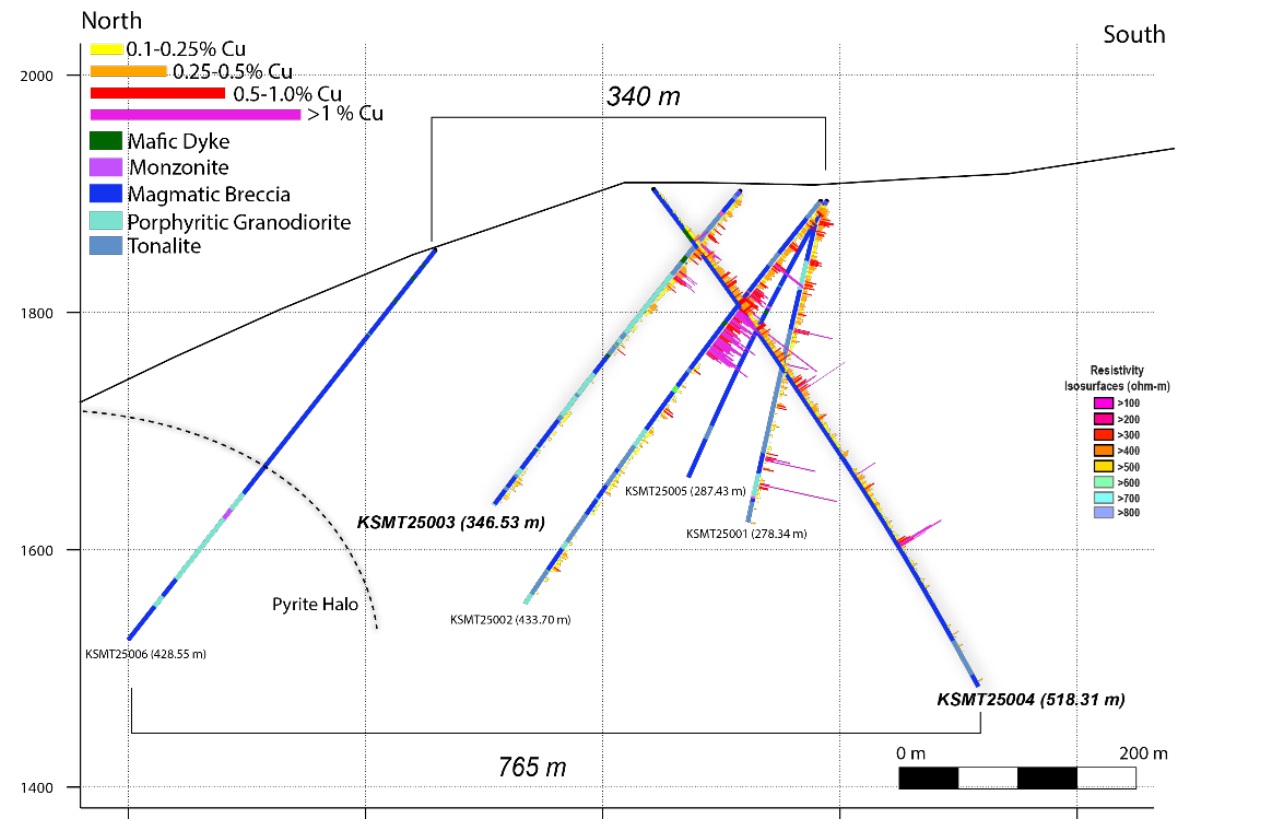

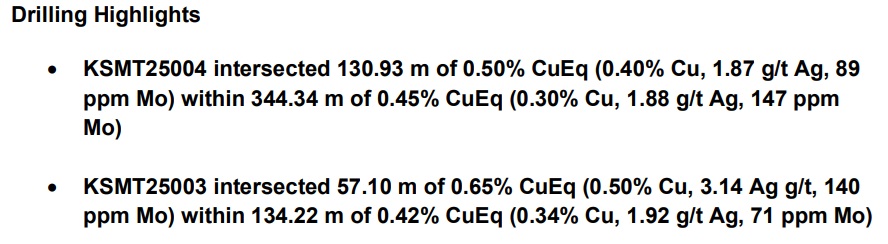

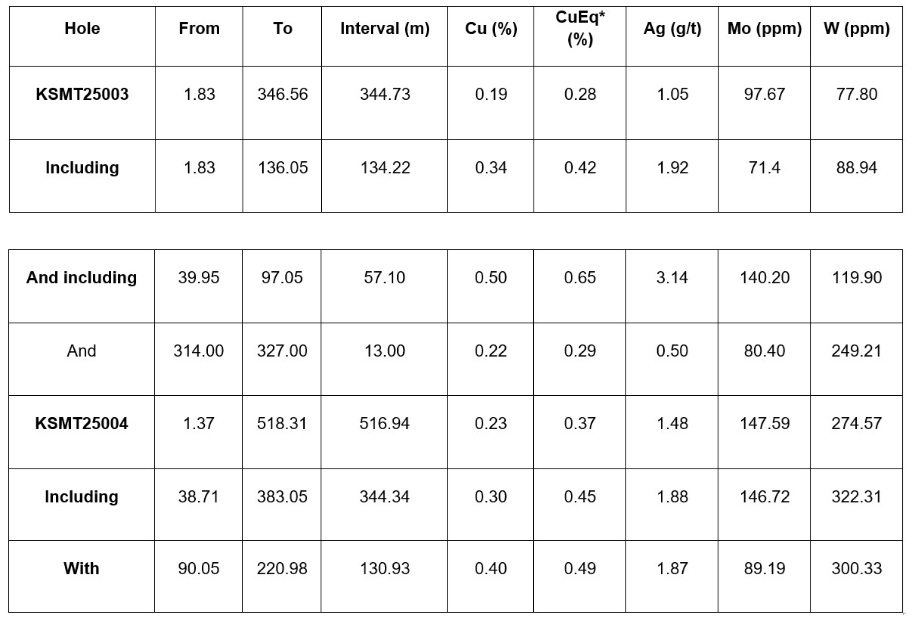

IDEX Metals (IDEX.V) has released the long-anticipated assay results for holes KSMT25003 and 004, which were drilled on the Kismet Breccia target, part of its fully owned Freeze copper-gold-molybdenum project. While the headline result in the company’s press release only mentions the copper values (and perhaps this disappointed the market a bit), the copper-equivalent grades are 25% to 30% higher than the pure copper values. As you can see below, the silver and molybdenum grades boost the value of the rock but the ultimate net contribution will of course depend on recovery rates and payability percentages as well as the used commodity prices (the company used $3.75 copper, $35 silver and $30 molybdenum, so using the current prices will have a slightly negative impact on the copper-equivalent grade).

As you can see in the table below there are some higher grade intervals that boost the average grade of the holes, but it is of course encouraging to see the mineralization starts pretty much at surface and that is a positive element.

We aren’t quite sure why the market barely reacted to the fresh assay results (if anything, the reaction was slightly negative). The grades are fine (not shocking, but at $6 copper even ‘okay’ grades will work), and although these are the first four holes drilled at Kismet, the drill program was able to demonstrate the continuity of the breccia mineralization while getting more familiar with the structural controls of the system. Also keep in mind the copper mineralization remains open in all directions and at depth, while the results of the first few holes have also yielded several high-priority drill targets.

The assay results of holes 005 and 006 are still pending, and it will be interesting to see what hole 006 shows, as that hole is drilled about 200 meters away from the other five holes.

And as a full disclosure: We disclosed in our August update that we sold stock during the run up before the first assay results were published. We recently bought shares again in December ahead of the publication of the assay results of the four remaining holes (of which two have now been reported on). At the current share price, we think IDEX Metals still provides attractively priced exposure to the Idaho Copper Belt.

Disclosure: The author has a long position in IDEX Metals. IDEX is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.