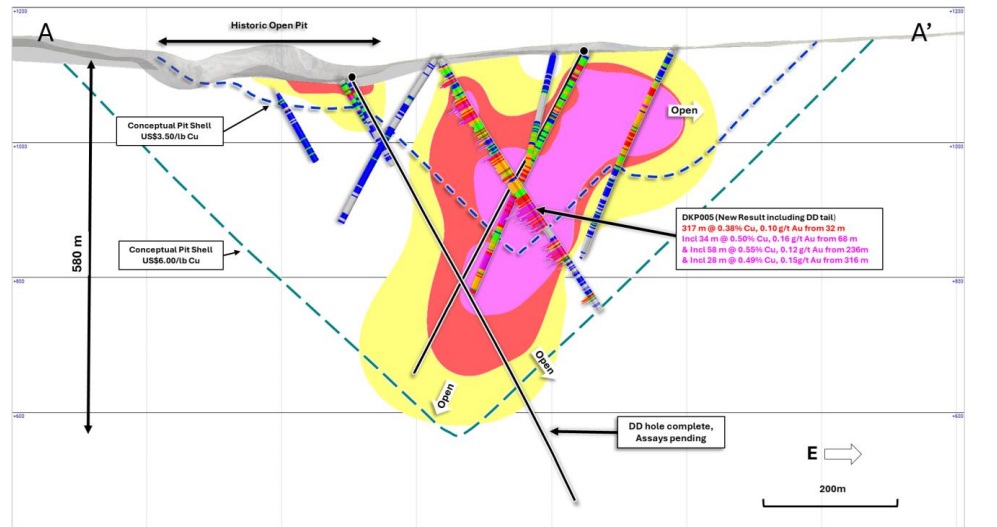

Hot Chili (HCH.V) has released an exploration update on its Costa Fuego copper project in Chile, where drilling is ongoing on the copper porphyry discovery on the La Verde zone of the project. Two diamond holes returned intervals of strong copper porphyry style mineralization which could potentially be an up-dip expansion to La Verde’s gold-rich higher grade core. Additionally, one of the holes that was drilled a bit deeper encountered 28 meters of 0.49% copper and 0.15 g/t gold and 47 meters of 0.57% copper and 0.12 g/t gold.

The company has now completed 2,900 meters of drilling with assay pending for six diamond holes, and all six holes encountered wide intervals of copper porphyry style mineralization.

Despite its recent share price increase, Hot Chili still is one of the cheapest copper development stories out there. And while the pre-feasibility study indicated an IRR of just 19% and an after-tax NPV8% of US$1.2B, those numbers were based on $4.30 copper and $2280 gold. Applying $3,500 gold would add about $60M in pre-tax undiscounted cash flow per year and over an initial primary production life of 14 years, this would add up to in excess of $800M in pre-tax and undiscounted cash flow. On an after-tax basis and applying an 8% discount rate, using $3500 gold would likely add about $250-300M to the NPV while the after-tax IRR would undoubtedly increase as well.

The company also used $28 silver but as the silver production is pretty minimal at just over 150,000 ounces per year, the higher silver price won’t really move the needle.

Disclosure: The author has a long position in Hot Chili. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.