has led legal work on over US$18B in M&A, raised over US$3B in equity and debt, and managed major credit facilities, joint ventures, and global compliance. He also contributed to UN and EU mining governance initiatives. He began his legal career at Blake, Cassels & Graydon LLP.

Travis Snider, VP Sustainability and External Relations

Travis Snider is an Arizona-based mining executive with 30 years of experience across exploration, production, permitting, and sustainability. He has led renewable energy initiatives for mining operations and held leadership roles at Engineering & Environmental Consultants, Alliance Mining, Elm Tree Minerals, and Sierra Resource Group. His background includes senior roles at Phelps Dodge and Wilcox Professional Services, as well as work with NV5, Kleinfelder, and Mactec. Snider is active in state mining associations and local community leadership. He holds a B.Sc. in Environmental Chemistry from Arizona State University.

Conclusion

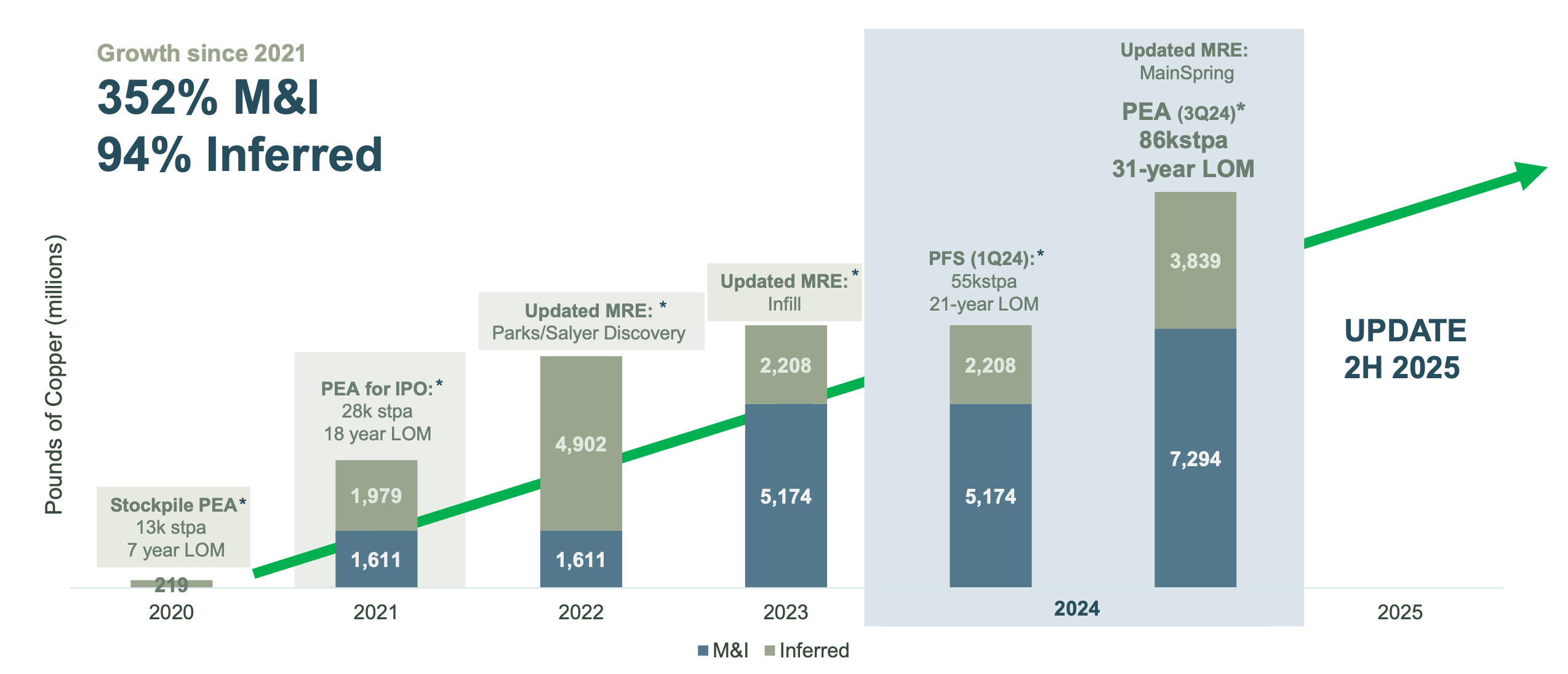

Arizona Sonoran Copper owns one of the highest valued and most advanced projects in the Americas with a total copper content of in excess of 10 billion pounds across all resource categories (with 7.3 billion pounds of copper in the measured and indicated resource categories and an additional 3.8 billion pounds of copper in the inferred resource category). The project is located on private land and was sold to Arizona Sonoran Copper by the State Trust and ADEQ. As the latter is involved in the permitting process as well, we can assume it streamlines the request for and access to data and the decision-making process.

Given this project has a brownfields status, the permitting process shouldn’t be too egregious, and it’s now up to Arizona Sonoran Copper to maintain its social license so it can continue to count on the support of the local population.

That appears to be the main point of attention as from a technical perspective, the company seems to have a good grip on the metallurgy and heap leach process for the Cactus project. CEO George Ogilvie enjoys a good reputation after having been at the helm of Kirkland Lake and Battle North Gold. Both companies were subsequently sold, and we wouldn’t be surprised to see ASCU become a desirable candidate in the M&A space upon the completion of its pre-feasibility study.

Disclosure: The author has a long position in Arizona Snoran Copper. Arizona Snoran Copper is not a sponsor of the website. This report is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our disclaimer.