Krakatoa Resources (KTA.AX) is currently raising A$3.1M in a placement priced at A$0.0105 per unit (with each unit consisting of one shares and half an option. Each full option allows the option holder to acquire an additional share at A$0.02 during a period of approximately three years). The proceeds of this financing will be used to complete the current 7,000-10,000 meter maiden drill program on its Zopkhito antimony-gold project in Georgia.

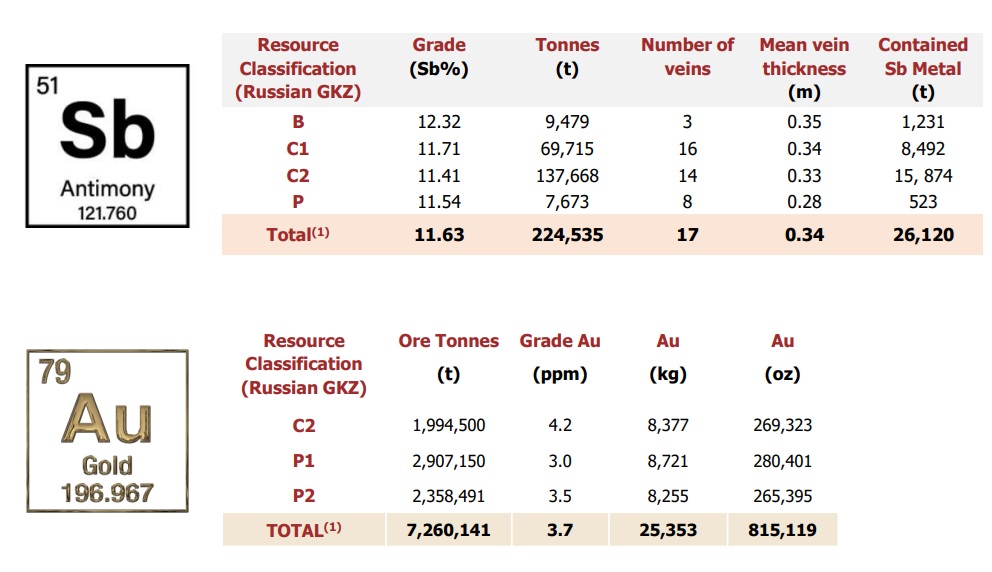

The project currently hosts a resource (non-JORC compliant) of 225,000 tonnes at 11.6% Sb as well as 7.1 million tonnes containing 3.7 g/t gold. This means the project currently has approximately 26,000 tonnes of antimony and just over 800,000 ounces of gold.

Krakatoa currently has two drill rigs active on the project and the drill program should be helpful in putting a JORC-compliant resource together. The updated resource will then be the starting point to work on a Preliminary Economic Assessment on the project.

Disclosure: The author has no position in Krakatoa Resources. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.