After initially announcing a C$1M private placement, Bravada Gold (BVA.V) has confirmed it plans to upsize the size of the placement to C$1.6M. The terms remain unchanged, and the company is now planning to issue 40 million units priced at C$0.04, with each unit consisting of one common share and a full warrant with each full warrant allowing the warrant holder to acquire an additional share at C$0.05 during a three year period.

The net proceeds from this private placement will be used to work on a pre-feasibility study on the Wind Mountain gold/silver project. While this is a small gold/silver heap leach project, we expect the economics at $3000 or $3500 gold to look pretty decent given the very low initial capex associated with the project.

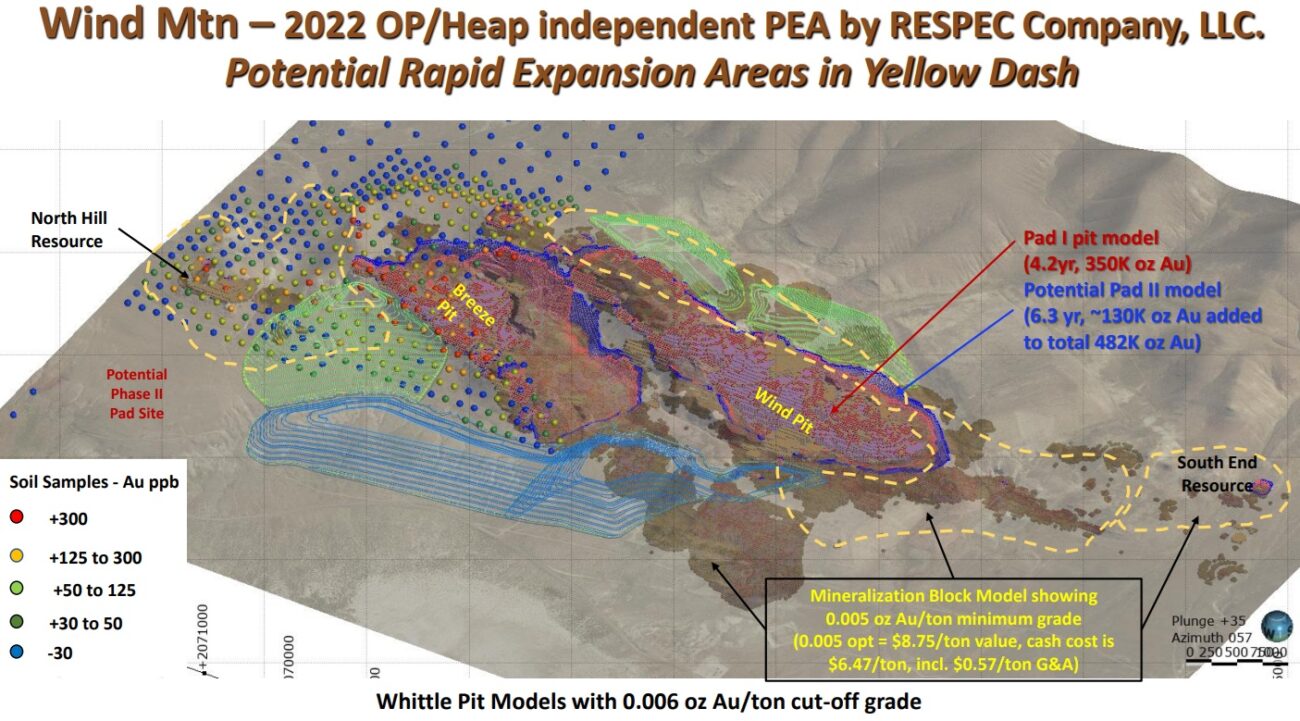

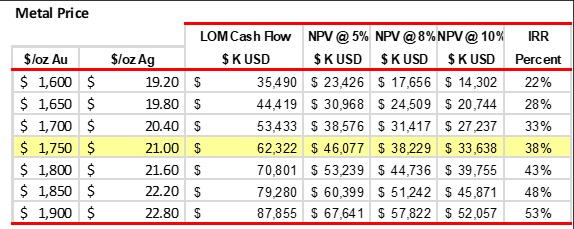

As a reminder, the 2022 Preliminary Economic Assessment outlined a small mine with an initial US$46.6M capex, producing around 50,000 ounces of gold per year at an AISC of US$1175 per ounce of gold. Keep in mind this study was completed in 20232with a base case gold price of $1750/oz. We should of course anticipate a substantial increase in the capex and opex to update the 2022 numbers to a 2026 scenario, but the 2022 sensitivity analysis already clearly indicated a higher gold price will definitely boost the economics of the project.

As the table above shows, increasing the gold price from $1750 to $1900 would add about US$21.5M to the after-tax NPV5%. For every $100 change in the gold price, about US$14M in additional NPV was generated. The impact of a higher gold price will of course diminish over time as taxes will start to kick in, but a pre-feasibility study will show whether or not Wind Mountain could be a neat little project at $3000 or $3250 gold. The C$1.6M capital raise will help the company to advance the project.

Disclosure: The author has no position in Bravada Gold. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.