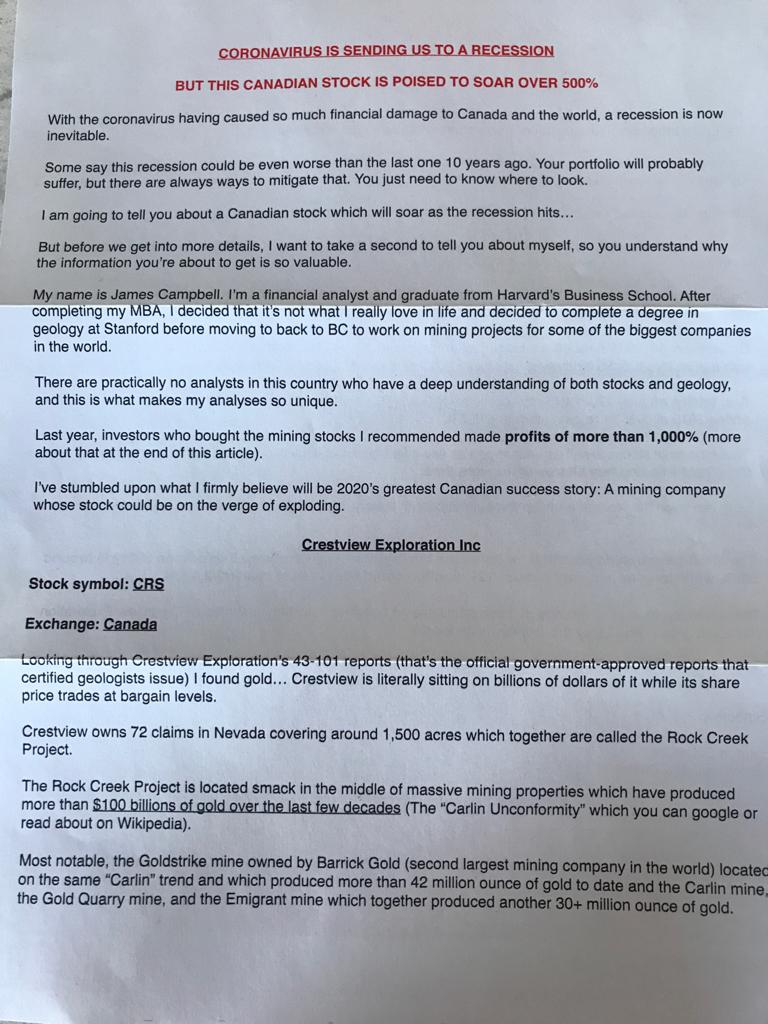

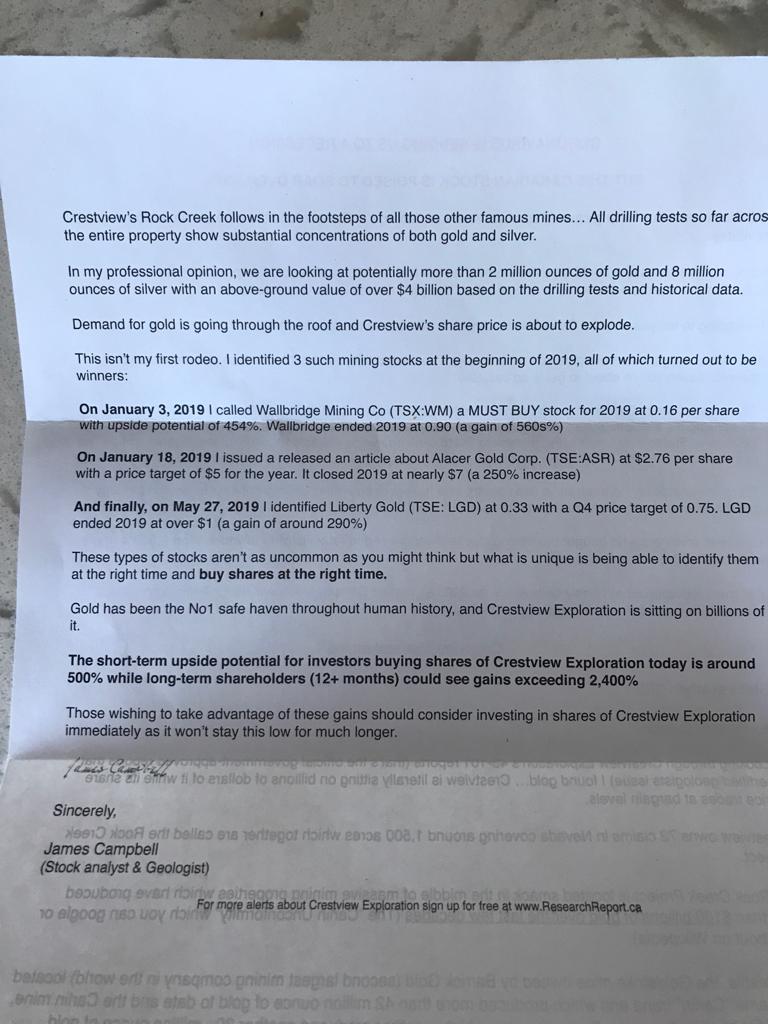

We received reports of a letter sent by snail mail by a ‘James Campbell, geologist and MBA graduate’ promising investors in Crestview Exploration (CRS.C) gains of 500% in the short term and 2400%. The letter is also referring to a Canadian website ‘researchreport.ca’ which seems to be just a landing page to harvest e-mail addresses.

A quick round of googling doesn’t result in any hits for a James Campbell who is both a geologist graduated from Stanford and an MBA graduate of Harvard Business School (we would also expect every Harvard graduate to not mis-spell the name of their alma mater as the letter calls it ‘Harvard’s’ Business School). James Campbell appears to be a fake name, just like ‘Greg Wilson‘, a pseudonym used online.

Upon researching the company, it looks like Crestview Exploration is still in its infancy. The company got listed on the CSE (where the rules and regulations aren’t as strict as on the Toronto Stock Exchange or the TSX Venture Exchange) in September last year, and there are several red flags popping up.

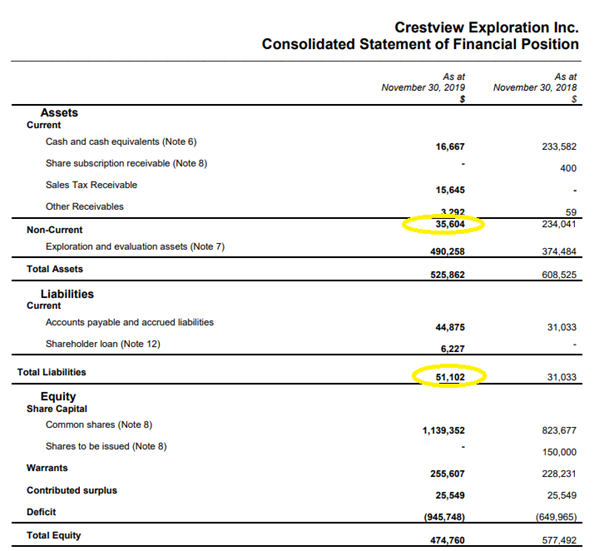

First of all, the most recent financial statements provide an overview of the situation as of November 30th 2019. At that date, Crestview had just C$17,000 in cash and C$51,000 in current liabilities indicating the working capital position was already negative 4.5 months ago. Since November 30th, Crestview has finished a sampling program (Press release, December 2nd 2019) but no assay results have been published yet. Additionally, an aerial survey was completed in February. This means the working capital position will have deteriorated even further since November as Crestview continued to incur expenses.

Crestview confirmed earlier in Q1 it is planning to drill the project in the third quarter of this year, but as the financial statements show, there simply is no money to drill the project. Subsequent to the end of November, 1.4 million warrants expired unexercised, but Crestview raised C$61,000 from C$0.10 warrants and C$231,000 from investors exercising warrants with a strike price of C$0.60. That will keep the company’s lights on for a few more months, but the treasury is likely still running on fumes (the Q1 financials should be filed soon) and the company will have to raise cash before getting back in the field if it wants to do some meaningful exploration (Crestview spent just C$203,000 on exploration) the past two years combined.

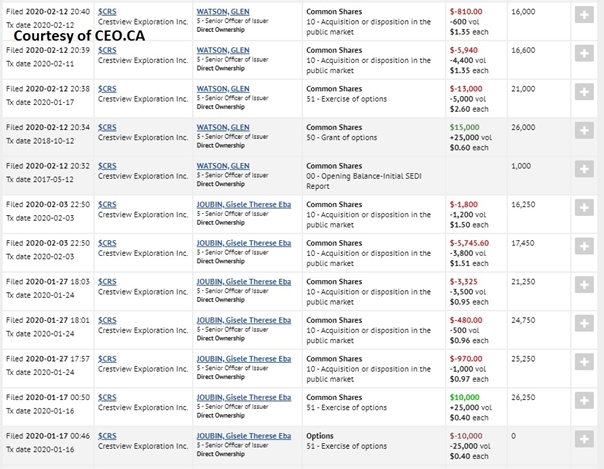

Additionally, according to the official filings, insiders have been selling stock in Crestview Exploration. In their defense, most of it was upon exercising options but apparently management didn’t get the memo about the 2,400% gains further down the road nor the C$10 target price that was slapped on by ‘Greg Wilson’.

Glen Watson, the CEO owned 1,000 shares in Crestview, exercised 25,000 options to increase his position to 26,000 shares before selling off 10,000 shares again for total proceeds of C$19,800. This means the CEO currently owns just 16,000 shares in Crestview Exploration. Shares that are basically free as he invested just over C$15,000 in the company but already sold stock to the tune of C$19,800. Unless there are late filings, the current management team of Crestview doesn’t seem to have any real skin in the game other than a symbolic.

There are simply way too many red flags to waste even one additional minute of our time on Crestview Exploration:

- Promotional snail mail (seriously? This is 2020) promising quick gains.

- The company was already out of money four months ago and the recent warrant exercises will only have plugged the hole on a temporary basis. Expect Crestview to tap the equity markets shortly.

- According to the prospectus (found on SEDAR), the founders round initially created shares at C$0.025, C$0.05 and C$0.10. Even if the share price halves, the founders will still be making money.

- We see the insiders selling off their positions in Crestview, which doesn’t signal a lot of confidence in the company’s future.

Anyone who promises you short-term returns of 500% and 2,400% returns on a longer term basis is just letting his mouth write cheques his body can’t cash. Don’t fall for it. The company is out of cash and will most likely have to raise money any day now.

Semi-anonymous letters that sound over-promotional belong in only two places. Either in your garbage bin or on the desk of your province’s securities commission for additional scrutiny.

Disclosure: The author has no position in Crestview Exploration and is staying very far away from it.

I had just opened up this exact same letter just today! I’m glad I came across this article after an quick Google search.

Shame on these people for exploiting a global emergency to scam people!

I received this same letter in my mailbox today. I was suspicious and ‘ googled ‘ the content and CEO’s name.

Your article was what Google made available. Thank you as I found it very helpful !

Like previous posters, no record of James Campbell, Harvard grad etc.

TOTAL SCAM!!

The regulators have already stepped in as they issued a bulletin that starts like this:

“The British Columbia Securities Commission (BCSC) and the Alberta Securities Commission (ASC) are warning the public to exercise extreme caution about aggressive promotion of Crestview Exploration Inc., a B.C. gold mining company……….”

Karma does work for people like you

I had a feeling this was totally unsupportable and a scam as soon as I read it – as you said it came in the same sort of promotional envelope marked “Coronaviris affecting markets: Read Now.” Received it Apr 22. Normally this type of mail goes unopened into my garbage bin.. I was curious, but HIGHLY suspicious as soon as I started reading it.

I live in Ontario and will be checking with our securities commission to see if its aware.

I received this letter too but knew straight away that it was a scam. It is just very sad that many people, especially Seniors will fall for this. I hope the perpetrators get caught soon!

If I knew the secret of making 500% I would keep quite rather than inviting the world to share the bonanza!

I have received the same snail mail today with spelling errors corrected. Interesting. Same BS info.

I knew this was a scam as soon as I opened it. Wanted to see if others had gotten the same letter. Well, I got my answer.

i received it today and before opening it, i said to my kid this is misinformation just by looking at the envelop. so i opened letter and told my kid to google james campbell and there is no such person. he has just learned his first lesson on fraudulent claims.

Beware! Today it’s the 25th of May and this letter still going around! I just got one myself

.

Just got the letter – I live in an apt in Mississauga, mostly working class/middle-low income people, families who can’t afford a house – and someone trolls this address in hopes of scamming these people out of whatever precious little money they have? I am contacting the OSC.If Crestview is behind this, it should be delisted and the authors of the letter disciplined professionally and in courts if applicable. A James Campbell is listed as a retired member of Gossan Resources, so the person behind the letter even uses a legit name in the industry. Gossan has been informed.

Thank you for this. I was also suspicious of the correspondence and started to research. I noticed the insiders were not interested in thier own stock and came on here to google Mr. Campbell to reach out and ask him why he might suppose that is, and this was the first hit. Perfect.

Greed brings out the best in people LOL

I got an email from someone saying the stocks will triple for them too. Watch Out they make it sound personalized.

Thank you so much, very helpful information that for sure will help naive investor to run away from this type of scam.

I got the letter in late-May as a postal drop no address on the envelope. They must have cleaned up the letter a bit because Harvard Business School is now spelled correctly and the website at the end of the letter is canadianinvestor.com

Pingback: CrestView Exploration: snail mail scam mail all around Canada | The Frugal Nexus

These scams are being organized out of India so they’re impossible to trace. The promotional websites SmallCap Power and ubika are run out of India

So what happens here is that this guy probably bought a couple $$K of the stock, then mail this letter around. Its not really a scam, but the intent is that some people will buy the stock pushing its price higher. At this point the person who sent the letter will sale his shares reaping a good profit in a short time. Since this company has a smaller market cap, it doesn’t take that much demand to push its stock price higher. If you look at the quote on any website you’ll see exactly that: the stock was selling around 60-70 cents when the letters were circulating, then in the next 3 weeks, a sudden peak all the way to 90-95 cents. Not too long after, it went back to its previous level.