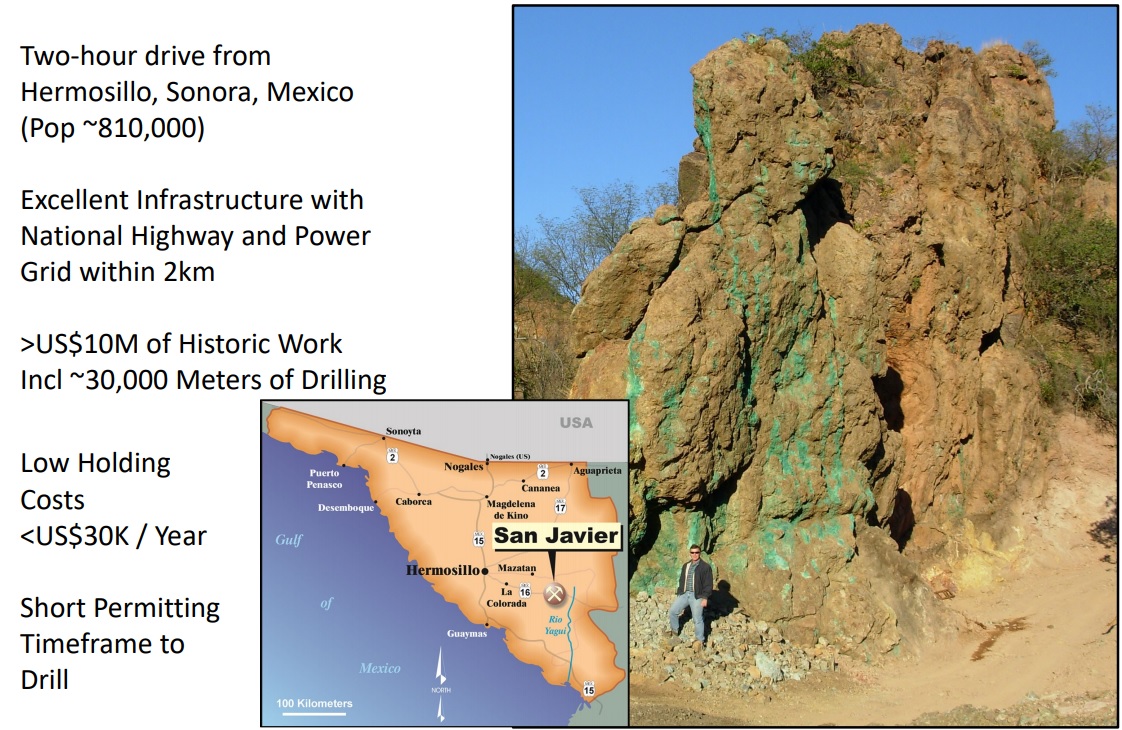

Barksdale Resources (BRO.V) has signed a binding letter of intent to acquire the San Javier copper project in Mexico’s Sonora province, located just two hours east of Hermosillo. The 1184 hectare property has been subject to about 30,000 meters of drilling which confirmed the existence of copper mineralization.

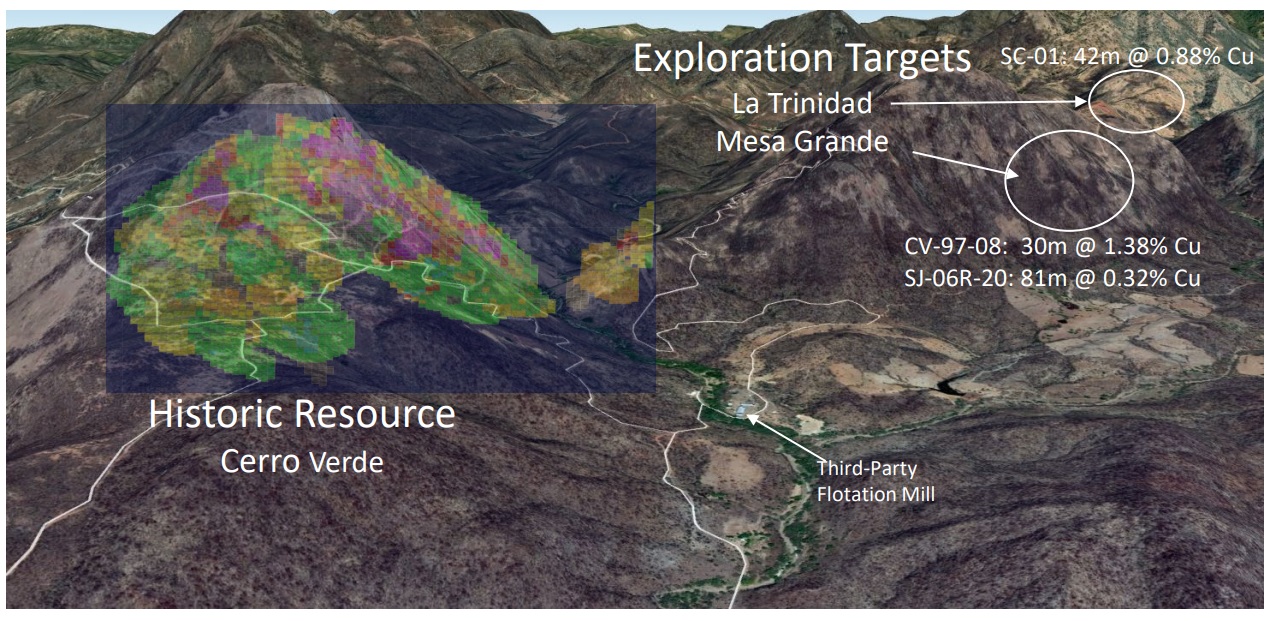

Some of the highlighted historical results are actually quite good with for instance almost 192 meters starting at surface with an average grade of 0.43% copper (oxide) while other holes contained other thick intervals of copper mineralization. Most near-surface rocks are oxidized but the previous drill programs also confirmed there are sulphide and transitional zones that are carrying decent copper grades.

Barksdale will be able to acquire full ownership of the project by making C$500,000 in cash payments while issuing 13 million shares to the vendor and will issue a gliding scale royalty. The NSR will be 1% when copper is trading below 3.50 dollars per pound but increases to 2% when copper prices exceed $3.50/pound. Meanwhile, during the DD process, Barksdale and the vendor, Tusk Exploration, identified title issues which will only be fully rectified in 2021. In order to not derail the transaction, both companies have agreed to defer a portion of the Y1 and Y2 cash and share payments.

To help fund the acquisition and to be able to hit the ground running, Barksdale originally intended to raise C$4M but expanded the offering to C$6.3M due to the level of interest in the financing. Barksdale will be issuing 16.6M units priced at C$0.38 with each unit consisting of one share and half a warrant valid for two years, allowing the warrant holder to purchase an additional share for C$0.55. This financing will close next week.

Disclosure: The author has no position in Barksdale Resources.