Generation Mining (GENM.TO) confirmed it has closed the previously announced bought deal. It raised C$15M in a combination of hard dollars and flow-through funds. The hard dollar financing consisted of 42.86 million units priced at C$0.28 with each unit consisting of a common share of Generation Mining as well as one fifth of a warrant with each full warrant allowing the warrant holder to purchase an additional share at C$0.50 for a period of three years.

The flow-through financing was priced at C$0.32 and a total of 9.7 million flow-through units were issued. The terms of the warrant are identical to the warrant terms of the hard dollar financing.

There was very strong insider participation in the financing. CEO Jamie Levy purchased 780,500 units (of which 500,000 were hard dollar units) while COO Anwyll purchased just under 180,000 hard dollar units. Additionally two directors acquired a total of 210,000 units as well in a mix of hard dollar and flow-through units. This means almost 1.2 million units (for a total investment of almost C$400,000) was taken up by certain members of the management and board.

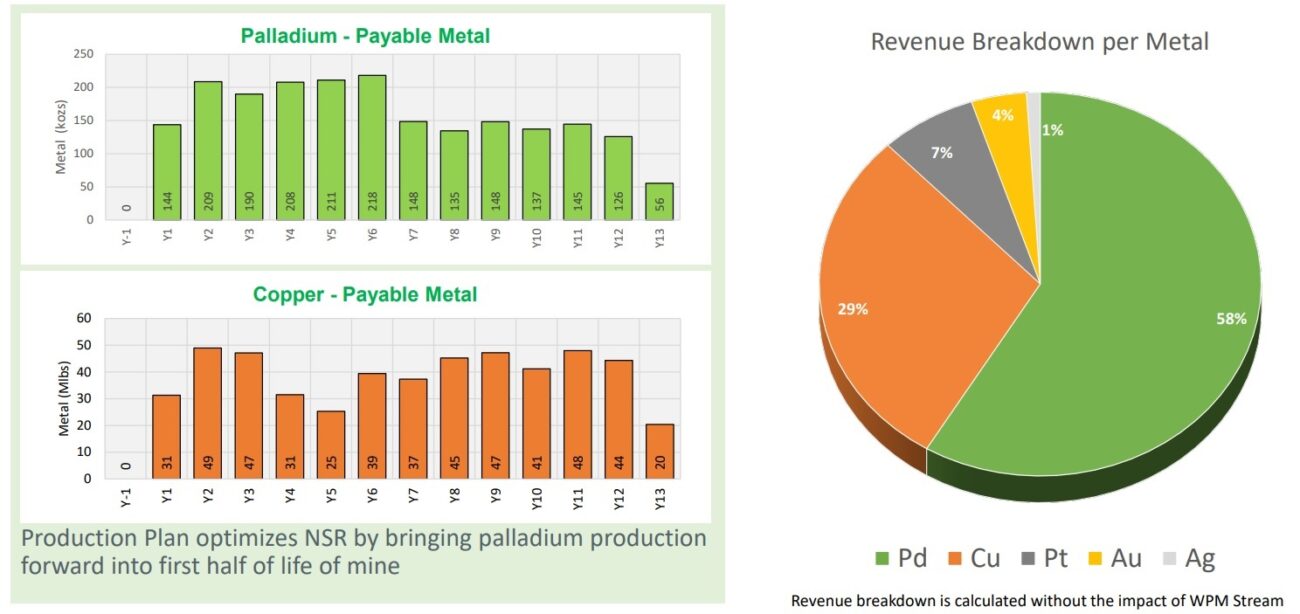

The company also announced it received the permit to remove trees for the Marathon copper-palladium project, which helps the company to tick another box.

Disclosure: The author has a long position in Generation Mining. Generation Mining is a sponsor of the website. Please read the disclaimer.