Arras Minerals (ARK.V) has announced it plans to complete a C$2M non-brokered financing by issuing up to 7.7 million units at a price of C$0.26 per unit. Each unit will consist of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share for C$0.40 for a period of three years.

This is the first time since 2022 Arras is raising money as the initial strategic investment by Teck Resources (TECK, TECK.TO) provided enough fire power to advance the joint venture on some of Arras’ projects. The partners now have outlined a US$2.5M work program to advance some targets to a drill-ready status this year. The entire US$2.5M exploration plan is funded by Teck.

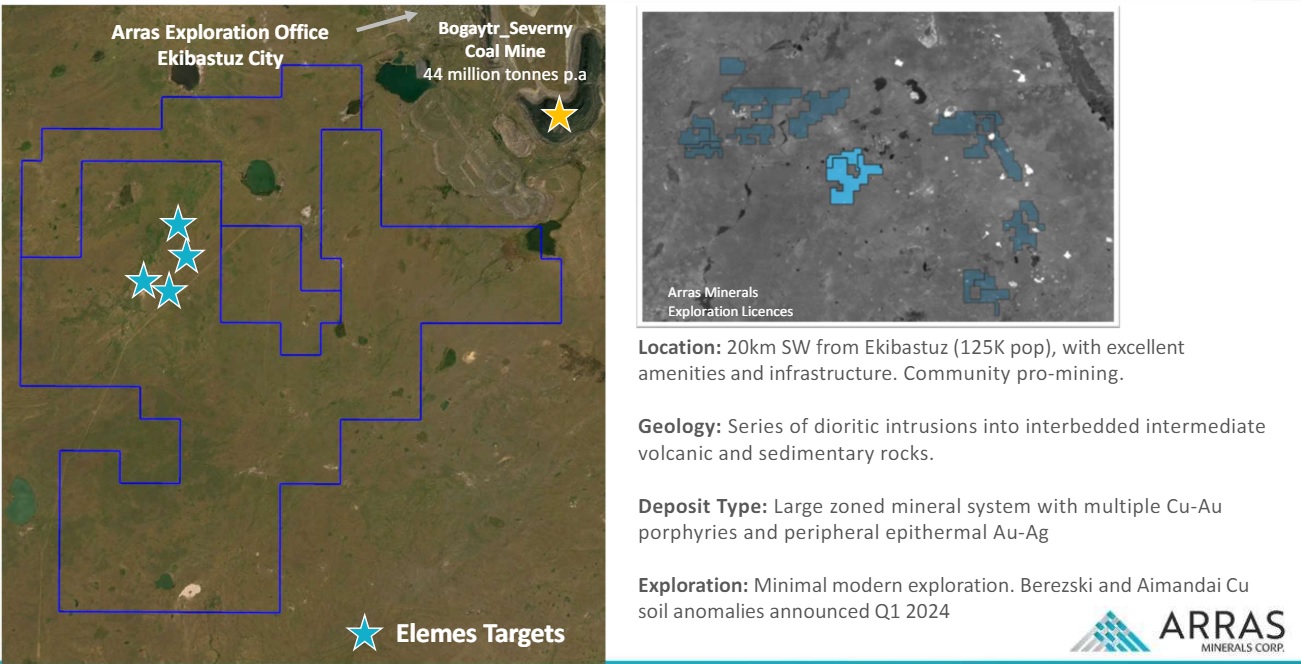

But Arras still owns claims that are not included in the Teck joint venture, and the proceeds of the current financing will be spent on those 100% owned projects. Earlier this year, the company announced very large copper-in-soil anomalies with multi-kilometer strike lengths. Those anomalies contain porphyry mineralization and Arras would like to test the mineralized structures this year.

At the end of January, Arras had a working capital of just US$0.1M.

Disclosure: The author has a long position in Arras Minerals. Please read the disclaimer.