Shortly after cancelling the deal with the potential Chinese buy who was willing to purchase the Bougouni lithium project in Mali, Birimian (ASX:BGS) is showing it doesn’t want to waste any time. Birimian wants to show it doesn’t really ‘need’ to sell the project, and the results of the scoping study are encouraging.

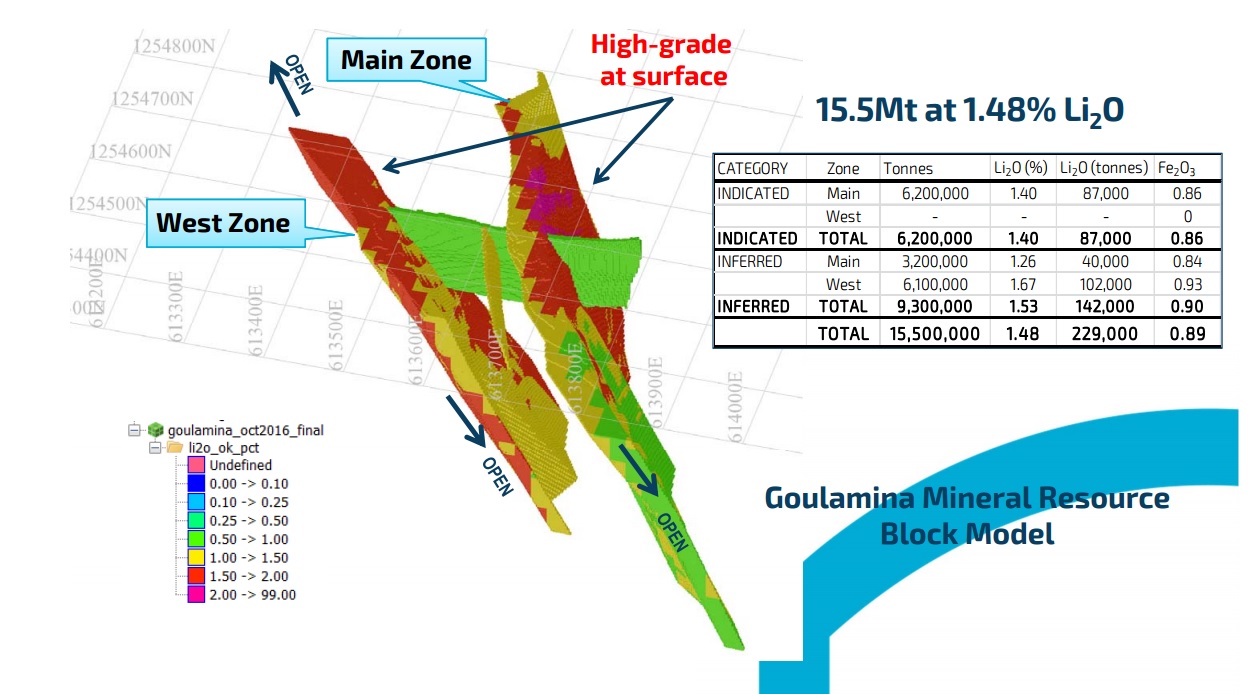

A total of 15.5 million tonnes were included in the mine plan which is based on a 1 million tonne per year processing rate during 13 years. The average annual spodumene production rate is anticipated to come in at 190,000 tonnes per year at a total production cost of $326/t. That’s pretty high (the transportation costs are very high as Mali is a landlocked country) but thanks to the low capex of $47M, the average annual cash flow would still be almost $40M, using a spodumene price of $550/t.

The company has used a base case spodumene price of $537/t but didn’t provide a net present value of the project. According to our own back of the envelope calculations based on the short summary of the scoping study, we end up with an after-tax NPV10% of A$200M, which includes the construction of Phase 2 in year 2 of the mine life. Again, this is a very rough and basic calculation, and might be improved in the pre-feasibility study.

Go to Birimian’s website

The author has no position in Birimian. Please read the disclaimer