It took the company a while (as labs were backed up), but Freeman Gold (FMAN.C) has now finally released the assay results of the first few holes drilled on its fully owned Lemhi gold project in Idaho. The assay results of four holes have been released and all four holes contained economic gold mineralization.

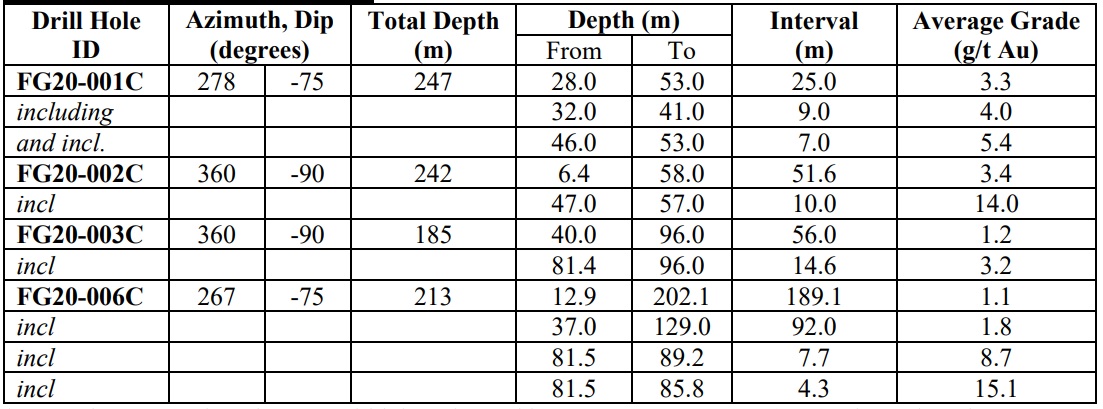

While the headline result (unsurprisingly) focused on the 10 meters of 14 g/t gold (within a broader interval of 51.6 meters of 3.4 g/t gold, every single one of the four holes is really good as Freeman drilled ‘shorter’ holes with high grade gold in oxide but as far as we are concerned, the 189.1 meter of 1.1 g/t gold is the best hole as that hole will be a tremendous help to quickly build tonnage while maintaining a high average grade. Using the historical recovery rate of 80%, 1.1 g/t as head grade would result in a recoverable grade of 0.88 g/t for a rock value of in excess of $45/t at $1600 gold.

Sure, the 189 meter interval has been slightly spiked by the 4.3 meters of 15.1 g/t but even if we would remove this shorter but higher grade interval, the residual 184.8 meters would still have an average grade of almost 0.8 g/t, way above the cutoff grade for an economic interval.

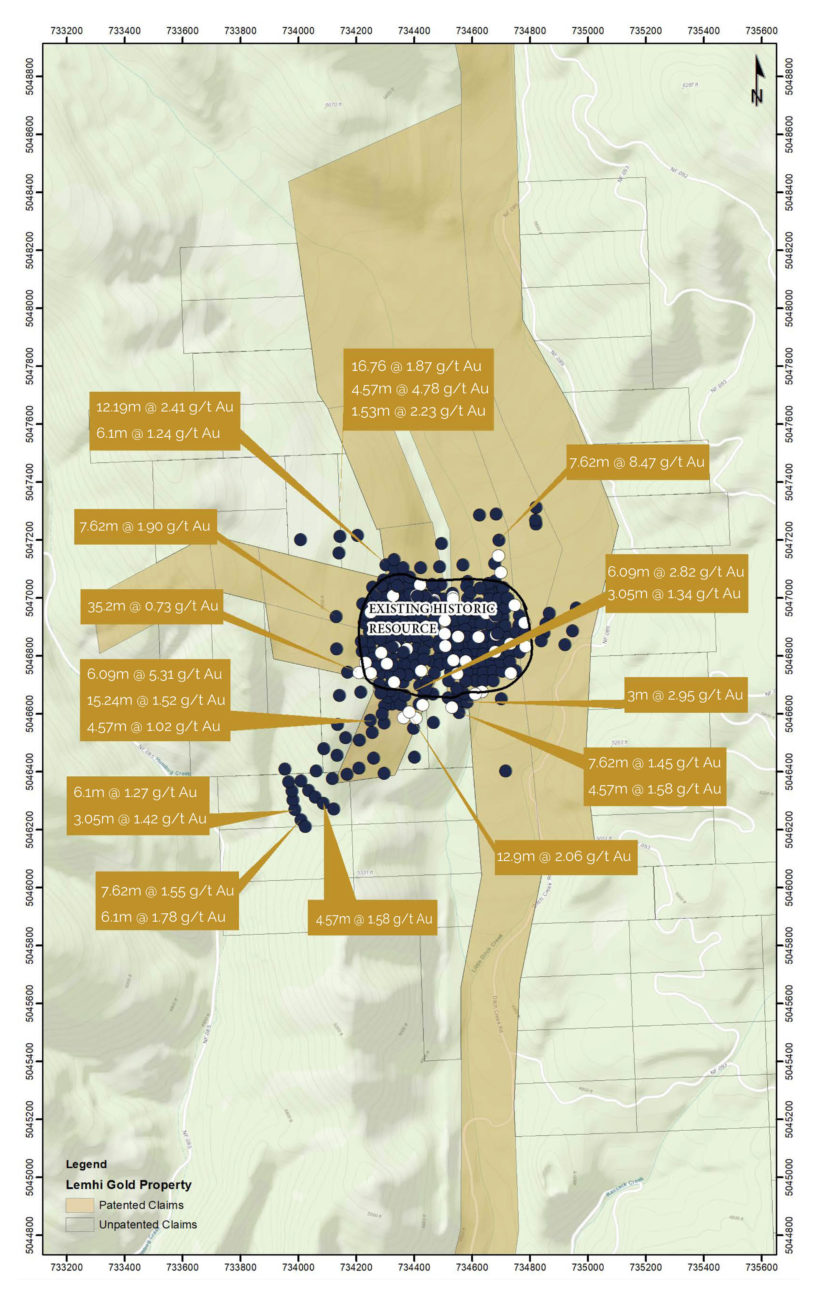

The reported intervals cover an area of 150 by 50 meters of the Lemhi deposit and are just the start. Freeman has completed 35 holes for a total of just under 7,150 meters which means assay results of 90% of the holes that have been drilled still have to be released. With just over 81M shares outstanding, the current market capitalization of less than C$50M remains quite appealing for a company which appears to be on track to define a 1.5-2 million ounce gold deposit in oxide, making it amenable for heap leaching.

Disclosure: The author has a long position in Freeman Gold. Freeman is a sponsor of the website. Please read our disclaimer.