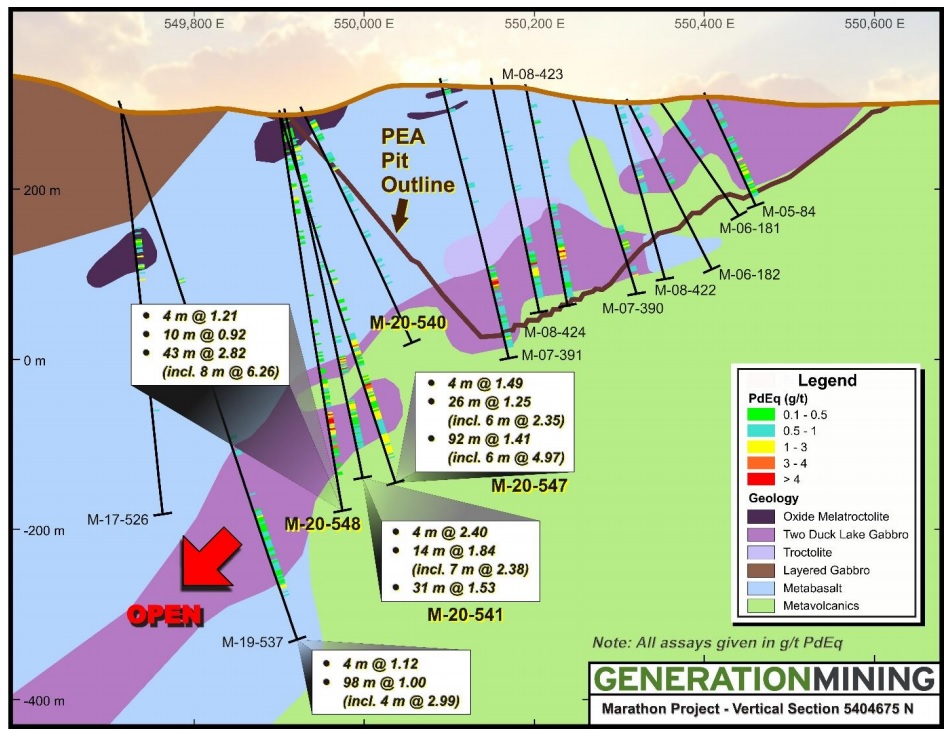

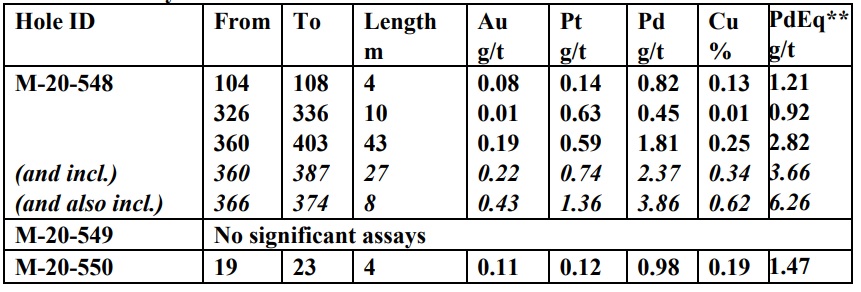

Generation Mining (GENM.TO) has released the assay results from the final three holes that were part of a twelve hole drill program at Marathon for a total of in excess of 5,000 meters. While one hole did not return any significant assays and a second hole only intersected a narrow interval of just 4 meters containing 1.47 g/t PdEq (albeit close to surface), hole 548 was actually one of the best holes drilled on the property. Note: the palladium-equivalent grades were calculated using a gold, platinum and palladium price of respectively $1300/oz, $900/oz and $1275/oz, and were thus not determined using spot prices.

The drill bit encountered three separate areas of PGM mineralization and while the two upper layers of 4 meters containing 1.21 g/t PdEq and 10 meters of 0.92 g/t PdEq are interesting but not shocking, the deepest interval is actually pretty intriguing. Starting at a depth of 360 meters down-hole, the drill bit intersected 27 meters containing 3.66 g/t palladium-equivalent. And this doesn’t mean the palladium grade was boosted by by-products; the pure palladium grade was approximately 2.37 g/t and while the other metals obviously spiked this ‘headline result’, let’s be clear: the 27 meter interval is palladium-heavy as the rock value for just the palladium (assuming 100% recovery and 100% payability which, to be clear, will never ever be obtained in a real world scenario) is just over $170/t using $2250 palladium. Within the 27 meter interval, Generation Mining also encountered a narrower zone of 8 meters containing 6.26 g/t palladium-equivalent (including 3.86 g/t palladium). This means the remaining 19 meters of the mineralized intercept had an average grade of approximately 2.57 g/t PdEq. Still pretty good!

These are encouraging drill results to have ended the 2020 exploration campaign with, and it looks like Generation Mining will perhaps be using the recently raised flow through funds to follow up on last year’s drill program. That being said, all eyes will obviously be on the outcome of the feasibility study later this quarter followed by the decision of Sibanye-Stillwater which will have to decide whether or not it would like to exercise its back-in right again.

Disclosure: The author has a long position in Generation Mining. Generation Mining is a sponsor of the website. Please read our disclaimer.