At the end of the first quarter, AbraSilver (ABRA.V) released the results of an updated pre-feasibility study on its Diablillos flagship asset in Argentina. The study came right on time to put the company in the spotlights again now the silver price is performing quite well.

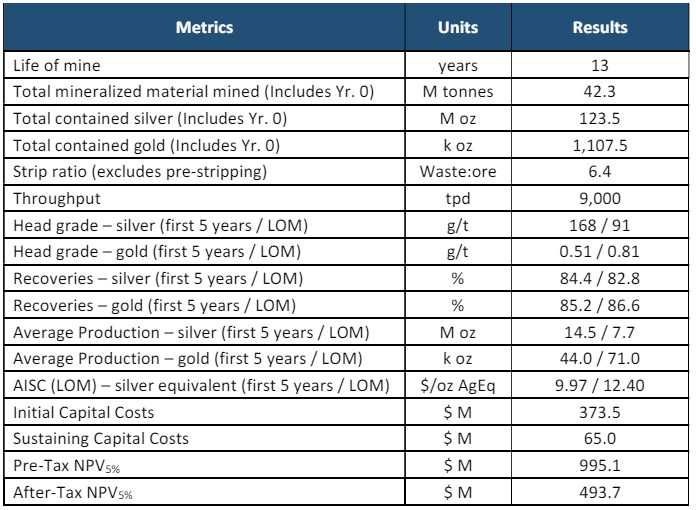

According to the economic study, the all-in sustaining cost per ounce of silver-equivalent is estimated at US$12.40 but the economics are spiked by the higher production rate at a lower cost in the first five years of the mine life. Although the total average annual production will be 7.7 million ounces of silver and 71,000 ounces of gold over the entire mine life, the first five years are silver-heavy and gold-light compared to the life of mine estimates. AbraSilver plans to produce 14.5 million ounces of silver and 44,000 ounces of gold per year in the first five years of the mine life and expects its AISC to be just below $10 per ounce silver-equivalent.

The base case scenario, which uses precious metals prices of $23.5 for silver and $1850 for gold, indicates an after-tax NPV5% of US$494M while applying an 8% discount rate would have a negative impact of approximately US$130M on the NPV which would then drop to US$363M. At the base case scenario, the after-tax IRR comes in at 25.6% but this increases to 33.3% using $27 silver and $2,128 gold (as shown below).

The higher precious metals prices obviously also boost the NPV as well with an after-tax NPV5% of US$742M and an after-tax NPV8% of US$568M.

The initial capex is estimated at US$374M, which is an increase of almost 50% compared to the 2021 study (this didn’t come as a surprise as the anticipated capacity of the processing plant has increased from 7,000 tpd to 9,000 tpd). The sustaining capex has more than fourfolded but remains very manageable as the project would require just $65M in sustaining capex.

Subsequent to releasing the results of the pre-feasibility study, Abrasilver attracted Kinross Gold (KGC, K.TO) and an affiliate of Central Puerto (CEPU) in a C$20M raise, issuing 50 million shares at C$0.40 per share. Both Kinross and Central Puerto now each own 4% of Abrasilver while the C$20M cash infusion comes in handy to further advance the project.

Disclosure: The author has no position in AbraSilver. Please read the disclaimer.