Aurania Resources. A company that makes the hearts of scavenger hunters beat a little bit faster whenever the name pops up as the company is applying an original exploration theory to find the so-called Lost Cities. And although the company’s home page clearly states ‘this is not a treasure hunt’, we beg to differ as the concept is pretty much literally a treasure hunt: using historical data to try to pinpoint the location of a supposedly rich gold system mined by the Spaniards.

We have to admit, the concept is great. But unfortunately even after spending tens of millions of dollars, that’s still all it is: a concept. Aurania has been trying to keep its investors engaged and interested by providing news on a regular basis, but most of these ‘updates’ aren’t very news-worthy as the company’s quest continues.

And because the concept of finding these semi-elusive gold cities still appeals, Aurania has been able to continue to secure funding but unfortunately the cash is pouring out of the company and we expect Aurania to tap the equity markets again in the next few weeks given its sky-high burn rate. A look at the financials:

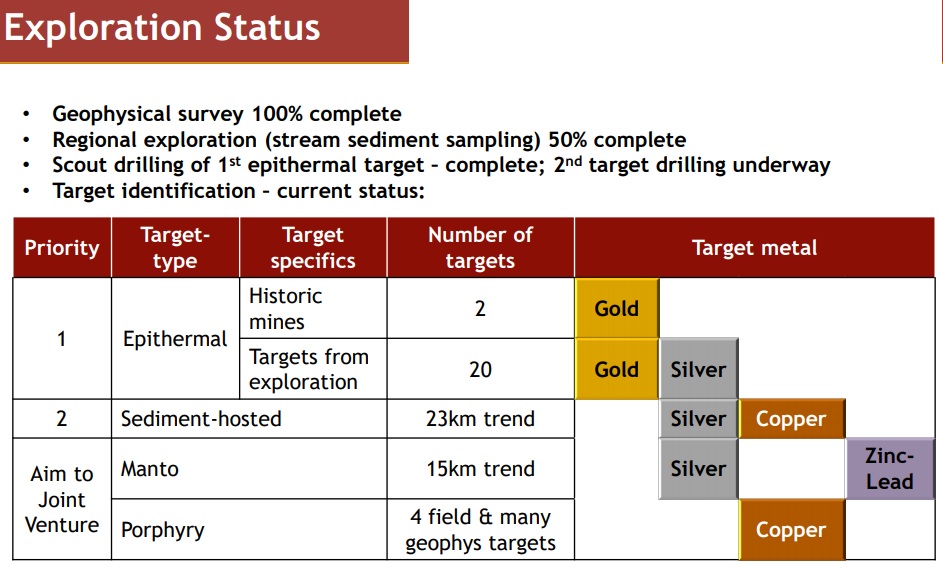

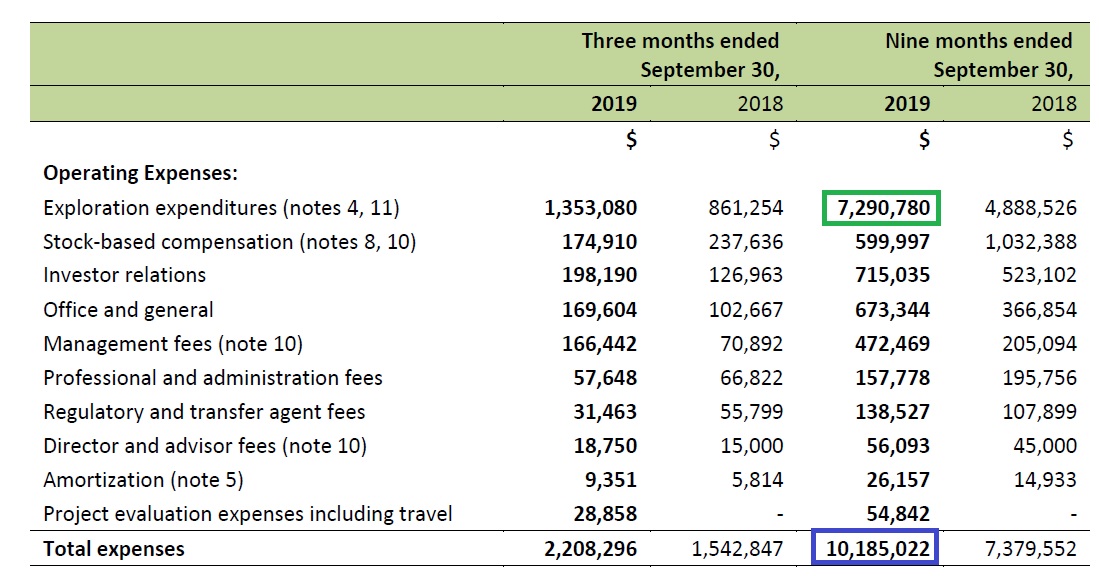

In the first nine months of the year, Aurania reported C$10.2M in expenses, of which C$9.6M were cash expenses (with the remainder mainly consisting of stock-based compensation and amortization expenses). Of the C$9.6M, roughly C$7.3M were booked as ‘exploration expenditures’ and expensed rather than capitalized (which makes sense, as there isn’t anything to show for yet, project-wise). Spending 75% of the expenses on exploration sounds excellent. But the story looks different when you actually have a look at the breakdown of said exploration expenses.

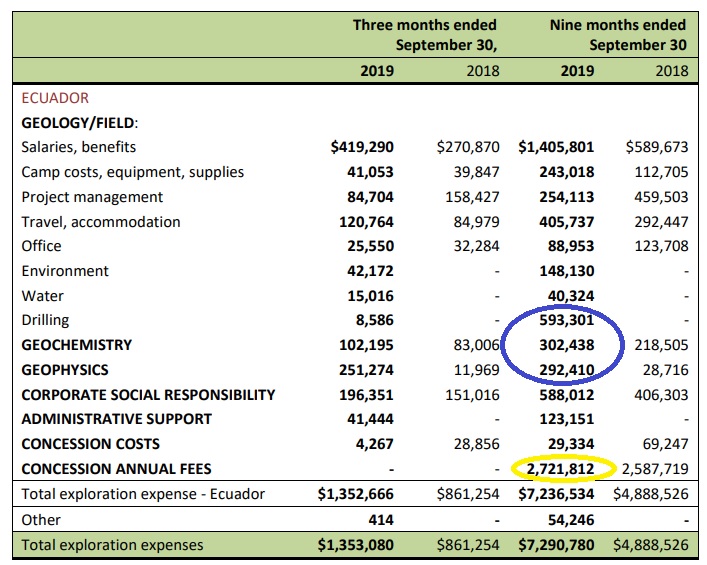

Of the C$7.3M, C$2.72M had to be paid as an annual concession fee. While that obviously is an absolute necessity, it does mean that the real exploration expenses are substantially lower. In fact, only C$1.2M of the C$7.3M booked as an exploration expense was effectively spent on drilling, Geochem and geophysics and as you can see in the previous image a lot of money was spent on salaries, travel, CSR and camp costs.

This means Aurania continues to bleed cash with virtually nothing to show for so far. It’s good to see CEO and main shareholder Keith Barron only takes a relatively moderate salary income [correction: there only is a C$15,000 ‘other compensation’, and no salary] so he will have to make his money on the equity side by making sure his shares appreciate in value. Fortunately he already owned in excess of 10 million shares even before Aurania went public at C$0.40/share

But how good Barron’s intentions might be (and we really hope every single shareholder will make a huge splash), with a burn rate of almost C$10M in the first nine months of the year and just C$2.5M in cash on the balance sheet as of the end of September, Aurania will have to tap the equity markets in the very near future. The current share price and market capitalization may enable Aurania to raise a sufficient amount of money to cover the 2020 budget, but unfortunately the current C$125M market capitalization of Aurania Resources consists of C$124.9M worth of hopes and dreams and very little fundamental value.

Disclosure: The author has no dog in this race.