Goldshore Resources (GSHR.V) has closed its flow-through financing, raising a total of C$10M by issuing 14.7 million shares on a flow-through basis. The company issued 10.8 million shares on a flow-through basis at C$0.65 per share while an additional 3.9 million shares were issues as part of a premium flow-through issue, priced at C$0.76. The weighted average issue price for the 14.8 million shares was approximately C$0.68.

The proceeds will be used to help fund the company’s ongoing 100,000 meter drill program on its flagship Moss Lake gold project in Ontario which already contains 1.4 million ounces in the indicated and 1.6 million ounces of gold in the inferred resource category in the open pit category. There’s an additional 135,000 ounces of gold in the underground zones while the East Coldstream deposit hosts an additional 860,000 ounces across all categories.

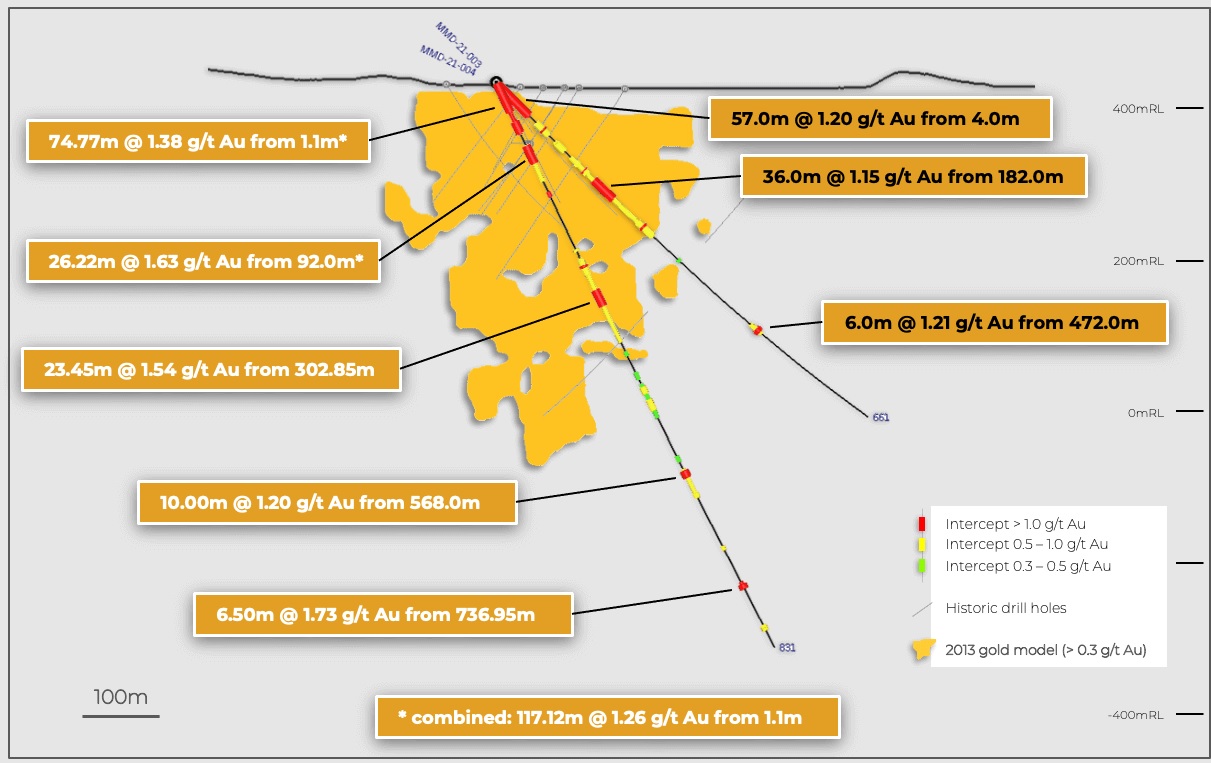

Subsequent to closing the financing, Goldshore released the assay results from hole 4 and 5 with 117 meters containing 1.26 g/t gold starting just below surface, including a very interesting 42.5 meters containing 1.37 g/t gold starting just 1.1 meters below surface. Additionally, hole 5 encountered 8.5 meters of 2.53 g/t starting at just 42.5 meters downhole and 16.5 meters containing 1.26 g/t from 139.5 meters downhole.

Goldshore is happy with these results as they seem to extend the width and depth of the mineralization by 38% and 56% respectively when compared to the 2013 block model. That’s obviously good news and we are looking forward to seeing more assay results from the ongoing 100,000 meter drill program in 2022. The total amount of drill rigs has now doubled to four which should increase the pace.

Disclosure: The author has a long position in Goldshore Resources. Please read our disclaimer.