Cora Gold (CORA.L) has announced it signed a new agreement with Lionhead Capital Advisors whereby the latter will provide US$25M of funding to develop the Sanankoro gold project in Southern Mali. The term sheet is subject to the completion of a definitive feasibility study before the end of the second quarter next year, but it already provides useful insights on the financing structure for the project.

The US$25M will consist of two major parts and will be structured as a 50/50 equity financing and convertible financing. The equity will be priced at a 10% discount to the 30 day VWAP at the day Cora Gold announces the achievement of the Project Milestone (the completion of the feasibility study) or the lowest price Cora raised cash at in the 60 days preceding the milestone.

The convertible debt will have an 8% coupon which is very low for a Mali-based gold project, but it looks like the lender will be making money on the ‘extras’: Lionhead will receive a 1% NSR on the first 250,000 ounces produced. At $1750 gold, this NSR would have a gross undiscounted and pre-tax value of just under US$4.4M which is a nice sweetener for a US$12.5M debt deal. Cora Gold will be allowed to repurchase this NSR for a US$3M cash payment but it looks like that will only be the better choice should the gold price exceed $2,200 for a while. Otherwise it wouldn’t make sense for Cora to pay US$3M rightaway versus $4.4M spread out over several years unless the cost of capital drops dramatically for Mali-based gold projects (which we don’t expect to happen).

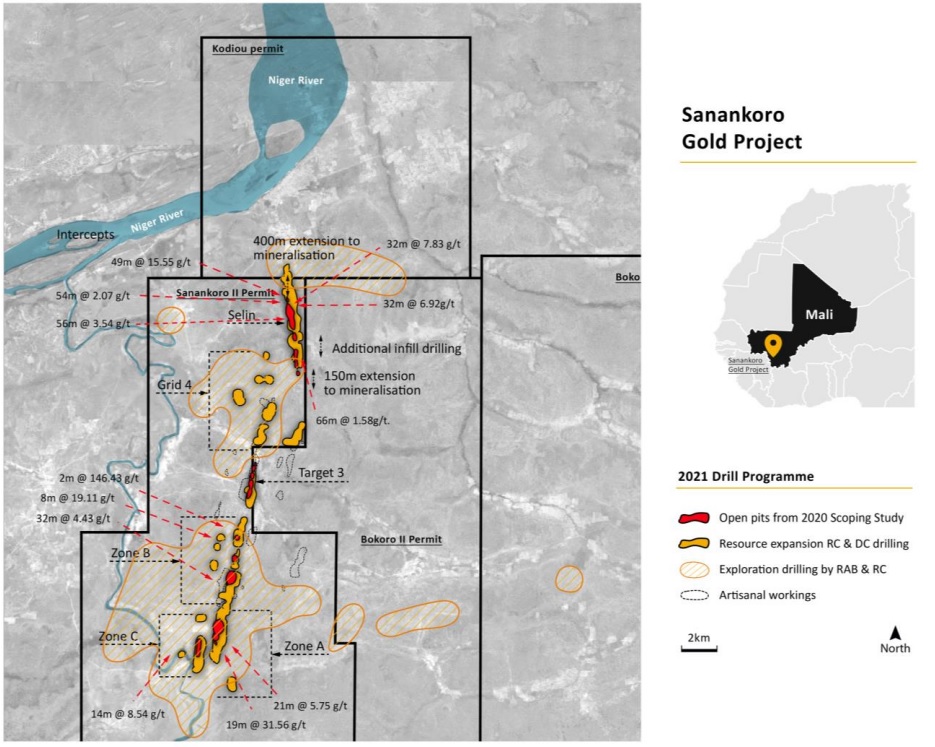

As Lionhead is a related party (one of Cora’s directors and 34.55% shareholders is a founder of Lionhead), it’s good to see a firm term sheet on the table as this will make Cora’s life easier. The company is currently working towards an updated resource estimate which should be released later this quarter, and the definitive feasibility study should be ready in the first half of next year. It will be interesting to see the changes in the mine plan as Cora is now zooming in on a CIL processing route. That makes a lot of sense at the current gold price, but it will be interesting to see how the capex requirements and economics of the projects will change.

Disclosure: The author has no position in Cora Gold. Please read our disclaimer.