Great Bear Resources (GBR.V) has announced the Supreme Court of British Columbia has issued its final order approving the sale of Great Bear to Kinross Gold (KGC, K.TO). The transaction is now expected to close on or around February 24th, which is next week Thursday.

The company also announced the final exchange ratio for its shares. The shareholders who tendered their stock to the all-share offer made by Kinross Gold will receive the 3.8564 shares of Kinross Gold. Based on the Kinross share price at the closing bell on February 17th, the all-stock offer represents a value of C$28.46 per share of Great Bear (excluding the theoretical value of the Contingent Value Right). The shareholders who opted for the cash bid of C$29/share will not get the full C$29 in cash but will be pro-rated and receive C$26.16 in cash as well as 0.3783 shares of Kinross Gold. Using the same closing price of C$7.38/share, this represents a value of C$28.95 per share of Great Bear, and Great Bear’s share price will likely continue to move in tandem with the Kinross share price.

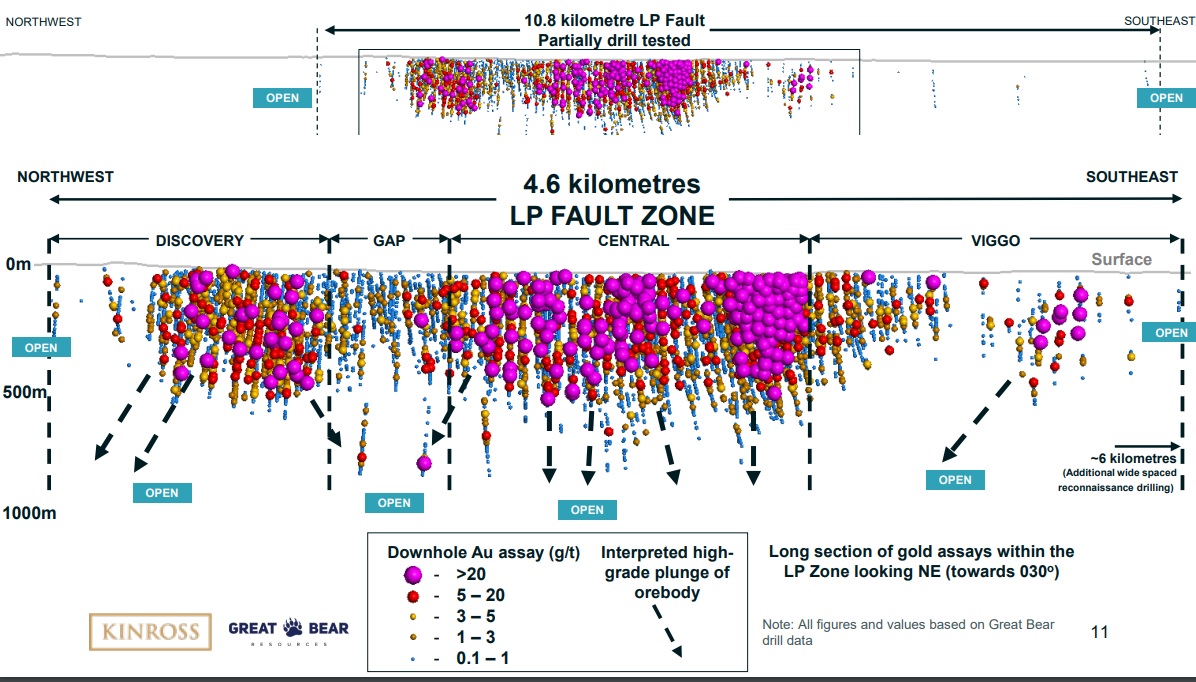

The shareholders of Great Bear will also receive a CVR which will be converted into 0.133 shares of Kinross Gold upon announcing commercial production at Dixie provided that a total of 8.5 million ounces of gold in the reserves and measured and indicates resources have been defined within 10 years.

Disclosure: The author has a long position in Great Bear Resources and has tendered into the cash offer. Great Bear is a sponsor of the website. Please read our disclaimer.