Future Metals (FME.AX) has confirmed it will issue 40 million new shares in a private placement priced at A$0.125 per share to raise total proceeds of A$5M. Interestingly the units consist of one common share and 1/3rd of an option with each full option (tradeable as FMEO on the exchange) allow the option holder to acquire an additional share at A$0.10 by June 11 2024. Future Metals will also issue up to A$0.5M in securities to existing shareholders as part of a Share Purchase Plan.

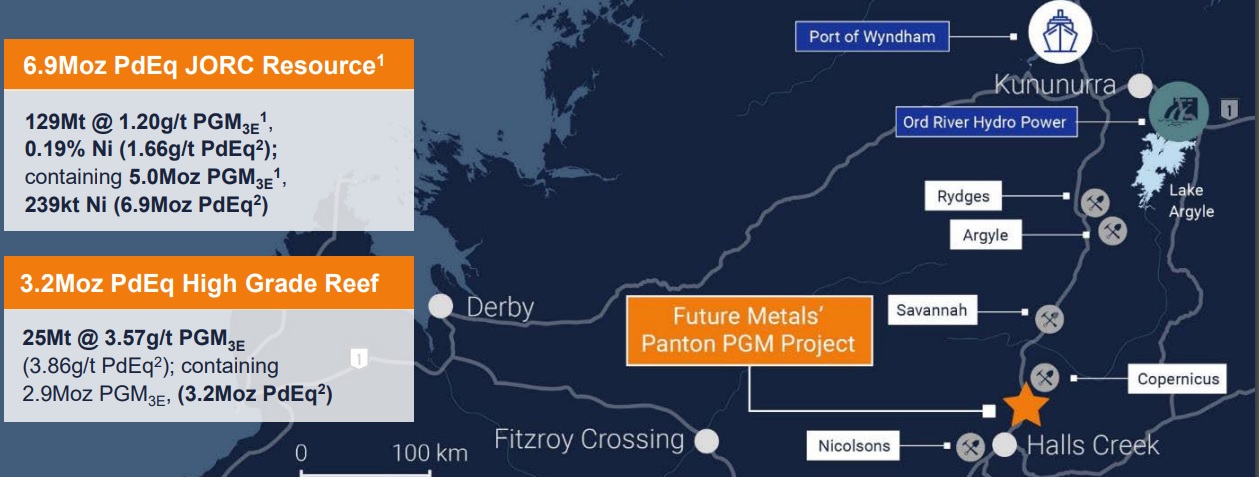

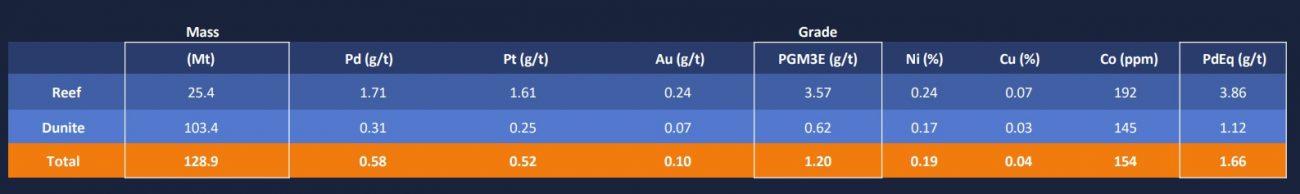

The proceeds will obviously be used on the flagship Panton nickel-palladium project which hosts about 6.9 million ounces of palladium-equivalent. As you can see above, the existing resource contains quite a bit of nickel as well, making it a very intriguing mix of commodities. The Panton project also contains a higher grade zone with just over 25 million tonnes at an average grade of 3.86 g/t palladium-equivalent for a pro forma rock value of in excess of US$250/t (excluding recoveries and payability percentages).

Recent exploration activities have confirmed new exploration targets outside the current resource area and hopefully the company can increase the size and grade of the existing resource.

Disclosure: The author has no position in Future Metals. Please read our disclaimer.