Group Eleven Resources (ZNG.V) has announced it has entered into an agreement with Cormark Securities to conduct a bought deal private placement for C$5M. The offering consists of a straight-share financing (no warrants are attached) priced at C$0.32 per share. This represents a 15% discount to the closing price of C$0.375 on Monday.

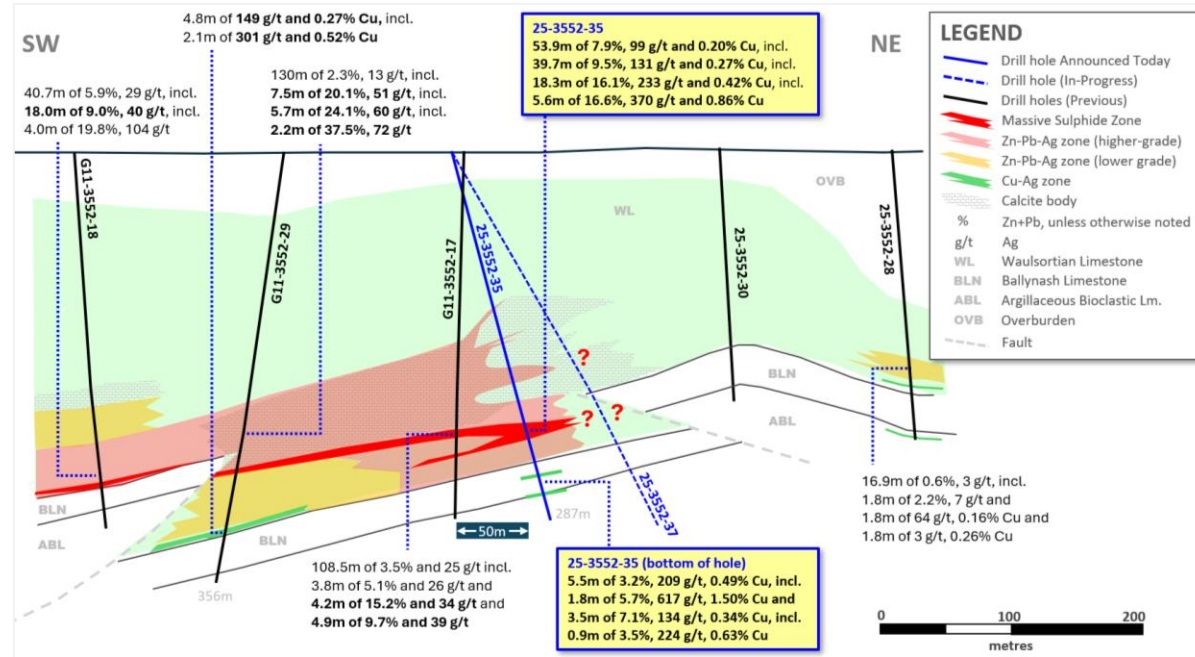

Combined with the C$2.2M in cash proceeds from the early exercise of warrants and options received in the past few months, this financing will put the company on solid footing to continue its drill program in Ireland. The Ballywire drill program (which has yielded excellent results so far) will be expanded from 5,000 meters to 25,000 meters, and this will allow the company to get a much better understanding of the mineralization where recent results returned almost 40 meters of 9.5% ZnPb, in excess of 4 ounces of silver and 0.27% copper per tonne of rock.

Given the recent interest in Group Eleven, we wouldn’t be surprised to see this no-warrant financing being upsized.

Disclosure: The author has no position in Group Eleven Resources. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.