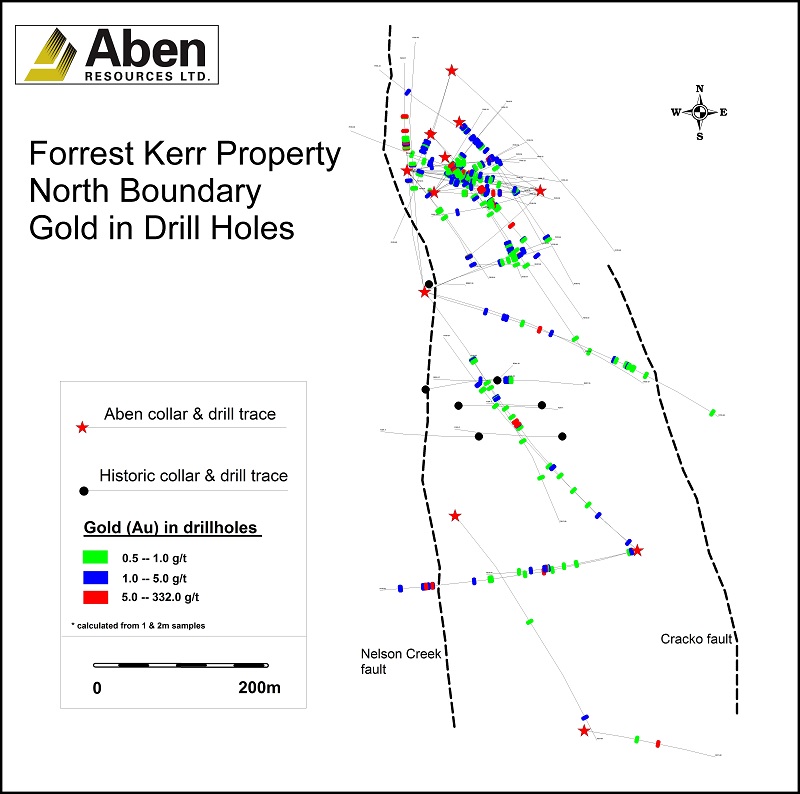

Aben Resources (ABN.V) has released a few updates on its drill program on the Forrest Kerr gold project in British Columbia’s Golden Triangle area, but unfortunately the company hasn’t been able yet to replicate the stunning drill results from last year. Not that we nor the market were expecting more blowout drill results, as this year’s drill program was intended to gain more insight in the geological structures at Forrest Kerr.

The holes that were released a few weeks ago continued to confirm the presence of polymetallic mineralization throughout the North Boundary zone. Hole 47, for instance, encountered a few low-grade gold intervals as well as silver-copper-lead-zinc mineralization while copper was also detected in holes 52, 53 and 54. Rather than just rehashing the press release (where Aben did a good job in explaining where the holes were drilled and what purpose they served), you can read the company’s description here below:

FK19-47 (110/-60) – Drilled from the same pad as FK19-46 (previously reported August 20, 2019 at 0.12 g/t Au over 500.5 meters) at a steeper dip to test for continuity of mineralization below 47 and between the main mineralized zone at North Boundary and historic high-grade gold mineralization reported by Noranda in 1991 (326.0 g/t Au over 1 meter). Hole 47 encountered multiple modest-grade gold (<1g/t Au) intercepts with intermittent Ag-Cu-Pb-Zn mineralization. Analytical results returned by both 46 & 47 have pushed the edge of known mineralization substantially Eastward.

FK19-48 (135/-45) – Drilled from a location 100 meters North of the main mineralized zone at North Boundary to test for potential Northeastward extension of mineralization. This hole failed to intersect significant precious metal mineralization.

FK19-49 (195/-57) – Drilled from the same pad as FK19-50 (previously reported August 20,2019 0.46 g/t Au over 61.7 meters starting at 188.0 m) at a shallower dip. Both holes 49 & 50 were planned to test for the downward extension of a mineralized horizon discovered in 2018 (holes FK18-17 & 18) situated approximately 50 meters NW of high-grade Au-Ag-Cu mineralization at North Boundary. Hole 49 intersected weaker gold mineralization (0.52 g/t Au over 8m) than the steeper hole 50 but the combined result of the two holes shows a 20+m extension to the zone encountered in 17 & 18.

FK19-52 (310/-55) – Located roughly 500m from the main mineralized core at North Boundary and drilled from the same pad at a steeper dip than the previously reported hole FK19-51. Both holes were drilled oblique to the roughly North-South mineralized corridor to test for the southward extension of mineralization and depth potential under historically reported mineralization. Several discrete horizons of base and precious metal mineralization were reported from this hole. From 323-339 m (16m interval) average grades were 2.22 g/t Au, Ag 2.39 g/t and 3050 ppm Cu. Included in this zone are two separate 1m high-grade intervals of 19.85 g/t Au, 9.10 g/t Ag, 6810 ppm Cu and 11.30 g/t Au, 8.70 g/t Ag & 14900 ppm Cu. The entire hole returned an average of 0.11 g/t Au over 469.0 meters.

FK19-53 (250/-45) – Collared from the same pad as holes 51 & 52 but drilled WSW to test for mineralization potential within and adjacent to several sub-parallel fault and shear structures. Between 346-364m this hole returned 1.24 g/t Au, 2.47 g/t Ag and 3459 ppm Cu over 18 meters. Included in this zone are two 1m high-grade intervals of 5.72 g/t Au, 8.70 g/t Ag, 5860 ppm Cu and 8.09 g/t Au, 5.40 g/t Ag & 14200 ppm Cu. Multiple other moderate to high-grade intercepts of Au, Ag, Cu and Zn mineralization were encountered with an overall average of 0.10 g/t Au over 430.5 meters.

FK19-54 (250/-60) – This hole undercut the precious and base metal mineralization encountered in hole 53 at a steeper dip. Several samples returned elevated precious and base metal intercepts from discrete zones with the most coherent zone between 203-215m depth (averaging 1.05 g/t Au, 1.71 g/t Ag and 2108 ppm Cu over 12m), including 1m highs of 7.14 g/t Au, 4.80 g/t Ag and 11550 ppm Cu.

Nobody said this would be easy and although it has been tough to replicate the exceptional results from the summer 2018 exploration program, the data of this year’s drill program should be very helpful to further interpret and finetune the interpretation of the mineralized structures at Forrest Kerr. As of the end of June (the most recent quarterly financials), Aben Resources had a working capital position of around C$5.4M, and its October corporate presentation shows it still has around C$2.5M in the treasury. This means Aben probably won’t have to raise more money until it’s ready for its 2020 exploration programs at Forrest Kerr, Justin and perhaps Chico as well.

Disclosure: The author has a long position in Aben Resources. Aben is a sponsor of the website.