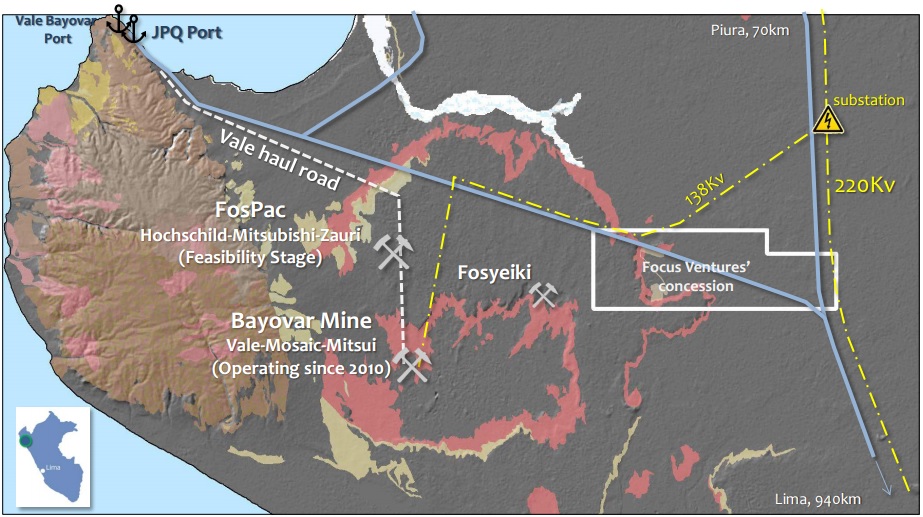

Focus Ventures (FCV.V) has released the summary of the pre-feasibility study and the results are a bit mixed.

The Net Present Value of the project definitely meets our expectations (C$350M on an after-tax basis for 100% of the project using a discount rate of 7.5%), but the initial capital expenditures and the IRR are a little bit disappointing.

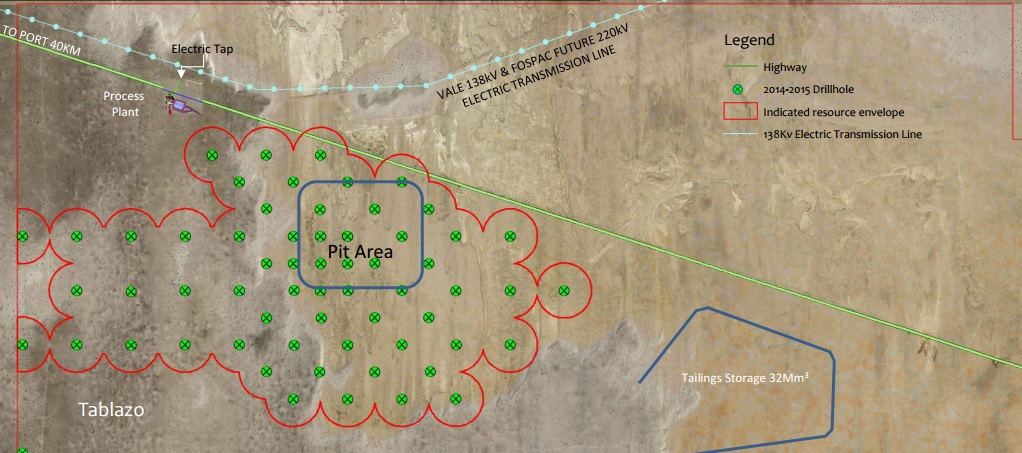

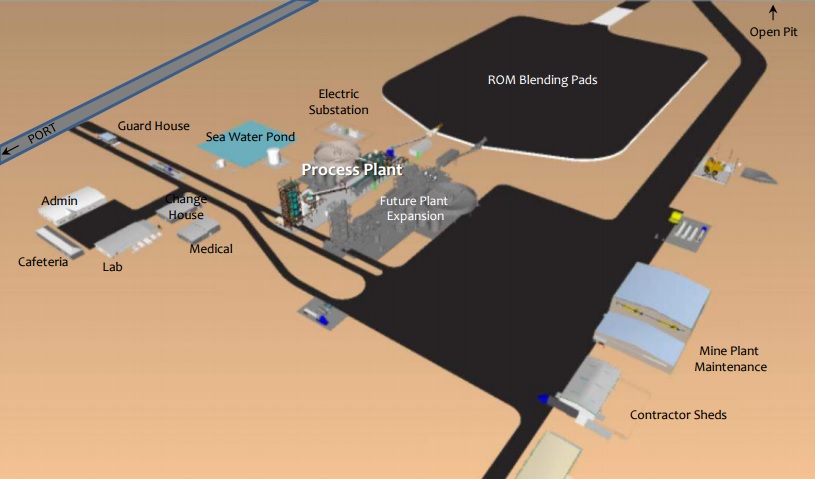

First of all, the capex of US$127M is quite a bit higher than what we originally anticipated, and even when we last met President David Cass in October, the guidance was for the total capital expenditures to be roughly around $50M which would have resulted in a very ‘financeable’ project with a minimal requirement for equity funding. The $127M includes the pre-stripping expenses, but we are a little bit surprised to see the total cost price of the first 500,000 tpa processing plant coming in at in excess of $80M (including a 20% contingency).

The higher than expected capex immediately resulted in the IRR being lower than expected as well, as we would actually have aimed to see an after-tax IRR of at least 20%. The only culprit for the low IRR is indeed the initial capex, as for instance the average production cost of $75/t and the operating margin of $90/t are in line with our expectations.

Despite this, we do think Focus will be able to increase the IRR to in excess of 20%. Keep in mind there was a lot of pressure on its consultants to have the pre-feasibility ready before the end of 2015 in order to avoid any penalty payments to the joint venture partner, but the negative consequence of this pressure was the fact there was no time at all to conduct any optimization studies to boost the results. Also keep in mind the study used an USD/PEN exchange rate of 3 versus the current spot rate of 3.40, which basically means the local expenses are now 13M cheaper compared to the USD-denominated assumption in the PFS. The pre-stripping cost will for instance be a local cost, and shaving off 13% of that will immediately save you a few million dollars in capital expenditures.

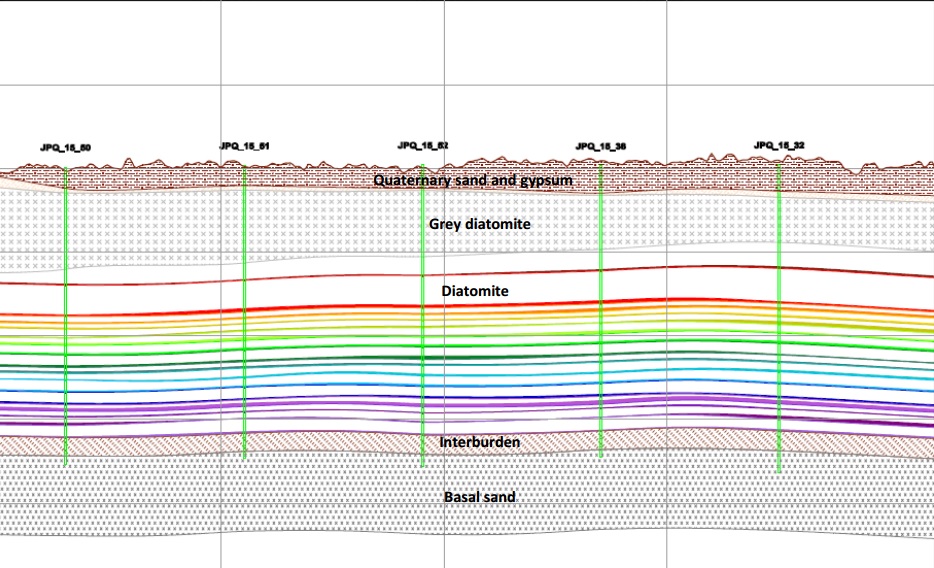

Additionally the initial mine life includes just a small part of the currently known total resource. As you can see on the next image, the 20 year mine life is just a theoretical cut-off as the cash flow in year 21 would have been discounted by a factor of 4.55 leading to just a marginal increase of the NPV. This doesn’t mean the mine life will be limited to 20 years, as we have literally zero doubt Focus will be able to convert more resources into reserves further down the road.

And finally, the base case scenario uses an average phosphate price of $165/t (which is the average of the 24% and 28% product which is expected to be sold for $145/t and $185/t respectively). Whilst this seems to be outrageous compared to phosphate concentrate, keep in mind Focus Ventures will produce Direct Application Phosphate Rock and even though the average grade will be lower, there usually is a huge premium associated with DAPR. Keep in mind competitor DuSolo Fertilizers (DSF.V) in Brazil received approximately $90/t for DAPR with a phosphate grade of 15%, which is an ‘inferior’ product compared to the 24% and 28% product Focus aims to sell.

The lack of transparency with regards to the pricing of the Sechura-based Direct Application Phosphate Rock is definitely not working in Focus’ advantage… However, the most recent date from 2015 is suggesting Focus’ neighbor Fosyeiki was selling its 24% DAPR at a price of $175/t, which would be 20% above the price Focus has assumed for its 24% product. That being said, a 10% decrease in the average pricing of the Sechura PhosRock would result in Focus Ventures seeing 40% of its NPV evaporate.

As a preliminary conclusion (we are obviously waiting for the technical report to be published before being able to single out additional details); the NPV is excellent, the IRR is quite low due to the higher than expected capital expenditures. However, the cheaper Peruvian Sol and the lack of optimization leads us to believe the current study can definitely be improved.

Go to Focus Ventures’ website

The author holds a large long position in Focus Ventures. Focus also is a sponsor of the website. Please read the disclaimer