Great Bear Resources (GBR.V) initially announced a C$37M bought deal of flow-through shares at a price of c$18.60 per flow-through share but due to strong demand, the offering was upsized that very same day to C$70M.

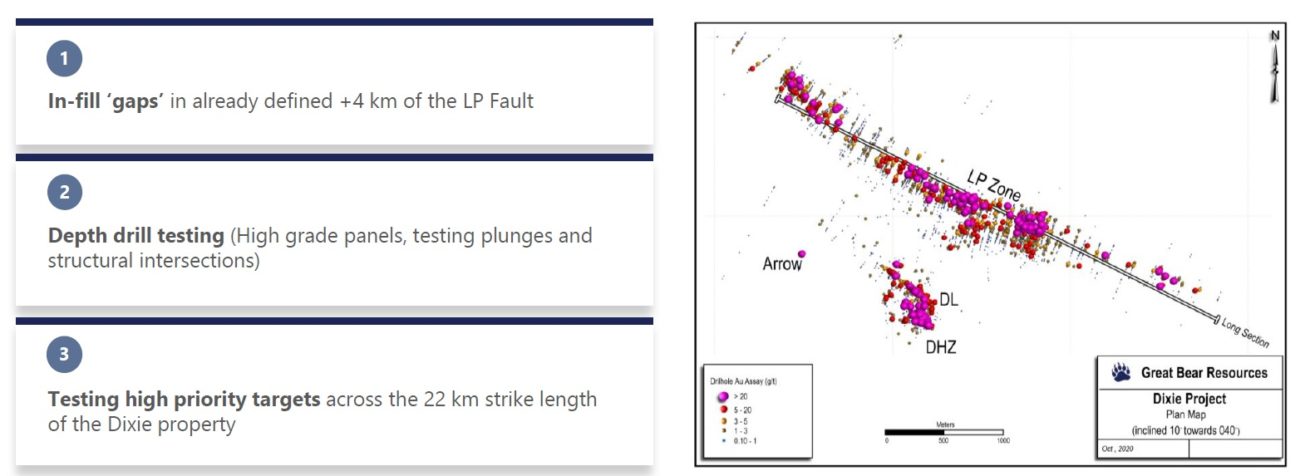

Great Bear will now issue 3.23M flow-through shares at the same price of C$18.60 but has now also attached a C$10M hard dollar raise to the flow-through deal. The non-FT financing was priced at C$12.75 (the same terms that were offered to the back-end buyers of the flow-through financing). This will push the total cash resources of Great Bear Resources to approximately C$100M of which we estimate C$80M will be flow-through money that will have to be spent before the end of 2022. Needless to say this means Great Bear will continue to aggressively drill the Dixie gold project.

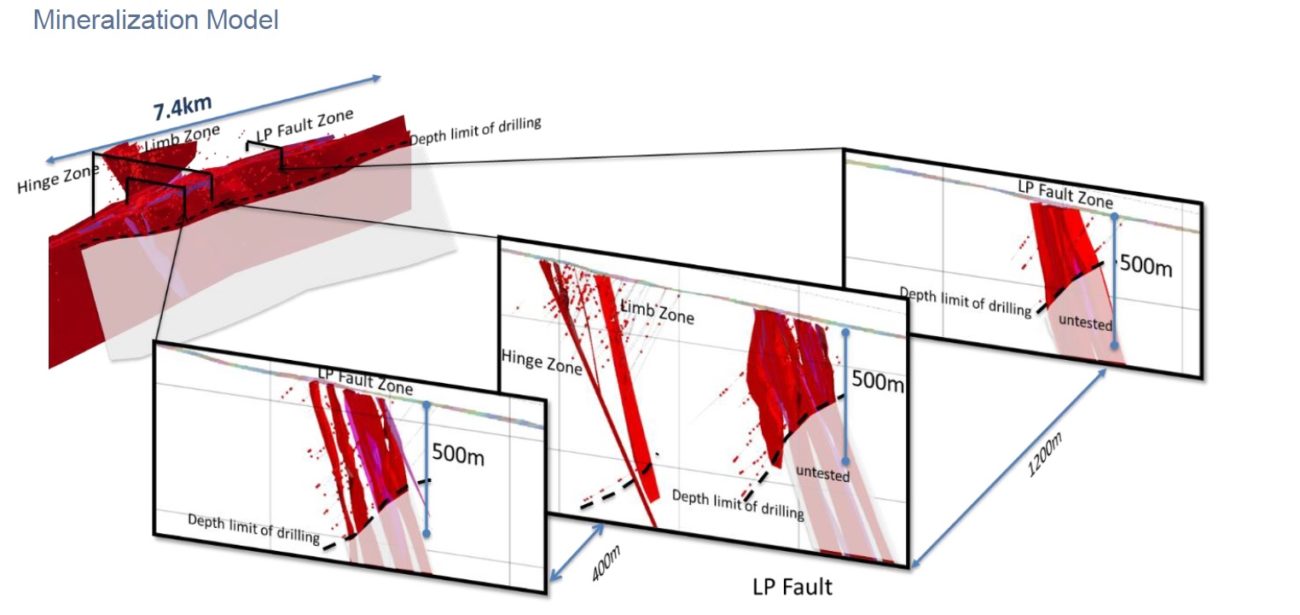

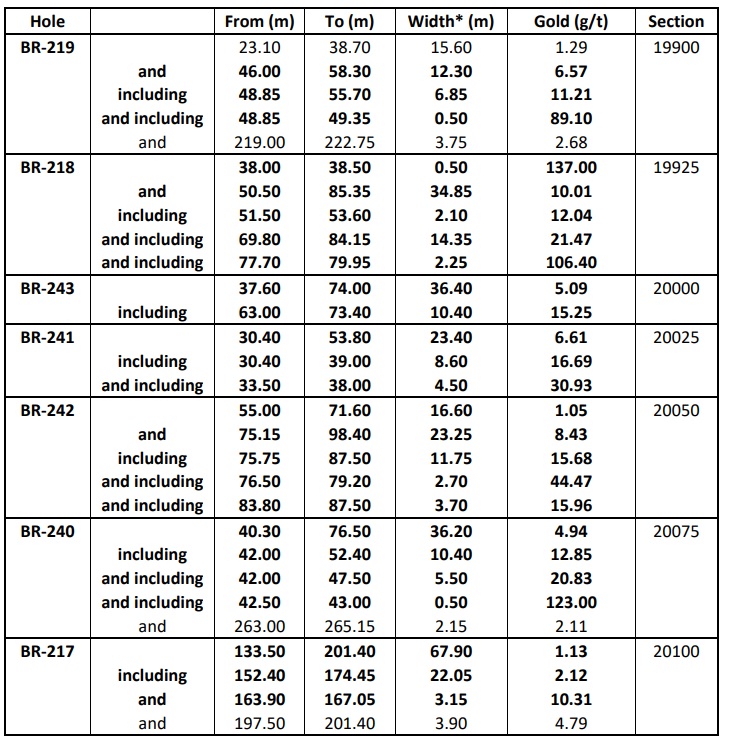

Meanwhile the assay results from the ongoing drill program are still rolling in (albeit at a delayed pace as labs are still reporting relatively long turnaround times. Great Bear is expecting to receive the assay results of an additional 50 holes within the next 4-5 weeks) and the most recent exploration update contained the assay results of seven holes drilled along the LP fault where the company is reducing the drill spacing to 25 meters along a 200 meter strike length (which represents just a portion of the total target area along the LP Fault) to further increase its confidence in the near-surface gold mineralization. Despite targeting mineralization close to surface, the gold grades are still very strong and Great Bear was able to highlight very high-grade gold results within the first 70 vertical meters from surface including almost 35 meters containing 10 g/t gold.

That’s an excellent example of how Great Bear will be able to add ounces to a near-surface resource. By the end of this year, about 400 holes will have been drilled along the LP Fault. And with about C$80M to be spent in flow-through money, we don’t expect Great Bear’s drill program to slow down anytime soon.

Meanwhile, the company has announced the results of a metallurgical test program conducted at the Dixie Limb zone. The average recovery rates for the gold are consistently high and are in line with the recovery rates encountered for the Hinge zone with recovery rates in the high-nineties with a 96-97% recovery rate in most of the samples. The met work press release is quite detailed and we would recommend you to read it in full HERE.

Disclosure: The author has a long position in Great Bear and is participating in the current financing. Great Bear is a sponsor of the website. Please read our disclaimer.