It has been brought to our attention a Belgium-based newsletter has been promoting a private placement to be conducted by Niocorp Developments (NB.TO). There were several factual errors in the ‘promotion’ e-mail, and we’d like to point out a few of these.

First of all, the author claimed there indeed is more scandium in the world and specifically in Australia, but that it would require, and we quote, ‘an astronomic capex’. That’s surprising as for instance Scandium International (SCY.TO) is indeed planning to build a scandium mine, but with a capex of just $77M we would not consider this capex to be ‘astronomical’ and in fact, definitely ‘financeable’.

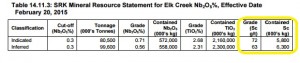

Secondly, the author makes it sound as if the addition of Scandium is a ‘new’ fact and CEO Mark Smith was ‘under an NDA’ and could not disclose the existence of Scandium. That’s really surprising because first of all we have never heard of an NDA not allowing a C-level executive to talk about a simple commodity that’s in the ground, but secondly, and more importantly, the scandium is NOT a ‘newly discovered’ feature of the project. We would like to refer you to the technical report filed on SEDAR at March 11 of this year, which included a NI43-101 compliant resource (dated February 20) estimate which includes Scandium. Additionally, we already discussed the impact of a lower scandium price in our blog post on April 11 (LINK). So the existence of Scandium was definitely discussed before June.

A final issue with Niocorp’s value proposition is the size of its production. With an expected output of almost 100 tonnes of Scandium per year, it would produce approximately 8 times the current demand for the commodity (see US Geological Survey data). Whilst we do agree Scandium is a very interesting commodity, it will take several more years to really develop a Scandium market and incorporate it in more (industrial) applications.

Don’t get us wrong, we are not on a crusade against Niocorp Developments (and are giving the company the benefit of the doubt as Niocorp has been using top-tier independent firms to validate its claims), not at all, but we are reacting against mis-informing people and wanted to point out some factual errors made by a Europe-based newsletter. And we aren’t alone. The well-respected Commodity Discovery Fund based in the Netherlands has also posted an open letter (in Dutch and now also in ENGLISH) on its website, warning for this type of practices.

Every investor is old and wise enough to make his or her own investment decisions, but you should only trust your OWN research and do your own homework. A good place to dig a bit deeper into Niocorp’s value proposition is to start reading the company’s SEDAR-filings (LINK) with a special focus on the NI43-101 compliant technical reports.

Disclosure: The author holds no position in either Niocorp Developments nor Scandium International. Please see our disclaimer for current positions.

I’ve done my research on this company. Please provide said “newsletter”, who the author is, and where author obtained said “newsletter “