92 Resources Corp. (NTY.V) is joining the ranks of lithium explorers, after the company unveiled the assay results of a sampling program on its Hidden Lake lithium property in NWT, Canada. A NI43-compliant report could be published any day now, and this report will be the basis for the next phase of company’s upcoming exploration programs to prove up the value of Hidden Lake. We had a chat with Dusan Berka, 92’s Director, CFO and Corporate Secretary to get a better understanding of the true value of the properties.

- You caught some headlines with the results of your channel samples at the Hidden Lake lithium property in the Northwest Territories. How did you come across this property? What’s the history behind Hidden Lake?

There were several factors we took into account before executing the acquisition of the Hidden Lake property;

- Lithium Carbonate experienced a dramatic price bump last November / December 2015 which brought direct attention to the demand growth curve for the commodity. It is clear that demand will continue to grow at a high percentage rate for many years, given the increase in demand from Electric Cars and similar applications;

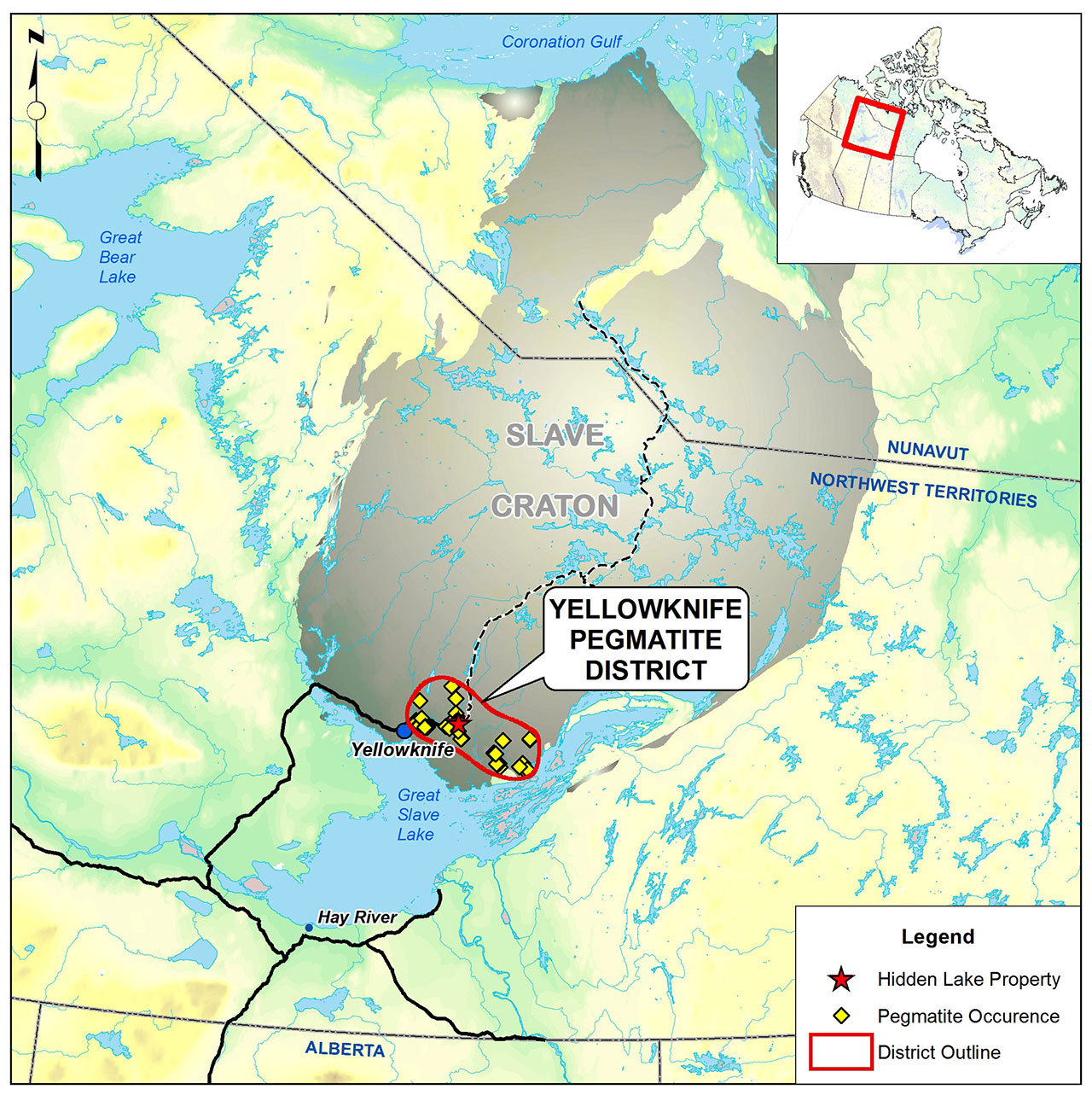

- The ability to be a first entrant into a known lithium pegmatite district like the Yellowknife Pegmatite Belt, afforded the opportunity to acquire some of the best tenures at a low cost; and

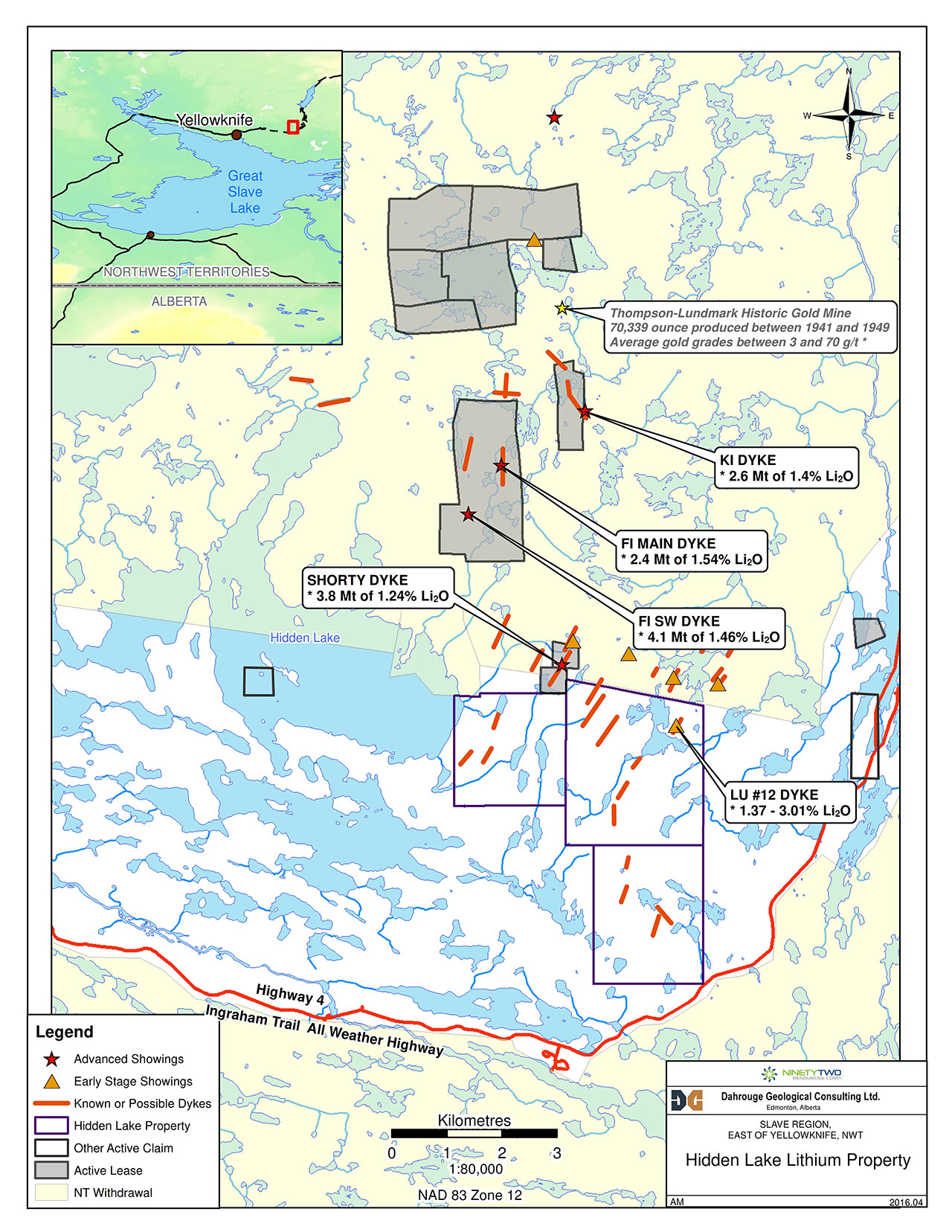

- Given what was known about the Hidden Lake Project, it became apparent that the project afforded the opportunity to move from discovery to resource building very quickly.

So this project ticked a lot of boxes, and we wanted to secure the property for the benefit of our shareholders.

- The second batch of assay results came in at or above expectations, how will you follow up on this in 2017? What’s the exploration plan there?

We expect to have a NI 43-101 compliant technical report completed before the end of this month. We expect the report to recommend a substantial next phase of exploration program and drilling. We are currently in the permitting process, and assuming we can mount a sizeable drill program this winter, then a first resource estimate could be possible during the summer of 2017.

Obviously, all this assumes additional financing, permitting and drilling proceed as planned.

- As of at the end of June, you had a working capital position of approximately C$1M after completing a private placement in June and exercise of numerous warrants. How far will your current cash position get you, and do you have plans to raise more capital in the near future?

Although we have a healthy treasury now (approx.. $600k in the bank), our plans are to raise additional between C$1-2M to carry out exploration program that will be recommended by the 43-101 report. We anticipate that 2017 exploration budget including winter drilling will be in the C$1.5M range.

- You also have some other properties. Could you share a little bit of background on those? Will these remain priority targets for the company, or will they be put on the backburner now you have a promising lithium project?

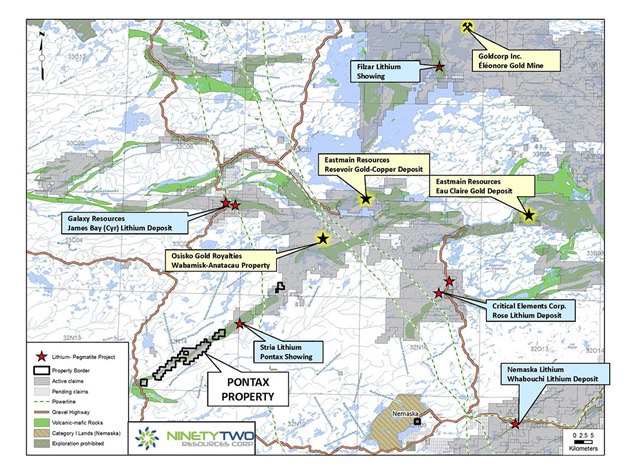

We also own the Pontax River property in the Eastmain Area of Quebec, and its location is actually very interesting.

As you can see on the previous chart, the Whabouchi, James Bay (Cyr) and Eastmain areas are host to numerous lithium pegmatites. Once Nemaska’s Whabouchi Lithium Project reaches commercial production, the entire district may receive additional attention and development, and a significant producer of spodumene, lithium carbonate and lithium hydroxide. Secondly, Quebec is well known for its support of mineral exploration and development; and long being considered as one of the best mining jurisdictions in the world.

As to the Pontax Property, it includes numerous pegmatite bodies identified during regional exploration for gold in the 1970’s and also covered a large part of the Pontax Greenstone Belt. Given the combination of gold and lithium potential, we felt it to be a high quality, early stage exploration property that we could put the boots on the ground in mid-2017. The focus would be primarily to quickly sample the known pegmatite bodies and ascertain the projects lithium potential … but also keep an open mind as to other commodities, as it’s located in an existing greenstone belt, so we might be able to recover some interesting gold assays as well.

Our other properties will remain on back burner for the time being, as we will fully focus to position ourselves as a pure lithium explorer.

Go to 92 Resources’ websiteThe author has no position in 92 Resources. 92 Resources is not a sponsor of the company, but affiliated company Zimtu Capital used to be a sponsor in the past. Please read the disclaimer

Pingback: Undervalued Lithium Stocks - Smart Stock Trading Strategies